Japan

Wood Products Prices

Dollar Exchange Rates of 25th

April 2017

Japan Yen 111.1

Reports From Japan

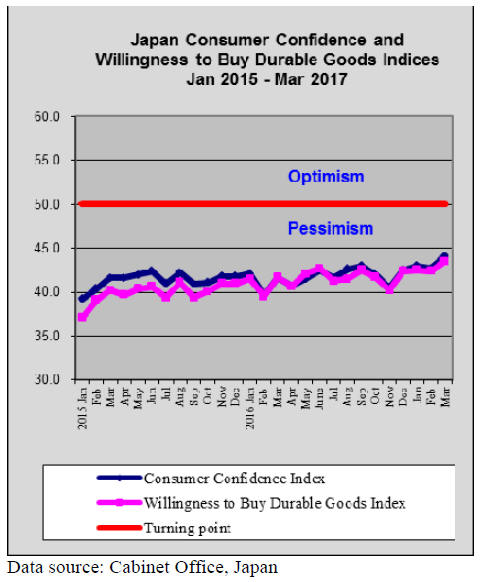

Prospects for Japan¡¯s economy looking

brighter

With the March economic numbers released it seems the

Japanese economy posted the best quarterly performance

in three years. New business investment and hiring

continued at a steady rate in March building on the trend

in the first two months of the year.

Against this background, at its latest meeting the Bank of

Japan (BoJ) raised its economic forecasts and did not offer

any hint of further stimulus.

The BoJ forecast for GDP for fiscal 2016/17 was lifted to

1.6 from the 1.5 projected in January but the BoJ was less

optimistic on the consumer price index which it thought

could weaken further. In the first quarter 2017 the

manufacturing sector was the main driver of growth with

the service sector growth providing an additional boost.

The good news continued with the IMF raising its forecast

for Japan¡¯s GDP growth for this year. The latest World

Economic Outlook report says the Japanese economy is

expected to expand 1.2% in 2017, significantly higher than

the 0.8% previously forecast. But the IMF cautions ¡°in

spite of the rebounding output and the tightening labour

market, consumer prices and wages have stayed almost

flat.¡±

As Japan's economy heads into the second quarter

prospect seem to have improved. However, all the good

news could be undone if the US succeeds in weakening

the dollar against the yen as this would hit Japan¡¯s export

growth.

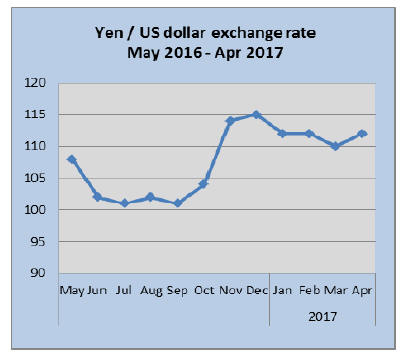

Yen had a turbulent April

The yen had a turbulent April, first strengthening and then

swinging weaker again. The roller-coaster ride was driven

first by the run-off election between Emmanuel Macron

and Marine Le Pen in France which boosted the euro and

took from the yen. During this period the yen moved as

firm as 108 to the US dollar but was driven back to 110 as

news of the likelihood of a Macon win emerged.

The other issues that eventually pushed the yen back to

112 to the dollar was the decision from Washington that

the US will not abandon the North American Free Trade

Agreement and the decision of the BoJ to continue its

current monetary policy.

Analysts are now beginning to say that the yen could be

losing its status as the number one safe-haven currency.

Geopolitical issues, especially because of the situation in

North Korea, along with the action of the BoJ to continue

its negative interest rate policy when many other countries

are lifting interest rates, is undermining the yen safe haven

status.

¡¡

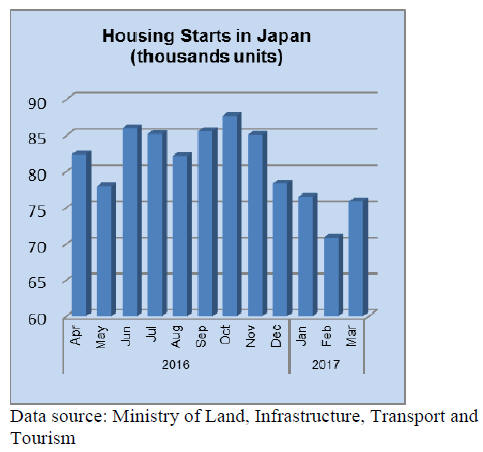

Housing starts reverse direction ¨C 4 month

downtrend

broken

Data compiled by Japan¡¯s Ministry of Land, Infrastructure,

Transport and Tourism show that March housing starts

were only slightly up on levels in February. However the

slight rise in March starts broke the downward trend that

started in November last year.

March housing starts were up around 7% on February

which, if maintained would result in annualised housing

starts to rise to 984,000.

The Ministry data reports construction companies as

saying orders increased in March but at a slower pace than

in March one year earlier. Construction companies in

Japan are now preparing for the change in the population

in Japan. By 2025 around 6 million baby-boomers in

Japan will be 75 years old or older which has led

construction companies to begin assessing opportunities in

providing housing for the ageing population.

A report by the Cabinet Office in Japan says Japan¡¯s

population peaked at about 128 million in 2010 and is

expected to be about 52 million in 2100.

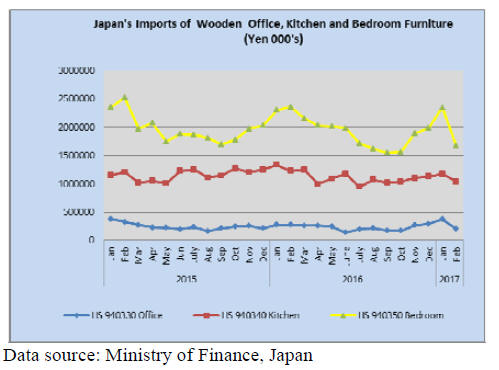

Japan¡¯s wooden furniture imports

The value of Japan¡¯s wooden office furniture imports in

February 2017 was down 27% year on year and down a

massive 45% month on month. This downward trend was

mirrored by kitchen furniture imports which fell 15% year

on year and 12% month on month.

The low value of February wooden furniture imports was

driven even lower by the steep drop in wooden bedroom

furniture. Year on year February wooden bedroom

furniture imports dropped 29% and month on month

February imports were down 27%.

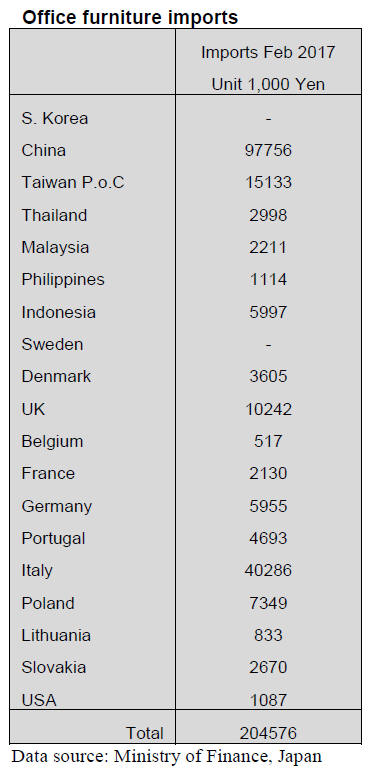

Office furniture imports (HS 940330)

In February, as was the case for the past 12 months China

provided most of the wooden office furniture into Japan.

At 48% of total wooden furniture imports China was the

number one shipper followed by Italy (20%) Taiwan P.o.C

(7%) and for the first time shippers in the UK contributed

5%.

February arrivals of wooden office furniture from the EU

rose to 38% of total imports of this category, up from the

16% in February 2016. The surge in imports from the EU

was largely down to the jump in deliveries from Italy.

Year on year, Japan¡¯s February wooden office

furniture

imports were down 27% and month on month the decline

was even more dramatic (-45%).

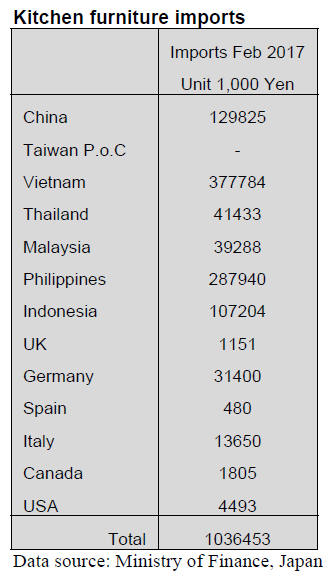

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s February imports of wooden kitchen

furniture dropped 15% year on year and by 12% month on

month.

Vietnam was the major source of Japan¡¯s wooden kitchen

furniture at 36% of total imports of this category but

shipments from Vietnam dropped 23% in February

compared to the level in January.

The second ranked supplier was the Philippines (28%)

followed by China (12.5%). In February, both the

Philippines and China saw shipments decline (-6% and

-24% respectively)

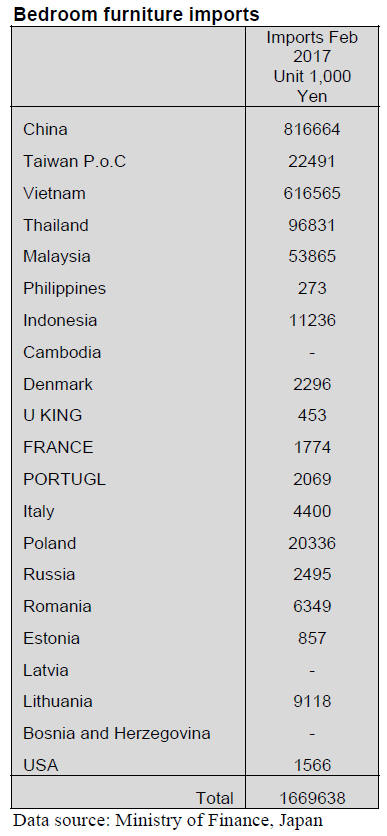

Bedroom furniture imports (HS 940350)

Wooden bedroom furniture import data from Japan¡¯s

Ministry of Finance shows there was a massive correction

in the value of imports in February compared to a month

earlier.

Japan¡¯s wooden bedroom furniture imports grew

steadily

for the three months from October last year and peaked in

January this year. The 27% drop in the value of imports in

February this year comes on top of a 29% decline in year

on year imports.

China and Vietnam are the main shippers of wooden

bedroom furniture to Japan with China accounting for

48% and Vietnam 36% of February imports. The other

two main suppliers were Thailand (6%) and Malaysia

(3%). Shipments of wooden bedroom furniture from EU

member states are insignificant at between 1-2% per

month.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Hardwood resources in Japan

The Forestry Agency made investigation of hardwood

resources in the national forests and demand trend. Total

stock of hardwood in the national forests is 554,000 cbm.

The largest species is beech with 97,000,000 cbm then oak

with 5,800,000 cbms and birch with 5,200,000 cbms. In

these, resource volume, which can be actually usable, is

about 30-40%.

By the area, Hokkaido has oak, ash, maple and katsura.

The North East has beech and horse chestnut. Kyushu has

oak and chinquapin.

By use, 95% of hardwood is consumed for wood chip.

There are many furniture manufacturers and wood

working plants, where quality hardwood is easily

available. Log distribution channel .is necessary for

making sliced wood veneer and wood working while sawn

board is necessary for furniture, which recovery ratio is

30% and music instrument, which recovery ratio is only

10%.

Hardwood stock in privately owned forests is

overwhelmingly heavy in Hokkaido and the North East.

There are spotty hardwood forests in other areas but they

are way further in the forests so harvest and supply is

difficult.

Wood supply and demand projection

The Forestry Agency held a meeting to forecast wood

supply and demand for the second and third quarter of this

year. Forecast of new housing starts in 2017 by think tanks

is 4.4% less than 2016 but the forecast of wood demand

would be the same as last year.

At the meeting in last December, an average housing starts

in 2016 by eleven think tanks figured 971,000 units then

forecast for 2017 is 935,000 units then at the meeting in

March, the forecast is revised downward to 962,000 units

in 2016 and 920,000 units in 2017.

Also by the Japan Federation of Housing Organizations,

the survey made in last January reported that total orders

received by members of house builder have decreased by

three straight quarters and decline seems to continue.

Despite decline of housing starts, the supply seems to

remain unchanged from last year.

By sources, European lumber would decrease by about

10% by dropping housing starts. Meantime, radiata pine

log supply for the second quarter would increase by 27.5%

in the second quarter and by 68.1% for the third quarter.

The reason is demand for domestic radiate pine lumber

products would increase after the Chilean lumber supply

would decline due to extensive forest fires in Chile in

January. Lumber supply for the second quarter would

increase by 25%.

Meantime demand for the second and third quarter would

be slow so both logs and lumber would be less than the

same period of last year.

Domestic log supply for lumber in the second quarter

would be less than last year. Domestic logs for plywood

would be down by 6.3% in the second quarter then 2.7%

more in the third quarter in an anticipation of increased

production of floor base and concrete forming.

Demand for plywood and laminated lumber is almost flat

from last year. Demand of concrete forming panels for

preparation of the 2020 Tokyo Olympic Games would

start in the third quarter. Demand of imported thin and

medium thick and structural panels would decline.

Demand of concrete forming panels would increase as

more condos and concrete building would be built.

Log supply from North America may be 10% more than

the demand. Lumber supply would stay unchanged from

last year.

Russian log supply and demand would decline in the

second quarter and lumber supply would decline in both

second and third quarter.

South Sea log supply in the second and third quarter

would increase for lumber.

South Sea (tropical) logs

Weather in Sarawak, Malaysia has been gradually

recovering from rainy season and Sabah¡¯s weather is

better than Sarawak so weather factor is getting normal but

in Sarawak, log procurement is difficult due to illegal

harvest control by the Sarawak state government.

India, which had been inactive for log purchase, returned

to the market as log inventories are decreasing in India and

has started active buying but it cannot buy enough logs in

Sarawak so it goes to Sabah and other sources like PNG

and Solomon Island so export log prices stay up high.

With insufficient log supply, Japanese importers have hard

time to make up shipping plan.

In Japan, there are a limited number of South Sea

(tropical) log users and it does not pay to bring logs in

with hard effort due to high log prices so there is no

aggressive purchase of South Sea logs any more. Some

South Sea plywood manufacturing mills in Japan reduce

the production and import plywood from South Sea

countries to become wholesaler.

Sarawak meranti regular log prices for Japan are US$275-

280 per cbm FOB. Further increase is likely because

higher transportation cost in producing regions.

In Sabah, supply of keruing and kapur has been declining

due to decrease of resources so the prices for these species

continue climbing. In PNG and Solomon Islands, log

purchase by China and India is active so Japan has no

room to get in.

|