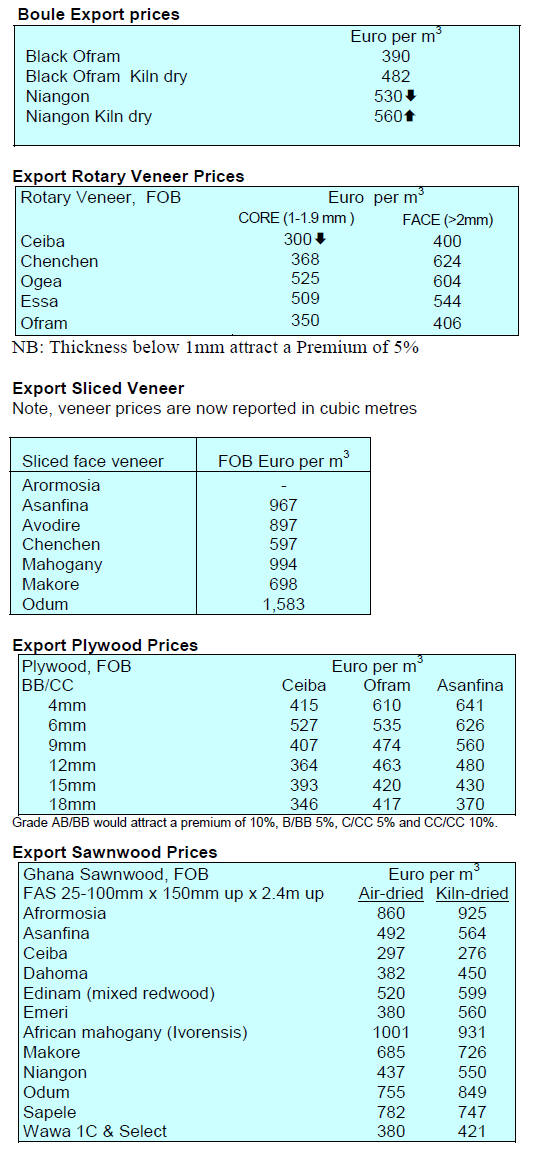

2. GHANA

BVRIO trading platform for Ghana

The BVRIO ‘Responsible Timber Exchange’, trading

platform to connect buyers and sellers of legal and

certified timber products first mentioned in the ITTO

market report Volume 20 Number 20, 16–30 November

2016, has launched a Ghana chapter.

This development has been encouraged by the Forestry

Commission (FC) and the management of BVRIO plans to

work with the FC to take advantage of Ghana’s wood

tracking system which assures legality.

The BVRIO website says “the BVRIO Responsible

Timber Exchange is a negotiations platform to promote

the trading of timber products from legal and/or certified

sources creating transparency, efficiency and liquidity in

this market. The platform has an in-built risk assessment

system to assist users in conducting the due diligence of

each of the timber consignments traded.”

See: http://bvrio.org/timber/

UNIDO support on ISO management

Inspectors from the Timber Industry Development

Division of the Forestry Commission recently benefitted

from training on International Standards Organisation

(ISO) and International Electro-technical Commission

(IEC) management systems.

The workshop which received technical support from the

United Nations Industrial Organization (UNIDO) Trade

Capacity Building (TCB) programme, was meant to

deliver knowledge and skills in implementing the ISO/IEC

17020 standards.

Manufacturers to get boost from tax cuts

Oxfordeconomics has reported that the Ghana government

is waiting for approval from ECOWAS to remove taxes on

selected imports, a move which is in line with the

ECOWAS Common External Tariff.

When approved the construction sector will benefit as

import duties on raw materials will be eliminated. Taxes

on machinery and raw materials for production will be

removed which should boost manufacturing.

In the real estate sector, the decision to remove the 5%

VAT on property transactions outlined in this year’s

spending plan should also help reduce the cost of both

residential development and boost home sales.

See

http://www.oxfordbusinessgroup.com

Business leaders stress need to support SMEs

Leaders of Ghana’s Private Enterprise Federation recently

met with Minister Designate for Investment and Business

Development.

The press statement from PEF says the CEO of PEF, Nana

Osei-Bonsu emphasised the need to build capacity,

identify opportunities and create structures to enable the

private sector, especially the SMEs, take advantage of the

opportunities that will be created by the government.

The Minister is reported to have pledged to work with the

Federation to achieve his goal of developing at least 1000

businesses each year for the next four years.

He stated that he has two key objectives; the first is how to

get investments into critical sectors of the economy and

the second is how to identify and support key existing

Ghanaian businesses to become more efficient and

profitability.

The Private Enterprise Foundation (now Federation) was

established in 1994 as the apex institution to forge

consensus and provide the leadership voice for advocacy,

on the initiative of the Association of Ghana Industries,

Ghana National Chamber of Commerce and Industry,

Ghana Employers’ Association and the Federation of

Associations of Ghanaian Exporters.

See:

http://www.pef.org.gh/index.php/en/about-pef/statementsreleases/

58-pef-meets-new-minister-designate-for-investmentand-

business-development

Analysts report markets remain very quiet and as a result

few price movements have been reported.

3.

SOUTH AFRICA

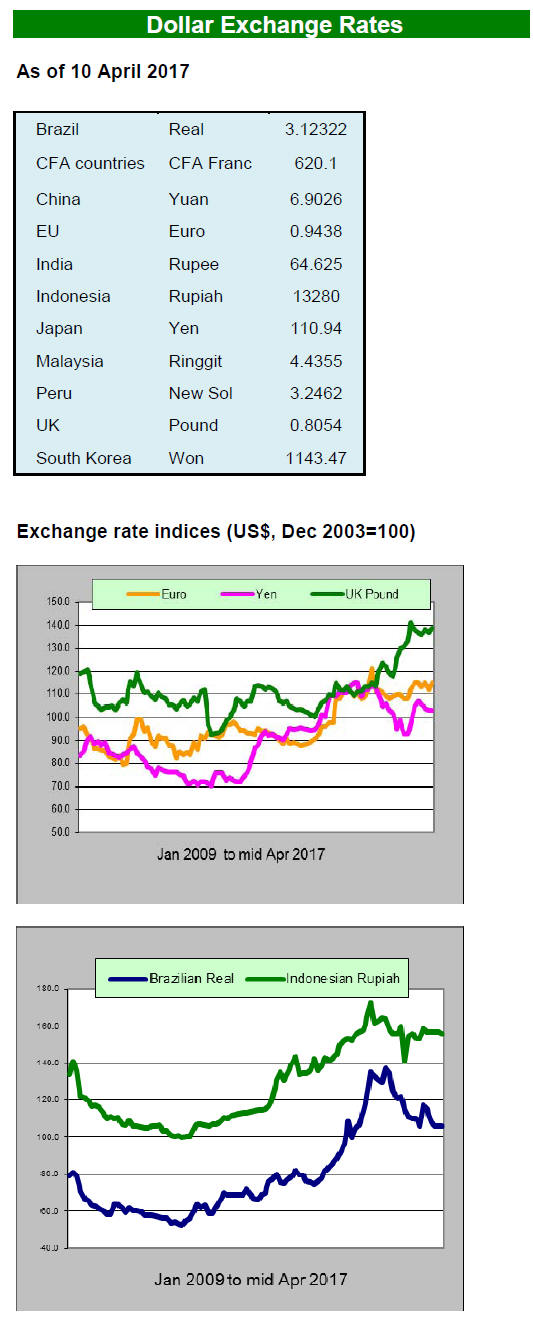

Rand crashes on rating downgrade

The recent cabinet reshuffle in South Africa has not been

received well in financial markets. Almost immediately

the country’s credit rating was relegated to junk status and

the rand plummeted. The rand weakened more than 10%

against the US dollar in just a few days.

The South African Central Bank said any decision to

support the rand would be made after assessing the impact

of the currency movements. The Central Bank Governor

said it was too early to tell if the credit rating downgrade

would push the economy in to a recession.

Analysts in South Africa write “things are all a bit

unsettled here since S&P issued their downgrade giving

South Africa non-investment/junk status. The agencies

maintained the financial rating as investment grade so that

may slow the rand decline.

The political upheaval from the cabinet reshuffle has

sparked widespread protests around the country which is

affecting business confidence. The impact of this turmoil

is likely to be higher interest rates and higher inflation

which will hurt the property market. At the moment

buyers in the building and construction sectors are only

purchasing for immediate needs.

Weak demand all round

Demand for meranti, especially for window and door

frames, has been undermined by price competition from

local produced aluminium alternatives. Also, local

aluminium product manufacturers can offer quicker

deliveries which are an advantage in a situation where

endusers are buying to only satisfy current projects.

Analysts report the market for domestic pine is also weak

which has driven some Cape mills to extend marketing

into the Johannesburg area, an indication that their nearby

markets are not strong. At the moment pine prices are

steady but if demand weakens further price discounting

will follow. This situation is mirrored in the panel market

where plywood prices have fallen sharply.

On the other hand, demand for American hardwoods is

holding up say analysts as these hardwoods are mainly for

bespoke production but eventually there is likely to be

resistance against the higher rand prices due to the

exchange rate.

All in all not a great picture. Analysts write “The domestic

housing market has turned very weak as people are

uncertain if they can get a mortgages in the new

environment and I expect the commercial/shopfitting

market will also decline as new projects are put on hold.”

4.

MALAYSIA

Global trade picking up

Trade analysts, RHB Research, pointed out that exports

from Asia have started to recover and RHB has forecast

Malaysia’s overall exports could recover by as much as

6% in 2017 compared to the 1.1 % growth seen in 2016.

RHB Research also pointed out that Malaysia’s export

growth in February was the strongest recorded in almost

seven years.

In terms of markets, the acceleration in February exports

was helped by a growth in shipments to China, ASEAN

member countries, the EU and US. However exports to

Japan slowed in the first two months of 2017.

Only STA members can get harvesting license

It has been confirmed that companies tendering for short

term timber licences must first be members of Sarawak

Timber Association (STA) and should be legitimate timber

operators having experience in harvesting and have no

previous record of illegal logging activities.

This clarification came after an announcement by the State

government that it intends to issue short term timber

licenses through an open tender process. Short term timber

licenses are only issued for state land forests which have

been approved for development or for Native Customary

Land (NCL), Development Areas and Native Communal

Reserve approved for development.

The duration of these short term licenses will depend on

the size of the area involved and the timber stock.

Successful bidders are still subject to payment of royalty,

premium, cess and other charges based on the volume of

timber extracted.

STA Training

STA Training (STAT), a training provider owned by STA,

has also been appointed by the State as a training provider

under the state Forest Rules (Trained Workmen)

legislation, 2015.

STAT has been training the industry workforce in various

skills. For forests managers, STAT offers a post-graduate

diploma in applied science, conducted in collaboration

with Lincoln University, New Zealand.

Fibreboard exports

Malaysia exported 1.036, mil. cu.m of fibreboard in 2016,

an increase from the 2015 exports of 985,854 cu m. The

2016 exports earned a healthy RM 1.183 billion. Most of

the fibreboard (83%) was produced and exported by mills

in Peninsular Malaysia.

Analysts report that a major producer, Evergreen

Fibreboard Bhd. is expanding manufacturing capacity

targeting demand for boards for furniture production. In

addition to expanded fibreboard production the company

intends to add a second line for the production of RTA

furniture.

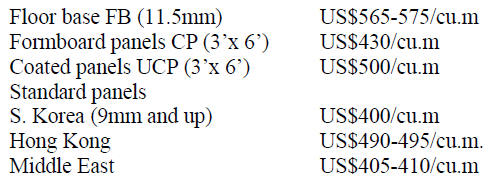

Mid-March plywood export prices

Plywood traders in Sarawak reported February FOB

export prices as:

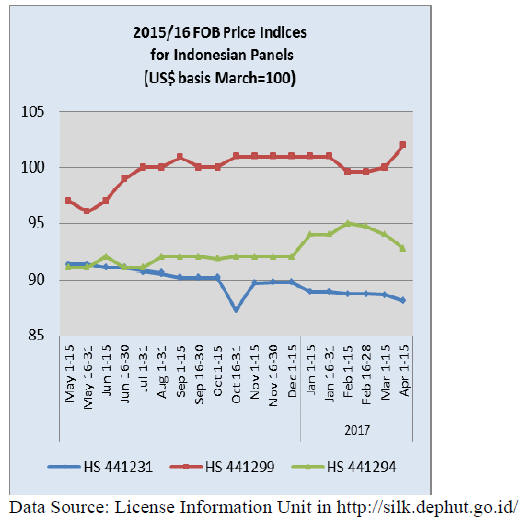

5. INDONESIA

Minister - not all markets require SVLK

certified

products

In a press statement, Airlangga Hartanto, Indonesia’s

Minister of Industry, suggested not all furniture and

wooden craft items need to be SVLK certified and shipped

with a V-legal documents. He asserted that the V-legal

document and FLEGT license was a requirement for the

EU market only.

The Minister said many manufacturers shipping to markets

other than the EU have not requested SVLK certification

as this was not a requirement in those non-EU markets.

However, at present it is a requirement that all products

listed in the VPA need to be verified legal through the

SVLK system. This should be reviewed, said the

Minister.

In follow-up statement the Minister revealed that his

ministry was considering policy options to ensure the

furniture and craft industries remain competitive in

international markets. This was in response to complaints

from businesses that the current regulations impeded

export growth.

Hartanto said the future of Indonesia’s furniture industry is

bright as the government has developed policies and

regulations that will support competitiveness of the sector.

He said the government is working to eliminate barriers

faced by manufacturers so that the full potential for

design, production and marketing can be achieved.

In related news, the Association of Indonesian Furniture

and Handicraft Industries (HIMKI) has submitted a

proposal to the Minister of Environment and Forestry

asking for downstream manufacturers to be exempted

from the requirement for SVLK certification.

The HIMKI proposal gained support when Gati

Wibawaningsih, Director General of Small and Medium

Industries Division in the Ministry of Industry, said SVLK

certification should not be required in the manufacture of

downstream products if the raw material utilised is from a

SVLK certified supplier.

Oil palm plantations not a cause of deforestation say

academics

A group of Indonesia researchers have developed a novel

argument on the role of oil palm plantations in

deforestation. Their argument runs – the worst

deforestation in Indonesia occurred during the resettlement

programme and when forest concession allocations were

highest between 1960-1980 but that the planting of oil

palm only began in early 2000. This issue has been given

extensive coverage in the domestic press.

See:

https://sawitindonesia.com/rubrikasi-majalah/berita-terbaru/4-

peneliti-sepakat-sawit-penyelamat-kerusakan-hutan/

http://economy.okezone.com/read/2017/03/31/320/1655644/sawi

t-disebut-bukan-pemicu-deforestasi

https://ekbis.sindonews.com/read/1193066/34/ditentang-unieropa-

sawit-justru-penyelamat-deforestasi-1490937666

http://beritajatim.com/ekonomi/294067/sawit;_hantaman_isu_def

orestasi_dan_persaingan_bisnis.html

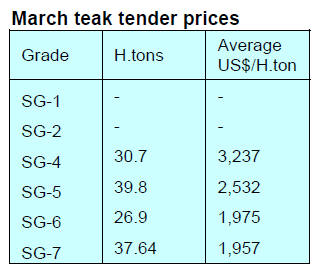

6. MYANMAR

Business slows in holiday season

Business activity is very quiet at the moment as everyone

celebrates Thingyan, the Buddhist festival in Myanmar

that marks the New Year. Thingyan celebrations began 13

April and will run until the 17 April and culminate in the

New Year according to the Myanmar calendar.

Forest Rangers to be rearmed

Forest Rangers in the Sagging Regions will be retrained

and provided with weapons in what is thought to be a

move which could be replicated in other regions of the

country. Until the military take-over Rangers regularly

carried firearms but these were withdrawn.

Over the past two years there have been several fatal

shootings of Rangers when they confronted timber

smugglers.

Exporters beat tax deadline

To avoid the newly introduced 10% Special Commodity

Tax which came into force on 1 April most exporters

shipped out almost all of their stock just before 31 March

2017. Analysts in Myanmar believe most was shipped to

Europe.

Focal Group for Communication to service importers

Industry and the timber association are extremely anxious

about developments in some EU member states with

respect to teak imports from Myanmar. The private

sector has urged the Forestry Department (FD) and the

Myanma Timber Enterprise (MTE) to act to ensure market

access for wood products from Myanmar.

In a related development, a Focal Group for

Communication, comprising representatives from MTE,

FD and the Myanmar Forest Certification Committee

(MFCC) has been formed. It is understood that the Group

will process inquiries from foreign importers to clarify

traceability and the legal status of consignments.

So far, the Group has not made any public statements.

Some sawnwood specifications defined as ‘finished

products’

According to sources close to FD, the definition of

finished products to be applied under the new tax regime

has been made. It appears that only sawnwood larger than

12 square inches (for example 2” thickness X 6” width)

will be defined as sawnwood under the Special

Commodity Tax.

Tamalan seizures continue

The CITES declaration on Tamalan is in force but

attempts at smuggling continue. In the past three months

the authorities in Myanmar confiscated about 1,500 tons of

tamalan discovered ready for shipment in Yangon.

7. INDIA

Growth in Indian housing sector

A recent report from Cushman & Wakefield says middle

and low income groups will drive housing demand in India

with most development set to be in Sura,t Kochi and

Visakhapatnam.

These three cities are expected account for almost half of

total housing demand up to 2020, says the report entitled

“Embracing Change: Exploring Growth Markets for

Indian Housing”.

The report identifies eleven tier II and tier III cities where

housing demand is set to be robust.

See: http://www.cushmanwakefield.co.in/en-gb/research-andinsight/

2016/credai-report-2016/

In other housing related news, the government, the

Confederation of Real Estate Developers’ Associations of

India (CREDAI) and the National Real Estate

Development Council (NAREDCO) will meet to review

the government’s affordable housing programme.

The government is calling on CREDAI and NAREDCO to

help private sector developers launch affordable housing

projects. The government offers incentives to developers

willing to build affordable homes but the Minister for

Urban Development and Housing and Urban Poverty

Alleviation has said, so far, no developers have submitted

proposals for affordable homes. The minister is calling on

CREDAI and NAREDCO to try and determine why.

Gabon a source of veneer and plywood for Indian

industries

Gabon is well known for its timber resources and the

recently completed Special Economic Zone (SEZ) has

been promoted in Indian newspapers and invitations

extended to Indian wood based industries to take

advantage of the opportunities offered by the zone.

The Gabon SEZ is a public-private partnership between

Olam International, the Republic of Gabon and the African

Finance Corporation. Log supplies will be guaranteed for

manufacturers setting up in the zone.

Gabon can supply a wide range of timbers with okoume

being the most popular for veneer and plywood

production.

Apart from okoume, Gabon’s reserves of exploitable

timber are said to extend to 25-35 mil. cu.m of ozigo, 20-

30 mil. cu.m of ilomba, 15-20 mil. cu.m of azobe, 10-20

million cu.m of padouk and large stocks of mahogany,

kevazingo, ebony, dibetou, movingui, and Zebrano.

The advertisements in India for the SEZ say companies

locating to the zone will enjoy tax benefits and

advantageous recruitment conditions.

India has been trying to supplement domestic timber

resources through imports from South East Asian

countries and some companies have invested in production

capacity in Asia to meet domestic requirements of veneers

and plywood. But now, because the Gabon SEZ is seen as

offering an attractive alternative, some Indian

manufacturers have production facilities in Gabon.

For more see: http://www.gsez.com/

As quality of imports fall mills turn to domestic teak

In the previous round of auctions the logs offered were

mostly old with few of fresh fellings and this pushed down

prices. However, freshly felled logs have become available

so prices have rebounded.

Analysts report the quality of imported plantation teak

from many suppliers has fallen which is driving millers to

purchase domestic teak, especially when auction prices

dip.

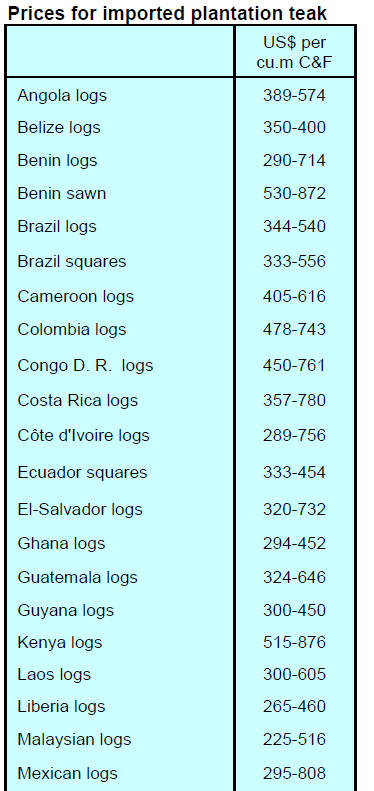

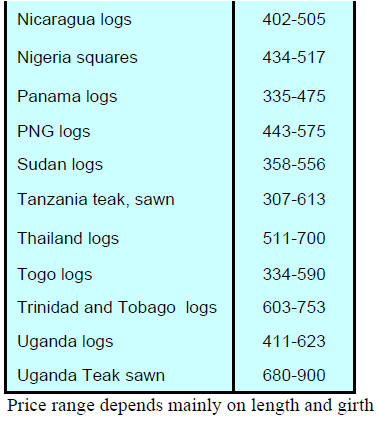

Plantation teak imports

As the Indian rupee steadily gains strength against the US

dollar, importers have been encouraged since the landed

cost of imported teak has fallen. Over the past two weeks

C&F prices have remained steady.

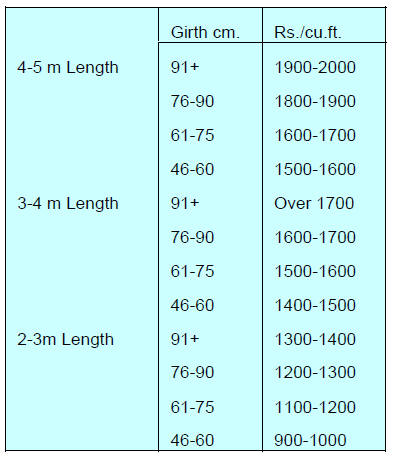

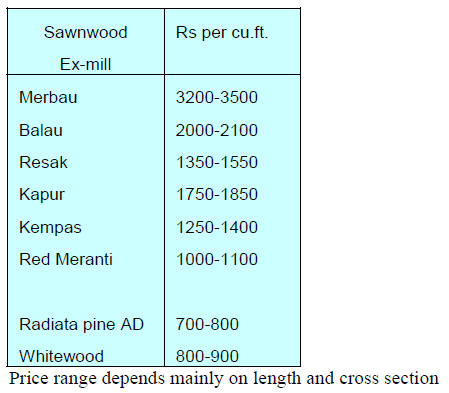

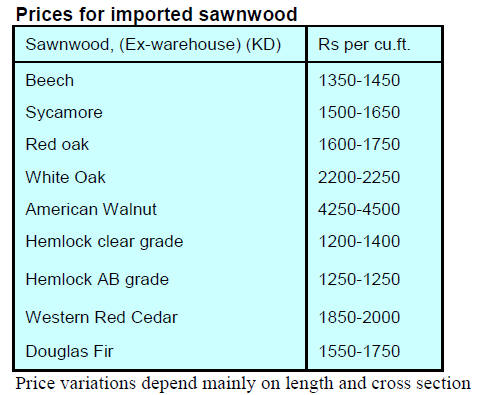

Sawnwood prices

Prices for sawnwood milled from imported logs remain

unchanged as shown below.

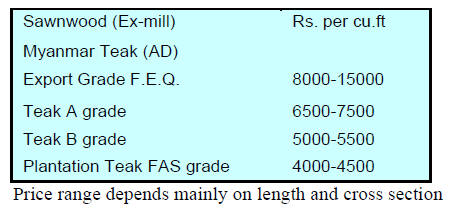

GST could result in higher teak prices for

endusers

Prices for sawn Myanmar teak remain unchanged from

two weeks earlier. Indian importers have seen an

opportunity to increase purchases of Myanmar teak as

some EU buyers withdraw due to fears of contravening the

EUTR.

With an increase in imports likely due to a stronger rupee

and the only issue on the horizon which could result in

increased wholesale prices is the implementation of the

Goods and Services tax set for 1 July this year.

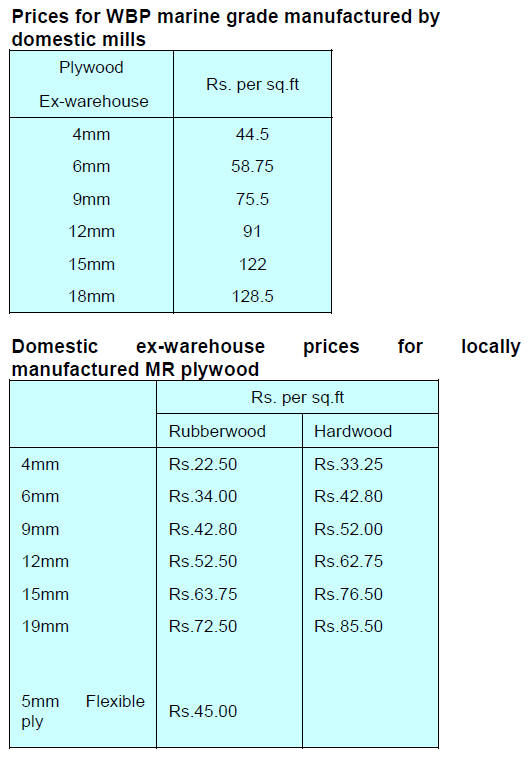

Pressure to raise plywood prices eases

Resin prices have come down to the relief of plywood

manufacturers and anlaysts report the supply of logs is

improving. The combined impact of these two

developments has eased the pressure for an increase in

wholesale prices. As with teak sawnwood, much will

depend on the impact of the GST on costs.

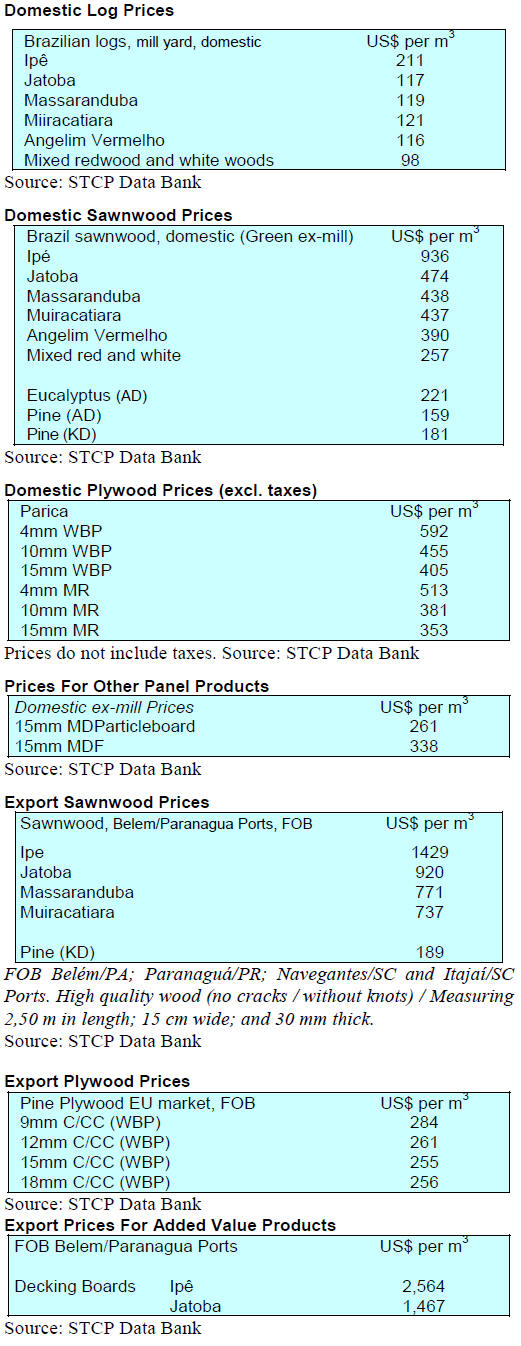

8. BRAZIL

Industry discusses 2017 economic

prospects

Although the Brazilian timber industry ended 2016 on a

negative note the Brazilian Association of Mechanically

Processed Timber Industry (ABIMCI), together with the

Timber Industry Council in the Federation of Industries of

Paraná State (FIEP), have projected a more favorable

business climate for the Brazilian timber sector in 2017.

In 2015 wood product exports increased 6% and in 2016

rose 2% despite the country’s GDP falling for each of

those years. It is against this background and because

demand in the US market is firming so prospects for 2017

are good says ABIMCI.

In addition to improved overseas demand higher

government spending and moves to stimulate the domestic

economy should lead to increased timber consumption,

especially in civil construction. Housing could be a major

growth area in Brazil as the country needs an estimated 80

million housing stock by 2025.

According to the Paraná State Forest Based Companies

Association (APRE) the construction sector offers great

opportunities for the forestry sector and that is why it is

important that manufacturers in the timber industry seek

continuous improvement in the quality of wood products

offered.

Inspection of wood transport in Mato Grosso State

Representatives of the Center for Timber Producers and

Exporters of State of Mato Grosso (CIPEM) recently met

with the Brazilian Federal Highway Police (PRF) to

discuss current procedures for inspection of forest

products being transported by road in the state of Mato

Grosso.

The meeting was prompted after several cases where

timber had been seized on suspicion of illegality only to be

proven to be legal. The problem, according to the Timber

Industry Union of Northern Mato Grosso (SINDUSMAD),

is not that cargoes are held but that the process to release

the trucks is slow and results in financial losses for

companies as delivery dates cannot be kept.

SINDUSMAD reported that members had discovered that

seized trucks with timber were not secure and pilfering of

the timber often occurred. In order to resolve these

problems, the establishment of a committee composed of

CIPEM representatives to assist PRF in improving the

inspection procedures has been proposed.

Another proposal made at the meeting was to conduct

immediate audits on seized timber suspected of being

illegal before the police ‘infraction report’ is issued

because once an ‘infraction report’ is issued it can take

from three to six months to clear the paper work and

release the truck and timber.

The PRF stated that it will review cases of timber

seizure

irregularities and verify the problems to be

corrected/rectified, taking into account the "Manual of

Procedures for Storage, Measurement and Inspection of

Forest Products", which standardises the procedures for

those agencies involved in inspection at different stages of

the wood supply chain in Mato Grosso.

Growth in Brazil’s wood panel exports

Brazil’s woodbased panel exports increased in the first

two months of 2017.

According to the Brazilian Tree Industry (IBA), in the first

two months of the year 174,000 cu.m of woodbased

panels were exported, a 40% increase compared to the

same period in 2016.

Between January to February 2017 export revenue from

the entire forestry sector was US$1.3 billion down 6%

year on year and only the woodbased panel sector

recorded an increase (US$39 million, up 22%). As a result

the trade balance in the forestry sector registered a positive

balance of US$1.15 billion in the first two months of the

year.

Latin American countries continue to be the main

destinations for the Brazil’s woodbased panels.

Business round with Mexico

Representatives of ABIMCI participated in a meeting on

‘Business Opportunities and Internationalisation’ with

Mexico in early March. The meeting addressed the

business environment, the commercial and trade

relationship between the two countries, opportunities for

Brazilian companies in Mexico and logistics and customs

issues.

Mexico is currently the world's 12th largest economy and

the a member of the largest free trade area in the

Americas. Mexico’s GDP was US$2.31 trillion in 2016

and has been growing at an average of 2.2% over the past

three years.

According to ProMexico, the Mexican government's

export promotion agency, Brazilian companies can have

access to 46 countries in three continents with which the

Mexican government maintains trade agreements,

representing a market of one billion consumers.

ABIMCI expects the results of this dialogue to be positive

in the near future for wood product industries that include

mechanically processed wood products, such as

sawnwood, veneer and high value-added products. The

latter includes, among other products, wood frames, doors,

windows, floorings and furniture components.

9.

PERU

Fast track procedure for forest

concession allocation

From the end of March access to a forest concession is

possible through a revised and shortened procedure

according to a provision published by the National

Forestry and Wildlife Service.

The areas that can be granted through the new fast track

procedure are those concessions which have reverted to

the State. There are about 3.3 million hectares of such

areas across the country. Also included in the fast track

procedure are those forest areas that were offered through

public tender but were not taken-up.

Regional Forestry and Wildlife Authorities are responsible

for identifying and publishing available areas that can be

fast tracked. Erik Fischer, Chairman of the Association of

Exporters said this move will help to revive the forest

sector which is facing a crisis.

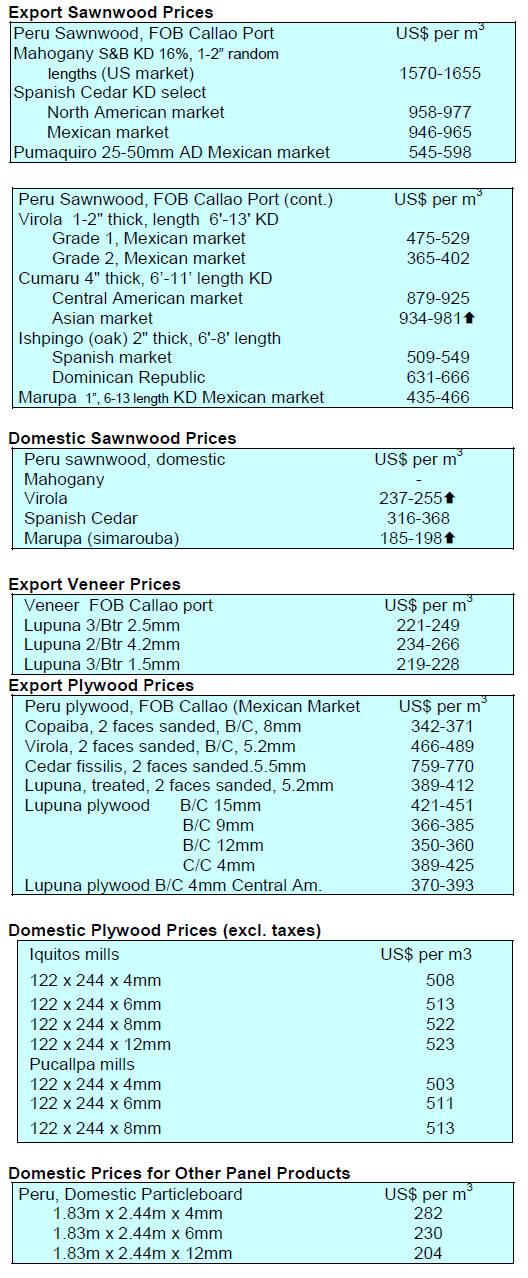

Particleboard imports fall

During the first two months of this year the value of

particleboard imports fell 4.6% compared to the same

period last year. In the period January - February 2017

Chile was the main supplier of particleboard to Peru.

While Chile maintained its rank as the top supplier, in the

first two months of this year fell the value of imports fell

15.5% year on year.

Ecuador was the second ranked but, as with Chile imports

declined (17%). In a reversal of the downward trend

imports of particleboard from Brazil increased in the

January/February period. Novopan Peru was again the

main importer of particleboard followed by Arauco Peru.

Coordination of method for measurement of forest

resources

The National Forestry and Wildlife Service (Serfor)

presented the results of its field investigation aimed at

standardising the method for measuring timber resources

to an Inter-Institutional Technical Group.

This group comprised representatives of the Regional

Governments Loreto, Madre de Dios and Ucayali, the

Forest and Wildlife Resources Supervision Agency

(Osinfor) of the Ministry of Production, Forest Regents

and the National Forest Confederation (CONAFOR -

PERU).

This initiative on standardising measurement protocols is

being supported by the North American/Peruvian Forest

Sector Initiative (PFSI).

National Forestry and Wildlife Plan – top priority

The Ministry of Agriculture and Irrigation, through the

National Forest and Wildlife Service (Serfor), has

indicated that the development of a National Forestry and

Wildlife Plan is a priority as it will result in strategies and

actions for the sustainable management of forest

resources.

The development of the plan will be coordinated by

National Center for Strategic Planning (Ceplan).

Serfor reported that this planning tool will be created

through consensus with stakeholders including regional

governments, guilds, indigenous communities, academy,

civil society and forestry development specialists.