|

Report from

North America

More hardwood plywood from China, Indonesia,

Malaysia

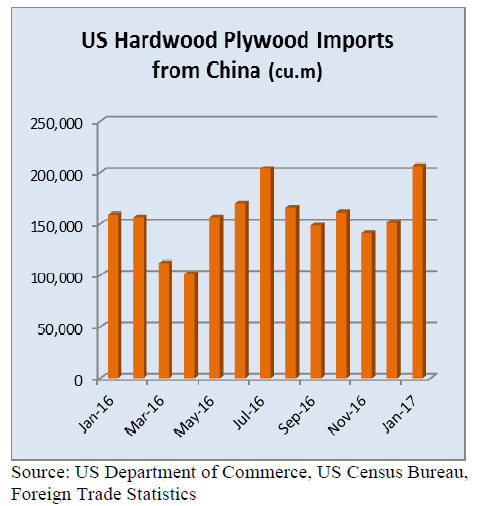

The volume of hardwood plywood imports grew one third

in January from the previous month and at US$155.4

million imports were 28% higher than in January 2016.

Much of the growth was in plywood imports from China,

Indonesia and Malaysia. Imports from China were 206,870

cu.m. in January and accounted for 60% to total hardwood

plywood imports.

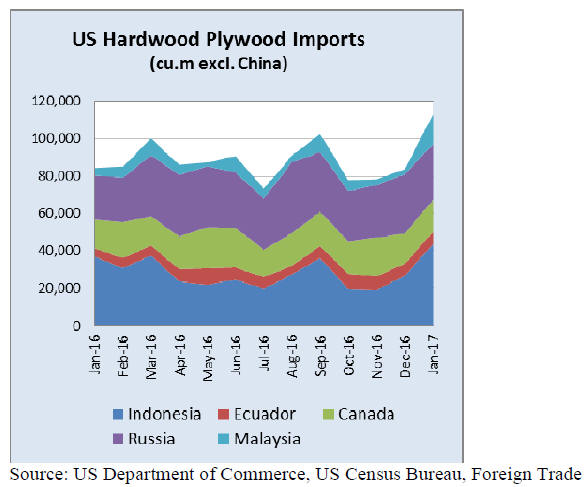

Indonesia¡¯s shipments to the US were 43,442 cu.m. in

January, up 18% from the same time last year. Hardwood

plywood imports from Malaysia more than tripled from

January 2016 to 15,829 cu.m.

Among smaller suppliers Cambodia and Vietnam

continued to grow plywood shipment to the US market.

Both countries exported over 3,000 cu.m. each to the US

in January.

Tropical veneer imports down except from Cameroon

Tropical hardwood veneer imports declined 6% in January

to US$2.7 million. Imports from all major suppliers

decreased except Cameroon. Italy remained the by far

largest supplier of tropical veneer to the US, followed by

China, Cote d¡¯Ivoire and Cameroon.

China the leading supplier of hardwood mouldings

Hardwood moulding imports were worth US$16.7 million

in January, unchanged from January 2016. However,

China surpassed Brazil as the largest source of US

imports. Imports from China were US$5.8 million and

from Brazil US$4.3 million.

Malaysian shipments were almost unchanged from

January 2016 at US$1.1 million. Imports from Indonesia

increased to US$707,197 in January.

China¡¯s 35% share of hardwood flooring imports

January 2017 hardwood flooring imports gained 42% year

on year and were worth US$3.8 million in January.

Imports of assembled flooring panels (including

engineered hardwood flooring) were US$14.3 million,

61% higher than in January 2016.

China¡¯s share in hardwood flooring imports has increased

substantially. Imports from China were worth US$1.35

million and accounted for 35% of total monthly hardwood

flooring imports in January. Indonesia was the largest

source of imports in 2016, but in January Indonesian

shipments to the US were worth only US$494,931.

Hardwood flooring imports from Malaysia were also down

compared to January 2016. Imports from Europe

surpassed US$0.5 million in January.

Imports of assembled flooring panels decreased 11%

month-over-month on January, but imports from Brazil

and Thailand were up. China remained the largest source

of imports in January at US$6.0 million, followed by

Canada and Indonesia. Assembled flooring imports from

all leading suppliers were higher than in January 2016.

Wooden furniture imports remain at record high levels

The value of wooden furniture imported in January was

almost unchanged from the previous month at US$1.58

billion. Imports were 13% higher than in January 2016.

Furniture imports from China declined 2% month-overmonth

to US$768 million in January, but imports were

12% higher than at the same time last year.

The strongest growth was in wooden furniture imports

from Vietnam, which increased 10% from December to

US$339 million. Imports from Vietnam were 24% higher

than in January 2016. Furniture imports from Canada,

Mexico and India were also up compared to January 2016.

Malaysian furniture exports to the US were US$58.9

million in January, unchanged from December and slightly

down from January last year. Imports from Indonesia were

slightly down in January at US$45.9 million.

Imports of non-upholstered wooden seats grew for the

third consecutive month in January. Upholstered seating

imports declined 3% from December. Imports of wooden

kitchen and bedroom furniture were up in January, while

office furniture imports declined.

US producers want earlier action on plywood imports

from China

The Coalition for Fair Trade of Hardwood Plywood has

filed "critical circumstances" petitions with the

Department of Commerce according to the Hardwood

Plywood and Veneer Association. The purpose is to stop

an increase in Chinese hardwood plywood shipments to

the US before antidumping and countervailing duty orders

are imposed.

Duties are due to be determined April 17 for

countervailing duties and June 16 for antidumping duties.

If the petitions are successful, antidumping and

countervailing duties will be imposed 90 days earlier than

currently scheduled. If critical circumstances are found,

Chinese hardwood plywood imported as early as January

17 will be subject to countervailing duties, and plywood

imported as early as March 16 will be subject to

antidumping duties.

The previous Department of Commerce investigation

ended with the removal of all anti-dumping and

countervailing duties on hardwood plywood from China.

Vietnamese furniture manufacturing facility to open in

US

The Vietnamese furniture producer Vinh Long has

announced a US$15 million investment in a new furniture

plant in Arkansas. It will be the first Vietnamese-owned

manufacturing plant in the US according to the company.

Vinh Long plans to produce particleboard furniture for

Ikea and other retail customers in North America.

The state of Arkansas will provide an incentive package to

the company after it has hired the planned 75 employees

for the manufacturing facility. Vinh Long cites sustainable

supply of raw materials and local support as reasons for

the investment.

Furniture manufacturing down for third consecutive

month

Real gross domestic product (GDP) increased at an annual

rate of 2.1 percent in the fourth quarter of 2016 according

to the second estimate released by the US Department of

Commerce. In the third quarter, real GDP increased 3.5

percent.

The unemployment rate changed little in February. The

rate was 4.7%, down from 4.8% in January according to

the US Bureau of Labor Statistics. Employment grew in

construction and manufacturing.

Economic activity in the manufacturing sector expanded in

February and the overall economy grew as well, according

to the Institute of Supply Management. New orders,

production, inventories and employment increased

industry-wide.

The only industry that reported contraction in February

was furniture and related products. It was the third

consecutive month of lower activity in furniture

manufacturing. Wood product manufacturers reported

growth in February.

Consumer confidence was high in early March and

significantly up from March 2016, according to the

University of Michigan consumer confidence index.

Households were more optimistic about current economic

conditions than any other time since 2000, mainly due to

better personal finances.

Consumers were divided about future economic prospects.

Republican voters expect strong economic growth, while

Democrats anticipate a deep recession, which may

discourage their discretionary spending.

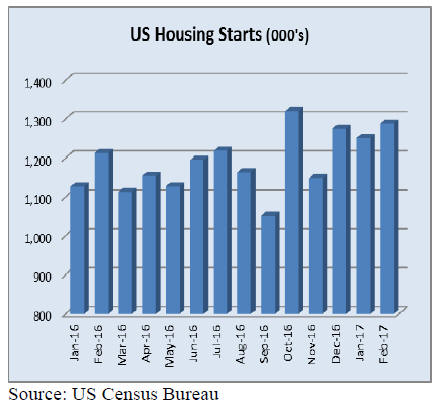

Housing construction up in February

Housing starts increased 3% in February to a seasonally

adjusted annual rate of 1,288,000, according to the US

Department of Housing and Urban Development and the

Commerce Department. Single-family home construction

grew over 6% and accounted for 68% of total starts.

The number of building permits issues, which indicates

future building activity, decreased 6% in February from

the previous month at a seasonally adjusted annual rate.

Multi-family permits fell, while single-family

authorizations increased 3%.

In February builders¡¯ confidence in the market for new

single-family homes jumped to its highest level since June

2005, according to the National Home Builder

Association.

The association¡¯s chairman cited President Trump¡¯s recent

executive order to repeal or revise the ¡°Waters of the

United States Rule¡± for protecting waterways that can

affect permitting of construction.

Sales of existing homes sales declined in January,

according to the National Association of Realtors.

February¡¯s sales were still 4% higher than a year ago. The

median price of existing homes increased for the 60th

consecutive month. The median home price was 8%

higher than a year ago.

Lacey Act and composite wood products

Like other imported wood products, particleboard and

MDF fall under the US Lacey Act to prevent trade in

illegally logged timber. The United States Department of

Agriculture describe the procedure of declaring composite

products where identifying the species may be difficult.

If species identification is difficult while using due care, a

Special Use Designation (SUD) can be used. So-called

¡®Special Composite SUD¡¯ is allowed for products that are

made from more than one plant species, processed into

small fibres and bonded together. This includes MDF,

HDF, OSB, particleboard, paper, paperboard and

cardboard.

The SUD cannot be used to declare plywood. Plywood has

to be declared by wood species, unless it has a composite

core. The outer plies still need to be filed normally.

The requirements for composite wood products are

available in the Frequently Asked Questions section of the

Lacey Act webpage:

https://www.aphis.usda.gov/plant_health/lacey_act/downl

oads/Lacey-Act-Program-faq-11-23-2016.pdf

|