Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March 2017

Japan Yen 114.75

Reports From Japan

Economy performed well in 2016 but

uncertainty

looms

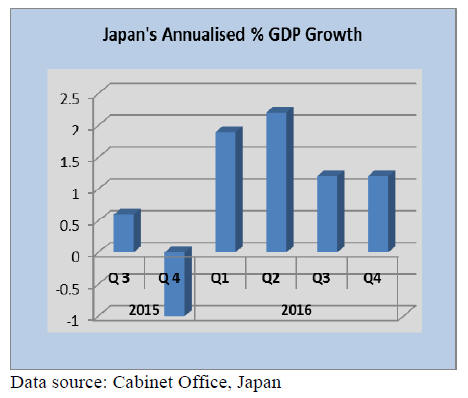

Increased business investment in the final quarter of 2016

lifted economic growth higher than initially reported.

Third quarter growth came in at annualised 1.2% however;

the revised figure is still below forecast prepared in mid-

2016 which anticipated growth at 1.6%.

The lackluster growth underlines the challenges facing the

Japanese government which, along with the Bank of

Japan, have been struggling to reverse the years of

economic stagnation. Japan's economy grew for four

consecutive quarters in 2016 but the latest survey of

businesses shows deep concerns about prospects in the

medium term due to rising uncertainty at which way the

global economy will move.

See:

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

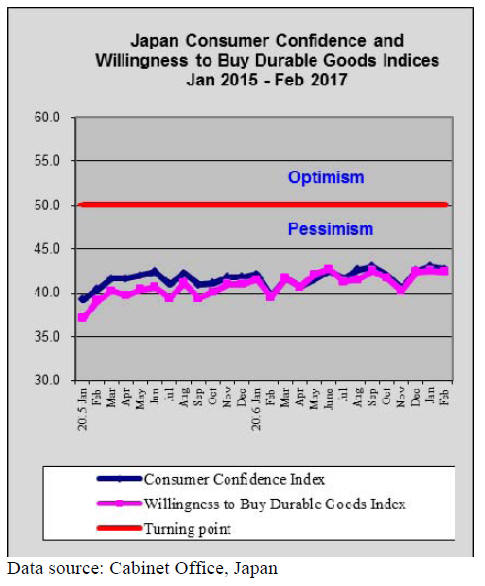

Consumer Confidence falls unexpectedly

Consumer confidence fell in February where analysts had

expected a slight improvement given the positive signs in

the index in December 2016 and again in January this

year. The consumer sentiment index dropped to 43.1 in

February from January's 40-month high.

Among the individual components assessed the overall

livelihood index fell in February as did the indices for both

income growth and willingness to buy durable goods.

The most positive result of the February survey was that

those surveyed saw improvement in employment

prospects. In January the composite employment PMI

recorded the largest advance as the workforce expanded

led by expansion in manufacturing.

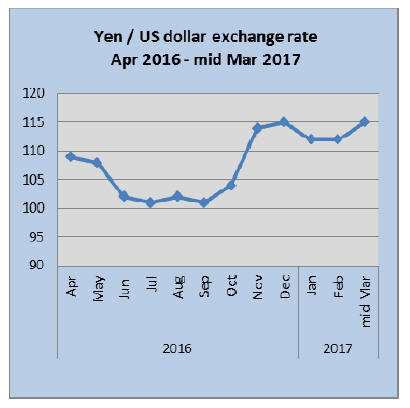

Interest rate rise drives yen lower

In early March there was an unexpected weakening of the

US dollar against the yen as currency traders factored in

the likihood of a rise in US interest rates. For the month to

15 March the yen weakened slightly against the US dollar

once again pushing up the cost of imports.

The prospects are for further yen weakness as signals from

the US Federal Reserve are still pointing to a steady

increase in interest rates following the 0.25% increase just

announced.

With inflation at around 2.7% and low unemployment

pressure on prices in the US have started to rise.

Japan remembers - a moment of silence at 2.46pm

Thousands of people in areas most affected by the massive

11 March 2011 earthquake and tsunami were still living as

evacuees in temporary makeshift homes as the country fell

into a moment of silence at 14.46 11 March 2017 marking

the 6th anniversary of the disaster.

The number of those living in makeshift homes after the

nuclear disaster had fallen by around 70% at the beginning

of this year but that still leaves over 100,000 mainly

elderly people, unable to get on with their lives.

Due to delays in the building safe permanent housing and

due to high radiation levels near the nuclear facility many

people will have to remain in temporary homes.

Import round up

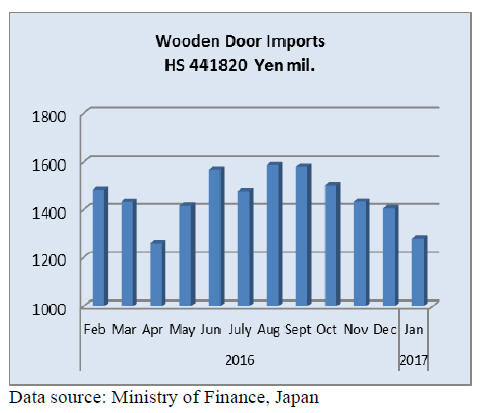

Doors

Year on year Japan¡¯s January 2017 imports of wooden

doors (HS 441820) were down 25% compared to January

2016 and from a month earlier they were down around

9%. Since September last year there has been a steady

decline in imports into Japan of wooden doors.

The top suppliers in January in order of rank were China,

Indonesia and Malaysia which together accounted for over

90% of Japan¡¯s wooden door imports for the month.

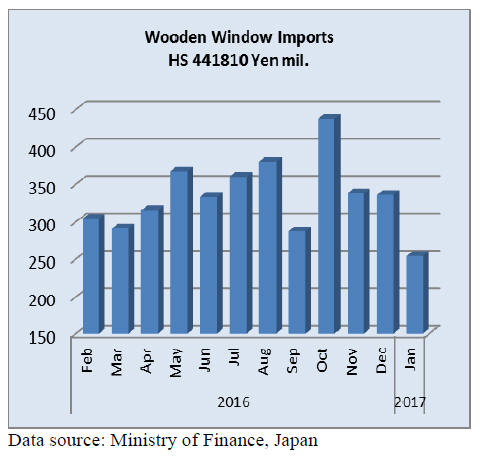

Windows

There was a sharp drop in Japan¡¯s year on year wooden

window imports in January 2017 (-19%) and compared to

a month earlier January 2017 imports dropped almost

25%. The January 2017 value of wooden window imports

was one of the lowest over the previous 12 months and

only just above the record low in September 2016.

As was the case in previous months shippers in China and

the Philippines dominated Japan¡¯s imports of wooden

windows. Shipments of wooden windows in January 2017

from these top two suppliers accounted for over 80% of

imports.

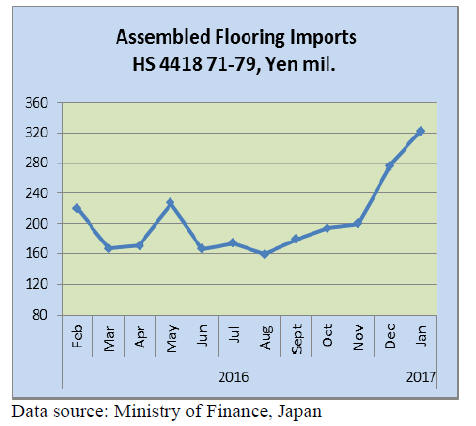

Assembled flooring

Three categories of assembled flooring are included in the

data presented below, HS 441871, 72 and 79.

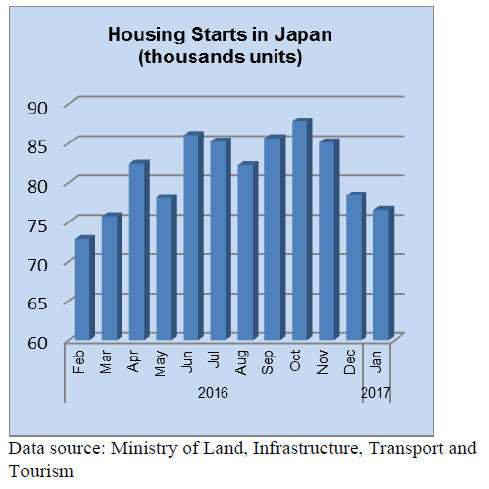

The continued increase in the value of imports of

assembled flooring is in sharp contrast to the trend in

imports of wooden doors and windows such that this is not

just a reflection of exchange rate fluctuations. The surge in

the construction of apartments in Japan is thought to

behind the unusual increase in imports of assembled

flooring.

From a year earlier, January 2017 imports of

assembled

flooring were up a staggering 63% and there was a rise of

17% in imports over levels in December 2016.

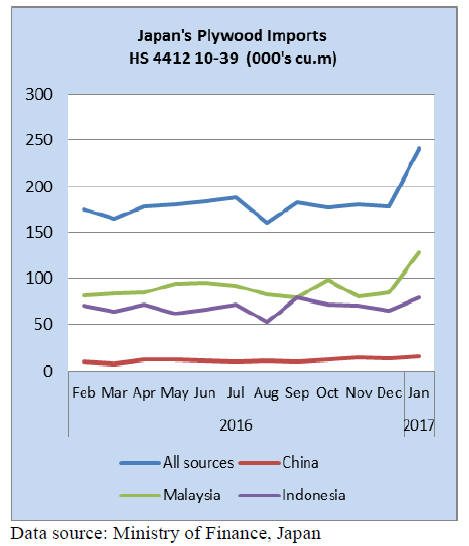

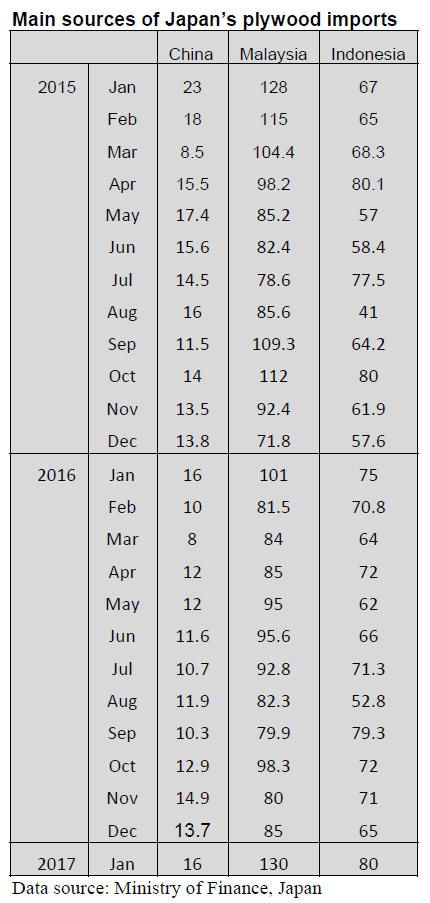

Plywood

The figure below shows the trend in imports of 4

categories of plywood, HS 441210/31/32 and 39.

Throughout 2016, as was the case in 2015, almost 90% of

Japan¡¯s plywood imports are from Malaysia, Indonesia

and China. This trend continued into January 2017.

January 2017 arrivals of plywood from the top three

suppliers, Malaysia, Indonesia and China beat

expectations by rising 18%. January arrivals from

Malaysia surged 18% year on year, shipments from

Indonesia were up 6% but arrivals from China remained at

the same level as a year earlier.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Clean Wood Act

The Act on promotion, use and distribution of legally

harvested wood and wood products will be effective May

20, 2017.

Basic draft of ministry ordinance of effective regulation

and standard of judgment is disclosed on February 22 and

public opinion is invited until March 23.

Since wooden building needs variety of materials, the act

is made with flexibility to register legally proven materials

only.

The act requires and promotes use of legally proven

wood

materials for users of wooden products such as

manufacturers, distributors, house buildering companies

and contractors.

This is promotion method, not regulation like the Building

Standards Act so it is up to individual¡¯s decision. Anyone,

which wishes to follow the act, will register to the

organizations and tries to procure and market legally

proven wood products.

Method of legality proof has three methods. One is group

verification, which is selected by the Green Purchase law

then second is Forest Certification systems. Third is

independent method by individual company. Also local

wood certification by prefectures can be used as

verification method. Forest Certifications are considered

as verification method.

Details of group certification may have some changes in

languages of legal certification such as registration of

harvest. For imported wood products, it is necessary to

have confirmation if the products are conformed to law of

country of origin and legal certification systems.

The Forestry Agency will publicize information of

producing countries on its web pages.

Wood products, which are not proven even after effort to

seek legality, can be handled as long as they are separated

from legal products.

The Forestry Agency commented that it would ask

cooperation to exporting countries not to increase wood

products without legal certification through diplomatic

channels and it is important that exporting countries

should have system to prove legality.

There are many demands to start handling legally certified

products first so registration system would have system to

register partially. For instance, housing company registers

domestic wood.

North American and European products for structural

members then withholds certification of other materials

until system to certify legality is established.

For some wooden building materials manufacturers have

three different series of products, they can register only

one first and withhold rest of series. After all, this aims to

promote use of legally proven wood products without any

penalty.

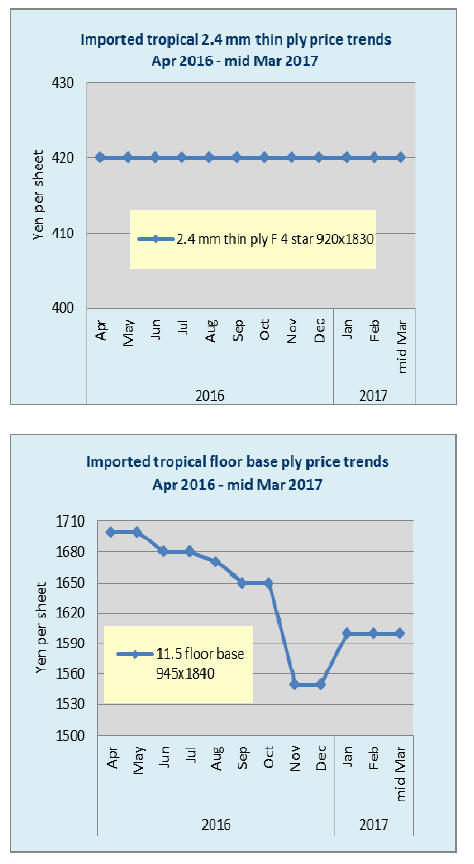

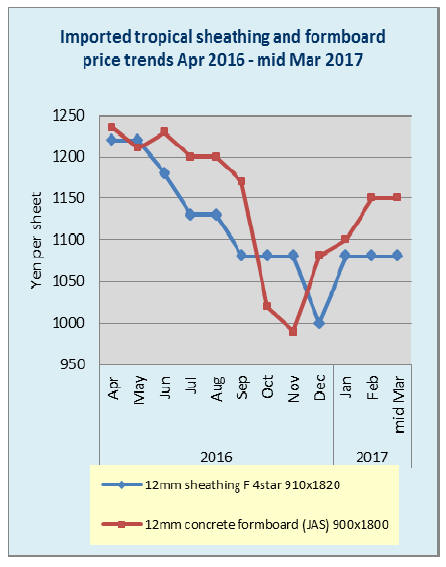

Plywood

New orders by precutting plants to plywood manufacturers

are declining but demand to deliver orders, which are

delayed, is strong. Movement of import plywood

continues to be dull so the importers are watching the

market before book closing at the end of March.

The importers and wholesalers need to increase the sales

prices after cargoes, which cost is high with weak yen in

late last year, arrive from now on.

January production of softwood plywood in January was

227,700 cbm, 1.4% more than January last year and 4.6%

less than December. Fewer working days in December by

year-end holidays and lower efficiency of drying by cold

weather in the North East and Japan Sea side plants caused

lower production.

The shipment in December was 235,000 cbms, 1.1% less

and 1.8% less. The shipment exceeded production

by7,200cbms. Precutting plants were busy in January to

catch up delayed orders.

Plywood plants continue full production because

mills in

Eastern Japan carry about a month of delivery delay and

Western Japan mills have maximum of three months of

delay. The inventory dropped down to 83,300 cbms, 7,200

cbms less than December so tightness continues.

January arrivals of imported plywood were 308,500 cbms,

17.4% more and 32.1% more. Malaysia supplied 133,400

cbms, 28.5% and 51.8% more.

Indonesia 88,500 cbms, 6.5% and 23.2% more.

China69,000 cbms. Delay the customs clearance in

December and more orders placed by the importers for

tight items are the reasons of higher volume. Cargoes

coming in after March are high cost by weak yen so the

importers need to push the prices.

|