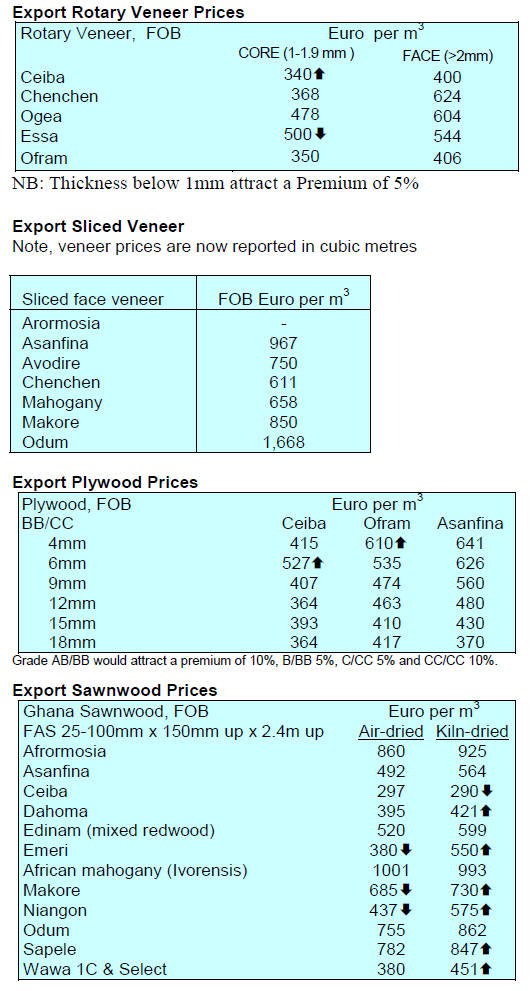

2. GHANA

Rosewood export banned

The Minister of Lands and Natural Resources has

announced a nationwide ban on the export of rosewood

products and instructed the Forestry Commission to stop

issuing felling permits for rosewood.

The Minister announced a renewed drive against rosewood

felling when he met stakeholders called to support solving

the challenges in the forestry and timber sectors which he

said have a huge potential for driving economic

development in the country.

Natural resource sector receive boost in budget

The new administration has pledged resources to support

the forestry and this has been reflected in the 2017 budget

dubbed ‘Sowing the Seeds for Growth and Jobs’.

Finance Minister Ken Ofori-Atta said the budget aims to

address issues hindering growth in the manufacturing

sector and in job creation by the private sector.

The 2017 budget includes some key initiatives to boost the

forestry sector:

the Ministry of Lands and Natural

Resources has

the Ministry of Lands and Natural

Resources has

been allocated a budget of GHó348 million for

2017, an 18% increase on last year’s budget

work will be undertaken to expand the

work of

work will be undertaken to expand the

work of

the Forestry Commission ‘Rapid Response Unit’

whose task is to protect forest reserves

and the private sector will be engaged

in

and the private sector will be engaged

in

establishing 6,000ha of plantations through

public/private partnerships

The key macroeconomic targets in the budget for the

medium-term (2017-2019) include an overall real GDP

growth to an average of 7.4% and inflation within the

range of 8-10%.

In related news, the Forestry Commission has appealed to

the government to allow officers in the Rapid Response

Unit to be provided with firearms training so they can

effectively confront poachers and illegal miners in national

forests. Currently the Unit does not have weapons to

match the sophisticated assault rifles used by illegal

chainsaw operators and miners.

Affordable housing plan

At over 30% Ghana has one of the highest mortgage

interest rates in the world which puts owning a home out

of reach of most people. Atta Akyea, the Minister for

Housing and Works, has proposed setting up a fund for

affordable homes and the abolition of the tax on property

sales.

In a recent report Oxfordeconomics says “Ghana currently

faces a significant housing shortage, with various industry

estimates putting the deficit at roughly 1.7 mil. units and

growing at a rate of 70,000 units a year”.

Meeting the demand for housing will require vast amounts

of wood products so if the plan is implemented the wood

product manufacturing sector would get a considerable

boost to domestic sales.

See: http://www.oxfordbusinessgroup.com/searchresults?

sector=all&country=54035&keywords=

3.

SOUTH AFRICA

Rising mill stocks signal weak demand

Local analysts report the timber market is currently

subdued and that this is borne out by the high level of

stocks at domestic sawmills.

It is reported that delivery times from domestic mills have

come down from around 6 weeks during the time of peak

demand to just 2 days now in some cases. Last year pine

mills in South Africa sold just over 63,000 cu.m less than

in 2015.

Local mills had been hoping to increase prices in the first

quarter to compensate for rising production costs but

attempts at a price increase have now been postponed until

at least May.

The weak market is mainly the result of the stagnant

housing and construction market.

Sales of domestic constructional timbers are down

as are

sales of meranti and okoume.

Hardwood sales have fallen so much that there has been

some moderate discounting as importers try to adjust their

stocks. Demand for US hardwoods is similarly affected

and it is only exchange rates that are impacting price

levels.

Domestic MDF and particleboard producers pushed

through a small price increase recently and this is being

maintained even as demand slips. The main reason behind

the steady prices for panels is the weaker rand which has

pushed up the price of imported panels.

Shopfitting boom coming to an end

There is still some ongoing activity in the shopfitting

segment of the market but many of the shopping mall

construction projects are nearing completion. There are

few prospects for new projects so suppliers to the

shopfitting segment of the market will have to rely on

refurbishments and shop upgrades to maintain business.

The industry is still anxiously awaiting the announcement

of government construction contracts which has been

further delayed creating stress in the timber sector.

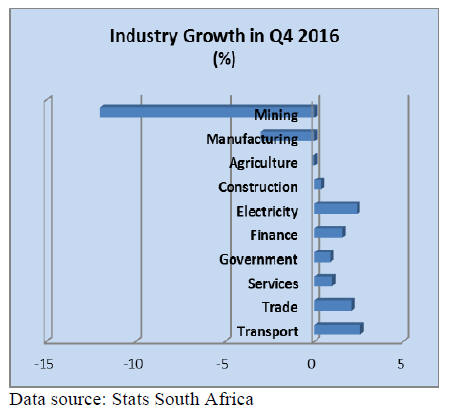

GDP dips into negative in fourth quarter 2016

A recent press release from Stats South Africa has

reported the main contributors to the negative GDP growth

rate late last year were the mining/quarrying and

manufacturing sectors. Mining and quarrying activity

declined 11.5% year on year in the fourth quarter, largely

the result of lower production in coal, gold and other ores.

Output from the manufacturing sector dropped 3%

because of lower production in the food and beverages,

petroleum, chemical products, rubber and plastic sectors.

The agriculture, forestry and fishing industry have been in

decline for eight consecutive quarters.

The largest positive contributors to GDP were the trade,

catering, the accommodation industry, finance, real estate

and business services.

See:

http://www.statssa.gov.za/?p=9631

4.

MALAYSIA

Furniture fair month in Malaysia

The four-day Malaysian International Furniture Fair

(MIFF) and the Export Furniture Exhibition (EFE) were

held simultaneously running 8-11 March. While report on

the fairs are yet to be released, MIFF chairman, Tan Chin

Huat, said his show is expected to generate contracts

worth in the region of US$1bil. Last year contracts

concluded topped US$900 mil.

Tan said he expects the weaker Ringgit to help boost

exports and reports that this year’s MIFF hosted a record

number of exhibitors.

The Export Furniture Exhibition (EFE) was arranged by

EFE Expo Sdn Bhd, a wholly-owned subsidiary of the

Malaysian Furniture Council (MFC). This four-day event

showcased a diverse range of furniture featuring more than

300 exhibitors across eight halls within a 30,000sq.m

exhibition space at Putra World Trade Centre in Kuala

Lumpur.

Speaking on these two events, Plantation Industries and

Commodities Minister, Mah Siew Keong, said increasing

demand for Malaysian furniture products, coupled with

innovation in the industry, will ensure growth of the

Malaysian furniture industry.

2017 has been declared the Year of the Internet Economy

by the Malaysian Government and Minister Mah

expressed confidence that local furniture producers would

expand activities in the digital marketplace.

MTC sponsorship of buyers to Malaysian Fairs

In a recent press release the Malaysian Timber Council

(MTC) has explained the philosophy behind its sponsoring

of exhibition space and visits to these trade fairs which

aim to attract investment and facilitate trade for Malaysian

timber and wood product manufacturers.

This year MTC sponsored participation of some SME

furniture companies at both fairs. At the same time, the

Council also sponsored 15 Indian companies for the India

Export Pavilion in EFE.

Last year MTC sponsored 20 buyers from India but has

trebled the number this year. “Sponsoring these buyers is

part of MTC’s Incoming Sourcing Mission and it has

delivered far-reaching benefits to the industry which is

why we are tripling the number of sponsorships for this

year,” said MTC Chief Executive Officer Datuk Dr Abdul

Rahim Nik.

For more see:

http://www.mtc.com.my/images/media/392/20170307_mtc_trebl

es_sponsorship_of_buyers_to_furniture_fairs.pdf

Local species for plantations

Sarawak’s Chief Minister, Abang Johari Tun Openg,

wants to explore the opportunities for establishing

plantations of fast-growing indigenous trees to supply

wood for the timber industry.

Currently, most of the plantations are of acacia

mangium.

The Chief Minister called for research to identify local

species suitable for plantations.

In related news a South Korea company has expressed

interest in investing in the biomass industry in Sarawak. A

spokesperson from the Embassy of the Republic of Korea,

said the potential of biomass industry in Malaysia is very

attractive for Korean companies.

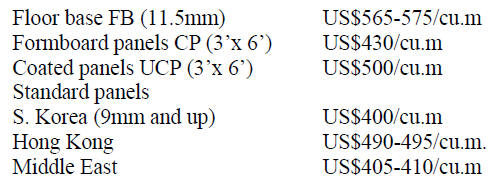

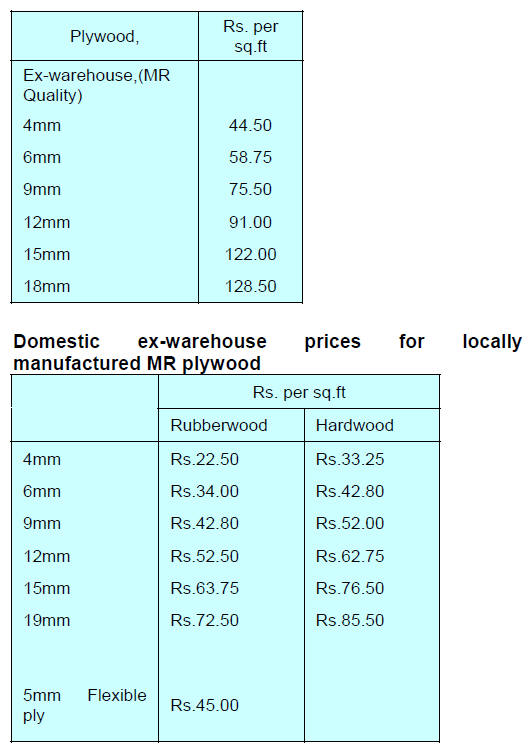

Plywood export prices

Plywood traders in Sarawak reported February FOB

export prices as:

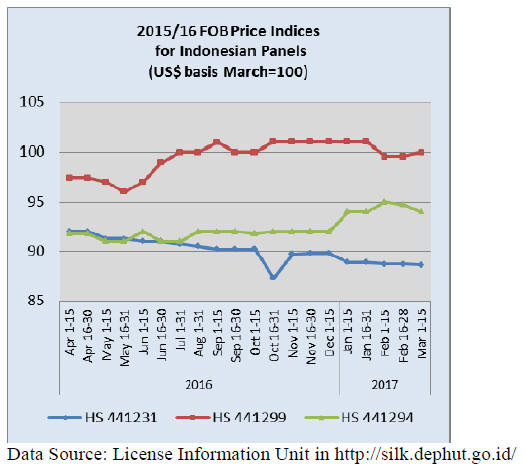

5. INDONESIA

Plans to expand non-tax revenues from

forestry

The Ministry of Environment and Forestry plans to

reactivate Standing Stock Compensation charges to boost

non-tax revenue from production forests. Putera Parthama,

Director General in the Ministry said 2016 non-tax

revenues from the forestry sector were Rp2.7 trillion

sharply down on the level in 2015.

Parthama suggested that one of the causes of falling nontax

revenues was the gradual decline in output from

forestry enterprises much of which stems from the falling

prices for Roundwood, especially from plantations.

Forestry enterprises have role in climate change

mitigation

The Director General of Climate Change in the Ministry of

Environment and Forestry said enterprises can play an

important role in the national emission reduction target of

29% by 2030.

In the discussion on ratification of the Paris Agreement on

Climate Change it was argued that support from forestry

businesses, along with local governments, nongovernmental

organisations and indigenous peoples is

essential if emission reduction targets are to be achieved.

In the national emission reduction plan the forestry sector

is expected to contribute around 17% of the reductions.

Other main contributing sectors are energy, waste

management and agriculture.

Indonesia, Saudi Arabia seek expanded trade

cooperation

Indonesia and Saudi Arabia have agreed to strengthen

collaboration in developing mutually beneficial trade

strategies, market research and the encouragement of joint

activities.

Indonesia’s Trade Minister reported that the two

countries

will share trade databases to encourage business

cooperation.

It was noted that Saudi Arabia is tied into the Gulf

Cooperation Council Customs Union and any trade deals

must be conducted through this Union.

In related news, the chairman of the Indonesian Chamber

of Commerce and Industry (Kadin), has reported that

Saudi Arabian entrepreneurs were attracted by Indonesia’s

woodcraft products and that there are opportunities to

expand trade with Saudi Arabia.

In recent years Indonesia’s trade with Saudi Arabia has

been declining, dropping to US$5 billion in 2016

compared to US$8 billion in 2015.

6. MYANMAR

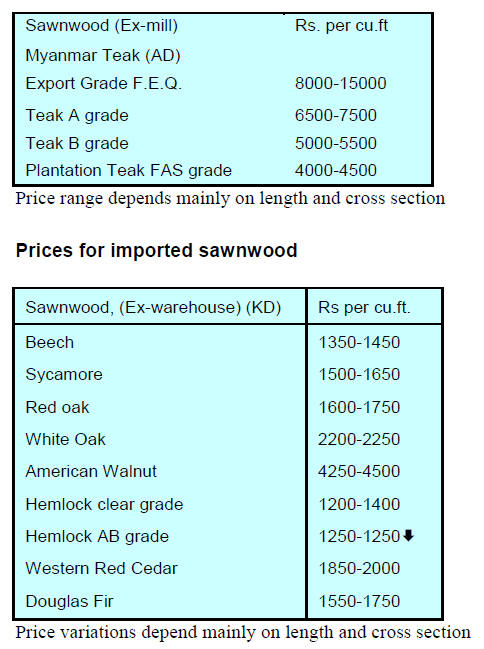

Exporters rush to avoid 1 April tax

Parliament has now confirmed the 10% Special

Commodity Tax on all sawn timber export and local sales.

This tax and the zero tax on finished products will come

into force 1 April this year. It is understood that the private

sector and Forestry Department are now discussing what

products are included in the term sawn timber.

A domestic newspaper, Yangon Times Journal, quoted a

former Secretary of a timber association as contending that

teak is itself a high value product so all teak products

could be deemed high value. He pointed out that the price

per cubic metre for high quality sawnwood can be much

higher than the per cubic metre price of wood in, for

example, a teak garden chair.

As a result of the introduction of the Special Commodity

Tax on sawnwood manufacturers are rushing to ship

stocks of teak during March and this is putting pressure on

the availability of containers.

One major exporter has said that his company has

accepted the new tax as a contribution to government

revenues but hopes that the authorities will be flexible in

how the ruling is applied.

It is reported that both state and private sector mills are

facing difficulty in securing workers and they are also

having problems with log supplies. These two issues and

the imposition of the new tax have prompted some foreign

owned mills to consider ceasing production.

Interim export data

For the 9 months April to December 2016 earnings from

timber exports totalled around US$75 million. As of

December last year there were around 100 wood product

exporters in Myanmar. There is a growing concern on the

part of EU importers about verification of the legality of

wood products from Myanmar.

EU traders who attended the Myanmar Timber Legality

Assessment System workshop last month in Yangon

expressed satisfaction on the Gap Assessment Report by

Myanmar Forest Certification Committee. They expressed

optimism on prospects for increased transparency by the

Forestry Department and the Myanma Timber Enterprise

which will provide tangible information on the traceability

and the legality status of Myanmar wood products.

7. INDIA

Inflation rate trends

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index for all

commodities (Base: 2004-05=100) for the month of

January, 2017 rose by 1% to 184.6 from 182.8 for the

previous month.

The annual year on year rate of inflation, based on the

monthly WPI, stood at 5.25% (provisional) for January

2017.

See:

http://eaindustry.nic.in/cmonthly.pdf

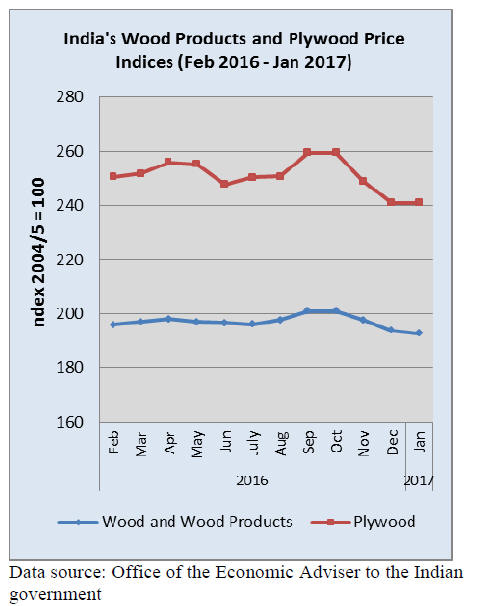

Timber and plywood price indices slide at year end

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

Demonetisation continues to haunt

Provisional figures from India’s Central Statistics Office

(CSO) suggest GDP for the third quarter 2016 expanded

7% compared with 7.3% in the previous quarter as the

effects of demonetisation ran through the economy.

Viral Acharya, Deputy Governor of the Reserve Bank of

India, has said the Bank expects the negative impact of the

withdrawal of large denomination currency notes will

continue to be felt into early 2017.

The 7% growth figure has been challenged by some local

analysts who say the full impact of the demonetization was

not factored in when the CSO prepared growth estimates.

More help for affordable homes sector

Of the estimated 400 million people living in urban India,

some 35% live in ‘informal’ housing. These temporary

housing areas lack basic services and most of households

do not have any formal property rights and depend on

casual informal work making it difficult for them to break

out of the poverty trap.

The government has ambitious plans to expand affordable

housing and this will get a boost as affordable houses may

soon be exempt from stamp duty, which currently ranges

from between 4% and 8% of the transaction value.

At a recent meeting with CREDAI, the Confederation of

Real Estate Developers' Associations of India, the Minister

for Urban Development reported that his ministry had

submitted a request to state governments to exempt

affordable houses from stamp duty.

He also reported that the central government would ensure

that there was no net tax increase on housing as the new

goods and services tax (GST) is implemented.

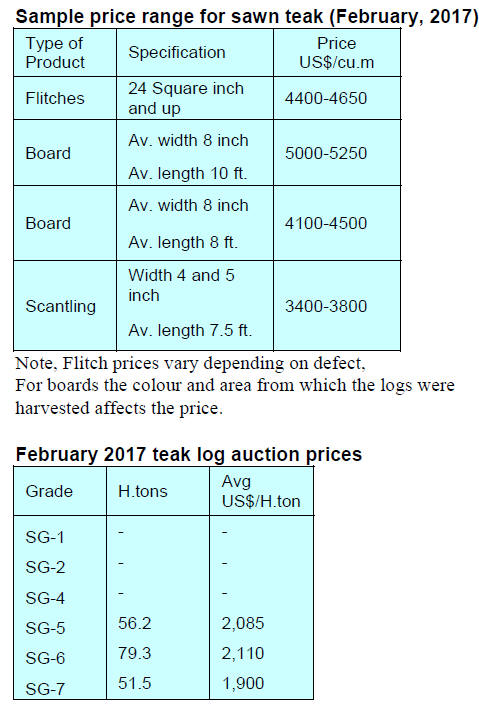

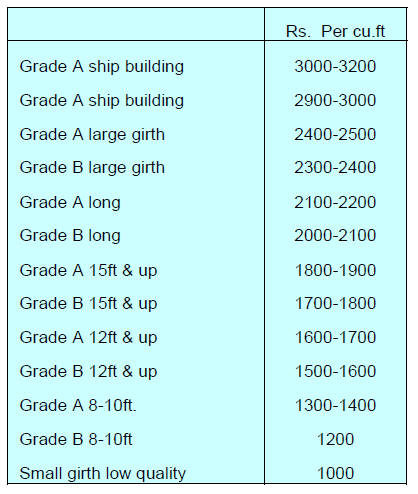

Teak auctions in Western India

Auctions at various forest depots in North and South

Dangs and the Valsad Divisions were held from 16

January to 8 February 2017. Approximately 13,000 cubic

metres of logs were offered for sale of which some 65%

was teak, the balance being hardwoods such as Adina

cordifolia, Gmelina arborea, Pterocarpus marsupium,

Acacia catechu and Mitragyna parviflora.

Since imported teak logs are mostly of small girth buyers

attending the auction of domestic logs are there to secure

larger girth logs. At the recent sale prices were down

slightly from the most recent past sale.

Very good quality non-teak hardwood logs 3-4m long

having girths 91cms & up of haldu (Adina cordifolia),

laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium attracted prices in

the range of Rs.1200-1300 per cu.ft., grade A logs were

sold at RS. 1000-1100 per cu.ft and medium quality logs

were sold at between Rs500-650. Small girth logs were

sold at Rs.300-500 per cu.ft.

Analysts at the sale say the main reason for the slip in

prices was sluggish market conditions for teak in the local

and international markets and the fact that the logs offered

had high reserve prices but were smaller than at the

previous sale.

Buyers anticipate that as fresh logs arrive at the depot

there will be a downward pressure on reserve prices for

the unsold ‘old’ logs.

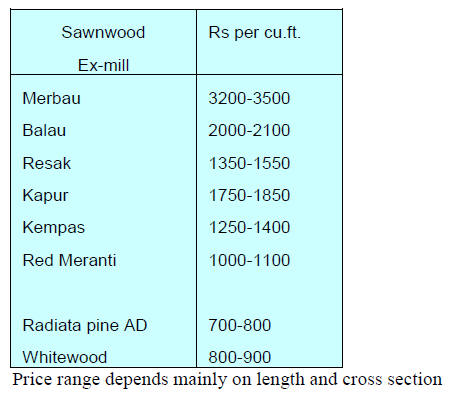

Myanmar teak prices

Growing competition from alternative durable timbers at

much lower prices is affecting demand in the Indian

domestic market for Myanmar teak. The decision by

Myanmar to impose an export tax on sawnwood will

increase the landing cost and further undermine sales in

the local market.

At the moment prices have not changed but this will not

last for long as imports continue but at higher prices.

Pressure mounts for increase in plywood prices

Plywood prices remain unchanged from two weeks earlier

but as production costs rise due to higher resin and log

prices then manufacturers will be looking for an

opportunity to lift prices by around 5 to 6%.

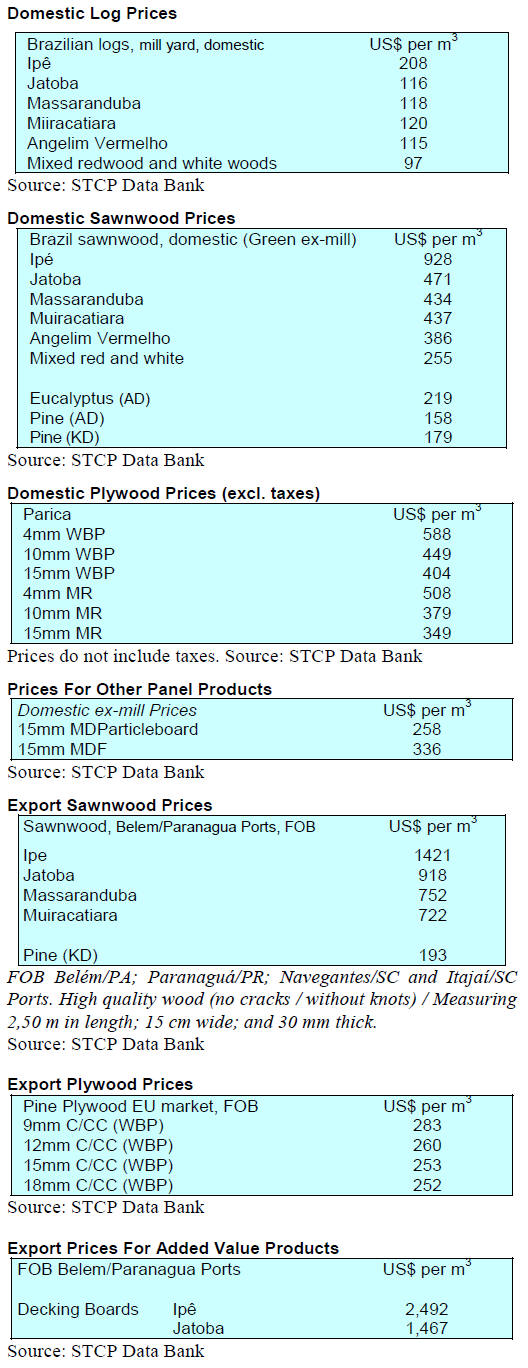

8. BRAZIL

Furniture industries react strongly to

plywood price

hike

The Furniture Industry Association of Rio Grande do Sul

(Movergs) and the Bento Gonšalves Furniture Industry

Union (Sindmˇveis) jointly issued a statement denying

support for the recent plywood price increases announced

by manufacturers.

The furniture industry union said that the increase would

add between 8-15% to the price of plywood used for

furniture manufacturing. Movergs and Sindmˇveis cannot

understand how plywood makers could contemplate an

increase with the furniture manufacturing sector facing a

severe downturn in sales.

According to the Brazilian Institute of Geography and

Statistics (IBGE) 2016 overall furniture sector production

across Brazil was down 11% compared to 2015 but in the

Bento Gonšalves furniture cluster sales dropped 18% in

2016 and the industry there had the lowest employment

level for the past 10 years.

New regulation raises risk that production could be

halted merely on suspicion of irregularities

The Center for Timber Producers and Exporters of the

state of Mato Grosso (CIPEM) recently met to discuss the

likely impact of the new regulation IN 01/2017 issued by

the Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA).

This regulation sets out new rules on activities in

the

forest-based sector including logging in the Amazon.

During the CIPEM meeting entrepreneurs expressed

concern about the punitive nature of this new regulation as

it imposes even more restriction than the current Federal

Decree, Decree 6514/2008. The risk is, say analysts, that it

will hamper production in the industry.

Under the previous regulation wrongdoing had to be

proven before forest operations could be halted. However,

the private sector interpretation of the new regulation is

that forest operations can be halted merely on suspicion of

irregularities. This, say operators, could give rise to

unnecessary suspensions as the criteria for ‘wrongdoing’

are unclear.

Operators also point out that their experience of the

current regulation is that, in the event an investigation

reveals no wrongdoing, the process for reinstatement is

time-consuming and bureaucratic. CIPEM plans to

promote discussions on this and closely follow

developments if a case is brought against an operator.

Woodbased panel exports surged in January

The Brazilian Tree Industry (IB┴) has reported that

January 2017 exports of woodbased panels increased by

57% to 85,000 cu.m compared to levels in January 2016.

Export earings in January reached US$19 million, a 46%

increase year on year.

Sales in the domestic market also rose in January 2017

with some 508,000 cu.m traded, an almost 8% increase

compared to January 2016.

Exports of woodbased panels grew faster than exports of

pulp and paper. In January 2017, the pulp and paper sector

recorded exports of US$765 million (+ 18.4%). Latin

American countries were the main markets for Brazil’s

woodbased panels and paper.

Northern Mato Grosso to develop timber export cluster

The Timber Industry Union of Northern Mato Grosso

State (SINDUSMAD) is planning to create a timber export

cluster in Sinop, the fourth largest city in northern Mato

Grosso. The Center for Timber Producers and Exporters of

the state of Mato Grosso (CIPEM) and the Federation of

Industries of Mato Grosso State (FIEMT) are supporting

the plan.

Sinop is one the largest timber producer municipalities in

the region and about 10% of the timber companies there

are exporting. There are about 60 companies with export

potential but currently focus only on the domestic market.

The aim is to have more enterprises diversify into export

markets.

9.

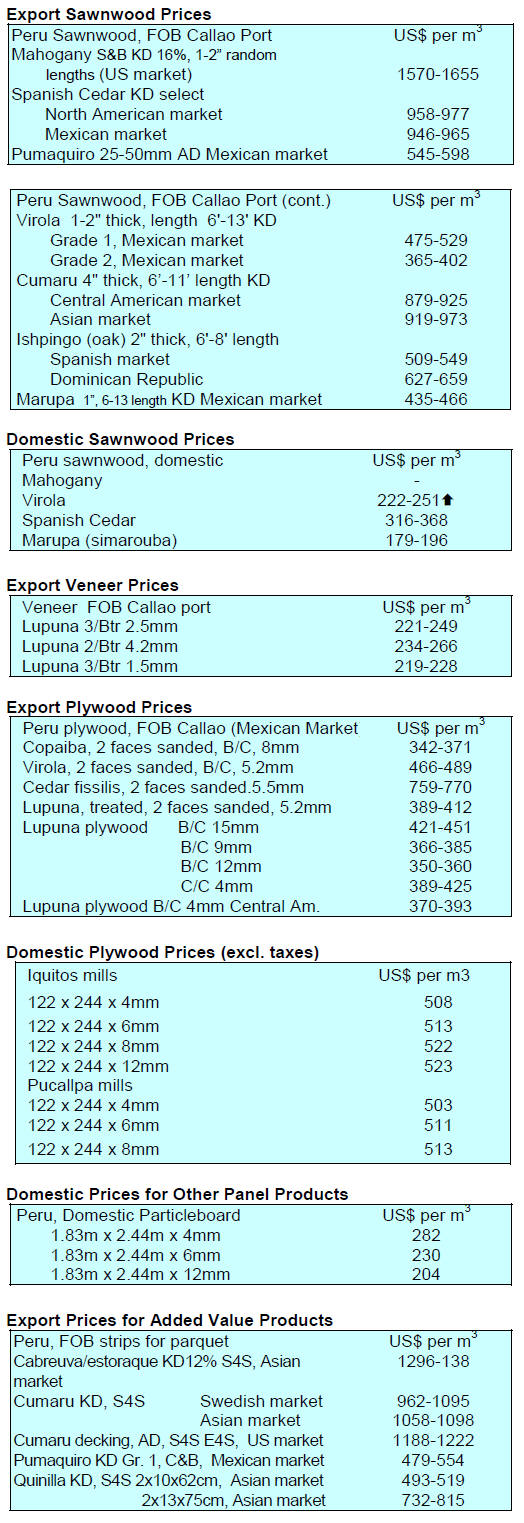

PERU

Wood processing machinery show scheduled

for this

year

This year the sixth biannual wood working machinery fair,

Fenafor Maderera, will be held from 24 to 26 August.

Fenafor has earned international recognition as a leading

event for Latin America and is considered as a good

platform to launch new processes and products for the

timber sector in Peru.

Analysts write, “Fenafor offers the industry in Peru an

opportunity to experience the most diverse range of

machines, equipment, supplies and services for wood

processing”.

In the most recent Fenafor, over half of the exhibitors were

from overseas and included companies from Germany,

Argentina, Brazil, Colombia, Chile, Spain, Italy and the

USA. Peruvian companies specialising in machine

manufacturing and supplies for the timber industry also

participated .

Productivity-oriented innovation and market

diversification key issues for industry

In a statement on its website the Association of Peruvian

Exporters (ADEX) says the projected rapid growth in

2017 exports will result in the creation of some 300,000

direct, indirect jobs. If this is achieved it would represent

an almost 10% rise on the number of jobs created in 2016.

ADEX President, Juan Varilias, called for the

implementation of new strategies to boost shipments of

manufactured goods as increased manufacturing can create

jobs.

A survey of businessmen reported by ADEX showed

productivity-oriented innovation and market

diversification are the key issue for manufacturers in the

country. Eliminating bureaucratic’ red-tape’ and legal

barriers is also high on the wish list for local industries.

See: http://www.andina.com.pe/Ingles/noticia-perus-exportsector-

to-create-310000-jobs-this-year-647960.aspx

Agroforestry buffer zone for protected areas

Plant a million trees in Tambopata and Bahuaja Sonene to

stop deforestation. Around 1 million cocoa trees have been

planted to create a buffer zone around the Tambopata

National Reserve and the Bahuaja Sonene National Park in

Madre de Dios according to SERNAP (El Servicio

Nacional de ┴reas Naturales Protegidas por el Estado).

This initiative aims to eliminate deforestation by creating

agroforestry systems in degraded areas adjacent to

protected areas.