2. GHANA

Minister firmly supportive of forest

plantation strategy

The newly appointed Minister of Lands and Natural

Resources, John-Peter Amewu, visited the Forestry

Commission and the Ghana Geological Survey Authority

recently.

The minister said he will be taking action to eliminate the

high levels of illegal logging and chainsaw milling which

undermines the efforts of the Forestry Commission.

The minister noted that poor farming practices, annual

burning, population pressure, the complex nature of

Ghana’s land tenure system and weak law enforcement are

serious challenges to be addressed.

The new minister is firmly behind the plans to

expand

forest plantation development as well as efforts to

encourage the bamboo and rattan industries.

Relief on electricity rates for strategic sectors of

economy

During a recent address to the nation, President Nana

Addo Dankwa Akufo-Addo said the government will

immediately act to lower some of the levies and taxes on

electricity tariffs despite the US$2.5 billion debt weighing

on the energy sector. The government plan includes

improving transparency in tariff setting and introducing a

new tariff policy for strategic industrial consumers.

The President said while Ghana produces power from its

domestic facility at around three US cents per kilowatt

hour the price charged to businesses is ten times more than

the average across West Africa noting that under such

conditions it is very difficult for industries in Ghana to be

competitive.

See:

http://www.ghanaweb.com/GhanaHomePage/business/Taxeslevies-

on-electricity-tariff-to-be-reduced-President-Akufo-Addo-

512716

New container terminal for Takoradi by March

Hellenic Shipping news has reported that IBISTEK, a

Ghanaian owned company, in collaboration with the

Ghana Ports and Harbour Authority (GPHA), has

completed the first phase of construction of a new

container terminal and could begin to accept containers by

the end of March.

IBISTEK has said all containers that arrive at the Takoradi

Port from 4 March this year would be sent to the new

terminal. This multi-million dollar project should improve

the efficiency at the port.

See: http://www.hellenicshippingnews.com/takoradi-port-offdock-

container-terminal-to-start-receiving-cargo/

3.

SOUTH AFRICA

Residential housing demand robust in 2016

The South African Statistics Department has released data

showing the value of approved building plans increased by

6.0% (R6,068.1 million) in 2016 compared to 2015. All

three major building categories recorded increases.

The largest percentage increase was recorded for

residential buildings (7.1% or R3,590.5 million), followed

by non-residential buildings (6.5% or R1,589,8 million)

and additions and alterations (0.4% or R887.8 million).

The value of buildings reported as completed increased by

8.3% (R4 723,6 million) in 2016 compared to 2015. All

three major building categories recorded increases.

The largest percentage increase was recorded for

residential buildings (8.7% or R2,789.7 million), followed

by non-residential buildings (8.6% or R1,257,1 million)

and additions and alterations (6.9% or R676.8 million).

Rand exchange rate fixing uncovered

South Africa’s Competition Commission has accused 17

international and local banks of colluding to fix the price

of the country’s currency, the rand, over the past decade.

The Commission said in a statement that workers at more

than a dozen global banks were involved.

Fines up to 10% of the banks' South African

revenues will

be imposed. Four major banks involved in the scandal

account for around 90% of the national banking market.

See:

http://www.compcom.co.za/wpcontent/

uploads/2017/01/Competition-Commission-prosecutesbanks-

currency-traders-for-collusion-15-Feb-2016.pdf

Retail sales growth slows in 2016 - survey points to a

weak start in 2017

2016 retail sales growth slowed to 1.9% year on year from

the 3.3% growth in 2015 marking the slowest rate of

increase since the 2008/09 recession.

Consumer spending has been held back by high

unemployment which affected disposable income and

consumer confidence. Other data shows that there was a

contraction in credit in 2016.

While reports suggest 2017 inflation will be flat and will

favour household finances, this positive effect could be

off-set by tax increases likely to be announced in the 2017

Budget. As such, consumer spending could remain

restrained.

4.

MALAYSIA

Dutch public procurement policy

recognises Malaysian

certification

The Government of The Netherlands has announced the

acceptance of the Malaysian timber certification scheme as

compliant with the Dutch public procurement policy for

sustainable timber.

This decision, said Himmat Singh, Chairman of the

Malaysian Timber Certification Concil (MTCC), marks an

important milestone for Malaysia’s scheme and is a

significant endorsement of Malaysia’s commitment and

ongoing efforts in promoting sustainable forestry and

timber industry through a timber certification scheme.

The MTCC believes acceptance of the MTCS within the

Dutch public procurement policy for sustainable timber

will allow Malaysian wood based companies to enjoy

better access to the Dutch markets.

The Dutch market currently accounts for about 30% of the

total export of PEFC/MTCS-certified timber products

from Malaysia. Certified timber products from Malaysia

constitute approximately 50% of the total certified tropical

timber imported into the Dutch market.

This volume is approximately the same as the volume of

PEFC/MTCS-certified timber collectively imported by

other EU member states with operational sustainable

timber procurement policies, namely United Kingdom,

Germany, France, Belgium and Denmark.

In related news, Sabah’s Forestry Department Director,

Sam Mannan, said timber from the state is gaining

worldwide acceptance amid concerns that the forest

products must come from sustainable sources.

More and more timber companies in the state are securing

international certification. Bornion Timber was the latest

company in the state to be certified under the MTCS.

Mannan commented that satisfying all the requirements of

certification schemes is not easy and Bornion Timber has

worked hard over the years to achieve this.

See:

http://www.mtcc.com.my/news-items/malaysian-timbercertification-

scheme-fully-accepted-in-the-netherlands/

http://www.thestar.com.my/business/businessnews/

2017/02/07/dutch-govt-recognises-malaysian-timbercertification-

scheme/

Now only short-term logging licenses in Sarawak

The new Chief Minister of Sarawak, Abang Johari Tun

Openg, has announced that, with immediate effect, only

short-term timber license by way of a tender process will

now be offered to timber companies. This is to ensure that

licenses are awarded in a transparent manner.

The statement from the State government says short-term

timber license would be issued by open tender for state

land forest that had been approved for development as

well as for native customary land development area and

native communal reserve earmarked for development.

The statement from the Chief Minister’s office the says

Forest Department would fine-tune the mechanism for the

award of timber licenses for forest area on land subject to

Native Customary Rights (NCR), taking into consideration

the interest of the community involved.

Easing of cabotage policy

The Malaysian Transport Ministry has agreed to ease the

cabotage policy in respect of Sabah as a step towards

helping the state’s economic growth. Sarawak is also

calling for an easing of the old policy.

(Cabotage:the transport of goods or passengers between two

places in the same country by a transport operator from another

country. It originally applied to shipping along coastal routes,

port to port, but now applies to aviation, railways, and road

transport as well.)

There has been an on-going debate on the causes behind

the higher cost of many consumer goods in Sabah and

Sarawak compared to Peninsular Malaysia and this has

been largely attributed to Malaysia’s cabotage protection.

Under the cabotage policy, shipping vessels from

anywhere in the world are required to berth at Port Klang

in Peninsular Malaysia and cargo unloaded before tbeing

transshipped to Sarawak and Sabah by Malaysian

registered vessels. This double handling raises costs which

have to be passed on to consumers.

Many calls have been made in Sabah and Sarawak for the

cabotage1980 policy implemented by the Transport

Ministry to be reviewed or abolished to address the higher

prices of goods in the two states.

Bombay Timber Merchants Association visits

Sarawak

After meeting the Minister of Plantation Industries and

Commodities in Kuala Lumpur a delegation of timber

merchants from Mumbai visited Sarawak. The delegation

was led by Bombay Timber Merchants Associations

(BTMA) chairman Mohd. Iqbal S. Chhapra. The visit was

to strengthen bilateral trade of timber and timber products

between India and Sarawak.

Iqbal said association members were hoping to acquire an

insight into the wood-based industry in Sarawak

particularly on facilities to produce and supply sawn

timber due to the high demand from India.

To ensure smooth business, he urged Sarawak exporters to

adhere to the Indian market requirements, including the

need to fumigate sawn timber and to work closely with

their Indian counterparts in order to sustain the market.

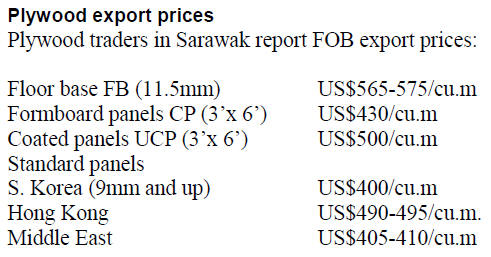

India is the second largest export market for Sarawak in

terms of timber and timber products with logs being the

main export items. Concerted efforts are being made to tap

the potential of the Indian market in order to boost the

export of plywood, sawn timber and other value-added

products.

Sarawak earned RM970 million from the export of timber

and timber products to India in 2016 compared with

RM1.25 billion in 2015. The main export products were

logs, followed by plywood and sawnwood.

See:

http://www.theborneopost.com/2017/02/22/indian-timbermerchants-

here-on-working-visit/

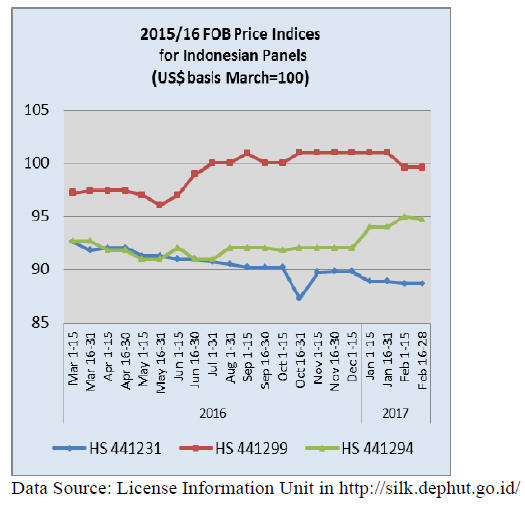

5. INDONESIA

Forest concessionaires could contribute

more to

economy says Association

Chairman of the Association of Indonesian Forest

Concessionaires (APHI), Indroyono Susilo, has claimed

that allocated natural forest concessions could generate a

much greater contribution to the economy if they were

fully utilised.

The problem, says Susilo, is that the private sector is

reluctant to invest to raise production because the business

climate is not attractive.

Efforts by the government and the private sector to

conclude the national timber legality verification system

(SVLK) to satisfy the EUTR is having little impact on

investment sentiment says Susilo.

Despite having easier access to EU markets and having

absorbed the cost of EUTR, compliant companies are

finding their wood products are not attracting better prices.

In related news, the Executive Director of APHI, Purwadi,

has opened the debate on log sales again by pointing out

that APHI members could get much better prices in

international markets for raw materials than in the

domestic market.

Is FSC ready to modify 1994 rule?

The Indonesian media are reporting that Kim Carstensen,

Director General of the Forest Stewardship Council (FSC),

advised FSC International that he recognises the 1994 FSC

rule is not appropriate for Indonesia and is a major

obstacle for Indonesian industries to secure FSC

certification.

This rule excludes FSC certification of plantations

established in areas converted from natural forests after

November 1994.

Reports say FSC plans to revise this rule which would

allow Indonesian timber companies to obtain certification

from FSC if they wish. The head of the Department of

Forest Management, Faculty of Forestry, UGM

(Universitas Gadjah Mada), Ahmad Muryadi, pointed out

that many of Indonesia's forest plantations were

established after 1994.

For more see:

http://www.cnnindonesia.com/ekonomi/20170209143603-92-

192344/demi-indonesia-fsc-ubah-aturan-sertifikasi-kayu-tahunini/

Expanded manufacturing the path to job creation

The Indonesian President has once again called for action

to increase investment in the manufacturing sector to

create a more diversified economy and thus be less reliant

on the trade in commodity products. He said the country is

yet to fully benefit from expansion of downstream

processing.

The government has a target of providing jobs for 16.3

million workers in 2017, an increase of 5% on 2016

figures and expanded manufacturing is the answer.

Industries that create most jobs include textiles, footwear,

food products and tourism.

With most foreign investment being in capital intensive

industries it falls on local investors to invest in labour

intensive production.

6. MYANMAR

Myanmar TLAS not a ‘quick-fix’ for

legality verification

The Myanmar Forest Certification Committee (MFCC)

has conducted the last of its recent workshops on Gap

Assessment as part of preparations for the Myanmar

timber legality assurance scheme (TLAS). The work on

TLAS is being conducted with assistance from the EUFAO

FLEGT programme.

This workshop attracted many international participants

especially because of the recent case when a Swedish

importer of Myanmar teak was penalised for failing to

show due diligence.

Some civil society groups expressed concern that

Myanmar’s TLAS could weaken the resolve of

stakeholders to see through what are considered essential

reforms in the forestry sector.

MFCC Secretary, Barber Cho, clarified that Myanmar’s

TLAS project was initiated in 2014 long before the recent

accusations that the legality of some of Myanmar’s timber

exports could not be verified. He emphasised that there is

no risk that the Myanmar system could be used as a ‘quick

fix’ for legality verification.

He also reiterated that the commissioning the country’s

TLAS will be conducted through dialogue with all

stakeholders.

The certification workshop was advised that the Forestry

Department intends to use the results of the Gap Analysis

to strengthen the current legality verification system.

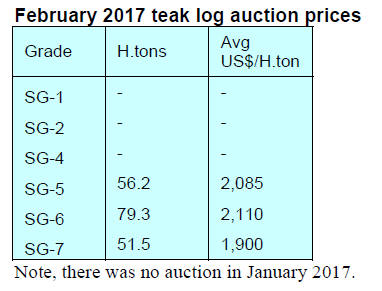

Myanmar Timber enterprise (MTE) is planning to apply a

data base system to trace the origin of timber when

harvesting begins after one-year logging suspension.

Currently, MTE is using hammer markings on one end of

log and log numbering from which the supply chain can be

tracked.

When the harvesting ban is lifted the indications are that

MTE will fell and harvest around 20,000 teak tree and 600

000 hardwood trees in this year ( Myanmar’s Annual

Allowable Cut is defined by the number of trees that can

be felled. Each tree yields from 1.2 to 1.5 Hoppus tons).

The focus of attention of international workshop

participants was largely on how the Forestry Department

can immediately strengthen traceability and legality

verification. Many participants from Myanmar pointed out

that importing countries, including the EU, need to apply

the same stringent rules to wood products manufactured

from Myanmar teak and other hardwoods and exported by

other countries.

In related news Chairman of Myanmar Timber Merchants

Association, Dr. Sein Win was quoted as saying that the

private sector will seek from government the authority for

a third party verification system which would strengthen

the compliance with the EUTR.

Export tax announcement catches exporters by

surprise

The recently approved National Taxation Law 2017

includes provision for a 10% commercial tax on the export

value of sawnwood.

This development has caught exporters by surprise and

while they are obliged to support this new tax due to come

into force on 1 April they are asking that it will be applied

to contracts agreed after 1 April.

If it is applied to contracts already agreed but due to be

shipped after 1 April exporters will suffer financial losses.

Amongst the Myanmar timber sector there is growing

concern for the survival of the wood industries because of

two recent developments; the requirement from EU, the

main market for sawn teak, to assure legality and comply

with the EUTR and now the new commercial tax.

7. INDIA

Finally, Infrastructure Status for

affordable homes

segment of housing market

To try and revive the housing market the government has

finally awarded ‘infrastructure status’ to the affordable

housing segment of the market which should, because of

tax incentives and access to financing, stimulate

investment in this segment. Real estate companies and

CREDAI, (Confederation of Real Estate Developers’

Associations of India) have been lobbying for this change

for 7 years.

Local analysts say this change of status will allow house

builders to access lower interest financing. The

government has redefined the definition of Affordable

Housing projects which provides for 100% tax deduction

related to such housing projects.

In related news the government also announced a package

of tax support for builders with a huge stock of unsold

homes.

The government decision on infrastructure status has,

according to a report from Reuters, prompted Qatar

Holdings (a subsidiary of the state owned Qatar

Investment Authority), to consider investing US$250

million in an affordable housing fund run by one of India's

fund management entities.

For more see:

http://www.reuters.com/article/qatar-india-fundsidUSL5N1FR20Y

Stalled export of rosewood musical instrument parts

With the inclusion of all Dalbergia spp. in Annex II of

CITES Indian exports of products manufactured from this

species have stopped. CITES and the Indian Forest

Service are working with exporters to arrange procedures

and required documentation that will allow exports to

resume.

Analysts report that the delay revolves around which

agency will be charged with issuing CITES certificates.

Manufacturers are looking for a speedy conclusion to this

issue to allow them to keep their factories running.

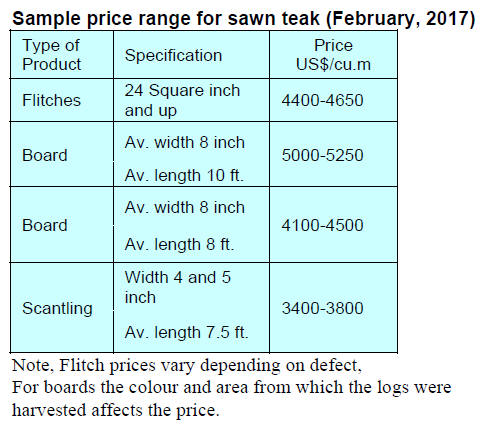

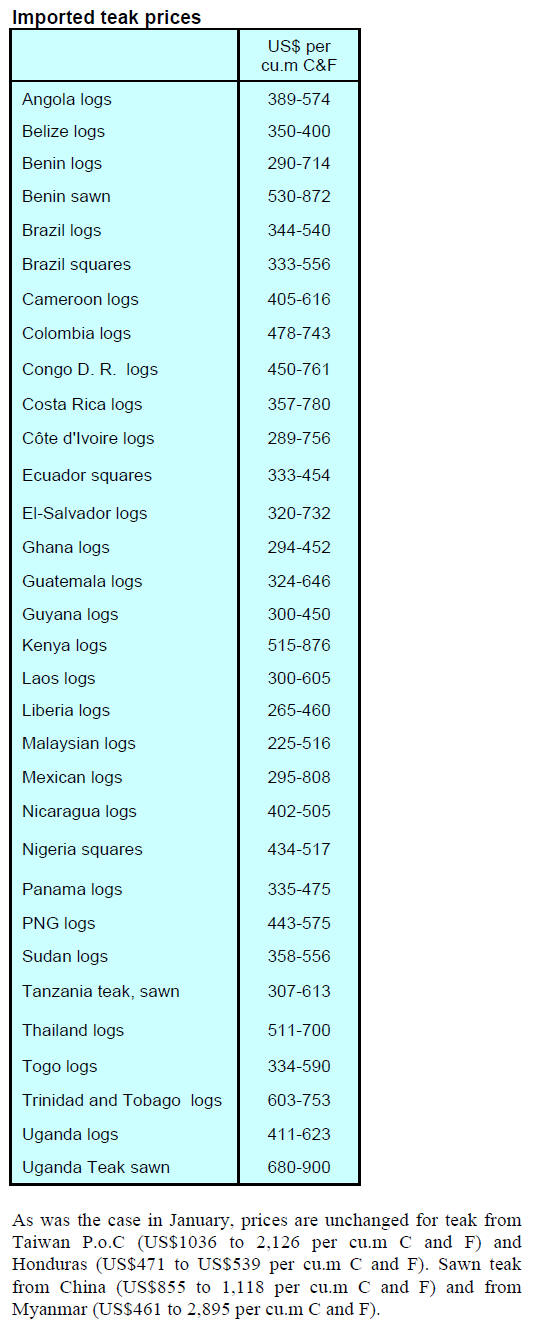

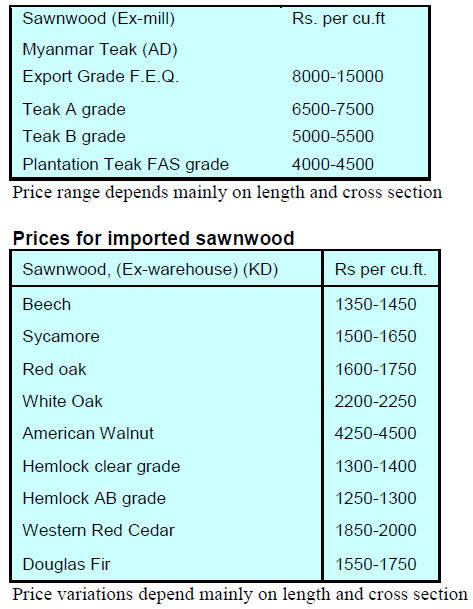

Plantation teak imports

Local analysts report demand for imported plantation logs

and sawnwood is steady and once again prices have not

changed over the past two weeks.

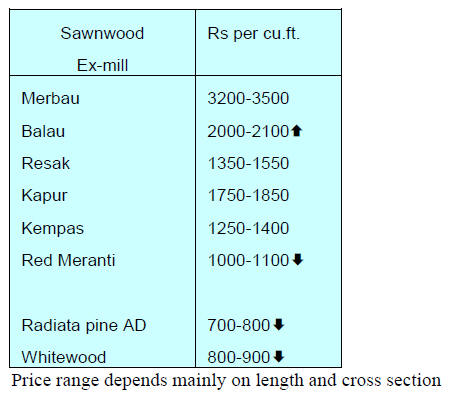

Prices for locally sawn imported hardwoods

Some price movements have been reported with balau

prices moving up and meranti prices sliding slightly.

Adjustment in ex-mill prices for radiata and whitewood

sawnwood have also been reported.

Myanmar teak prices

Demand for imported teak sawnwood from Myanmar is

under pressure from alternatives say analysts. This, along

with problems of procurement, is discouraging local

traders. Production for export is currently supporting price

levels but local sales are weakening which could

eventually drive down prices.

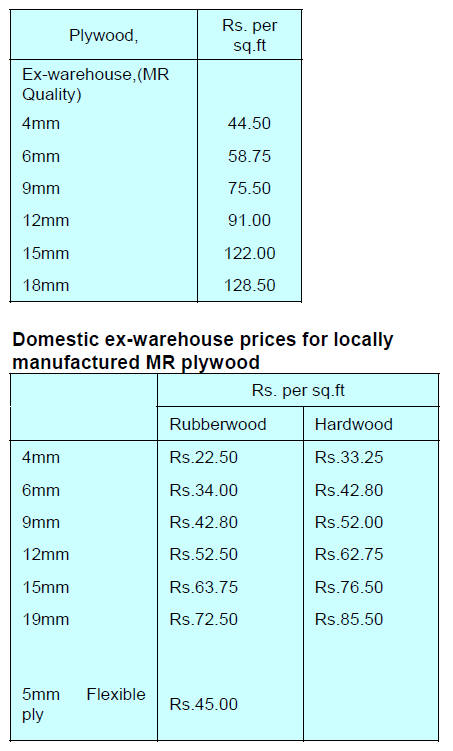

Plywood manufacturers see profits eroded on

several

fronts

Log availability problems continue to effect production

rates and mills are maintaining the higher prices

established recently.

In addition, resin costs and even labour costs have started

to rise which is a challenge for manufacturers. Raw

material suppliers are no longer offering extended credit

but are asking for advance payments.

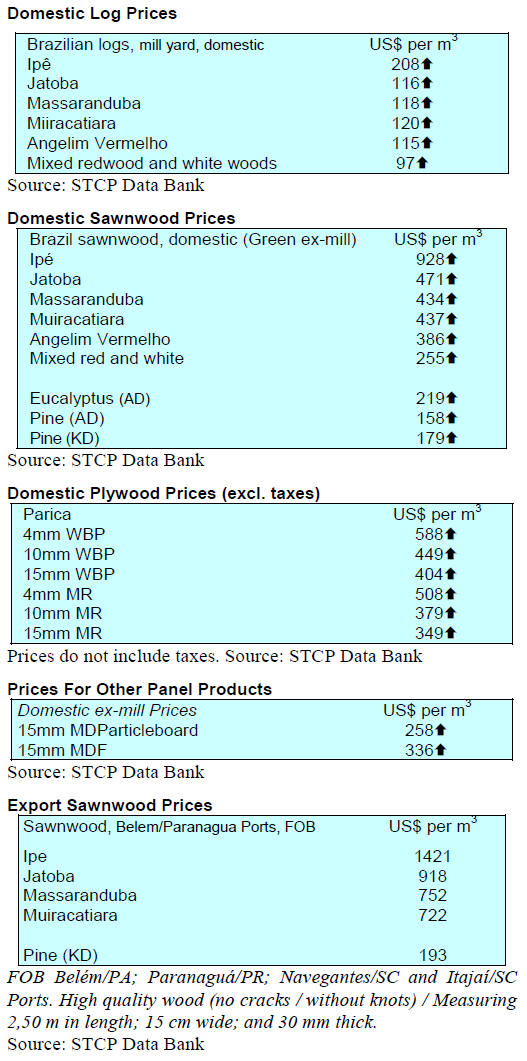

8. BRAZIL

Currency strengthens but interest rates

fall as

economy weakens

The National Consumer Price Index (IPCA) for January

2017 rose by just 0.38%, slightly above the 0.30% of

December 2016, which was the lowest IPCA for a January

since 1994.

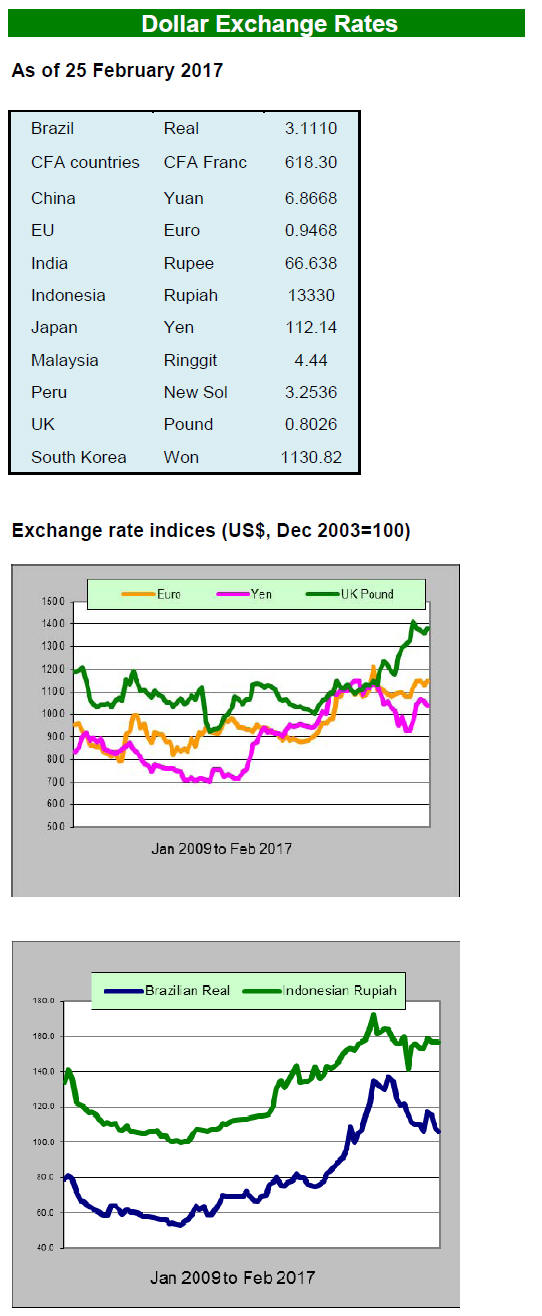

In the currency markets the average exchange rate in

January 2017 was BRL 3.20/US$ compared to BRL

4.05/US$ in January 2015 signalling an appreciation of the

Brazilian currency against the US dollar.

At last month’s meeting the Monetary Policy Committee

(COPOM) of the Central Bank reduced the basic interest

rate for the third time in row, from 13.75% to 13%. The

Central Bank’s decision was based on indications that

point to economic activity below expectations.

Development of Brazilian forest industry sector

discussed

Representatives from Brazilian states with forest resources

met, during the inauguration of the new board of directors

of the National Forum of Forest-Based Activities (FNBF)

in Brasilia. The group discussed promoting positive

developments in the Brazilian forest industry.

At the meeting representatives from the Center for Timber

Producers and Exporters in Mato Grosso (CIPEM) pointed

to the need for an awareness raising programme to expand

the use of wood products.

A contribution from WWF-Brazil highlighted the notion

that development of the forestry sector goes beyond

governance and the legal framework and should include

industrialisation, modernisation of industrial parks,

adoption of new technologies and skill development.

On the topic of industrialisation, the Brazilian National

Confederation of Industry noted that the sector has great

potential to expand wood product manufacturing.

Sindimov looks to higher construction activity to lift

furniture demand

A spokesperson from the Furniture Industry Union of São

Paulo (Sindimov-SP) said business recovery amongst

members is likely to be slow but that as growth in other

sectors improves then prospects for the furniture sector

will also rise.

Over the past 12 months the Brazilian economy weakened

by around 16% from the previous 12 months according to

the Brazilian Institute of Geography and Statistics (IBGE).

The Union believes that as the new government gains

confidence the situation in Brazil will change for the

better. To foster business recovery this year furniture

companies in São Paulo will seek to improve profitability

thorough training employees, reducing production and

strengthening management.

According to the Market Intelligence Institute (IEMI), the

2017 growth in the furniture production could reach 2%

which equates to around 404 million items. In 2016,

production was approximately 396 million pieces, a 7.7%

decline on 2015 levels.

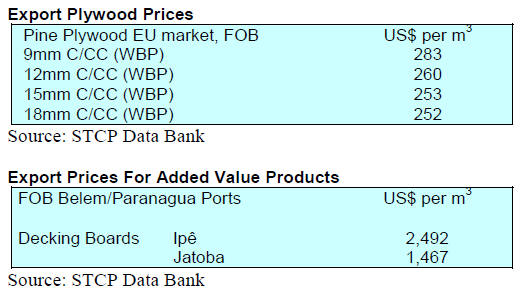

Export round up

In January 2017 Brazilian exports of wood-based products

(except pulp and paper) increased 20.0% in value

compared to January 2016, from US$175.2 million to

US$210.3 million.

The value of pine sawnwood exports fell 82% between

January 2016 (US$20.2 million) and January 2017

(US$3.7 million). In terms of volume the change was

102,000 cu.m in January 2015 to just 18,000 cu.m this

January.

In contrast, the volume of tropical sawnwood exports rose

32% from 24,800 cu.m in January 2016 to 32,800 cu.m in

January this year.

However the value of these exports increased by just 13%

from US$12.1 million in January last year to US$ 13.7

million this year.

Brazil’s pine plywood exports increased 31% in value in

January 2017 in comparison with January 2016 levels,

from US$26.6 million to US$ 34.8 million. In volume

terms exports increased 29% over the same period.

Tropical plywood exports from Brazil increased

significantly in volume and in value in January this year

rising from 6,200 cu.m (US$2.2 million) in January 2016

to 10,600 cu.m (US$3.9 million).

The value of wooden furniture exports also rose in January

from US$23.6 million in January 2015 to US$26.6 million

in January this year.

9.

PERU

Forestry Development Board has first

formal meeting

The new created Forestry Development Executive Board

has met for the first time and was addressed by the Deputy

Minister of Agricultural Policies, Benjamín Quijandria.

The minster charged the Board with coming up with a

work plan to identify and promote action for the efficient

and sustainable management of the country’s forest.

This Board has be created to plan for the sustainable

development of the forestry and their mandate covers the

entire supply chain and thus involves industry players.

Various public institutions, regional governments,

business associations and representatives of indigenous

organisations that on the Board agreed to maintain a

permanent dialogue.

In support of the dialogue, Alfredo Biasevich, Chairman

of the Forestry Committee of the National Society of

Industries, said the commonly held view that deforestation

is associated with commercial logging is conceptually

wrong pointing out that deforestation is caused by land use

change for agriculture, livestock faming and mining.

Peruvian exporters anticipate US$2 million from

attendance at DOMOTEX

The intense and rising competitiveness in the European

flooring sector was apparent at DOMOTEX 2017 which

was attended by a few companies from Peru. Domotex

2017 was held in Hannover, Germany and is a major

European fair specializing floor coverings.

The Peruvian group at the show anticipate that sales in the

region of US$2 million will be generated from the

business contacts made at the show. The participants from

Peru estimated that each received around 50 business

enquiries from potential customers and distributors mainly

in Europe and Asia.

Peruvian companies promoted their certified wood

products which strengthened their sales pitch especially

with EU buyers. Peruvian exports of certified wood

products were almost US$10 million last year.

http://gestion.pe/economia/exportadores-peruanos-proyectannegocios-

us-2-millones-feria-europea-pisos-y-revestimientos-

2182049