|

Report from

Europe

Indonesia makes big impact at IMM Furniture Fair

Like the Domotex show held in Hanover earlier in the

month, the IMM Furniture Fair in Cologne between 16

and 22 January highlighted the challenges facing tropical

suppliers looking to increase their share of the European

market, as pressure continues to mount from domestic

manufacturers and non-wood materials.

Demand for wooden exterior furniture, traditionally an

important niche market for tropical wood products, is

coming under pressure from other modern weatherresistant

materials.

However, the Fair also emphasised that wood, alongside

other natural materials and organic finishes, is very

fashionable for interior furniture, that there is strong

interest in furniture with a strong back story, and that

small, well-designed products have an important role in

the European furniture sector. All these trends offer new

avenues to market for suppliers of tropical wooden

furniture.

As if to emphasise these opportunities, the headline of the

leading article on the IMM show by Decoist, a leading online

magazine focused on architecture and modern design

was ※Wood is beyond good 每 it*s sensational!§.

Decoist observes that ※one of the big furniture design

trends of 2017 is undoubtedly the way in which top

manufacturers and designers have so whole heartedly

embraced wood. In a world where organic finishes and

natural materials are making a rapid comeback, wood is

definitely the absolute king of 2017 and this trend is likely

to continue to last beyond the year as well!§

Decoist*s comment that ※Indonesia made a big impact at

this year*s show with their unique creations§ is

particularly encouraging for the tropical wood sector and

an early sign of the potential of Indonesia*s market

development strategy in Europe.

Indonesia had a significant presence at the show having

booked just under 600 square metres for a national

pavilion displaying products from a wide range of

Indonesian companies, a timely investment in marketing

for a national furniture industry that is the first, and only

capable of delivering 100% FLEGT-licensed product.

Indonesia did well to target IMM Cologne which is now

one of world*s leading furniture shows following a

marketing drive to internationalise the event. The show

achieved a record number of visitors this year, exceeding

150,000 for the first time.

Of the 104,000 trade visitors, around 56,000 came from

Germany and 48,000 from abroad (an increase of 4%).

There were particularly large increases in visitor numbers

from Spain, Russia, Italy, the UK, Netherlands, Poland,

China, South Korea, India and the United Arab Emirates.

The show boasted around 1,200 exhibitors from 50

countries displaying more than 100,000 pieces of furniture

and furnishing items, a third of which were shown to the

international market for the first time in Cologne.

Non-wood materials taking greater share in exteriors

market

While wood is in the ascendance in the interiors sector, the

IMM show highlighted that alternative materials are

making more ground in the exteriors sector. Exterior

furniture continues to become more and more flexible and

decorative and adapts to growing demand for pieces that

can be used both inside and outside.

This demand is driven both by new materials and lifestyle

changes in which more people spend time on balconies,

decks, patios and similar spaces which combine features of

gardens and rooms.

Solid tropical wood garden furniture is increasingly

substituted by outdoor sofas and chairs comprising

modern, weather-resistant materials, with water resistant

cushions and frames created using steel or plastics woven

using traditional wicker techniques.

Teak is still popular, but mainly to accent and soften

furniture made primarily in other materials.

A star attraction of the show was the Caribe collection of

outdoor furniture designed for Ames by Sebastian

Herkner, a leading designer who was Guest of Honour at

the IMM Cologne show in 2016, in collaboration with

Colombian craftsmen. The pieces were made of woven

plastic string and steel using the "Momposino" weave

which is taught in school as a craft in the Santa Marta

region of Colombia.

While not made of wood, the message conveyed about the

Caribe collection in the IMM show publicity is relevant

and should give encouragement to manufacturers of

tropical wood furniture.

The IMM organisers observe that ※the Caribe series stands

for a trend in the interiors industry which is exemplary of

the growing need for meaningfulness among

manufacturers and consumers. And contrary to some

expectations, this trend is evidently being carried by the

market.

It is not always the case that one succeeds in combining

sustainable production with an aesthetic concept in a pilot

project while at the same time also accommodating the

increasing interest of people for authentic products.

However the number of products that tell their own special

story is constantly growing.§

Another trend at the IMM show that could be exploited by

the tropical timber sector is to extend the use of solid

wood into the climatically difficult environment of the

bathroom. Together with the bathroom furniture

manufacturer, Keuco, the company Team 7 from Austria

was displaying the Lignatur edition at IMM Cologne

which utilises natural wood to provide a high quality and

unique finish to bathrooms.

Again, the material used in this instance was not tropical

timber, the traditional European favourites of walnut and

oak being preferred. However, use of tropical wood would

offer manufacturers both technical and aesthetic

advantages in high-end bathroom furniture.

Furniture trade in Europe growing slowly

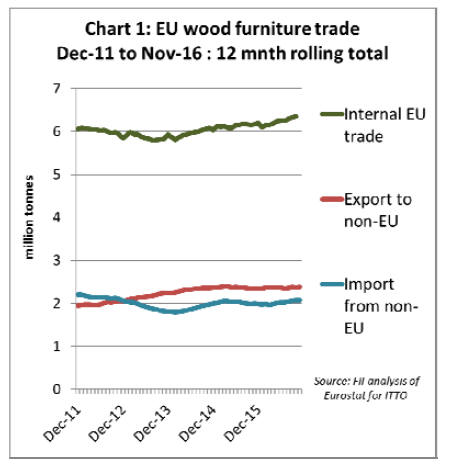

The trade background to the IMM fair is shown in Chart 1

which indicates that internal EU trade in wood furniture

has been rising slowly since December 2013.

This is due partly to improving consumption of wood

furniture products manufactured in the EU, and to the

increasing role of manufacturing facilities in lower cost

Eastern European countries such as Poland and Lithuania

to supply wood furniture to other parts of the EU.

The EU continues to maintain a small trade deficit in

wood furniture with the rest of the world. Total EU

exports to non-EU countries remained level at around 2.4

million tonnes in both 2015 and 2016, while imports were

also stable at around 2 million tonnes.

EU imports of wood furniture from China, which is by far

the largest external supplier accounting for 50% to 55% of

the total, were sliding in 2015 and the first half of 2016,

but recovered slightly towards the end of last year.

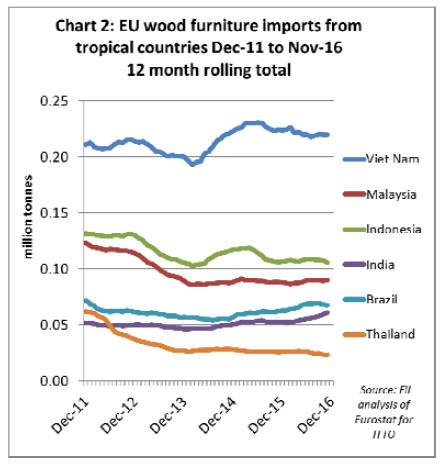

The performance of tropical countries in supply of wood

furniture to European markets has been mixed in recent

years (Chart 2). EU imports from Vietnam increased

sharply between April 2014 and April 2015, taking share

from China at that time.

However, EU imports from Vietnam were sliding slowly

between mid-2015 and the end of 2016.

EU imports of wood furniture from Indonesia surged

briefly and temporarily in 2015, but fell back again in

2016.

It will be interesting to see whether Indonesia*s delivery of

FLEGT licensed furniture and support for marketing in

Europe will now be translated into an increase in sales.

Meanwhile EU imports of wood furniture from Malaysia

and Thailand have been broadly flat over the last 3 years

after losing ground in 2011 and 2012.

In contrast EU imports from Brazil and India have been

making ground in the last two years, although both are still

relatively minor suppliers of wood furniture to the EU.

EU importers stock up on FLEGT licensed Indonesian

plywood

The Global Timber Forum has published an interview with

the CEOs of two European importing companies,

Alexander de Groot of Fepco and Koen de Witte of

Altripan, that were among the first to receive FLEGT

licensed wood from Indonesia.

The interview highlights both the market opportunities and

remaining challenges of FLEGT licensing from the

perspective of two of Europe*s largest plywood importing

companies.

According to Alexander de Groot, FLEGT licensing offers

a significant market opportunity for Indonesian plywood

in Europe as due diligence is no longer required and

buyers can be absolutely certain that all Indonesian wood

comes from legal sources.

Koen de Witte said that a large group of customers in

Europe have been afraid of buying tropical wood because

of possible EUTR problems and related negative publicity

but that FLEGT licensing means importers can now start

promoting tropical wood to these companies again.

Koen de Witte noted that products from Indonesia are

rather expensive compared to competing materials from

China or Malaysia and that logistics can be a challenge,

however FLEGT licensing offers an opportunity to

promote Indonesian plywood as a legal and high quality,

sustainable product. He said that Indonesia will also have

an increasing advantage over time as EU Competent

Authorities are getting stricter and there are more checks

on operators.

Koen de Witte said that there has yet to be any perceptible

increase in demand from their own customers for FLEGT

licensed timber, but ※arrivals of wood from Indonesia have

increased over the last few weeks as importers and traders

are stocking up on FLEGT licensed material§.

He also emphasised that it is early days and companies

like Fepco and Altripan will now push to increase sales

with active promotion and by making the more product

available in the market.

Koen de Witte reckoned that Indonesian wood products

are competitive in Europe and their market share will

increase - although this will be partly dependent on

developments in competing products which, for

Indonesian plywood, are mainly from Russia and China.

He suggested that ※the great variety of products from

China 每 in very different qualities and not always correctly

declared 每 is making life difficult. But there are initiatives

now to increase transparency and show customers how the

plywood is made and what the differences are. This will

improve Indonesia*s position§.

Alexander de Groot emphasized that European

governments also have a responsibility now to help

promote FLEGT licensed wood. He suggested that

FLEGT should, for example, immediately be incorporated

in public procurement rules and given the same status as

FSC or PEFC.

He noted that ※one of our customers just had a case in

Luxembourg, where authorities would not accept FLEGT

licensed wood on a bid for a public building project 每 they

only wanted FSC. This situation cannot continue - if

European governments are not behind FLEGT this will

sabotage the process§.

Both CEOs confirmed that of their own customers, the

larger distribution groups and merchants in Europe are

already familiar with the FLEGT process, but as large

corporations their decision-making processes are fairly

slow so it might take some time before they start

purchasing more FLEGT licensed wood. Smaller

merchants are generally less aware of FLEGT.

At present importers are still more inclined to prefer FSC

and PEFC, particularly in the UK and the Netherlands, but

here merchants are quickly becoming aware of the

importance of FLEGT licenses. France, Belgium and

Germany are more difficult as companies there use less

certified wood in general and interest in FLEGT is

perceptibly lower.

While recognizing that their Indonesian suppliers had to

work extremely hard to achieve FLEGT licensing, both

CEOs said that from the perspective of European

importers the process has been very simple. The importers

only had to register to obtain a FLEGT license number and

the rest was pretty much what they always had to do when

importing wood.

For them it basically comes down to uploading some

information on a website and is much simpler than having

to conform to EUTR due diligence requirements.

|