Japan

Wood Products Prices

Dollar Exchange Rates of 10th

February 2017

Japan Yen 113.20

Reports From Japan

Consumers still putting off durable goods

purchases

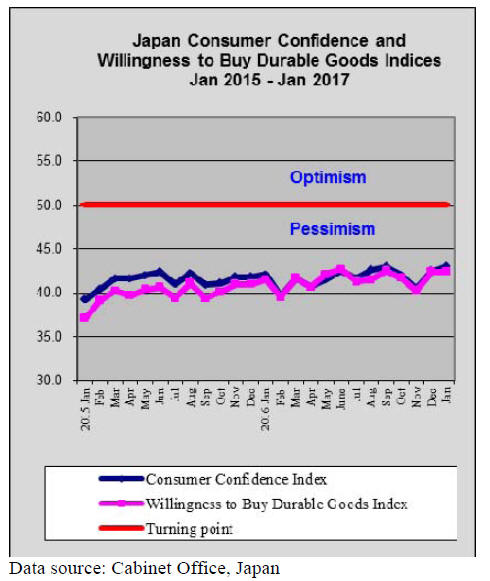

Cabinet data from the January consumer confidence

survey is showing a continued improvement with January

confidence coming in at the highest level in over 3 years.

While this is good news it must be remembered that all the

indices are still in the ¡®pessimistic¡¯ range i.e. below 50

(see graph below).

The overall sentiment index rose to 43.2 in January from

43.1 in December but the willingness to buy durable goods

showed no change.

Business confidence at 3 year high

Increased exports boosted by a weaker yen, expansion of

new orders for manufacturers and steady domestic demand

has brightened economic prospects for Japan, at least in

the short term.

Results from the latest business survey compiled by the

Cabinet Office show that manufacturing for export added

most to growth and that the services sector continued to

expand.

Optimism in the private sector has risen even against the

backdrop of uncertainty on where the US economy will be

taken by the new President. The rise in manufacturing

output has also boosted job creation and job growth in

January was at its highest for almost 3 years.

See:

http://www.esri.cao.go.jp/en/stat/di/di-e.html

More talking down the dollar but now by the US

administration

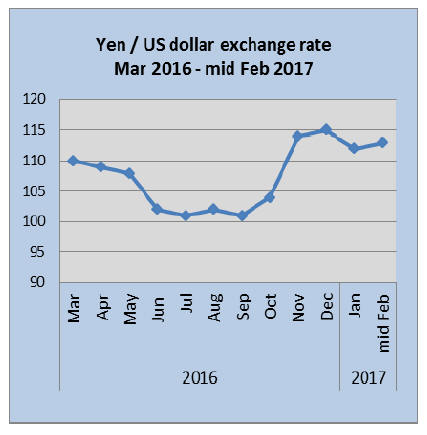

The US President has publically accused Japan of

manipulating the yen/dollar exchange rate, something

fiercely denied in Tokyo. This remark caused the US

dollar to fall to two-month low of yen 112 to the dollar in

early February.

But the ¡®trump effect¡¯ did not last and the yen recovered as

the US President turned his attention to the euro which he

said was grossly undervalued.

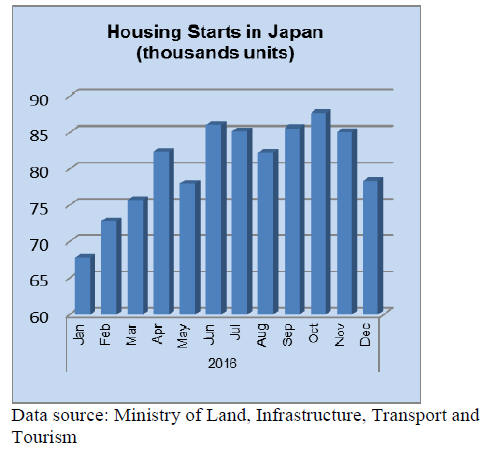

Build-for-rent now a major proportion of housing

starts

2016 housing starts exceeded 960,000 and of that almost

half were homes built-for-rent and was the first time in 8

years that built for rent homes had topped 400,000.

The surge in built-for-rent homes owes as much to

changes in Japan¡¯s inheritance tax structure as the ultralow

interest rates offered by commercial banks.

Local analysts point out that when land owner builds a

property on a plot of land the assessed land value drops

which has the effect of lowering the land value and thus

lowering any inheritance tax liability.

Almost all banks in Japan have campaigns promoting

loans for home building and these are being taken up by

people who see home rentals as a way to put otherwise

stagnant cash to work. The surge in supply.

of apartments is beginning to distort the housing market.

Vacancy rates for apartments in most of the major cities

have increased significantly over the past 12 months

which has put a downward pressure on rents.

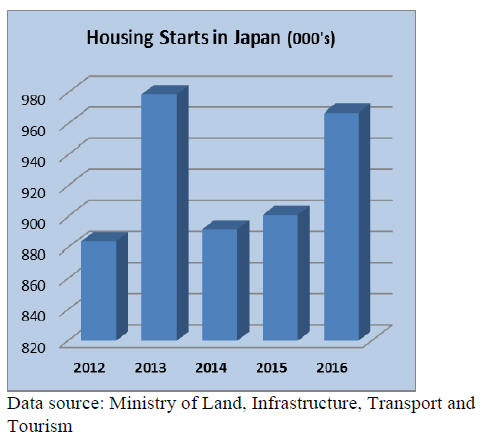

Twin peaks in housing starts

For the first time in 17 years Japan increased the

consumption tax in April 2013 and this caused housing

starts to peak. Home buyers were well prepared and there

was a surge in orders and completions in 2013 as buyers

moved to beat the 3% rise in consumption tax.

The second peak in housing starts was in 2016 and the

driver for this was low interest rates and, as mentioned

above, changes in inheritance tax structures in the country.

Import round up

Doors

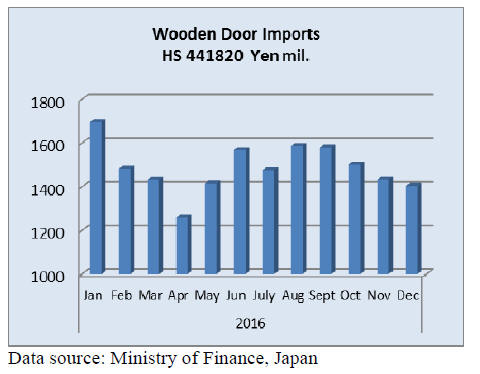

Japan¡¯s fourth quarter 2016 imports of wooden doors (HS

441820) were down 18% compared to the same period in

2105 extending the decline in the first three quarters of

2016 when wooden door imports were around 2% down

year on year.

For 2016 the top four suppliers in order of rank were

China, the Philippines, Indonesia and Malaysia and these

four accounted for over 90% of Japan¡¯s 2016 wooden door

imports.

Windows

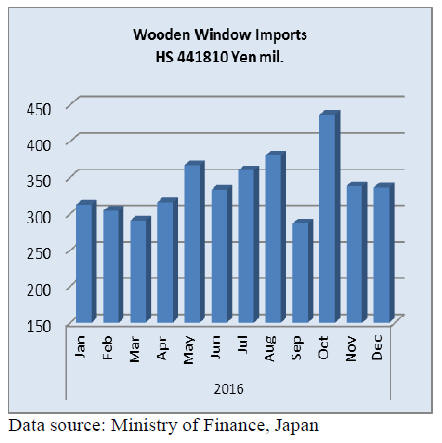

In the first three quarters of 2016 wooden window imports

were down around 7% compared to the same time in 2015

but the decline slowed in the fourth quarter where 2016

imports were at around the same level as in 2015.

Wooden window imports in 2016 were down 5% on 2015.

Throughout the year shippers in China and the Philippines

dominated Japan¡¯s imports of wooden windows with

shipments in 2016 from these two suppliers accounting for

around 80% of total wooden window imports with most of

the balance being shipped from the US.

Assembled flooring

Three categories of assembled flooring are included in the data

presented below, HS 441871, 72 and 79.

Despite the significant upward trend in imports of assembled

wooden flooring, overall, 2016 imports were only marginally

higher than in 2015. In November and December there was a

sharp rise in imports of assembled flooring with most of the

growth due to shipments from the main suppliers, China and

Thailand. For the year as a whole shipments of HS441872

accounted for the bulk of imports followed by HS 441879).

Plywood

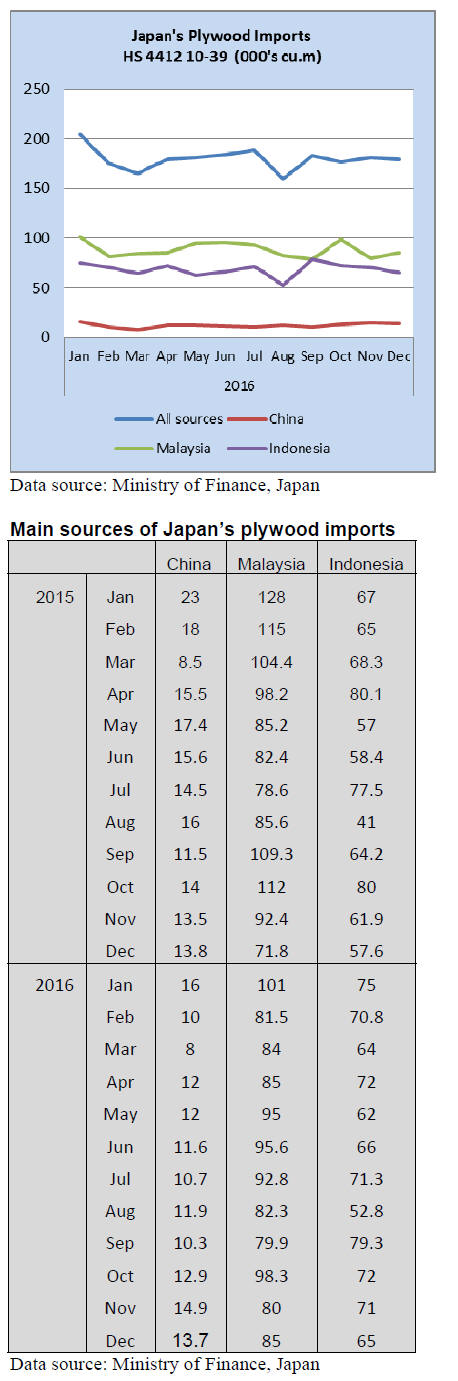

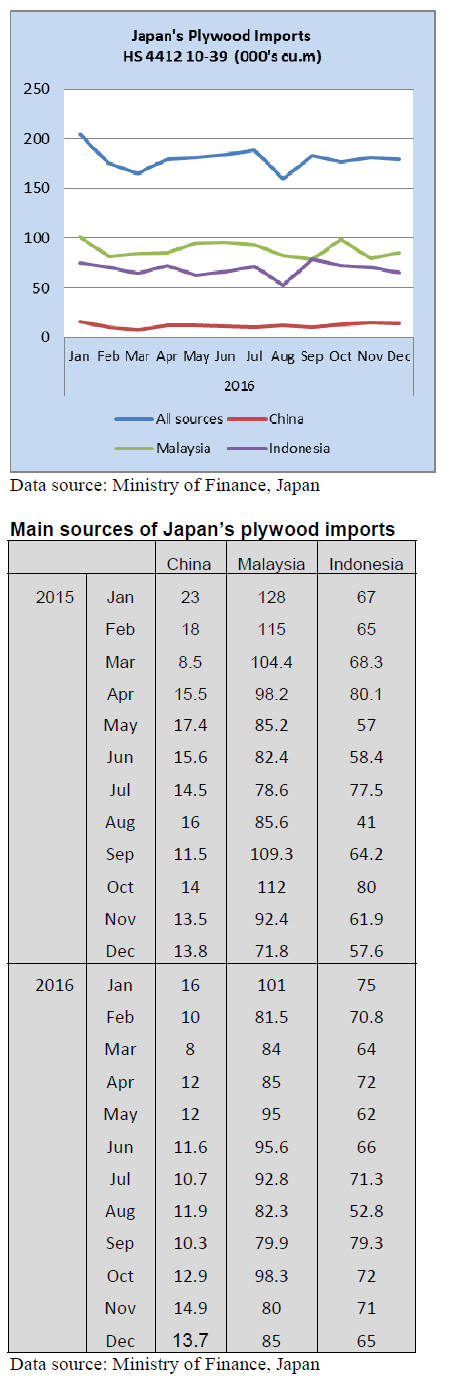

The figure below shows the trend in imports of 4

categories of plywood, HS 441210/31/32 and 39.

Throughout 2016, as was the case in 2015, almost 90% of

Japan¡¯s plywood imports are from Malaysia, Indonesia

and China.

Plywood imports in 2016 were down 3.5% compared to

2015. Shipments from China fell 20% in 2016 and

shipments from Malaysia were also down (-9%) year on

year. However, plywood imports from Indonesia bucked

the downward trend rising 6%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

EPA negotiations with EU

Negotiations on EPA with EU has started but so far there

is no agreement reached. The negotiations are aiming to

open up the markets and to abolish duties on trade

between EU and Japan. Like TPP, all kinds of wood

products like lamina, laminated lumber, SPF lumber, OSB,

melamine board and flooring are subject of negotiations.

At this point, it is uncertain if all the duties are removed

but the most likely scenario is to reach an agreement by

the end of February if both sides wish to conclude early

since many EU countries will have elections after March.

Laminated lumber is the most concerned item as the

volume of European lumber import in 2015 was 2,384,000

cbms, the top among other imports from other sources.

Also total structural laminated lumber import in 2015 was

705,200 cbms, which includes imports from China and the

U.S.A. Domestic production of this item was 1,346,600

cbms. European products are the largest competition with

domestic products.

Import duty on lumber is 4.8% and laminated lumber

3.9%. If these duties are removed totally, market prices

would drop as the import cost is down. The largest factors

of price fluctuation are exchange rate and supply and

demand balance. Pressure on prices gets larger if the

supply increases.

There is possibility that the European suppliers reduce the

export prices to expand market share in Japan. If this

occurs, domestic laminated lumber and solid wood lumber

would face severe price competition.

During process of the negotiation, some information is

reported that Japan would allow same degree of TPP

standard.

Large laminated lumber manufacturer says that there is not

enough information yet so laminated lumber

manufacturers have very little interest but if it would

become the same as TPP, there will be large confusion in

the industry including domestic lumber industry.

In TPP, duty on laminated lumber is totally eliminated to

zero from present 3.9%, which reduces the price of

imported laminated lumber by 2,000 yen per cbm. This

would increase import of laminated lumber but lamina

prices will be reduced step by step so domestic

manufacturers¡¯ cost remains high so imported products

have advantage in prices against domestic laminated

lumber.

There are increasing domestic laminated lumber with

cedar, cypress and larch lamina but they face tough price

competition with the import products. In supply regions,

there is no move to increase production for Japan yet

without any final agreement but some are reviewing

supply structure for Japan market.¡¯

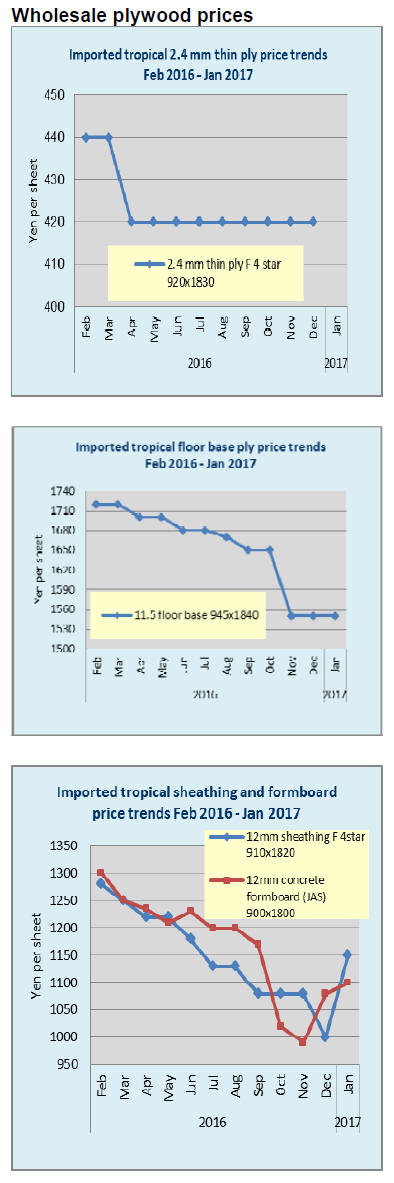

Risk of yen fluctuations drives down size of orders for

imported plywood

Supply tightness continues on both domestic and imported

plywood. Active orders from precutting plants on

domestic softwood plywood continues even after the New

Year holidays.

Meantime, future orders on imported plywood are absolute

minimum volume because there is possibility of drastic

fluctuation of exchange rate, depending on policy the new

president Tramp (Trump) takes. Present market is affected

by recent depreciation of the yen so the importers are

asking higher prices.

Looking at trend of the market, some users of concrete

forming panels try to procure low price items so the

movement is getting active compared to last December but

actually there is very little available as the inventories are

down close to the bottom so the importers and wholesalers

are waiting for next arrivals.

Actually the importers purchase minimum volume with

back to back contracts with the customers so there is no

surplus in the market. Accordingly, supply and demand

are balanced. Since future exchange rate is hard to foresee.

The importers are not able to make aggressive purchases.

Domestic softwood plywood production in last December

was 238,700 cbms, 3.0% more than the same month in

2015 and total yearly production was 2,897,200 cbms,

11.9% more than 2015. This the highest in last five years.

Monthly average production in the fourth quarter last year

was 247 M cbms while the shipment was 249,800 cbms so

the shipment continues to exceed the production. Total

year shipment was 2,939,000 cbms, 9.1% more than 2015.

The inventories were have been extreme low of less than

100 M cbms since last August so plywood mills ship out

as soon as produced with practically zero inventory.

December production of structural softwood plywood inn

December was 229,800 cbms, 8.7% more than December

last year and total year production was 2,786,500 cbms.

December shipment was higher than production at 238 M

cbms and the inventory was 77,200 cbms, 900 cbms less

than November. Some plywood manufacturers increase

the sales prices slightly since January because of higher

log prices and adhesive prices and they are considering to

make another hike during February.

For more see Japan Lumber Reports Feb. 3, 2017 No. 691

|