Japan

Wood Products Prices

Dollar Exchange Rates of 25th

November 2016

Japan Yen 113.22

Reports From Japan

Household spending done eight straight

months

According to the Ministry of Internal Affairs and

Communications Japan's household spending fell for the

eighth straight month in October. Household spending, a

key economic indicator dropped just under 0.5% in

October year on year signaling that consumers still are

very cautious on spending.

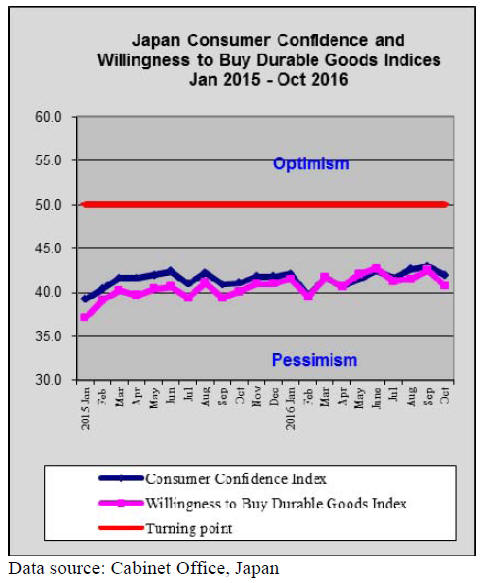

The Consumer Confidence Index in October 2016 was

42.3, down 0.7 points from September.

The Overall livelihood index fell as did all other indices.

Likely US stimulus spending drives up dollar

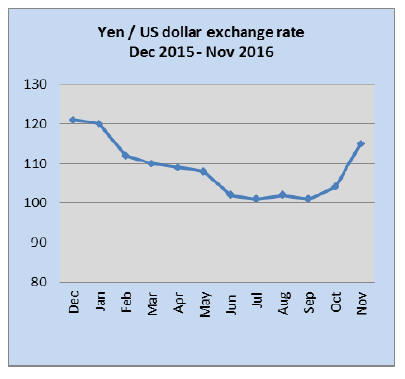

The yen weakened by around 7% against the US dollar

over the past month, a decline which is much more than

any other major Asian currency. The driver of the yen

weakness has been mainly the assumption that the new

Republication Administration in the US will push forward

with plans for massive stimulus measures coupled with a

rise in interest rates.

In the past 18 months a lot of money has flowed to

emerging markets as well as to Japan but this is now being

repatriated in anticipation of a stronger US dollar.

Three months of growth in housing starts

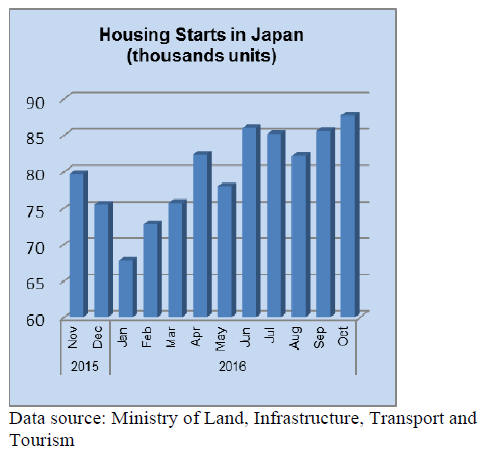

Japan’s October housing starts rose almost 14% building

on the gains in September. For the year to-date annual

housing starts could come in at around 983,000, much

lower than the 964,000 forecast.

Construction companies report healthy order book

positions (up 15% year on year).

Import round up

Doors

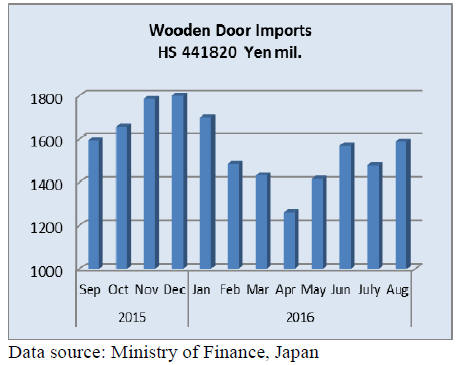

Year on year Japan’s August 2016 imports of wooden

doors (HS 441820) were up 5% and compared to levels in

July they rose 7%. As has been the norm for the year todate

the top three suppliers in August were China (67%),

the Philippines (17%) and trailing behind Indonesia at 5%.

The main drivers of demand for wooden door is the new

build and home renovation market and recent

improvement in housing starts and the especially strong

demand for apartments in the major cities is supporting

wooden door imports.

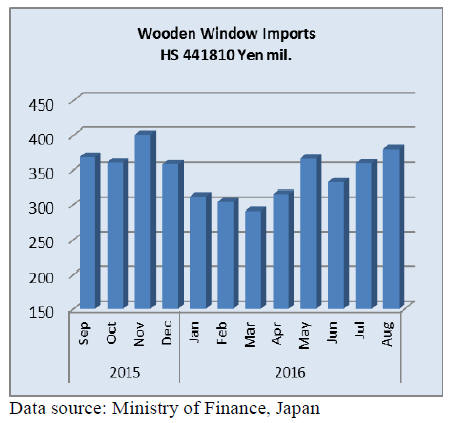

Windows

Japan’s wooden window imports have been rising steadily

for the three months since June this year and August

imports were up 5.5% on July. However, year on year

imports were down 6% in August.

As is the situation with wooden doors, shippers in China

and the Philippines dominate Japan’s imports. Shipments

of wooden windows in August from the top two suppliers

were running at around 35% each with the US coming in

third accounting for a significant 20% of imports.

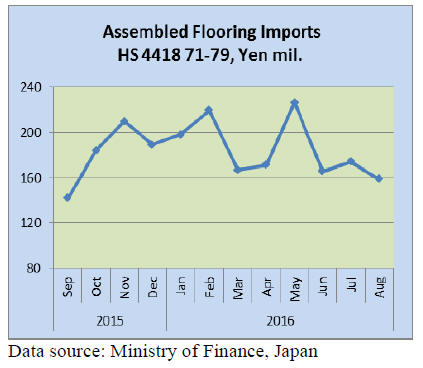

Assembled flooring

Three categories of assembled flooring are included in the

data presented below, HS 441871, 72 and 79.

Flooring shipped under HS441872 accounts for the bulk of

imports (62%) followed by HS 441879 (37%). Shipments

of HS 441871 are very small and come primarily from

Thailand.

Shippers in China dominated Japan’s August imports of

HS 441872 flooring accounting for around 74% of all

imports under this category. The other major supplier was

Indonesia (8%). Shipments from the EU accounted for

17% of Japan’s imports of this category of flooring.

Shipments of HS 441879 flooring are fairly evenly

split

between Indonesia (31%) and China (28%) with Vietnam

and Thailand together accounting for a further 17% each.

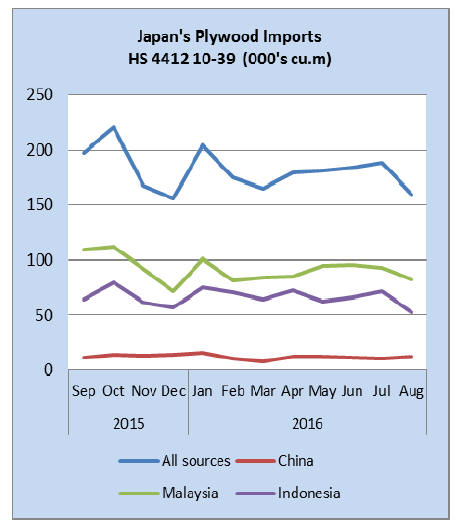

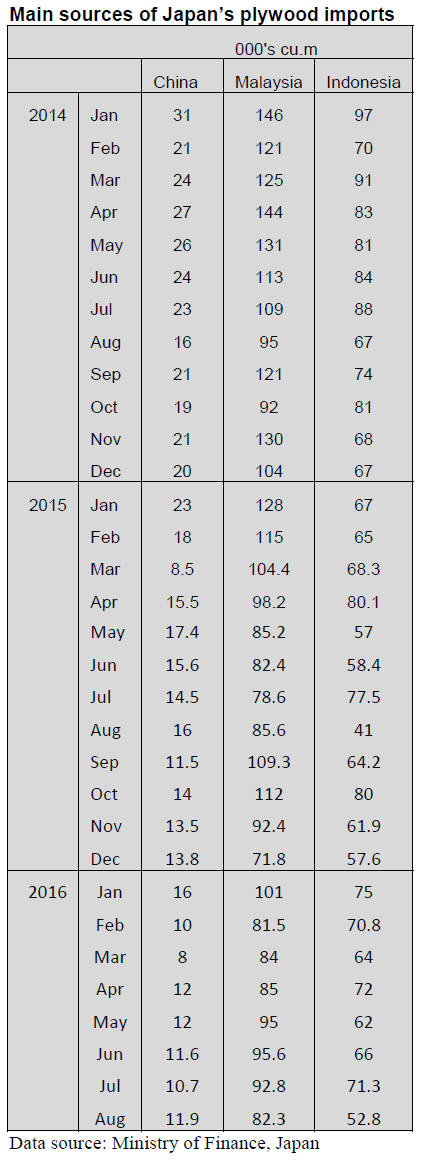

Plywood

The figures below depict the combined imports of 4

categories of plywood, HS 441210/31/32 and 39. Two

thirds of Japan’s plywood imports fall under HS 441231

and within the category Malaysia (54%) and Indonesia

(40%) are the main suppliers. The other significant

suppliers are China, taiwan P.o.C and the Philippines.

Shipments of HS 441232 plywood were mainly from

Malaysia and Indonesia with some originating in the EU.

With around 98% of Japan’s August plywood imports

accounted for within the two categories mentioned above

the balance is split between HS 441210 (China the only

supplier in August) and HS 441239 supplied by mainly

China, the Philippines and New Zealand.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Changing domestic log market

Self-sufficiency rate of wood in 2015 was 33.3% and it

was 31.2% in 2014. It had been below 20% for five years

since 2000 then it was increasing since 2005 steadily and

now it appears that the rate would stay 30% and higher

after about 30 years. The reason of increase is decline of

imported wood while domestic wood supply increased.

The supply of domestic wood in 2015 was 25,060,000

cbms. This is the first time that the volume exceeded over

25 million cbms in 21 years since 1994. When the rate was

the bottom in 2002 with 18.8%, supply of domestic wood

was 16,920,000 cbms so the supply has increased by about

8 million cbms in 13 years.

While the rate increased from 18.8% to 33.3% and the

volume increased by about 8 million cbms, there was large

change on both log supply side and demand side of

consuming lumber and plywood mills.

Changes of log users are that sawmills have much more

large capacity and shifting from imported materials to

domestic logs by plywood and laminated lumber mills

then start-up of biomass power generation facilities, which

use large amount of unused wood. This is totally new

demand for domestic logs.

Changes of log supply side are improved production by

introducing high performance logging machinery and

development of logging road system then larger subsidy

for harvesting thinning by the government. These changes

resulted in direct delivery of logs to user mills without

going through traditional log auction markets. Then large

log users expand much wider sourcing of distant areas.

Then who are major players in this stage? Log suppliers,

forest unions, system sales of national forest and log

marketing firms are the main players and they deliver

direct to users so a majority of increased volume of eight

million cbms in last 13 years is delivered direst to large

log users.

Advantage of log users is that they do not have to go to

many auction markets to collect necessary volume while

the suppliers have solid buyers with price stability by price

negotiation in every several months.

Plywood mills are large log users and some have to go far

places to buy logs. For instance, mills in Miyagi prefecture

buy logs from eleven prefectures including Hokkaido then

mills in Ishikawa prefecture buy logs from ten prefectures.

Transporting plywood logs is not economical but mills

need large volume of logs so they need to go far places.

When mills relied on imported materials, they situate close

to log receiving ports but now water front is not good

location if domestic wood is main material so some build

mills close to the forests. This is one of the changes in

recent years. Another change is building processing plants

close to log supply sources.

Rather than hauling logs in long distance, which costs

more for trucking, building wood chip plant then transport

wood chip to biomass power generation plant. Wood chip

trucking cost is far lower than trucking logs. Or building

veneer plant up in the woods then transport veneer to far

plywood mills, which saves trucking cost. The same deal

on lamina to laminated lumber mills. These changes are

not temporary but seem permanent

Plywood

Domestic softwood plywood consumption continues busy

by large house builders and precutting plants. September

production was 252,400 cbms, 17.0% more than

September last year and 9.8% more than August. The

production has been over 250,000 cbms for last three

months.

Structural plywood production was 245,300 cbms, 22.8%

and 6.7% more. The shipment was 254,900 cbms, 11.0%

more and 6.7% more so the inventories were down to

94,600 cbms. Decline of the inventory has continued for

last six months.

Structural plywood shipment was 246,200 cbms, 7.8%

more than August, which exceeded the production by 900

cbms. This is the same level of shipment as last June. The

inventories were down to 85,300 cbms.

Generally the supply continues tight but there is no

confusion of scratching the supply among precutting

plants since precutting plants place orders well ahead of

necessary time. There are still some precutting plants

looking for plywood and they inquire wholesalers and

trading firms occasionally. Wholesalers, which purchase

plywood regularly from the mills, are having necessary

volume but delivery is delayed on additional orders.

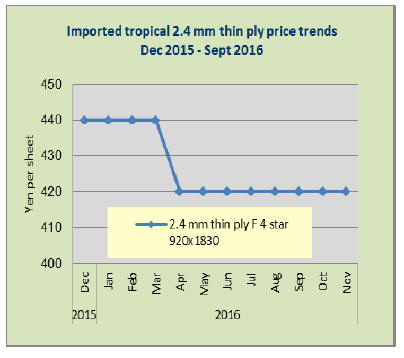

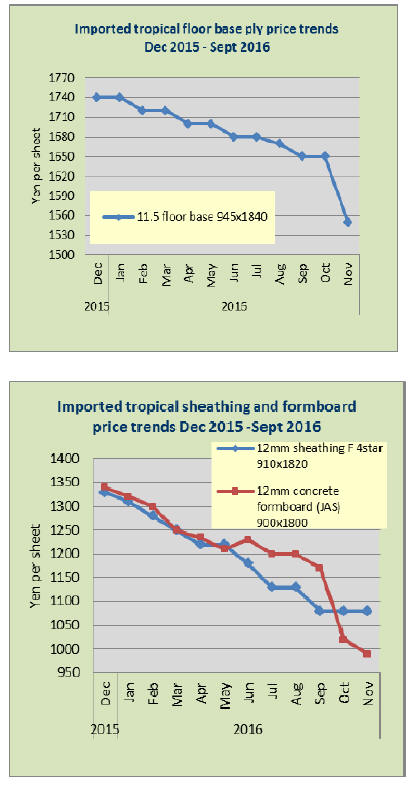

The market prices of imported plywood have been

dropping for last one year then the inventory adjustment is

done by trading firms and wholesalers in September’s

book closing month so the bottom feeling is spreading in

the market with limited future orders to the suppliers.

Trading firms and wholesalers try to stop further price

deterioration and retailers are following but the move is

not strong enough to push the prices up since the demand

for concrete forming panel remains weak.

Mitsui Home Component sets up Wood Structure

Research Institute

Mitsui Home Component (Tokyo) announced that it sets

up Wood Structure Research Institute. It will develop new

technique of wood structure, improvement of productivity,

and new business with wood structure and expand

business area of 2x4 method.

Mitsui Home Component has marketing division,

producing division and development division but this new

institute does not belong to any of these divisions and will

be independent from all the others in the company.

The company manufactures and process 2x4 lumber not

only for Mitsui Home but other builders and design and

does actual construction works. The Institute will develop

new technique other than 2x4 by taking in traditional post

and beam construction, CLT construction and large space

design to make the best use of wood.

Besides development of new business, it will improve

productivity of the plant and coordination between

production and marketing. Developing something the

market did not have and it should have marketability are

major theme for the Institute.

|