|

Report from

Europe

Tropical share of EU plywood market stabilises but at

low level

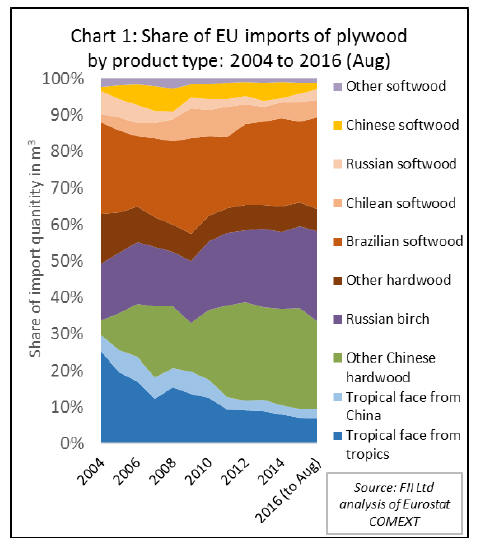

In the last ITTO report on the European plywood market

(MIS 16-31 May 2016), it was noted that the share of

tropical countries in EU plywood imports fell to an alltime

low of less than 8% in 2015.

While EU imports of plywood from tropical countries

were rising slowly last year, imports from other countries

increased more sharply, particularly of mixed hardwood

plywood from China and birch plywood from Russia.

Latest EU import data (to end August) shows that the

share of tropical plywood in total EU plywood imports has

stabilised at the lower level during 2016. However there

has been some shift in the share of other plywood

suppliers into the EU.

This year Chinese mixed hardwood plywood has lost share

in the EU market to Russian birch plywood and various

suppliers of softwood plywood, including Brazil, Chile

and Russia (Charts 1 and 2).

After falling back 7% to 276000 cubic metres in 2015, EU

imports of hardwood-faced plywood from tropical

countries rebounded 7% to 202000 cubic metres in the

first eight months of this year.

EU imports of tropical hardwood-faced plywood from

China, which increased 5% to 95000 cubic metres in 2015,

have continued to rise rapidly this year, up 30% to more

than 82000 cubic metres by the end of August.

However, EU imports of other hardwood-faced plywood

from China (including birch plywood, mixed light

hardwood, and various other forms of combi plywood)

have slowed this year, falling 6% to 709000 cubic metres

in the first eight months.

The changing composition of EU plywood imports from

China may be partly related to strong competition from

Russian birch plywood, of which EU imports increased by

26% to 741000 cubic metres in the first 8 months of 2016.

Enforcement of EUTR and CE marking requirements may

also be encouraging a shift from Chinese mixed light

hardwood products to plywood containing more clearly

identified species of known origin and technical

performance.

This same factor is also likely to explain the increase in

EU imports of Chinese plywood faced with hardwood

species identified as of tropical in origin.

Tropical countries have been supplying more hardwood

plywood into the EU this year. In the first eight months of

2016, EU imports increased 11% to 76000 cubic metres

from Malaysia, 7% to 73000 cubic metres from Indonesia,

and 12% to 30000 cubic metres from Gabon.

However, the shifting composition of plywood supplied

into Europe from China has meant that country has now

emerged as the EU¡¯s largest single supplier of tropical

hardwood plywood. This raises questions about the

relative competitiveness of plywood manufacturers

operating in tropical countries (Chart 3).

UK switches to tropical hardwood plywood

manufactured in China

Trends in overall EU imports of plywood are also partly

dependent on shifting market conditions and preferences

in different parts of the EU (Chart 4).

The increase in EU imports of tropical hardwood faced

plywood from China this year has been concentrated

almost entirely in the UK with a smaller amount destined

for the Netherlands.

In recent years, of all EU importing countries, the UK has

been most tempted by the low prices and relatively short

transit times offered by Chinese plywood suppliers.

UK importers have also been under intense pressure to

demonstrate conformance to EUTR after the NMO, the

UK¡¯s enforcement agency, published a report in February

2015 revealing failures by several UK importers of

Chinese plywood to meet regulatory requirements.

Specific concerns were raised over the lack of accurate

information on species content in Chinese hardwood

plywood.

The sharp rise in UK imports of Chinese plywood faced in

tropical hardwood may therefore simply be a result of

efforts to ensure more accurate identification of species

content.

It also suggests that a significant proportion of this

material is faced with FSC or PEFC certified tropical

hardwood, or at least that Chinese manufacturers are now

successfully reassuring customers of the legality of their

tropical veneer supplies by other means.

Much of the gain in EU plywood imports from Indonesia

during 2016 has also been concentrated in the UK, with

other gains being made in Germany, the Netherlands, and

Italy.

These gains have been sufficient to offset a big fall in

imports of Indonesian plywood by Belgium. Rising EU

imports of Malaysian plywood in 2016 have been mainly

destined for the UK, Netherlands and Belgium.

The gain in EU imports of plywood from Gabon in 2016

has all been concentrated in the Netherlands. In fact, 60%

of all EU plywood imports from Gabon have been

destined for the Netherlands this year. Imports into France

and Italy, which historically have been leading markets for

African okoume plywood, have declined so far in 2016.

Weak recovery in ECE wood market expected to

continue despite risks

Overall, the pattern of weak recovery in EU and North

American forest products markets following the global

financial crisis is continuing in 2016 while the CIS market

is declining.

Currency volatility and low oil prices have been key

determinants of recent forest products trade trends. New

market opportunities for forest products are arising from

innovative products and policy measures to reduce carbon

emissions and encourage moves to a circular economy.

However, there are significant downside risks to the

stability of the global economy. The forest products sector

also needs to focus more on ensuring the regulatory

environment does not create unnecessary barriers to trade

and enhances, rather than hinders, the competitiveness of

wood relative to other materials.

These were key conclusions of the seventy-fourth session

of the recent ECE Committee on Forests and the Forest

Industry (COFFI) held in Geneva, Switzerland.

See:

https://www.unece.org/forests/coffi74#/

Drawing on the UNECE Forest Products Annual Market

Review 2015-2016 published to coincide with the

meeting, and presentations by regional market experts, it

was concluded that the general condition of forest

products markets in the ECE region remained relatively

stable in 2015 and the first half of 2016.

See:

http://www.unece.org/forests/fpamr2016.html

European and North American markets experienced

moderate consumption growth, benefitting from generally

positive economic developments and improvements in the

housing and construction industry.

In contrast, deteriorating economic conditions and

currencies depreciations primarily accounted for a more

than 4% contraction of sawnwood and panels consumption

in countries of the Commonwealth of Independent States

(CIS).

COFFI highlighted that currency volatility is playing an

important role in trade of forest products in the UNECE

region. In the United States during 2015, imports of wood

products jumped about 10%, while exports declined by

about the same ratio due to the strong US dollar.

Meanwhile the weakness of the euro and other European

countries is contributing to a rise in the EU¡¯s net trade

surplus of forest products. In the CIS countries, a

weakened rouble is pushing exports to record highs for all

major product categories, in many cases more than

countering the lack of domestic demand and thus

increasing production.

The gap between the pace of economic expansion in the

EU and the U.S. is narrowing, as economic activity in the

euro area is rising. The wood furniture manufacturing

sector in Europe continues to show resilience and is

growing, with 84% of furniture consumed in Europe

produced domestically.

Construction is expanding only slowly across Europe as a

whole, but some individual markets are now performing

well, notably in Germany, Netherlands, and the UK, while

Spain is bouncing back after a particularly deep recession.

The meeting observed that recent trade negotiations within

the ECE region, if brought to a satisfactory conclusion,

offer potential to further boost international trade in forest

products.

Canada and the EU have concluded negotiations on the

Comprehensive Economic and Trade Agreement (CETA),

while the Transatlantic Trade and Investment Partnership

(TTIP) ¨C a trade agreement between the EU and the US ¨C

is still under negotiation. Both the CETA and TTIP would

encourage transatlantic trade particularly in value added

forest products.

Patchy and uneven growth in ECE hardwood

consumption

On sawn hardwoods, COFFI concluded that production in

the ECE region increased by 1.8% to 40.7 million cubic

metres in 2015, rising in all three sub-regions (Europe,

North America and CIS).

Consumption of sawn hardwood in the ECE region also

increased to 35.6 million cubic metres in 2015, a 0.9% rise

compared to 2014 and the fourth consecutive year of

increase. Falling consumption in Europe and the CIS in

2015 was offset by rising consumption in North America.

It was reported that European consumption of sawn

hardwood decreased 2.8% to 12.2 million cubic metres in

2015, mainly due to a significant decline in Turkish

consumption. Consumption in EU28 countries increased

by 0.8% in 2015, to 9.5 million cubic metres, benefiting

from (albeit slow) growth in key sectors of the EU

economy, including construction and furniture.

There has been little change in European hardwood

fashion trends which remain heavily oriented towards the

¡°oak look¡±. For example, oak is now used in over 70% of

wood flooring manufactured in Europe while the share of

tropical woods continues to decline and other temperate

species account for only a small share.

Such is the strength of demand for oak in Europe, that

supplies are becoming restricted and prices have been

rising sharply this year.

According to COFFI, sawn hardwood consumption in the

CIS sub-region fell 25.9% to 1.46 million cubic metres in

2015 following a 3.6% fall the year before. However,

hardwood production in the CIS increased 2.3% to 3.4

million cubic metres, with exports taking up the slack.

The weakness of the rouble encouraged a 50.5% increase

in sawn hardwood exports by the Russian Federation to

1.4 million cubic metres. The Russian Federation exported

1.2 million cubic metres to China in 2015, 49% more than

in 2014 and by far the highest level ever recorded.

|