Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November 2016

Japan Yen 106.83

Reports From Japan

Japan ratifies the TPP

The government of Japan has ratified the Trans-Pacific

Partnership (TPP) trade deal which was at the centre of the

government’s plan to revive economic growth through

expanded tariff free trade.

Under the terms of the TPP treaty it must be ratified by the

US to take effect but this may be unlikely in the short term

as the new Republican administration in the US has vowed

to review the agreement and may move to reopen

negotiations.

The quick ratification by Japan is meant to send a signal to

the US and other TPP signatories that Japan wishes to

proceed with the deal. A paper produced by the White

House Council of Economic Advisors says that if the US

does not ratify this trade pact US firms could lose

competitiveness in the Japanese market and this could

result in high job losses in the US.

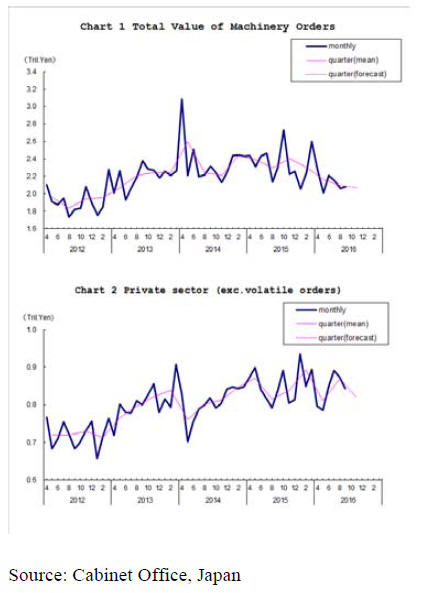

Machinery Orders for September and forecast final

quarter

The Japanese Cabinet Office has reported core machinery

orders fell once again in September. This was put down to

the weak global economy and weakness in Japan's

domestic economy.

In the October-December period the total amount of

machinery orders was forecasted to fall further by 1.3%

and private-sector orders have been forecast to drop by

almost 6% from the previous quarter. The Cabinet Office

downgraded its assessment of potential machinery order

growth and indicated recovery is now stalling.

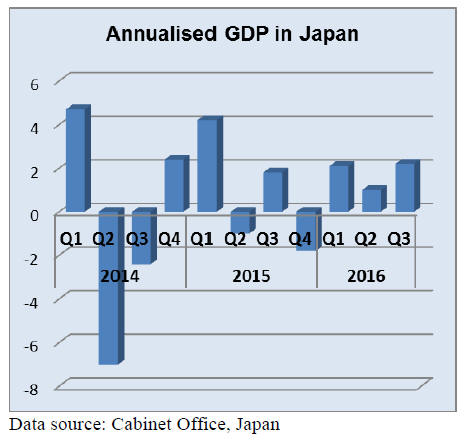

Annualised GDP swings back and forth

Preliminary GDP data point to an unexpected rise in the

past quarter. Japan’s economy expanded more than

forecast in the first nine months of this year driven by

higher exports which off-set weak consumer spending.

On the basis of the latest preliminary numbers Japan’s

GDP expanded by an annualised 2.2% as of September.

See:

http://www.esri.cao.go.jp/en/sna/data/sokuhou/files/2016/qe163/

gdemenuea.html

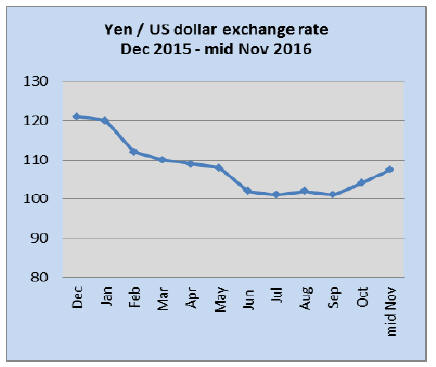

Dollar rises against yen after initial shock fall

The US dollar quickly recovered from a bout of selling

immediately after the result of the US election was

announced. The dollar was recently up about 1% against

the euro and it recovered from a nearly 4% loss against the

Japanese yen.

The US dollar had extended its gains to a five-month high

of yen107.50 on 14 November reflecting expectations for

an economic stimulus package from the incoming

Republican administration.

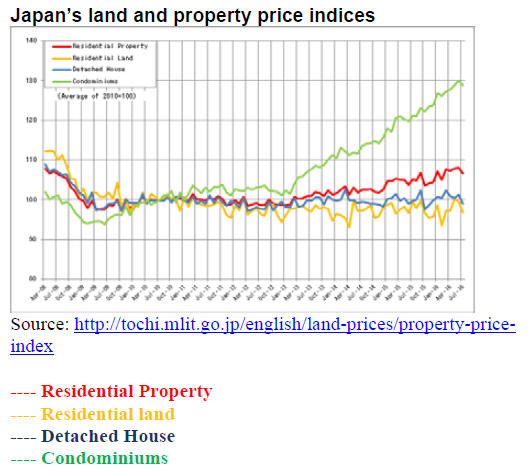

Apartment prices rise out of reach

Ultra-low interest rates in Japan have attracted buyers,

especially those with high levels of savings, to jump into

the property market. This has pushed prices in the Tokyo

area well out of reach of ordinary families.

An unusual situation has developed whereby, as average

sales prices for apartment continued up in Tokyo (rising to

a 25 year high), the number of offers dropped by almost

the same amount.

The Real Estate Economic Institute has reported that sales

of properties over yen 100 million rose by 85% this year

while demand for lower priced homes fell almost 20%

even as the commercial banks offered mortgages at around

1%.

Japan’s furniture imports

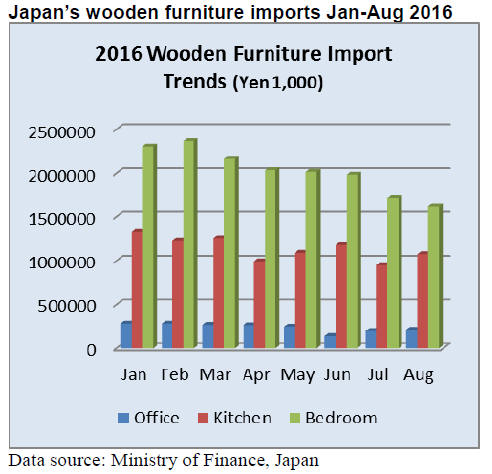

2016 started well for shippers supplying wooden office,

kitchen and bedroom furniture for the Japanese market.

But as the year advanced a pattern of steady decline

emerged which has been sustained through to August.

Japan’s imports of wooden office furniture items have

fallen around 24% since the peak in January. Similarly,

imports of wooden kitchen furniture have fallen by 19%

up to August and the fall in wooden bedroom furniture has

been even more dramatic as a 31% fall in imports has been

recorded.

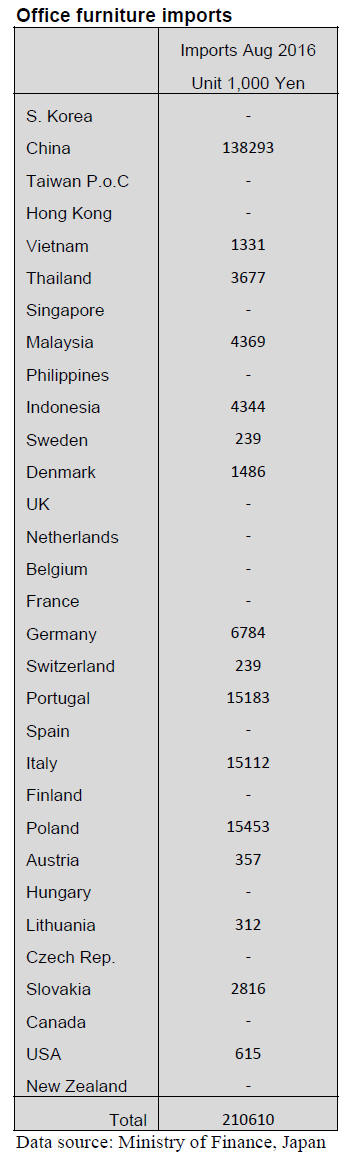

Office furniture imports (HS 940330)

Year on year, imports of wooden office furniture in

August were down 3% but there was a rise in month on

month imports of 14%.

The top three shippers to Japan of wooden office furniture

in August (as they were for the year) were, in order of

rank, China, Poland and Portugal. These three provided

around 80% of all Japan’s wooden office furniture imports

in August.

Compared to a month earlier shipments from China

rose

10%, shipments from Poland jumped 75% and shipments

from Portugal quadrupled.

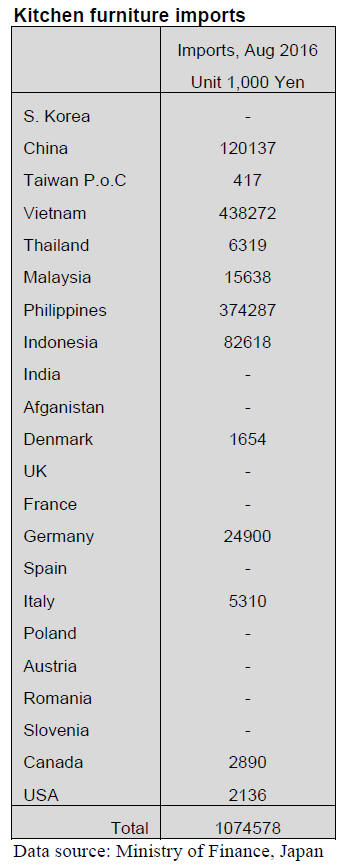

Kitchen furniture imports (HS 940340)

The hint of a recovery in wooden kitchen furniture imports

in June was not sustained through into July and even

though August imports bounced a little overall year on

year imports of wooden kitchen furniture fell 3%.

Throughout this year four shippers have dominated

the

imports of kitchen furniture, Vietnam ( 41% of Aug

imports), the Philippines (21% of Aug imports), China

(11% of imports) and Indonesia (7% of Aug imports).

These top four suppliers accounted for 94% of all wooden

kitchen furniture imports in August.

In August Vietnam saw shipments to japan rise 34%, the

Philippines achieved a 21% growth month on month while

both China and Indonesia saw shipments decline in

August (10% and 25% respectively)

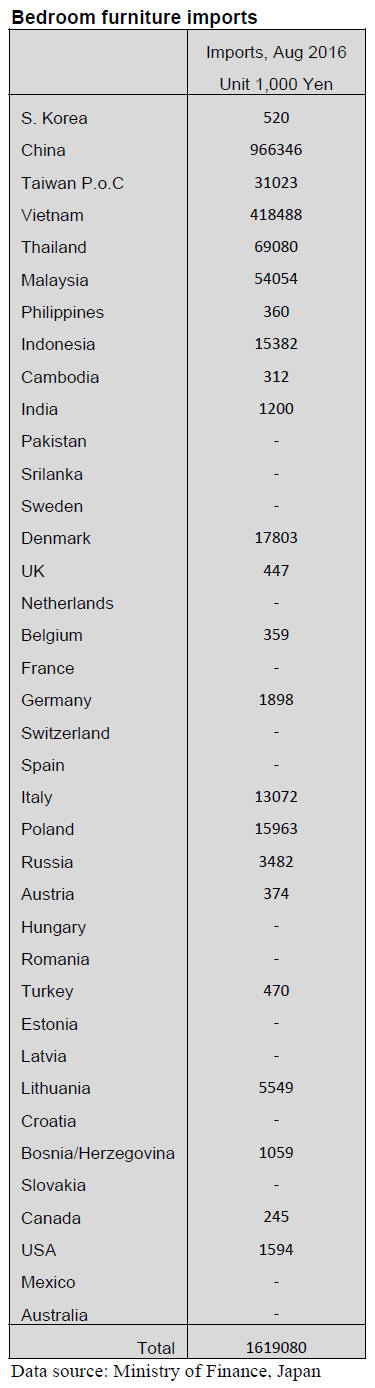

Bedroom furniture imports (HS 940350)

Bedroom furniture imports have plummeted since January

and it is difficult to explain why there has been such a

sharp fall. Housing starts and consumer sentiment are

drivers of demand for furniture but the extent of the

decline in bedroom furniture imports compared to the

more modest decline in kitchen furniture imports seems to

suggest other factors are involved.

One possible explanation could be that the home

renovation market which has expanded in recent years is a

factor. In a renovation project a new kitchen would seem

appropriate but those undertaking renovations may carry

their existing free standing furniture such as beds with

them to the renovated home.

Year on year August imports of wooden bedroom

furniture were down 11% and month on month imports

also dipped by 6%.

Two shippers, China and Vietnam accounted for around

85% of all Japan’s August imports of wooden bedroom

furniture. In August only Indonesia and Denmark recorded

noticeable gains in shipments to Japan.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood demand projection meeting

The Forestry Agency held the second wood demand

projection meeting and drew up demand projection on

major items for the second half of fiscal year of 2016.

New housing starts in 2016 are estimated about 959,000

units, 4.2% more than 2015. With this assumption, the

projection of demand for the second half of 2016 (October

2016 to March 2017) has very little change compared to

the same period of last year.

Projection of domestic wood is changed downward for

lumber use while wood for plywood is changed upward

for period of July through October and total year. Plywood

use would keep increasing. Generally the demand would

be expanding for the second half of the year. Export

volume of domestic plywood for the first seven month of

2016 increased by 81.3% from 2015.

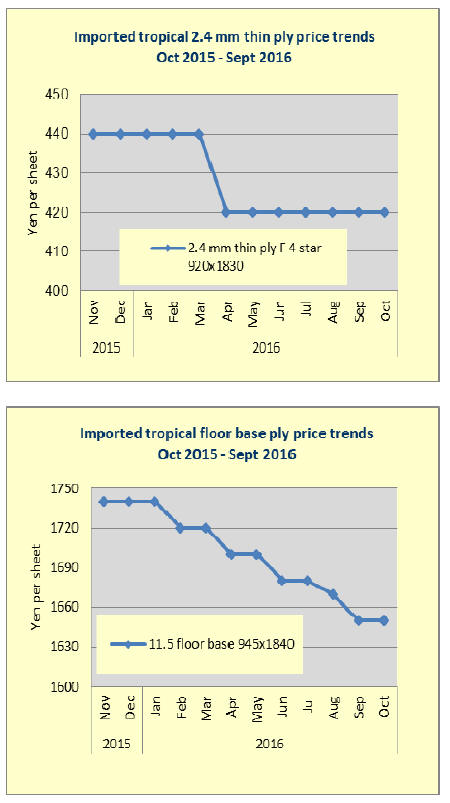

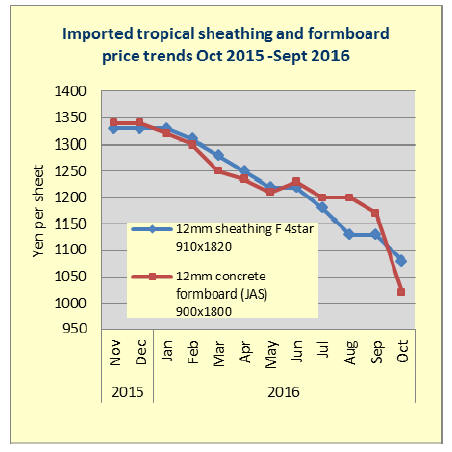

Imported plywood demand is firm for Indonesian floor

base by active operations of floor manufacturers in Japan

so Indonesian supply would increase while Malaysian

plywood demand would decline considerably with slow

demand for concrete forming panel.

Demand for laminated lumber is firm on both domestic

and import products so overall volume would increase

over last year. On imported laminated lumber, new

redwood plant will start up in Europe so this will be

additional for the imports.

North American log import would be almost the same as

last year probably with slight decline. Import of Douglas

fir logs last year was rather high because of coming

increase of consumption tax but after it was decided to

postpone, hope of rush-in demand faded. Demand for

North American lumber is almost the same as last year

with the supply increasing.

Demand for European common lumber would slow down

in the first quarter next year so the supply would decrease.

South Sea logs for lumber use would decrease because of

supply tightness .Logs for plywood would increase

temporarily since port of Niigata closes the gate for 40

days since February next year so local mills plan to import

logs before this happens.

Demand for Russian logs continues decline compared to

the same period of last year with number of sawmills

cutting Russian logs continue declining.

Log supply for biomass generation in Kyushu

With many biomass power generation plants starting,

some feared that log supply would be short but now the

supply is exceeding the demand in Kyushu.

Biomass power plants started about spring of last year and

a large one with output of 18,000 kw in Ohita, which

started recently seems to be the last one for a time being.

In short, the log demand for power generation plants in

Kyushu is estimated about two million cubic meters,

which is totally new demand. Supply shortage is solved by

aggressive log producers and power plants use other fuel

such as PKS and wood pellet so demand and supply

balance is now stable.

South Sea (Tropical) logs

After the Sarawak government reduced log export quota,

India and Japan have hard time to have enough volume for

shipments. Particularly, it is hard to buy small and super

small logs so the Japanese buyers are shifting to Sabah,

where more logs are available. Kapur and keruing in

Sabah are more difficult to buy now.

Rainy season will start in November and log supply will

get tighter. Malaysian log prices are staying high at

US$275 per cbm FOB on meranti regular, US$255 on

meranti small andUS$245 on super small.

Since the demand for South Sea logs, lumber and plywood

in Japan is sluggish in Japan, the buyers reduce purchase

volume if the export prices stay up high so there is quite a

gap between supply side and Japan side.

Since purchase by India and China is slow now, Sarawak

log suppliers cannot be aggressive now.

Meantime, weather in PNG and Solomon Islands is stable

so that log production is active but main buyer, China is

absent due to depressed China domestic market then India

started buying to replace Sarawak logs so there is no

surplus.

Itochu Kenzai expands sales of certified plywood

Itochu Kenzai Corporation (Tokyo) plans to increase sales

of ecological panel products. It has own ecological brand

of ‘global wood’ for panel products and it will add more

products under this brand.

Among major building materials trading firms, as far as

plywood handling is concerned, Itochu Kenzai is third

with 20% in total business but as far as domestic plywood

handling is concerned, it is the top with 25%.

Domestic plywood handling is further increasing.

Share of

import plywood and domestic plywood reversed this year

and domestic share is 52% and it thinks this trend would

continue.

Percentage of ‘Global wood’ is now 20% in total plywood

sales and it plans to add more products for this brand. In

imported plywood, they are hybrid plywood with 100%

planted wood and coated plywood and structural plywood

with forest certification. In domestic plywood, structural

plywood with cypress.

From Indonesia, new product is 100% planted wood

plywood with falcata for face and back and planted

meranti for core, which has higher specific gravity and has

much better nail holding performance, which solved weak

point of 100% falcate plywood.

Forest certified products have brand name of ‘Save naturestructural

and Save nature-coated concrete forming’. It

says monthly sales of ‘Global wood’ products are 10,000

cubic meters and it plans to increase 10% for this term.

Ta Ann’s to make all products certified

Ta Ann Plywood SDN BHD. (Sibu Sarawak, Malaysia)

proposed rearrangement of its own timberland and planted

areas to the Sarawak government to obtain Forest

Management Certification and it is approved on

September 23. This is one of the efforts to achieve

continuous growth and forest preservation and to make

environmentally friendly management.

Proposed content is to rearrange complicatedly located its

own timberland and planted areas clearly and makes three

natural grown timberland units and two planted timberland

units (LPFs). With this rearrangement, obtaining forest

certification will be much faster.

Ta Ann has been studying with many consultants to have

mutual certification between MTCS, which is Malaysian

forest certification system and PEFC after it disclosed

obtaining of FMC.

It has also been working together with Sarawak forestry

Department, universities and National Environmental

Academy to improve precision of investigation for the

certificate. Ta Ann uses logs from its own timberland so

that traceability is high.

Once mutual recognition by MTCS and PEFC, all the

plywood Ta Ann processes will be PEFC certified

products. Ta Ann makes eucalyptus veneer from logs

produced from PEFC certified forest at Ta Ann Tasmania,

Australia.

The veneer is shipped to Sarawak and Ta Ann makes

plywood, which is PEFC certified plywood. It supplies

coated plywood and structural plywood for Japan.

Domestic solid hardwood flooring developed

Horiuchi Wood Craft Co., Ltd (Ashigara county,

Kanagawa prefecture), wood processor of thinning and

local wood, has developed domestic solid hardwood floor

board with FSC certified wood. This is the first for such

certified wood products in Japan. It has started marketing

the product since this fall. It is order made products and it

takes about six to twelve months for delivery.

FSC certified material wood is procured from Iwate

prefecture and Hokkaido. Species are ash, oak, chestnut,

cherry, birch, beech, walnut and magnolia. Domestic

hardwood log supply is unstable and FSC certified logs are

hard to find and there are little mills to have COC

certificate so commodity production is difficult.

Horiuchi Wood Craft has been manufacturing various

hardwood products such as base for lacquer ware, wooden

toys, wood stationary and novelty goods. Since it has

acquired COC certificate, it has been manufacturing

certified goods so it has wide knowledge of certified

goods. It has built up network of forest owners with

certification and processing plants.

It has started certified hardwood products since last year

then it decided to start marketing hardwood floor as more

demand would increase toward the Tokyo Olympic Games

in 2020.

|