|

Report from

Europe

Tropical suppliers squeezed out of the European

flooring market

Tropical suppliers to Europe¡¯s wood flooring sector are

being squeezed out as domestic production in the region is

rising again, oak is becoming increasingly dominant, and

competition from laminated flooring and other non-wood

materials is mounting.

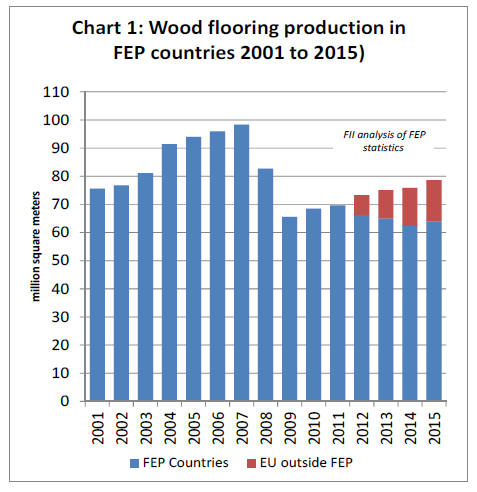

The European Federation of the Parquet Industry (FEP)

reports that European wood flooring production (not

including laminate flooring) was 78.0 million m2 in 2015,

3.6% more than in 2014.

This included gains of 2.6% to 64.0 million m2 in the 17

countries covered by FEP and 3.6% to 14.6 million m2 in

other EU countries that are not members of FEP. Despite

gains every year since 2009, production is still 20% down

on the peak of 98.3 million m2 in 2007. (Chart 1).

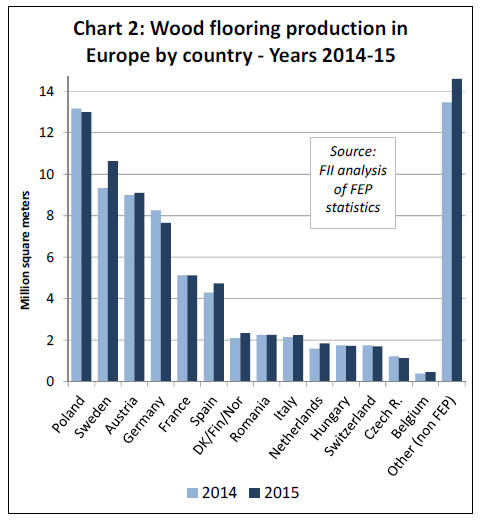

Amongst FEP member countries, significant production

gains were made in Sweden (+15%), Spain (+10%), and

Italy (+4%) during 2015. Production declined in Poland

and Germany and was flat in Austria, France, and

Romania. (Chart 2).

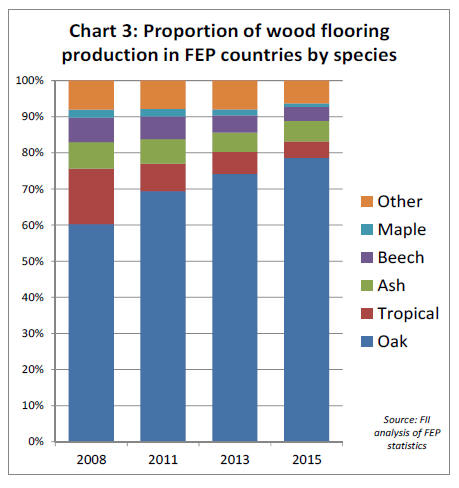

Oak-faced flooring accounted for 78% of all wood

flooring manufactured in Europe in 2015, up from 60% in

2008. The major loser has been tropical hardwood, which

has seen its share of wood flooring produced in Europe

fall from 14.7% in 2008 to only 4.5% in 2015.

In 2015, ash was the second most widely used species for

facing wood floors (5.6%), followed by beech (3.8%) and

walnut (1.4%). All other species accounted for less than

1% (Chart 3).

In 2015, multilayer parquet floors accounted for 84% of

wood floors manufactured in Europe, the majority

comprising three-layer parquet (roughly 70 % of total

market volume). Solid wood flooring accounted for only

14% of production.

The rise in European production in 2015 was stimulated

by an increase in domestic consumption. For the first time

since the onset of the global financial crisis, southern

European markets for hardwood flooring, particularly

Spain, gained momentum in 2015 and this trend continued

in the first half of 2016.

The rise in European production in 2015 was partly at the

expense of imports which lost market share during the

year.

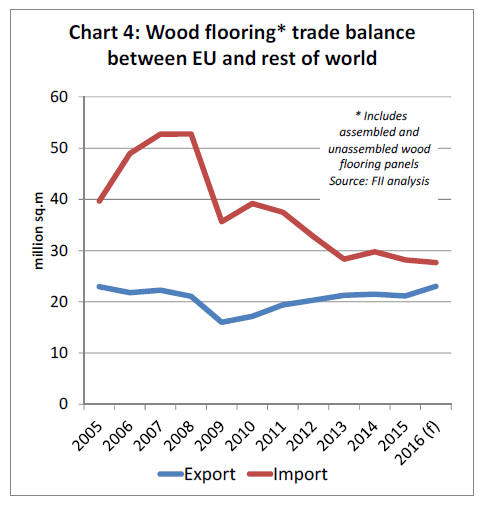

The EU¡¯s large trade deficit in EU wood flooring that

opened up before the financial crises, driven by the

housing bubble and a flood of product from China, has

narrowed sharply in recent years.

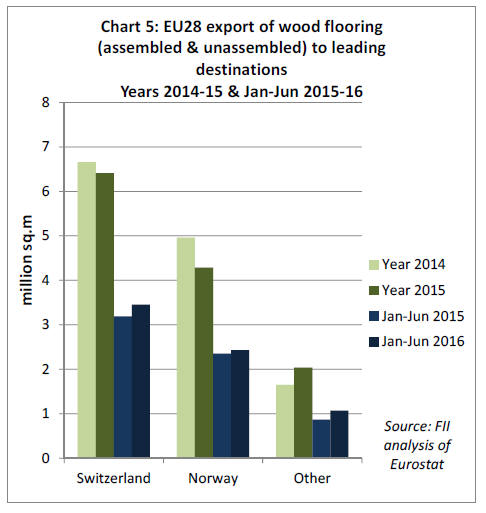

In 2015, EU wood flooring imports from non-EU

countries fell 5.4% to 28.17 million m2. Meanwhile EU

exports to non-EU countries fell only slightly in 2015 and

are rising again in 2016 (Chart 4).

Chinese wood flooring losing share in Europe

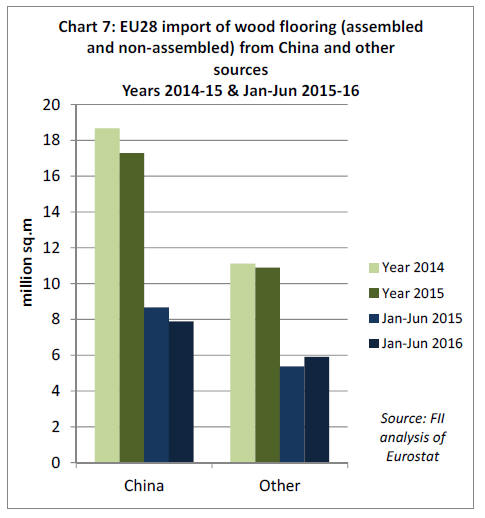

Imports of wood flooring from China, by far the EU¡¯s

largest single external supplier of this commodity, suffered

a set-back in the EU market in 2015 falling 7.4% to 17.3

million m2, the lowest level since 2005.

The downward trend has continued this year, with a

further 9% fall to 7.9 million m2 in the first 6 months of

2016. (Chart 5).

To some extent the decline in EU imports of wood

flooring from China in 2016 has been offset by rising

imports from other countries. However, all the gains made

in the EU market in 2016 have been by temperate

countries and no tropical country has benefited from

China¡¯s loss of market share.

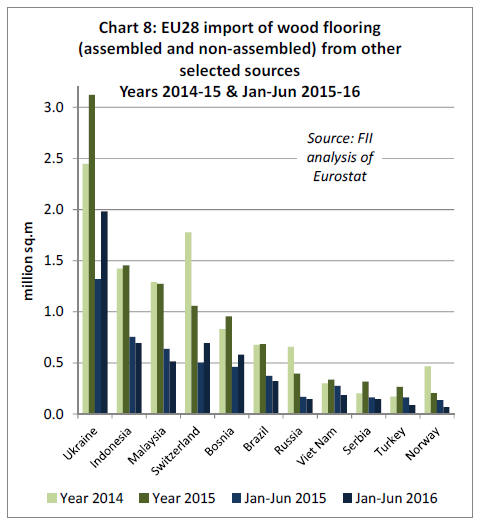

In the first half of 2016, EU imports of wood flooring

were significantly higher than the same period in 2015

from Ukraine (+50% to 1.98 million m2), Switzerland

(+40% to 0.69 million m2), and Bosnia (+26% to 0.58

million m2).

Imports declined from Indonesia (-8% to 0.69 million m2),

Malaysia (-19% to 0.52 million m2), Brazil (-13% to 0.32

million m2) and Vietnam (-33% to 0.18 million m2).

(Chart 6).

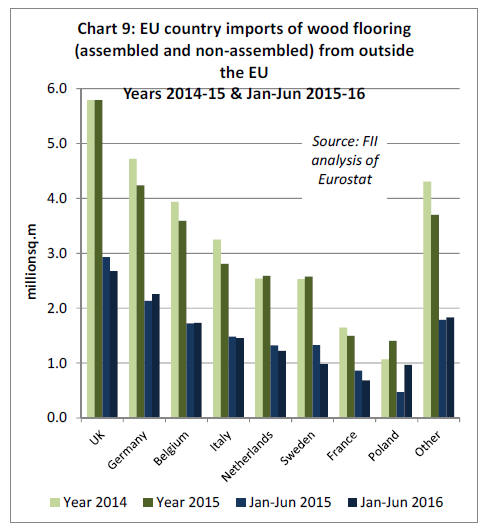

The destination for wood flooring imports into the EU is

also changing in 2016. Imports into the UK, the largest

destination for Chinese flooring products, declined 9% to

2.7 million m2 in the first six months of 2016.

Wood flooring imports have also weakened into the

Netherlands, Sweden and France this year. However there

has been a sharp increase in imports into Poland, the main

destination for Ukrainian flooring products (Chart 7).

Wood flooring faces stiff competition in the European

market from laminates and non-wood materials.

According to FEP ¡°it is becoming increasingly difficult for

consumers to differentiate parquet from competitive

flooring alternatives with a wood look surface.¡± Members

of the European Producers of Laminate Flooring (EPLF)

association sold 452 million sq.m of laminate flooring in

2015, around 333 million sq.m of which was in Europe,

over four times the volume of wood-faced flooring

consumed in the region.

Competition from non-wood materials is also intense and

varies between countries. For example, the challenge

comes particularly from luxury vinyl tiles (LVT) in

Germany and from ceramic tiles in Italy.

EU wood flooring exports rising again

After five years of continuous growth between 2009 and

2014, EU wood flooring exports declined slightly in 2015,

by 1.7% to 21.1 million sq.m. However, growth resumed

in the first six months of 2016 and exports rose by 9% to

11.2 million sq.m.

The downward trend in exports to Switzerland and

Norway in 2015 was reversed in the first six months of

2016 (Chart 8).

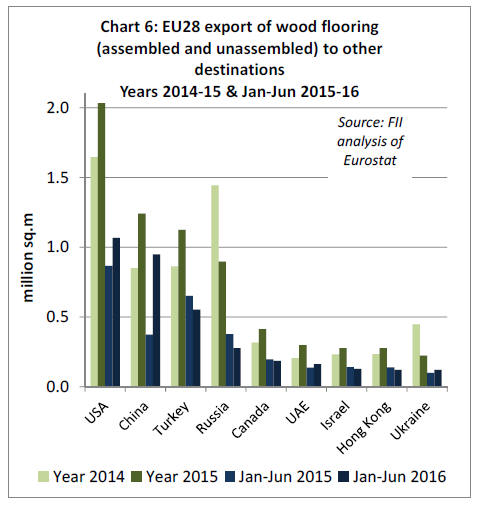

After making significant gains in 2015, EU wood flooring

exports continued to increase rapidly to the USA (+23%)

and China (+154%) in the first six months of 2016.

However, some of the gains made by EU wood flooring

products in the Turkish and Canadian markets in 2015

were lost during the first half of 2016. Exports also

declined to Russia during the same period. (Chart 9).

In summarising their latest market statement, published in

June 2016, FEP were reasonably positive about future

prospects for Europe¡¯s wood flooring sector. They noted

that ¡°after several years of hardship for the European

Parquet Producers and the overall negative developments

in both consumption and production, the sky has cleared

somewhat.

EU economic indicators point towards a continuation of a

slightly positive trend and the generally encouraging

reports received from a majority of FEP member countries

fuel the hope for better times ahead¡±.

These observations clearly apply to the domestic industry

as current trade trends suggest that opportunities both for

imports of finished flooring, and for tropical materials to

supply European manufacturers may be narrowing.

However, FEP also make some observations which

suggest some potential for imported materials. FEP

observed that ¡°from previous detailed marketing surveys

conducted by FEP, we know that parquet has a very high

desirability coefficient. It is sustainable, made from a

renewable raw material and should be valued as a longterm

investment¡±. Furthermore, FEP expressed concern

about ¡°the raw material supply situation (especially for

oak)¡±.

For tropical suppliers, the combination of restricted local

availability of oak, and the strong focus on demonstrating

sustainability through commitment to FSC labelling and

FLEGT licensing, offers potential to open up new

opportunities in this market ¨C although this would require

significant commitment to market development in a very

crowded and competitive sector.

|