Japan

Wood Products Prices

Dollar Exchange Rates of 26th

September 2016

Japan Yen 100.37

Reports From Japan

Consumer confidence picks up

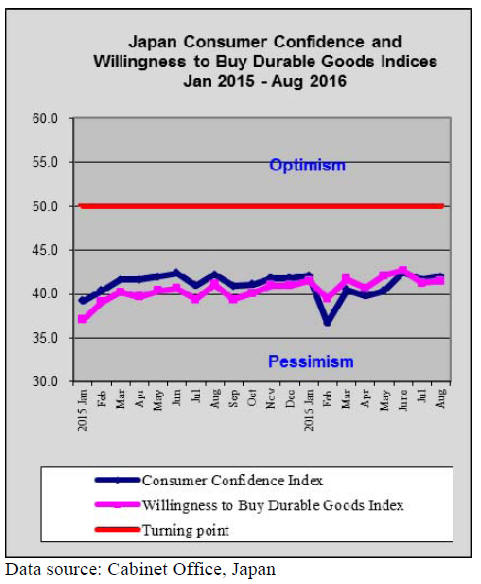

The August Cabinet Office survey of consumer confidence

showed that sentiment strengthened more than expected in

August. The overall sentiment index rose, as did the

indices for income growth, overall livelihood, willingness

to buy durable goods and the employment. All eyes are

now on the upcoming BoJ quarterly tankan survey to be

release in early October.

A poll of economists suggests overall business sentiment

could show an improvement driven by the large

manufacturers which have recovered from the drop in

production following earthquakes in southern Japan and

the growing consensus that Brexit issues are manageable,

but the strengthening yen will weigh heavily on sentiment.

Holding down the yen becomes increasingly

difficult

for the BoJ

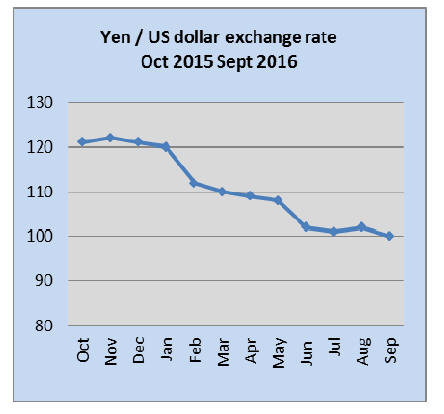

The BoJ has run out of easy options to keep the yen at

optimal levels for the country’s exporters and analysts

now say only an interest rate rise in the US will stem the

current steady strengthening of the yen.

At the end of September the yen was at just over 100 to

the dollar and the late surge in the yen strength came after

the BoJ said it intended to adopt a policy that keeps

interest rates at current levels for a prolonged period.

The Japanese yen has firmed more than 15% percent

against the US dollar this year and at 100 per dollar

exporters are facing serious problems.

For the first time in 9 years pace of decline in

land

prices slow

In the first half of this year loans for real estate purchases

sky-rocketed to more than Yen 3 trillion which is higher

than the peak recorded during Japan’s housing bubble two

decades ago. The surge in loans for homes and

commercial building is the result of the negative interest

rate adopted by the Bank of Japan in February this year.

It is apparent that the robust building sector is being driven

by high inflows of money as’ bricks and mortar’ are seen

as a safe bet for investment since commercial bank saving

rates have fallen. By way of example, prices for

development land in Tokyo’s up market areas have

doubled in three years.

This year, and for the first time in 9 years of continual

decline, average commercial land prices across Japan

leveled off according to the land price survey from the

Ministry of Land, Infrastructure, Transport and Tourism.

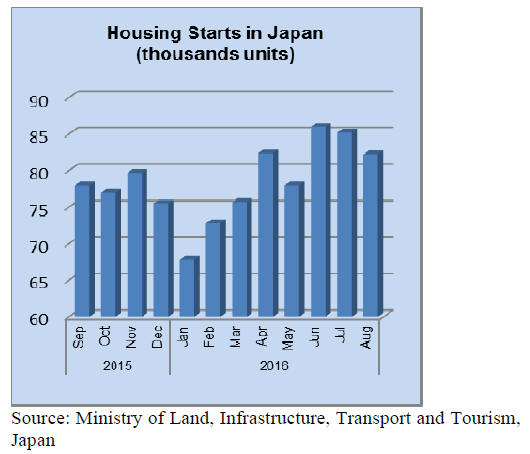

August housing starts, while continuing to expand above

month on month levels in 2015, the pace of increase

appears to be slowing. After the strong performance of

July starts expectations were for robust growth to continue

with analysts expecting at least a 7% year on year

expansion in August. However, the figures show that there

was only a 2.5% increase compared to August 2015.

Data from the Ministry of Land, Infrastructure,

Transport

and Tourism says construction companies reported an

almost 14% rise in orders in August which comes after the

steep decline in July.

Import round up

Doors

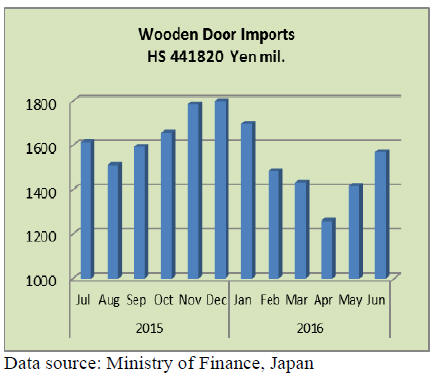

Japan’s first half 2016 wooden door imports were down

2% from the same period in 2015. June imports of wooden

doors were flat year on year but up 10% on levels reported

for May.

In June, the top three suppliers were China (62%),

Philippines (17%) and Indonesia (9%) making up over

80% of all wooden door imports.

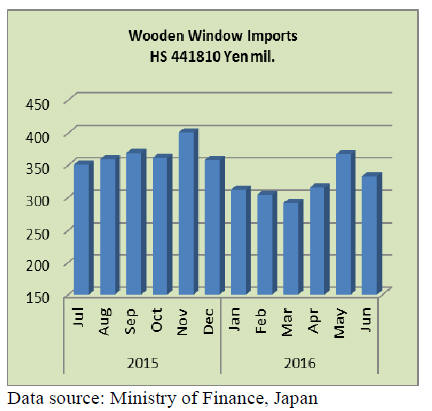

Windows

First half 2016 imports of wooden widows into Japan were

down 8% year on year. June imports were down by the

same amount compared to levels in June last year and

compared to May, June imports were down 9%.

In contrast to the other products reported the spread

between supply countries is closest with wooden windows.

The top suppliers in June were China (40%), the

Philippines (31%) and the US (23%). These three

suppliers account for the bulk of wooden window imports.

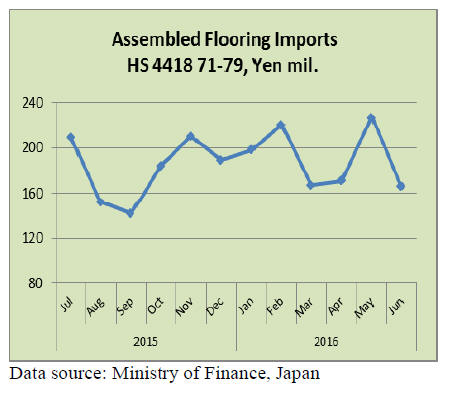

Assembled flooring

The figure below shows combined imports of HS 441871-

79. In June this year there were no imports of HS4418-71

products. First half imports of assembled flooring were

down 5% compared to the same period in 2015 and there

was a steep decline in June imports compared to May

(27%).

For HS 4418-72 the top suppliers were China, Thailand

and Indonesia while for HS4418-79 the top three were

Indonesia, Thailand and China.

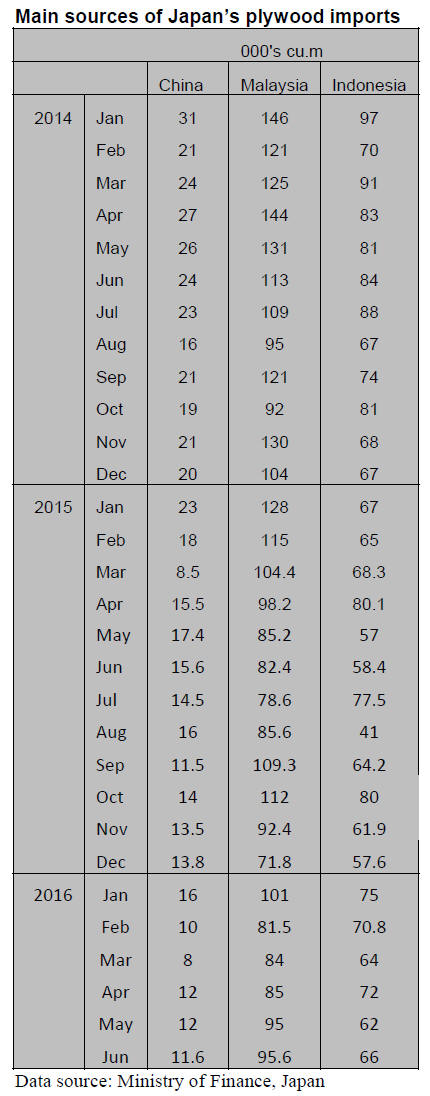

Plywood

Japan’s first half 2016 plywood imports were down 6%

year on year but June imports were some 8% higher than

in June 2015. Compared to a month earlier, the value of

June imports were virtually unchanged.

The main suppliers of plywood to Japan are Malaysia,

Indnonesia and China. Malaysia’s first half shipments to

Japan were down 11.5% year on year while shipments

from Indionesia in the first half of this year jumped 3.5%.

First half imports from China fell sharply (-29%).

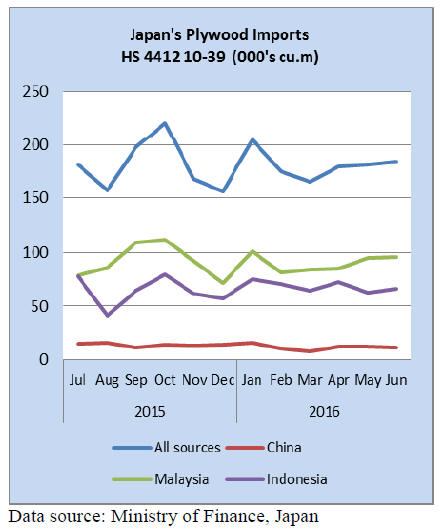

The figure below shows the combined imports of HS

4412

10-39. Very little plywood classified as HS 4412-10 is

imported into Japan, the bulk of imports comprise

HS4412-31 (68%) of total plywood imports with most

coming from Malaysia and Indonesia.

The second significant category of plywood imports is HS

4412-32 which contributes another 30% to total imports.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (tropical) log and lumber imports down in

the first half of the year

Both logs and lumber imports from South Sea countries

decreased for the first half of the year. Particularly log

import dropped by 19.4% compared to the same period of

last year. The reasons are tight control of illegal harvest by

the Malaysian government, higher export log prices in

limited supply and slump of Japanese hardwood plywood

mills.

Total log volume was 92,600 cbms, 19.4% less than the

same period of last year. Large drop of Malaysian log

export, which is about 80% of total, was the reason. In the

past, log export volume from Sarawak, Malaysia increased

after April with end of rainy season but the weather this

year was unstable then harvest volume allocation was

another reason of reduced supply.

The Japanese log importers were unable to purchase

sufficient volume to fill up ships after aggressive purchase

by India started.

South Sea lumber import for the first half was 250,300

cbms in which lumber was 113,000 cbms and free board

was 136,000 cbms. Indonesian mercusii pine harvest is

limited from the beginning of the year and some mills,

which failed to procure logs, stopped production so the

supply was low in January and February. Since then the

supply has been continuing in low level.

Log and lumber export for the first half of the

year

According to the trade statistics the Ministry of Finance

made up, softwood log exported from Kyushu ports for the

first half of this year is 254,848 cbms, 6% more than the

same period of last year but the value is 9.1% down due to

lower export value.

Log exporters have been complaining about poor return as

a result of lower export value by strong yen particularly

for China market.

Total log export from all Japan is 313,632 cbms, 2.2% less

than 2015 and the value is 15.4% less. Compared to all

Japan, Kyushu export business is better. There are eight

log exporting ports in Kyushu.

Export log prices in Kyushu are now 8,000 yen per cbm

delivered loading port, more than 1,000 yen down from

last year’s prices.

Despite lower export log prices, there have been enough

volume for export because log supply for biomass power

generation facilities was excessive as generation facilities

use a certain amount of imported fue.

Lumber export was 37,105 cbms, 25.5% more with the

value of 1,521 million yen, 2% more. In this, 10,876 cbms

were exported from Kyushu, 62.9% more with the value of

328 million yen, 22.7% more so lumber is becoming major

export item instead of logs.

Plywood

Market of domestic softwood plywood continues very

active movement. Orders from major house builders and

precutting plants are booming and plywood mills keep

running in full capacity.

Since the shipments are so busy that plywood mills have

no surplus to build up inventory. They ship out as soon as

they produces. Thick panels and special size panels are

particularly short in supply so that mills keep changing

production lines from one to the other.

In July, production of softwood plywood was 246,700

cbms while the shipment keeps high level of 250,000

cbms for two months. Therefore the inventories were

101,800 cbms, 3,000 cbms less than June.

Average monthly production during January and July this

year was 239,000 cbms, which is 27,400 cbms more than

the same period of last year.

Demand continues active in September. Medium and

small precutting plants have ample orders now from local

contractors and outsourcing orders from large precutting

plants so the demand for plywood will be busy through the

end of the year. Orders for tongue and groove panel will

take more than a month before delivery.

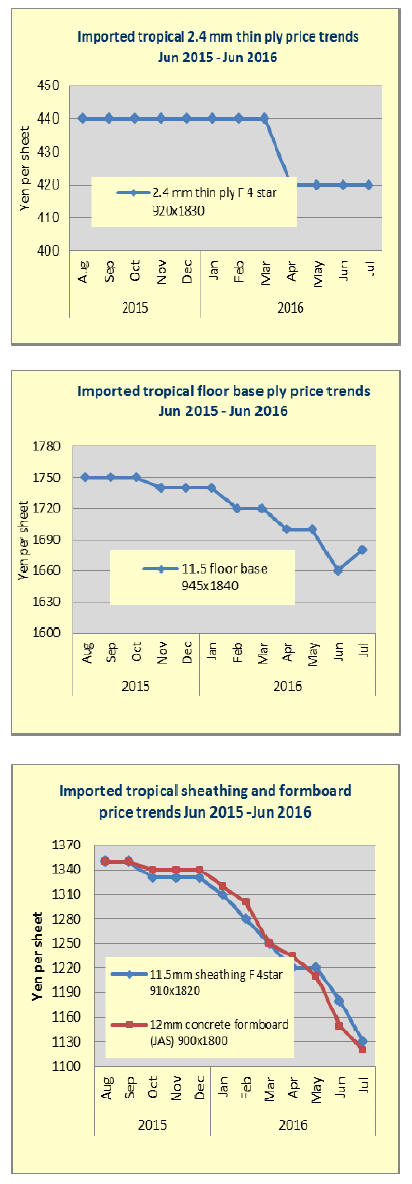

Movement of imported concrete forming panel was a

bit

active but the market is on weak side as prospect of further

appreciation of the yen is anticipated so that it is hard to

wipe out prospect of further reduction of the market

prices. The importers and wholesalers carry very limited

inventory but the shipment remains depressed.

Daiken started up Indonesian door plant

Daiken Corporation (Osaka) announced that its interior

door manufacturing plant in Surabaya, Indonesia started.

Daiken Darma Indonesia (DDI), a joint venture company,

will operate the plant.

Indonesia has the fourth largest population in the

world

and its economic growth is energetic so the housing

demand is expected to grow fast. Particularly, high and

medium income people are interested in high quality and

refined design products.

To expand the sales of housing materials, Daiken has been

researching the market since 2012 and established a joint

venture company, SDI which specializes marketing and

installation works of interior materials.

Now with start-up of the door plant, Daiken develops,

manufactures, marketing including installation works.

Daiken plans to start marketing the products to local

Japanese developers and house builders, which are

engaged in business in Indonesia first then approach local

developers. The target of sales is 180,000 sets by 2020.

|