Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September 2016

Japan Yen 102.71

Reports From Japan

Wage increases eaten away by rising prices

Japan avoided a second recession when the latest GDP

data was revised up to an annualised 1% growth over the

previous quarter. But the combined effect of slowing

exports, particularly to China, weak consumer spending

and subdued business investment is holding back growth.

In a recent IMF report there was a suggestion that the

government should adopt a hardline on wage

improvements. Major companies in Japan have reported

healthy profits and the IMF suggests they need to be

nudged into offering more pay as past wage increase have

been eaten away by rising prices.

The government is maintaining its undertaking to push up

the consumption tax from 8% to 10% next year and this is

likely to cause a surge in last minute purchases in the latter

part of the first quarter in 2017.

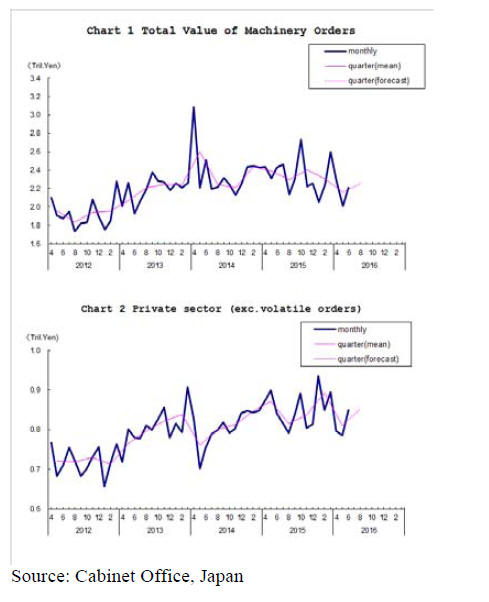

Machinery orders from domestic companies rise but

overseas orders drop

Cabinet Office data has shown that orders for machinery

by Japanese companies unexpectedly rose in July marking

the second monthly increase. This came as a relief for the

government. However, weak consumer demand and the

stronger yen continue to be holding down growth

prospects.

Machinery manufacturers reported that July orders from

Japanese companies rose 0.3% mainly from the steel and

chemical sectors but overall machinery manufacturers still

face major challenges as orders from overseas, which are

not included in the Cabinet Office assessment fell almost

12% in July from a month earlier.

For more see:

http://www.esri.cao.go.jp/en/stat/juchu/juchu-e.html

Business environment for Japanese SMEs

The Organization for Small and Medium Enterprises and

Regional Innovation, Japan (SMRJ) conducts regular

surveys of business conditions for SMEs, much the same

way as the Cabinet Office reports on the major companies.

In its April-June 2016 assessment the SMRJ says the

business condition index for all SME industries was minus

19.5 (down 1.4 points from the previous quarter),

signaling a worsening of conditions. Business conditions

in the manufacturing sector worsened in the second

quarter with industries in 14 sectors reporting deteriorating

conditions. In the SMRJ ‘Timber and Wood Products’

category of SMEs business conditions were reported as

weaker than in the previous quarter.

For more see:

http://www.smrj.go.jp/english/business_conditions/098747.html

and

http://www.smrj.go.jp/english/dbps_data/_material_/english/pdf/

survey/business_conditions_144.pdf

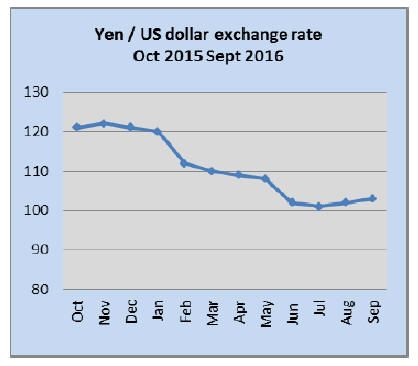

Exporters hope for a weaker yen

Tokyo investors cheered the downward trend in the value

of the yen against the US dollar. This reversal comes as

the Bank of Japan (BoJ) mulls further action to get the

currency back to around 105 to the dollar, said to be the

critical rate for exporters.

The likelihood of a US interest rate move some-time soon

has helped shift the emphasis to the dollar away from the

‘safe haven’ yen but exporters would like to see the yen

lower.

However, the BoJ threats of further efforts to stem the

strengthening of the yen have had little impact on currency

markets as the Bank has few options left other than even

lower negative interest rates.

Only surprisingly poor data on employment, retail

sales,

industrial output or consumer spending would trigger a

sharper depreciation of the yen.

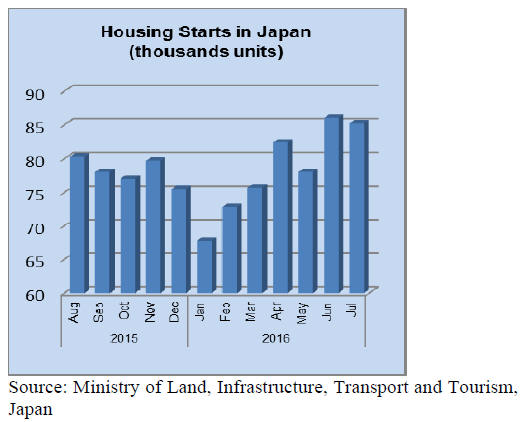

Boosting stock of low rent homes – discussion on

using vacant houses

The Japanese government is trying to find ways to boost

the availability of low-cost housing to provide for the

increasing number of elderly and the growing army of

young people who are trying to survive on low salaries,

especially those with one or more part-time jobs.

The stock of low rent public housing cannot meet current

needs so the government is considering if there is a way to

utilise the huge number of vacant houses in Japan. This,

say proponents of the idea, would help satisfy housing

needs and at the same time address the potentially risks to

public safety from abandoned houses.

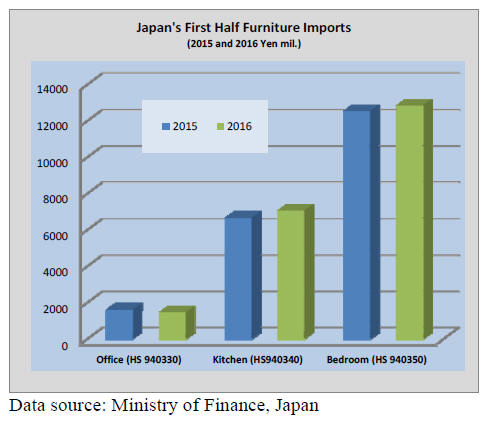

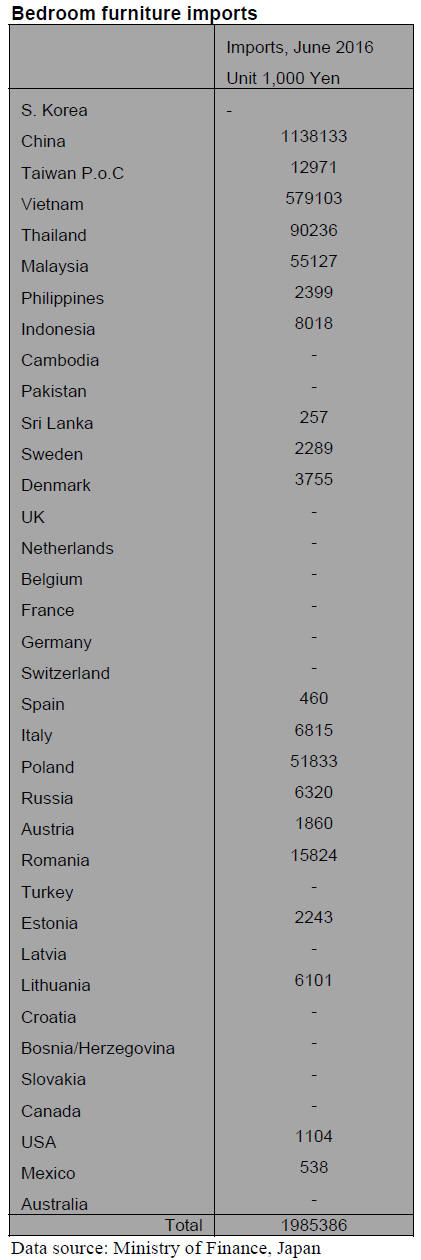

Japan’s first half 2016 furniture imports

Japan’s first half 2016 wooden office furniture (HS

940330) imports were down around 10% from the first

half in 2015 refelecting the continued weak business

climate in the country. On the other hand both kitchen and

bedroom furniture imports were up on 2015.

Wooden kitchen furniture (HS940340) imports in the first

half of 2016 rose 6% while imports of wooden bedroom

furniture (HS940350) in the first half of 2016 were up

marginally (2%) on the same period in 2015.

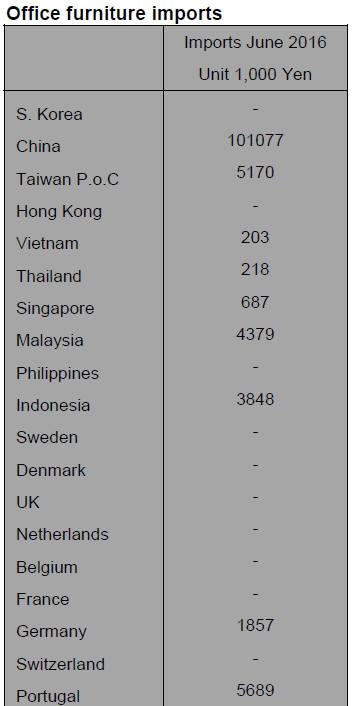

Office furniture imports (HS 940330)

Year on year, imports of office furniture in June 2016

were down a massive 28% compared to the previous

month. From the highs in January this year Japan’s

imports of wooden office furniture have consistently

fallen. Business confidence and a lack of private sector

investment by Japanese enterprises of all sizes has

dampened demand for furniture.

In June the top suppliers of wooden office furniture to

Japan namely, China, Portugal and Taiwan P.o.C saw

sales drop. Japan’s imports of wooden office furniture

from China fell 26% in June compared to May, imports

from Portugal were down 87% in June and imports from

Taiwan P.o.C fell 63% month on month.

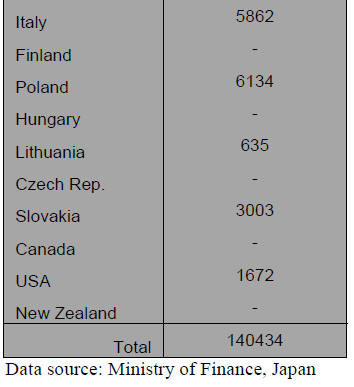

Kitchen furniture imports (HS 940340)

In contrast to the sharp fall in Japan’s imports of office

furniture, imports of wooden kitchen furniture in June

were up 4% year on year and up 8% month on month.

Shippers in Vietnam continue to dominate Japan’s

imports

of wooden kitchen furniture alone accounting for 36% of

all Japan’s wooden kitchen furniture imports. The

Philippines was the second largest supplier in June

accounting for a further 29%. When shipments from

China are included the top three suppliers accounted for

more than three quarters of Japan’s wooden kitchen

furniture imports in June.

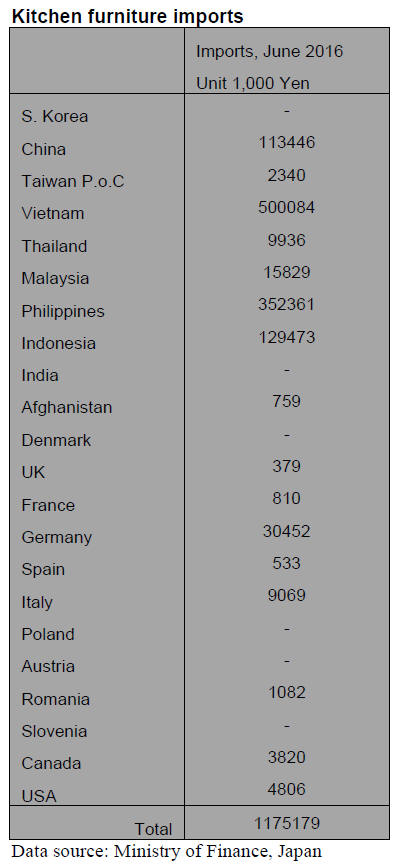

Bedroom furniture imports (HS 940350)

Once again there was almost no change in the value of

Japan’s June wooden bedroom furniture imports. For the

past three months the value of imports has been stuck in a

narrow range.

Year on year, June 2016 imports of wooden bedroom

furniture were up 5% but compared to May June imports

were down 1.5%. China was the main source of Japan’s

imports of wooden bedroom furniture accounting for 57%

of all imports of this category of furniture. The other main

supplier in June was Vietnam (29% share of imports) then

followed Thailand (4.5%) and Malaysia (2.7%),.

Suppliers in Europe accounted for a combined 5% of

Japan’s wooden bedroom furniture imports with Poland

being the main supplier accounting for just over half of all

shipments from Europe.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

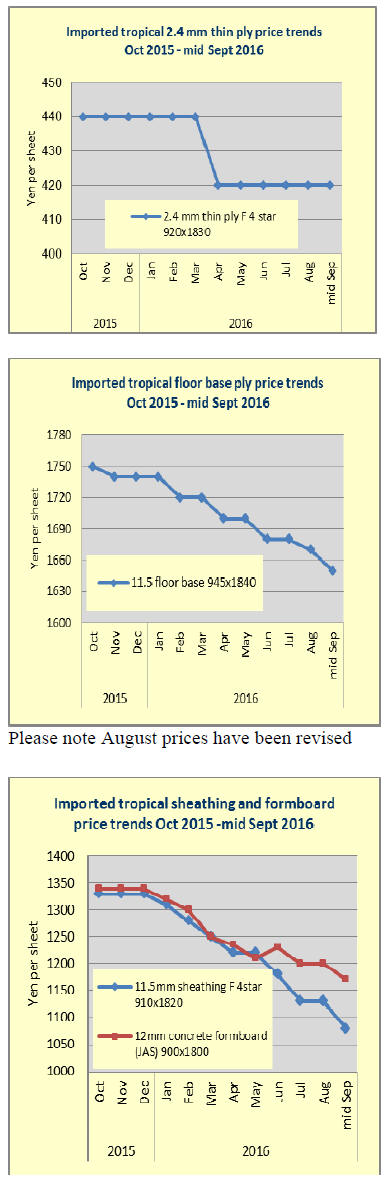

Sarawak Timber Association announced plywood

production curtailment

Eight major plywood manufacturers in Sarawak like

Shinyang, Ta Ann, Samurin and WTK announced to

reduce the production by 10-15% starting August until

Japan market recovers with owners’ signature.

This is unusual announcement by whole plywood industry,

not by individual manufacturer. Imported plywood market

in Japan has been depressed since early this year so that

ordered volume to the manufacturers have been dropping

for quite some time, which puts plywood mills in tough

spot.

The largest manufacturer, Shing Yang stopped sales after

it reduced the volume by 30% in last April and May but

the situation has not improved at all even by this move.

Looking at trend of imported plywood, the volume in 2015

was 17.3% less than 2014. Imported volume for the first

half of 2016 was 6.5% less than the same period of 2015.

Monthly average volume in 2016 is 232,200 cbms as

compared to 299,000 cbms in 2014, 20% down. Looking

at Malaysian volume, monthly average in 2014 was

121,800 cbms while monthly volume for the first half of

2106 is 93,400 cbms, 23% down.

Cost of supply side has been climbing. 6% commodity and

service tax is introduced in Sarawak since last April,

minimum wage is increased by 15% since last month, log

prices are staying up high. Log production in Sarawak for

the first six months of this year is 3,125,700 cbms, only

2% less than the same period of last year but aggressive

log purchase by India keeps log prices high even for

domestic use.

Export plywood prices on 3x6 JAS concrete forming panel

were about $ 450-460 per cbm C&F up until October last

year then the prices dropped down to $420 by weak

Ringgit. The prices are back up to previous level.

Plywood manufacturers are facing dropping order volume

with climbing manufacturing cost but Japan market has

very little hope for recovery. The group announcement

does not specify any period so they seem to keep

production curtailment until the prices recover to

satisfying level.

Log export for the first half of the year

According to the trade statistics the Ministry of Finance

made up, softwood log exported from Kyushu ports for the

first half of this year is 254,848 cbms, 6% more than the

same period of last year but the value is 9.1% down due to

lower export value.

Log exporters have been complaining about poor return as

a result of lower export value by strong yen particularly

for China market.

Total log export from all Japan is 313,632 cbms, 2.2% less

than 2015 and the value is 15.4% less. Compared to all

Japan, Kyushu export business is better. There are eight

log exporting ports in Kyushu.

Export log prices in Kyushu are now 8,000 yen per cbm

delivered loading port, more than 1,000 yen down from

last year’s prices. Despite lower export log prices, there

have been enough volume for export because log supply

for biomass power generation facilities was excessive as

generation facilities use a certain amount of imported fuel.

South Sea (tropical) logs

Export log prices stay up high in Malaysia. Sarawak

suffers spotty heavy rain. Log purchase by India got active

after Sarawak government decided to reduce harvest

volume. India will be in monsoon season for about two

months since late August so they sent many ships all at

once before monsoon season starts. It is difficult to fill up

ships at Sarawak only so they go to Sabah, PNG and

Solomon Islands.

Japanese buyers do the same by limited availability in

Sarawak. There is no panic feeling since the market in

Japan is in slump. Export log prices in Sarawak are

US$275 per cbm FOB on meranti regular, US$255 on

meranti small and US$240 on meranti super small.

In PNG and Solomon Islands, log purchase by China is

getting slow by slowdown of Chinese economy but India

buys aggressively so the log prices continue firm.

Monthly log import to Japan has been low with 15,000-

22,000 cbms after last peak of 37,000 cbms in last

October.

Plywood

Demand for domestic softwood plywood continues very

active. June production was 251,300 cbms while the

shipment was 255,400 cbms so the inventories were very

low at 104,800 cbms.

Total production for the first half of the year was

1,426,700 cbms, 11.3% more than the same period of last

year. If this pace continues for the second half, total year

production would be about 2,853,500 cbms, the record

high volume.

Meantime, the shipment for the first half was 1,445,500

cbms and total year shipment would be about 2,891,100

cbms, also the record high. Domestic softwood plywood

manufacturers continue a full production but during

August, some mills shut-down for maintenance for about a

week.

Meantime, precutting plants keep running to catch up

orders even during the Bon holidays in August so the

supply shortage was feared but plywood mills made

cautious deliveries to each precutting plant so there was no

serious supply problem. Demand for plywood continues

strong since precutting plants secured enough orders for

September.

Total import for the first half of the year was 1,393,400

cbms. With this pace, annual import would be about

2,786,900 cbms, which is lower than last year’s import of

2,885,700 cbms. The market in Japan lacks vigorousness

at all particularly after the yen got strong in early August.

Despite the announcement of Sarawak Timber

Association’s to curtail plywood production uniformly,

there is no reaction in the market as August is slow month

and actual influence by such curtailment will not show up

until September and October so there is no Particular

reaction to this announcement.

Import of European lumber for the first half

Total imported volume of European lumber from January

to June this year was 1,419,329 cbms, 24% more than the

same period of last year.

By active demand for laminated lumber in domestic

market, lamina supply continues tight while KD stud

shortage is solved. In this period, export prices increased

because of lively demand in European market and the

export prices of lamina and KD stud advanced by Euro 20

per cbm compared to last January prices but the increase is

offset by exchange rate fluctuation.

There was strong resistance for lamina price hike by the

Japanese laminated lumber manufacturers so the volume

did not increase.

Therefore, lamina supply was chronically tight by limited

supply and increased production of laminated lumber in

Japan. Lamina supply would continue tight through the

second half of the year as long as demand for structural

laminated lumber stays active.

Stud supply was unstable because of delayed shipments

by the major supplier but the supply seems to be

supplemented by other smaller suppliers so the market did

not react so much despite tight supply. The market prices

softened as the imported cost was reduced by weak Euro.

In Central Europe, quality log supply is tight after beetle

damage started so the supply for Japan does not seem to

increase much in the second half but the present export

prices for Japan are attractive for the suppliers so the

supply would increase if more suppliers join.

Looking at by source, the volume from Sweden and

Finland, which are main supply source of lamina,

increased sizably while Rumania dropped but Austria,

common lumber supply source increased significantly.

Exclusive import of Indonesian lumber core

Showa Lumber Co., Ltd. (Hokkaido) announced that it has

acquired an exclusive marketing right of lumber core

made by Indonesian manufacturing company, Sengon Inda

Mas, SIM. It has been a year after SIM acquired JAS

certificate on the product and it has passes the inspection

by the Japan Plywood Inspection Corporation.

Showa Lumber closed its own plywood plant at Shibetsu,

Hokkaido then it concluded plywood manufacturing

consignment contract with some Chinese manufacturer in

Shanghai, China and started importing basswood plywood,

basswood lumber core and lauan lumber core plywood.

Then by heavy smog problem in Shanghai, use of coal

boiler was banned so that the plant moved to province of

Jiansu in 2014 to continue plywood production.

However, facing labor shortage and import duty on

imported materials in China, Showa Lumber decided to

move to Indonesia, where falcate and plywood are easy to

procure.

The Chinese partner, SIM has bought out several falcate

lumber manufacturers in Pekalongan, Indonesia and built

new lumber and plywood plant. They have acquired JAS

certificate in 2015 and has been shipping test products.

Core of lumber core is planted species of falcate. Lumber

core is used for shelves, dividing panel and various wood

working and furniture. Thickness is 12-30 mm with 3x6

and 4x8. SIM now produces 100% falcate lumber core

plywood with not only core but face and back plywood.

Showa Lumber imports about 1,750 cbms of lumber core

(35 containers) a month to various ports in Japan like

Tokyo, Osaka, Nagoya, Akita and Tomakomai. It also

continues importing basswood plywood (3-18 mm 3x6)

supplied by SIM’s Jiangsu plant.

President Takahashi of Showa Lumber commented that

falcate is recyclable planted species in managed forest so

the supply is consistent to satisfy the customers. It also

continues importing Russian temperate hardwood lumber.

|