|

Report from

North America

US wood product imports update

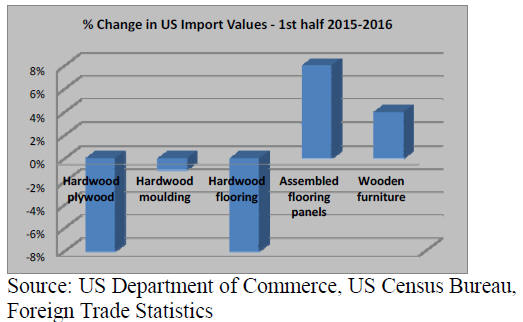

US imports of most tropical sawnwood and processed

wood products in the first half of 2016 were lower than in

the same period last year.

This is despite higher housing starts and increased

consumer spending compared to 2015. The exceptions to

the downward import trend were imports of wooden

furniture and assembled flooring panels (engineered wood

floors).

Decline in ipe and sapelli sawnwood imports

The import volume of sawn temperate and tropical

hardwood fell by one third in June to 86,178 cu.m.

However, the value of imports increased 2% to US$44.8

million because of higher tropical imports.

Imports of temperate species declined in June, while

tropical sawn hardwood imports volumes grew 18% from

May to 23,297 cu.m. The value of tropical imports was

US$23.9 million and accounted for 53% of all US sawn

hardwood imports in June, up from 49% in May.

Despite the overall growth in tropical imports, ipe and

sapelli imports declined in June. Ipe sawnwood imports

were 2,589 cu.m., down 35% from May. Sapelli imports

decreased 13% from the previous month to 2,379 cu.m.

Year-to-date sapelli imports were down over 40% from

June 2015. Imports of jatoba and teak also declined in

June.

Balsa sawnwood imports increased 14% to 5,283 cu.m.

Acajou d¡¯Afrique and keruing imports grew significantly

from May, but year-to-date imports remain below last

year¡¯s levels.

Among the main suppliers of tropical sawnwood to the US

market only Ecuador and Indonesia shipped more year-todate

than in June 2015.

Imports from the Democratic Republic of the

Congo/Kinshasa jumped to 1,178 cu.m. in June, up from a

monthly few hundred cubic metres earlier this year.

More hardwood plywood from China, Indonesia and

Malaysia in June

Hardwood plywood imports grew 4% in June to 279,542

cu.m. but year-to-date imports were lower than in June

2015. The value of plywood imported in June declined 3%

to US$155 million.

The reason for higher volumes yet lower value imports in

June was increased shipments from China. Imports from

China grew 8% from the previous month to 169,806 cu.m.,

while the value of imports decreased 5%.

Plywood imports from China remained below 2015 levels

in June, both in volume and value.

Hardwood plywood imports from Indonesia recovered

after a brief decline in May. June imports from Indonesia

were 24,486 cu.m., up 12% and worth US$15.4 million.

Plywood imports from Malaysia tripled to ,805 cu.m. from

the previous month, while imports from other major

plywood suppliers decreased in June.

Moulding imports from Brazil down

The US imported US$14.5 million worth of hardwood

moulding in June, down 9% from May. Year-to-date

imports were slightly lower (-1%) than in June 2015.

The month-on-month decline was chiefly in moulding

imports from Brazil. Brazil¡¯s shipments fell by 24% to

US$2.9 million. Imports from China and Malaysia were

up in June. Malaysian moulding shipments to the US were

worth US$1.2 million in June, up 12% year-to-date from

the same time last year.

Thailand increases engineered flooring exports to US

Hardwood flooring and assembled flooring panel imports

increased in June to US$4.2 million and US$16.9 million,

respectively. Year-to-date imports of assembled flooring

panels (engineered wood flooring) grew 8% from June

2015, but hardwood floor imports were down compared to

the same time last year.

Indonesia and China were the largest sources of hardwood

flooring imports in June at just over US$1 million each.

Despite a jump in imports from Indonesia in June, year-todate

Indonesian shipments were down 15% from June

2015. Hardwood flooring imports from China increased

24% year-to-date.

In assembled flooring panels, China and Thailand grew

their shipments to the US market compared to the same

time in 2015. China remains the main source of imports at

US$9.9 million in June.

Imports from Thailand are relatively small (US$323,408

in June), but year-to-date imports increased 76% from

June 2015.

Wooden furniture imports unchanged in June

Wooden furniture imports were unchanged in June

US$1.44 billion. Year-to-date imports were up 4% from

June 2015.

Furniture imports from China were unchanged monthover-

month, but imports from Vietnam and declined 3% in

June. Malaysia, Mexico and India increased shipment to

the US in June.Imports from most countries were up in the

first half of 2016, except for Malaysia (-2%) and Indonesia

(-4%).

Imports of bedroom furniture and wood furniture for other

uses increased in June, while office furniture, upholstered

and non-upholstered seating declined. Kitchen furniture

imports were unchanged from the previous month.

GPD growth up in second quarter

US GDP increased at an annual rate of 1.2% in the second

quarter of 2016, according to the first estimate released by

the Bureau of Economic Analysis. In the first quarter,

GDP increased 0.8% based on the final revised estimate.

The increase in GDP growth in the second quarter was

mainly due to higher personal consumption and lower

imports. Non-residential and residential construction

investment declined in the second quarter.The

unemployment rate was unchanged at 4.9% in July,

according to the US Bureau of Labor Statistics.

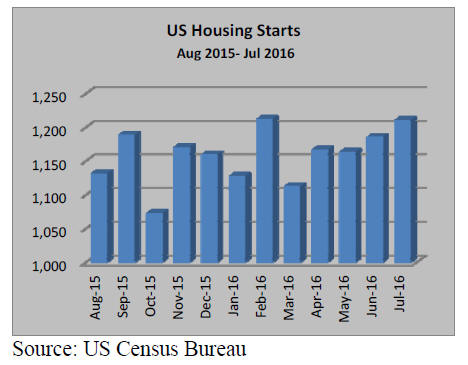

Housing starts continue to climb

Housing starts rose 2.1% in July to a seasonally adjusted

annual rate of 1.21 million units, according to data

released by the US Department of Housing and Urban

Development and the Commerce Department. This is the

highest level of residential construction since February.

Multifamily housing increased 5% in July, while singlefamily

construction was only slightly up (0.5%).

Single-family home builders are cautiously optimistic

about market conditions, according to the National Home

Builder Association. Shortages of building lots, skilled

workers and affordability issues continue to affect the

housing sector.

|