US Dollar Exchange Rates of 25th August 2016

China Yuan 6.6543

Report from China

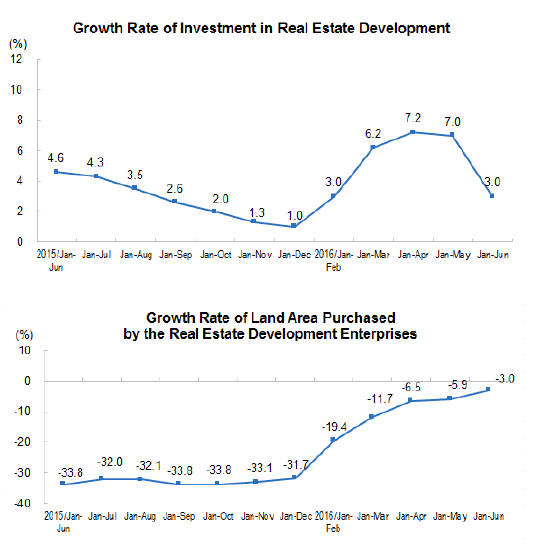

Huge rise in investment in commercial buildings

According to the National Bureau of Statistics in the first

seven months of 2016 investment in real estate

development was up by 5.3% year-on-year representing a

slight decline on the first six month performance.

Investment in residential building grew 4.5% and sales of

commercial buildings grew by almost 40%. However in

the first seven months land purchases by real estate

development companies fell almost 8%.

See:

http://www.stats.gov.cn/english/PressRelease/201608/t20160812

_1387836.html

¡¡

First half 2016 import update

China¡®s log imports totalled 23.91 million cubic metres

valued at US$3.97 billion in the first half of 2016, up 3%

in volume and down 10% in value over the same period of

2015. The average landed price for imported logs was

US$166 per cubic metre, a year on year fall of 13%.

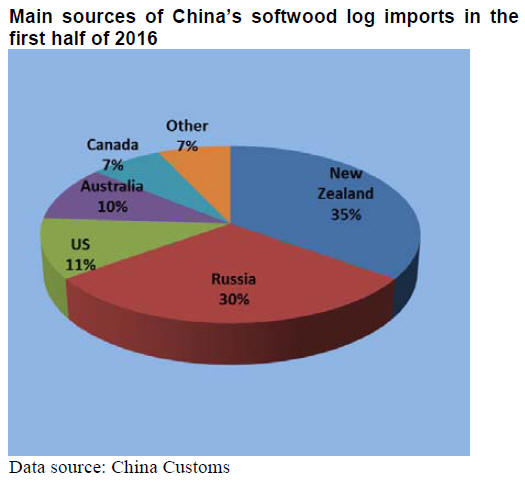

Of the total, softwood log imports amounted to 16.12

million cubic metres, or 67% of all log imports, a year on

year increase of 4%. Softwood log imports were mainly

from the top 10 countries, namely New Zealand (5.61

million cu.m, down 3%), Russia (4.78 million cu.m, up

6%), the US (1.81 million cu.m, up 12%), Australia (1.56

million cu.m, up 37%), Canada (1.19 million cu.m, down

4%), Ukraine (0.52 million cu.m, up 3%), Japan (0.24

million cu.m, up 35%), France (0.08 million cu.m, up

25%), Belarus(0.08 million cu.m, up 25%), DPRK(0.08

million cu.m, up 25%).

Softwood log imports of these above-mentioned countries

make up 99% of all softwood log imports. Softwood log

imports from the top 5 countries account for 97% of all log

imports.

The average price for softwood log imports was about

US$120 per cubic metre in the first half of 2016, a year on

year decline of 7%.

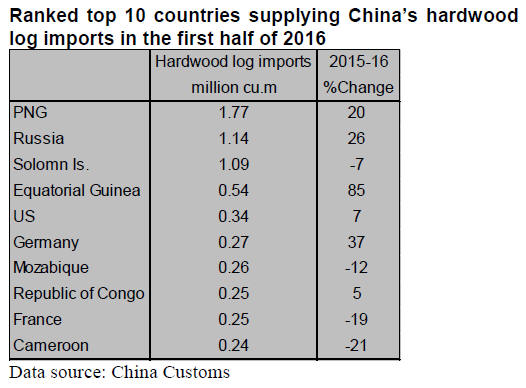

Hardwood log imports totalled 7.79 million cubic metres,

or 30% of all log imports, a year on year increase of 26%

in volume. Hardwood log imports were mainly from PNG

(1.77 million cu.m, up 20%), Russia (1.14 million cu.m,

up 26%), Solomon Isalnds (1.09 million cu.m, down -7%),

Equatorial Guinea (0.54 million cu.m, up 85%), the US

(0.34 million cu.m, up 7%), Germany (0.27 million cu.m,

up 37%), Mozambique (0.26 million cu.m, down -12%),

the Republic of Congo (0.25 million cu.m, up 5%), France

(0.25 million cu.m, down -19%) and Cameroon (0.24

million cu.m, down -21%).

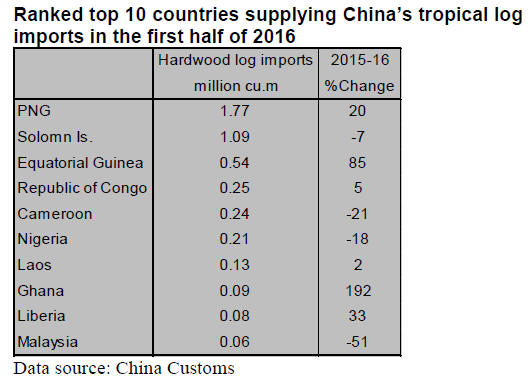

Tropical log imports rose 8% to about 4.77 million cubic

metres, accounting for 20% of all log imports and 61% of

all hardwood log imports.

The average prices for imported softwood logs, hardwood

logs and tropical logs were US$112, US$262 and US$395

per cubic metre respectively, down -7%, -16% and -11%.

However, the prices for softwood log imports from the

Democratic People¡¯s Republic of Korea and tropical log

imports from Liberia rose 5% and 33% respectively.

Sawnwood imports in the first half of 2016

China¡®s sawnwood imports totalled 15.61 million cubic

metres valued at US$3.82 billion in the first half of 2016,

down 2% and 17% respectively over the same period of

2015. The average landed price for imported sawnwood

was US$245 per cubic metre, a year on year drop of 17%.

Of the total, sawn softwood imports amounted to 9.02

million cubic metres, or 58 % of all sawnwood imports, a

year on year increase of 24%. Sawn softwood imports

were mainly from the top 10 countries, namely Russia

(5.40 million cu.m, up 51%), Canada (2.09 million cu.m,

down 14%), Finland (0.49 million cu.m, up 80%), Chile

(0.34 million cu.m, down 1%), Sweden (0.32 million

cu.m, up 33%), New Zealand (0.17 million cu.m, up 14%),

Germany (0.06 million cu.m, down 50%), the US (0.03

million cu.m, down 6%), Australia (0.02 million cu.m, up

66%) and Latvia (0.01 million cu.m, down 45%). Sawn

softwood imports of these above-mentioned countries

make up 99% of all sawn softwood imports, just sawn

softwood imports from Russia and Canada make up 83%.

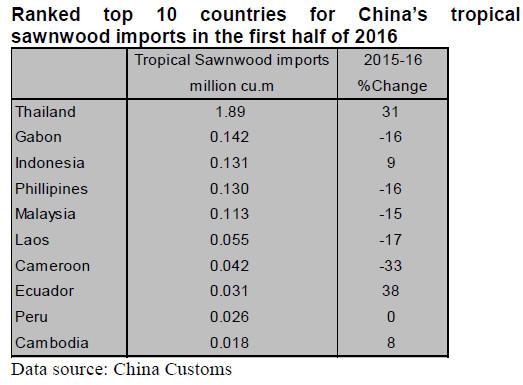

Sawn hardwood imports totaled 6.05 million cubic metres,

or 42% of all sawnwood imports, a year on year increase

of 11%. Sawn hardwood imports were mainly from the top

10 countries, namely Thailand (1.89 million cu.m, up

31%), the US (1.29 million cu.m, down 7%), Russia (1.17

million cu.m, up 17%), Canada (0.72 million cu.m, up

24%), Vietnam (0.16 million cu.m, up 42%), Gabon (0.14

million cu.m, down 16%), Indonesia (0.131 million cu.m,

up 9%), Philippine (0.130 million cu.m, down 16%),

Malaysia (0.113 million cu.m, down 15%) and Brazil

(0.25 million cu.m, up 90%).

Sawn hardwood imports of these above-mentioned

countries make up 89% of all sawn hardwood imports, just

sawn hardwood imports from Thailand, the US, Russia

and Canada make up 77%.

Tropical sawnwood imports rose 8 % to about 4.77 million

cubic metres, accounting for 17% of all sawnwood imports

and 40% of all sawn hardwood imports.

The average prices for imported sawn softwood, sawn

hardwood and tropical sawnwood were US$171, US$346

and US$371 per cubic metre, down -18%, -13% and -17%

respectively. However, the prices for sawn hardwood

imports from Indonesia rose 6%.

Myanmar no longer a main timber supplier

In the first half of 2016, China¡¯s log imports from

Myanmar were 9,700 cubic metre valued at US$13.96

million, plummeting 97% in volume and 87% in value.

Myanmar ranked 42nd among the various sources for

China¡¯s hardwood log imports.

China¡¯s sawnwood imports from Myanmar were 6600

cubic metre valued at US$3.09 million, plummeting 85%

in volume and 89% in value. Myanmar ranked 37th among

suppliers of China¡¯s sawn hardwood imports.

|