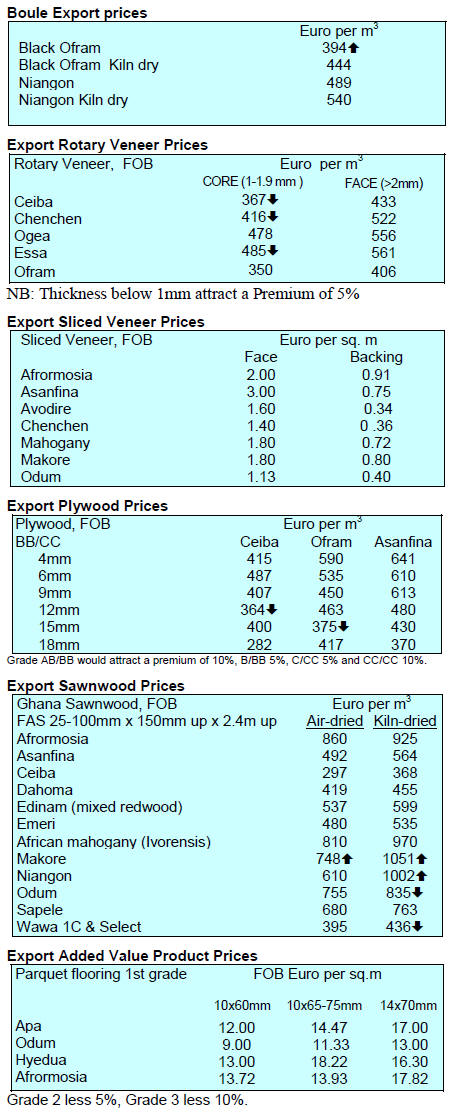

2. GHANA

Encouraging May export figures

The export of Ghana*s wood products in May 2016

yielded euro 18,755,766 from a volume of 33,348 cu.m

which represents an increases of 37% in value and 23% in

volume compared to exports in May 2015.

In terms of species the top were teak, rosewood, wawa,

papao/apa and ceiba and exports went to 39 different

markets with the top 5 being India, China, Vietnam,

United States of America and Germany.

Wood product exports to African countries included

plywood (overland transport), sliced veneer, air and kiln

dry sawnwood, rotary veneer and mouldings. Major

destinations included Egypt, South Africa, Morocco; with

the ECOWAS sub-region market taking the largest share

of 16,490 cu.m valued at euro 4.92million.

Despite the better export performance in May, Ghana*s

overland wood exports during the first 5 months of the

year suffered some setback as sliced veneer, sawnwood

and plywood exports were down year on year.

Plywood exports were particularly badly down.

Nigeria,

which had been the leading importer of Ghana*s plywood,

slipped to the second ranked importer after Niger, with

Burkina Faso and Togo ranked 3rd and 4th.

The drop in Nigeria*s plywood import has been attributed

to the foreign exchange controls introduced by Nigeria*s

Central Bank.

In the first 5 months the major market destination for

Ghana*s wood products were; Asia/Far East 113,671cu.m

(71%); Europe 18,972 cu.m (12%); Africa 19,786 cu.m

(12%); America 5,510 cu.m (3%) and Middle East

countries 2,953 cu.m (2%).

For more see:

http://www.fcghana.org/userfiles/files/TIDD%20Export%20Rep

ort/EXPORT%20OF%20TIMBER%20AND%20WOOD%20PR

ODUCTS%20REPORT%20FOR%20MAY%202016.pdf

Business executives discuss impact of Brexit

Business executives have met to discuss the impact of

Brexit on Ghana*s international trade.

Dubbed &Ghana Business Day*, the meeting brought

together high-level business executives, industrialists,

policy makers, the diplomatic community and

manufacturers.

Key speakers included the Minister for Trade and

Industry, Mr. Ekwow Spio-Garbrah, Bristish High

Commissioner to Ghana 每 Jon Benjamin and President of

the Association of Ghana Industries James Asare-Adjei.

The Bank of Ghana has warned that Britain*s exit from the

European Union could negatively impact Ghana*s external

trade., foreign investment and exchange rates. The Bank

also pointed out that Ghana*s strong trade relations with

both the EU and the UK could be affected as Ghana may

lose some budgetary support from the EU.

Recent statistics show that Ghana is currently the UK*s

fifth largest trade partner in Sub-Saharan Africa. For

Ghanaian exporters, including timber companies, Brexit

has created uncertainty which coupled with liquidity

problems, high interest rates and the unstable power

situation is undermining confidence in the timber sector.

Forestry Master Plan and plantation strategy released

The Ghana Forestry Commission website has made

available the Ghana Forestry Development Master Plan

(2016-2036).

See:

http://www.fcghana.org/userfiles/files/MLNR/FDMP_June%201

5%20Final_draft.pdf

The preamble says ※This plan has taken into full account

the need to improve the state of the environment, whilst

addressing the complexities of land and tree tenure and the

importance of appropriate and efficient land use.

Within the framework of the 40-year national development

blue print a 20-year Ghana Forestry Development Master

Plan has been formulated.

This master plan is the product of consultative processes

involving engagements with experts and technocrats in the

forestry sector, traditional authorities and landowners,

development partners, forest fringe communities, policy

makers and legislators.

The vision, goal, and objectives of the Forestry

Development Master Plan (FDMP) reflect the national

development agenda, the National Climate Change Action

Plan, Sustainable Development Goals of the United

Nations and the on-going sector activities.

The plan seeks to contribute to reducing Green House Gas

(GHG) emissions from deforestation and forest

degradation, climate and temperature regulation,

sustainable supply of timber and wood fuels, reducing

poverty and helping to conserve biodiversity.

The full implementation of the forestry development

master plan will witness a structural transformation of the

forestry sector including the industries and institutions.

The plan also provides for financial intermediation and

incentive mechanisms for natural forest management,

timber plantation development, plant and machinery

development for tertiary processing activities and micro

and small wood processing enterprises.§ Plantation

development is an integral part of the long term plan and a

specific strategy has been developed for the period 2016-

40.

The strategy is available on the GFC website and outlines

plans to restore degraded landscapes through the

development of commercial forest plantations, smallholder

plantations, enrichment planting of degraded forests and to

provide support for the incorporation of trees within

farming systems.

The document says ※During the Strategy period (2016 -

2040), it is expected that an estimated average annual rate

of 25,000 ha of forest plantations (i.e. 10,000 ha by public

sector, public-private partnerships, public每community

collaborations; and 15,000 ha by the private sector) will be

established.

It is expected that an annual average area of 5,000 ha of

under-stocked 2 and degraded forest reserves and

community forests will be enriched using high value

indigenous tree species over a 20-year period.§

For more see:

http://www.fcghana.org/userfiles/files/Plantation%20Annual%20

Report/Ghana%20Forest%20Plantation%20Strategy%20(2016%

20-%202040).pdf

3. MALAYSIA

Exports to get a boost from interest rate

cut

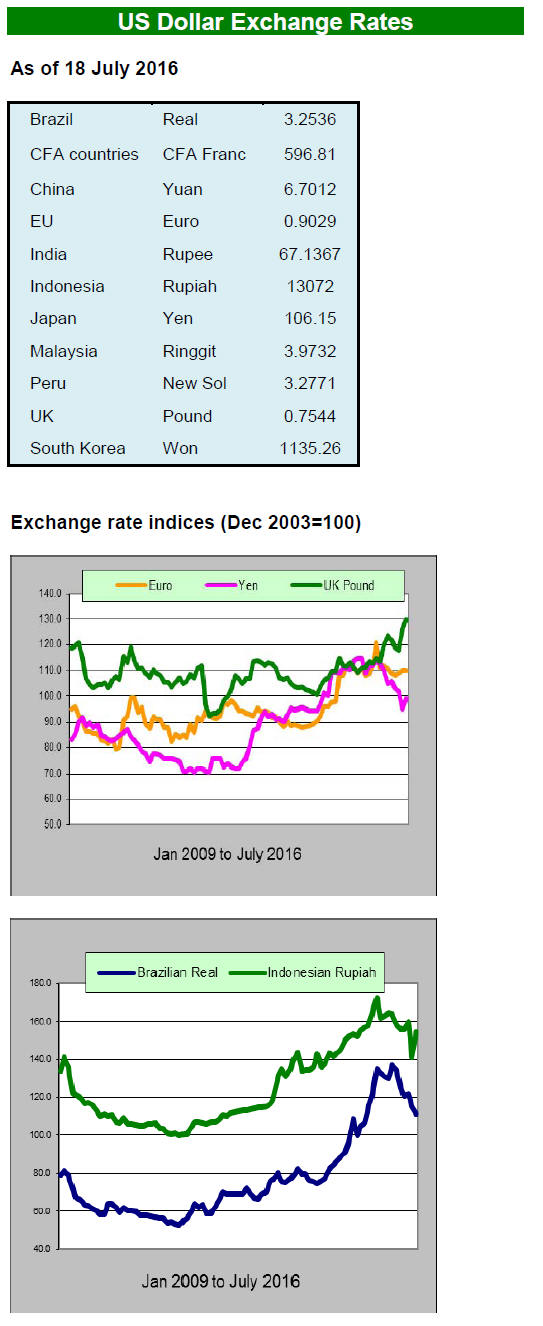

In a surprise move, the central bank, Bank Negara

Malaysia (BNM) lowered its policy rate to 3%, the first

reduction since 2009 citing heightened risks to the global

economy. This change should mean the commercial banks

will lower lending and saving rates.

Local observers suggest the BNM rate change was

linked

to the ringgit exchange rate and that the cut in rates was

aimed at weakening the ringgit to boost exports.

Implementation of import regulation postponed

The Malaysian Timber Industry Board (MTIB) has

announced that full implementation of the timber import

legality regulations under the domestic Timber Legality

Assurance System (TLAS) will be postponed until January

2017. From January 2017 importers will be required to

verify the legality of imported logs, baulks and plywood.

Importers have been advised to secure legality verification

for wood products from producing countries especially for

products which will be processed for export.

See:

http://www.mtib.gov.my/index.php?option=com_content&view=

article&id=2299%3Aimport-legality-regulation-under-timberlegality-

assurance-system-tlas-&catid=1%3Ahighlights&lang=en

Opportunities in bio-prospecting 每 native knowledge to

be tapped

Sarawak has taken its research of the State*s biodiversity

to a new level with the establishment of an Integrated

Biodiversity Research facility in the Sarawak Biodiversity

Centre (SBC).

Sarawak*s Chief Minister, Adenan Satem, said as the

research progresses new economic opportunities may

emerge through bio-prospecting. The aim is to have local

communities work with the new centre to pass on

traditional knowledge and experience.

At the moment communities in the Bario highlands are

working with SBC to explore the possibility of

commercialising LitSara essential oil.

Market volatility and economic uncertainty jar markets

Wood product exports from Sarawak in the first half of

this year fell 3.5 % to RM3.09 billion compared to the

same period in 2015. Analysts point to market volatility

and economic uncertainty in major markets such as Japan,

India, Taiwan P.o.C and China as behind the decline.

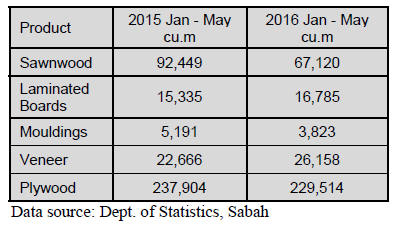

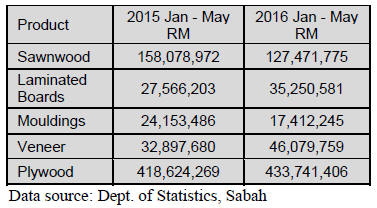

Sabah export update

The value of Sabah*s wood product exports between

January and May 2016 totalled RM 659.94 million, almost

the same as the value of exports in the same five month

period last year.

4. INDONESIA

Saudi Arabi to import gaharu

Importers in Saudi Arabia have placed a long term order

for Indonesian gahuru, internationally known as

agarwood. Agarwood forms in Aquilaria and Gyrinops,

both large tropical trees found throughout SE Asia, when

the trees become infected with a mould.

Since 1995 Aquilaria malaccensis, the main source for

gahura has been listed in Appendix II of CITES and in

2004 all Aquilaria species were listed in Appendix II.

Importers in Saudi Arabia have apparently contracted for

100 tonnes of Indonesian gaharu wood to be supplied over

the course of 12 months. Indonesian exports of gaharu for

this year to June were around 10 tonnes.

Moratorium on land clearing for palm oil to impact log

supply

The Indonesian government will introduce a five-year

moratorium on new palm oil concessions as part of the

country's effort to reduce the negative impact of land

clearing on the environment.

Last year the government extended the 2011 moratorium

on peatland clearing for plantations.

Darmin Nasution, Coordinating Minister for

Economic Affairs, said the government will have an

integrated plan that harmonises all concessions maps to

ensure that the new regulations do not overlap with

existing regulations in the mining, agriculture and

infrastructure development sectors.

A recent report from King*s College London and the

Center for International Forestry Research (CIFOR), says

the October 2015 forest fires in Sumatra and Kalimantan

released some 11.3 million tons of carbon each day (a

figure that exceeded the daily carbon emissions in the

European Union).

Traditionally slash-and-burn practices are used to clear

land for plantations after commercial logs are extracted.

See:

http://www.cifor.org/press-releases/carbon-emissions-2015-firessoutheast-

asia-greatest-since-1997-new-study/

Tax amnesty could boost growth

The Asian Development Bank (ADB) has maintained its

2016 growth projection for the Indonesian economy at

5.2%.

Growth will be driven by private consumption says the

ADB but some domestic and global risks remain. In

related news Bank Indonesia Deputy Governor, Perry

Warjiyo, has said he was optimistic that the tax amnesty

law would provide a boost to growth later in the year and

this should become more apparent in 2107.

Perry expressed the view that off-shore funds repatriated

under the tax amnesty deal will improve liquidity, allow

for a lowering of interest rates and stabilise the rupiah

exchange rate.

5. MYANMAR

First mill closure after logging

suspension

The first casualty of the suspension of logging has

emerged as a veneer mill in Myeik, a town in the southern

part of Myanmar. The mill has ceased production and the

CEO said milling would resume if raw materials become

available. Analysts comment that the mill was aware of

the likelihood of a logging suspension so should have

secured stocks to allow production to be maintained.

Tough to support unemployed elephants

Log haulage in Myanmar relies on elephants in many areas

and with the suspension of harvesting the owners of the

elephants are finding it hard to pay for food for their

animals. Elephants eat around 200 kg of foods every day

and securing food is now a problem.

The Myanma Timber Enterprise (MTE) has about 3,000

elephants while private sector enterprises have a further

2,000. According to researchers working elephants in

Myanmar can live for up to 40 years while the life span of

zoo elephants is around half that of working elephants.

Is there a place for private sector harvesting

when

logging suspension lifted?

For fiscal 2017-18 after the one-year suspension harvest

levels will be set at 320,000 Hoppus tons, about half the

production in 2015-16. In fiscal 2017-18 the teak harvest

will be around 15,000 Hoppus tons out of the total for the

year.

The domestic media have quoted U Myo Min, Deputy

Director of the Forest Department, as saying that private

logging companies will not be allowed to harvest logs as

the MTE will need to utilise its own resources for

harvesting. Prior to the log export ban MTE had subcontracted

some harvesting to private companies when

harvests were beyond the capacity of the MTE.

China - biggest investor in Thilawah Special Economic

Zone

The first phase of Thilawah Special Economic Zone which

started in 2014 has attracted around US$760 million in

investment. In the first phase, 73 enterprises from 16

countries were involved with companies in China

investing most followed by Singapore, Thailand, Hong

Kong, United Kingdom, Korea, Malaysia, Netherlands and

Vietnam.

Recently the Myanmar Investment Commission

announced business excluded from foreign investors and

the management of natural forests is one. There are

growing calls from domestic industry for some protection

of local sawmills. The argument is that foreign investors

should focus on added value products and should be

excluded from primary industries such as sawmilling.

SMEs need innovative financing mechanisms

At a recent conference Prof Aung Tun Thet, an economist

and adviser to Myanmar's Federation of Chamber of

Commerce and Industry called for support for SMEs in the

country pointing out that new financing mechanism need

to be found to help SMEs get established as SMEs play a

major role in job creation and poverty alleviation.

A recent Banking and Finance Conference heard that

SMEs face fierce competition from imported products

which is made worse when they face problems securing

credit and loans.

Official statistics indicate that there are over 125,000

registered SMEs in Myanmar. During the conference,

Janet Hyde, an investment specialist with the Asian

Development Bank said trade finance would be a key

pillar to boosting Myanmar's economic growth.

Timber imports for domestic milling

The government has decided that companies in Myanmar

be allowed to import wood raw materials.

U Kyaw Zaw, Director of the office of the Minister for

Natural Resources and Environmental conservation, said,

※a plan to permit the importation of raw timber from

overseas has been approved.§ In support of this U Kyaw

Zaw proposed the import duty on imported timber raw

materials be lowered.

Myanmar stopped exporting logs in fiscal 2014-15 and has

now temporarily suspended logging as part of a plan to rehabilitate

its forests but this has deprived domestic mills of

raw materials and could create a shortage of wood

products in the country.

To ease the situation the MTE will continue to sell

existing stocks of teak and hardwoods during 2016-17 to

meet the needs of local mills but traders in the timber

industry want to import timber raw materials to keep mills

in full production. Natural forest harvesting is expected to

resume in fiscal 2017-18 financial but harvest levels could

be only sufficient for domestic needs.

Timber trader, U Bar Bar Cho, said buying timber raw

materials from overseas sources could support the

government*s plan limit domestic logging. He pointed out

that some imported timber was cheaper than that produced

domestically and if imports were permitted end-users and

consumers would benefit from lower prices.

6.

INDIA

Wood product exports beat the trend

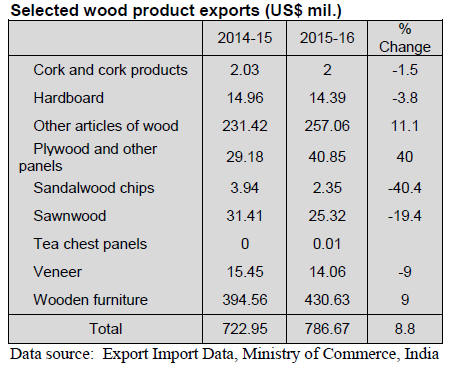

While India*s overall export performance in 2015 was

rather weak wood product exports were satisfactory. The

table below shows 2014/15 and 2015/16 exports for a

range of wood products. Of note was the high growth in

plywood and wood based panel exports in fiscal 2015.

Gurjan plywood facing tough competition

Plywood manufactured by small and medium sized plants

in the so-called &unorganised plywood sector* is facing

tough competition from products manufactured by larger

mills. The smaller mills continue to use gurjan face

veneers, traditionally the preferred timber. However,

plywood faced with poplar or eucalyptus has gained

market share as it is cheaper than gurjan faced panels and

have been accepted by consumers.

Until the log export ban in Myanmar gurjan logs were

readily available at competitive prices but now gurjan face

veneers are being sourced in Laos which has driven up

production costs.

Indian owned mills producing gurjan veneers in Laos

report that the authorities there would prefer to see exports

of plywood rather than low added value veneers but this,

say millers, would increase prices further but that the

Indian market for plywood at present is very competitive

and could not bear a price increase.

CREDAI calls for more loans for home buyers

The Indian Confederation of Real Estate Developers

(CREDAI) has called for relaxing bank lending to boost

housing developments so the sector can contribute more to

the GDP and meet the goal of providing housing for all. At

present the real estate sector in India accounts for only 6%

of the GDP far below levels in other countries.

The problem is, says CREDAI that real estate credit is a

very small percentage of total bank credit on offer. While

this has kept non-performing assets in real estate sector

close to zero it is strangling growth prospects.

CREDAI put the case that priority lending in the housing

sector be increased and that the private sector should be

eligible for slum rehabilitation loans.

See:http://credai.org/assets/upload/news_updates/real-estateindustry-

calls-for-easing-bank-lending-norms-the-times-ofindia.

pdf

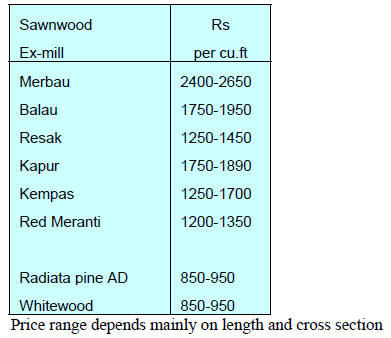

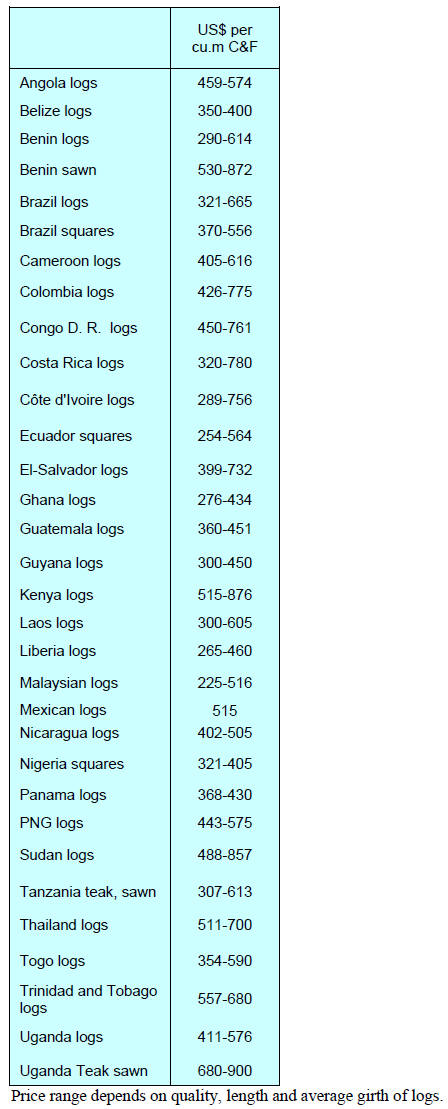

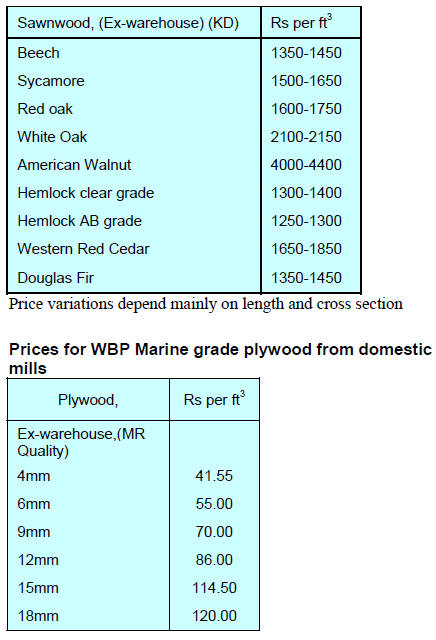

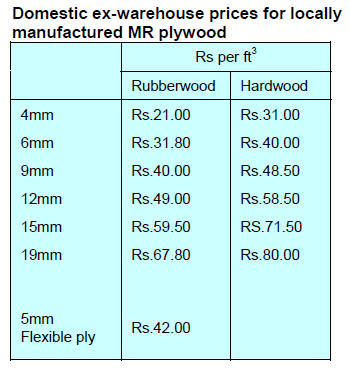

Prices for locally sawn hardwoods

As in the previous month the US dollar/Rupee exchange

rate has allowed importers to maintain past price levels.

Plantation teak prices

The current pace of deliveries matches demand thus C&F

prices remain stable.

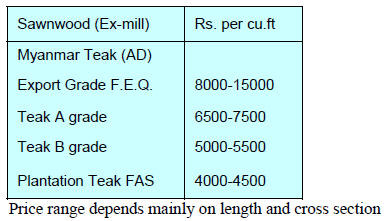

Myanmar teak flitches resawn in India

Ex-mill prices for sawn teak remain unchanged. Imports of

sawn teak from Myanmar have stabilized prices in the

Indian market.

Prices for imported sawnwood

Overall, prices remain unchanged except for American

walnut for which firm demand resulted in an upward

pressure on prices.

7.

BRAZIL

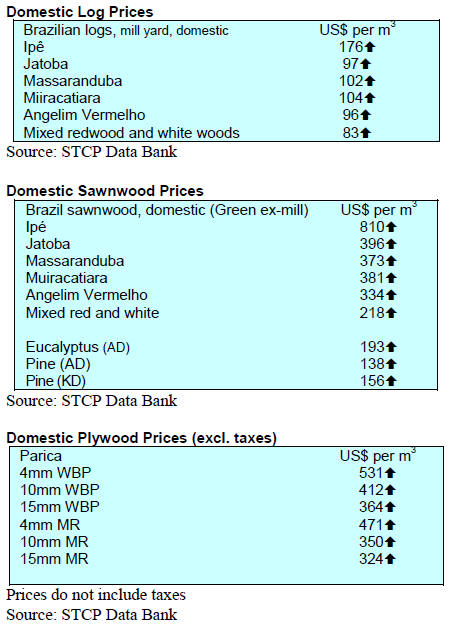

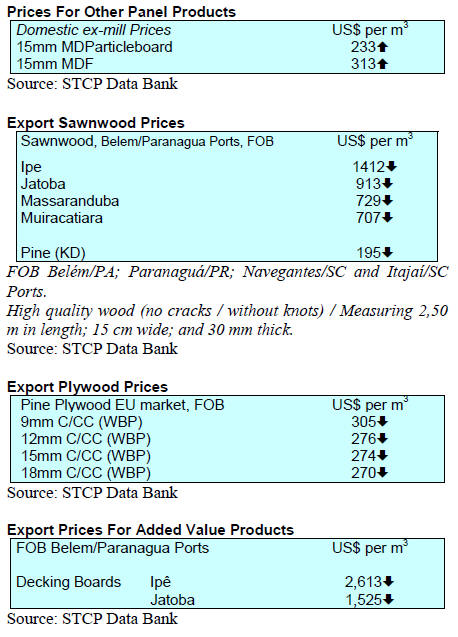

June tropical sawnwood exports increase

22%

In June 2016 Brazilian exports of wood-products (except

pulp and paper) increased 4.1% in value compared to June

2015, from US$231.7 million to US$241.1 million.

The value of pine sawnwood exports fell 3.9% over the

same period from US$30.9 million to US$ 29.7 million

but, in terms of volume June 2016 exports increased

15.7% year on year from 134,800 cu.m to 156,000 cu.m.

Tropical sawnwood exports increased 22.4% in volume,

from 26,300 cu.m in June 2015 to 32,200 cu.m in June this

year and the value of exports increased 12.3% (US$13

million to US$14.6 million).

June 2016 pine plywood exports increased 2.6% in value

year on year from US$34.1 million to US$35.0 million

and export volumes also increased from 99,600 cu.m to

134,200 cu.m.

A similar trend was seen for tropical plywood exports.

Year on year June exports were up 22.4% in volume from

9,800 cu.m in June 2015 to 12,000 cu.m in June 2016. The

value of exports increased 4.3% from US$4.7 million to

US$4.9 milion over the same period.

Brazil*s wooden furniture exports performed well in June

2106 rising US$35.2 million a year earlier to US$39.5

million.

ABIMCI pushes trade development

During June the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI) participated in

several meetings to promote Brazilian wood products.

Meetings were held with representatives from Argentina,

the United States and Japan.

The purpose of the meeting with the representatives from

Argentina was to discuss how to coordinate trade policies

between the two countries so as to facilitate exports. In

particular attention was focused on the need for the

automatic granting of import licenses for wood products.

In anticipation of growth in US demand for wood

products

Brazilian manufacturers foresee opportunities for greater

exports and for investment in the US.

During a meeting with US officials the various incentive

programmes for business investments in the US were

presented including the Select USA programme. (For

more see:

https://www.selectusa.gov/welcome)

This programme aims to attract more businesses to the US

and offers a range of assistance to startup operations such

as business information, research, technical and marketing

advice and networking. In 2015 the United States was the

main market for Brazil*s plywood and sawnwood .

The meeting with JICA and the Japan-Brazil Chamber of

Commerce aimed to expand exports and discussions on

Japanese assistance for the development of wood frame

construction systems suitable for Brazil.

Urgent review of Brazil/Chile maritime agreement

demanded

The Brazilian Tree Industry (IBA) has suggested a review

of the maritime agreement between Brazil and Chile

which has been in force since the 1970s is urgently

required. This agreement gives exclusivity to Chilean and

Brazilian ships for transport of goods between the two

countries but is now outdated and results in shipping costs

being higher than necessary.

At a meeting between representatives of the National

Agency for Waterway Transportation (ANTAQ) and the

Brazilian National Confederation of Industry (CNI)

Brazilian industry representatives pointed out that, due to

the agreement, the cost of shipping between Brazil and

Chile can be higher than shipping to China.

As trade has a major impact on growth, the IBA says it is

necessary to review the agreement for the benefit of both

countries.

Furniture makers search for solutions to overcome

marketing challenges

The 26th MOVERGS Congress held on 30 June in Bento

Gonçalves, Rio Grande do Sul was themed "Renovation -

Attitudes in search for better results". One of the

highlights of the Congress was presentations by speakers

from the Institute for Market Intelligence (IEMI). One

presentation provided an analysis of the national furniture

industry over the past 10 years looking at production,

demand and trends.

The statistics show that economic recession is having a

strong negative impact on the furniture industry and that

the challenge for furniture manufacturers in 2015 was how

to guard against the negative effects of the weak domestic

market.

What emerged from the analysis was that innovation

became the core driver of growth in the sector. To be

successful in this changing consumer behaviour and retail

channels had to be considered.

IEMI pointed out that understanding customer behaviour

is a basic rule in marketing and even more critical when

economic conditions are volatile. IEMI emphasised that

understanding demand drivers and categorising end-users

and their purchasing trends is important.

Entrepreneurs in the furniture sector were encouraged to

abandon the &comfort zone* of past production and

marketing models and rethink their business.

Domestic demand for furniture in Brazil is forecast to

remain depressed throughout the second half of this year

but an improvement should become apparent in 2017.

Economic viability of sustainable forest management

undermined by marketing of illegal timber

A study by Brazil*s Center for Sustainability Studies

(GVces) published in June reports that the economic

viability of Brazilian goal of increasing the area of forest

under sustainable management is closely linked to

addressing competition from illegally sourced wood

products.

Brazil has committed to increase the forest area under

sustainable forest management and to eliminate the

marketing of illegal produced wood products from natural

forests by 2030.

For more see: http://www.gvces.com.br/

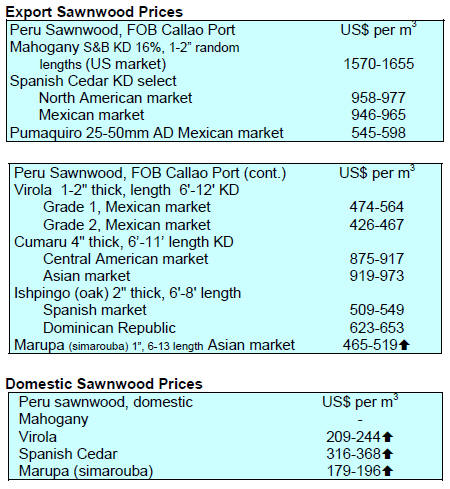

8. PERU

International investment seminar targets

forestry and

timber sectors

AGROBANCO, a state financial institution, charged with

providing credit and financing to micro and small

enterprises in the agricultural and forestry sectors, recently

arranged a seminar on rural microfinance. Themed

"Promoting Forestry Development in Peru" this was for

investors and entrepreneurs from a wide range of

countries. The aim was to encourage private investment in

the forestry sector in Peru and promote the financial

mechanisms on offer from the bank.

The event was attended by over 200 invited

representatives of business, finance and academia who

shared experiences and evaluated business opportunities in

Peru.

Among the international attendees was Alexis Wainer,

founding partner of Trypan (Chile); Glenda Lee, codirector

of Global Terra Latin America; Monarrez Mario

Macias, deputy director of Fisheries, Forestry and

Environment of the Bank of Mexico; Ricardo Luj芍n

Ferrer, director of Forest Brinkman and Associates

Reforestation (Canada).

Other attendees were Martin Sanchez Acosta, editor of

Electronic Bulletin New Forest INTA (Argentina);

Cannaval Robinson, CEO of Innovatech Business Forest

(Brazil); Manoel de Freitas, a forestry expert (Brazil);

Jorge Echeverria Vargas, corporate manager at MASISA

Forestal Forestal (Chile); Luis Enrique Arr谷llaga,

Chairman of the Board of PAYCO (Paraguay); Patricia del

Valle, Forestry and Landuse Unique (Germany); Felipe

Koechlin, executive director of Amazon Reforestadora

(Peru).

Directional felling training in cooperation with GTZ

In order to minimise the impact of logging the German

Technical Cooperation Agency (GTZ) arranged a training

event in the native community of New Irazola on

directional felling for chainsaw operators.

More than twenty chainsaw operators attended and

expanded their skill on the use of chainsaws and

directional felling.The course was conducted by Martin

Winkler and William Pariona, both of GTZ Peru.

Fibreboard imports fall

Between January and May 2016 Peruvian imports of

fibreboard amounted to US$10.24 million, a decline of

almost 5% compared to the same period in 2015. Chile

remained the main supplier despite seeing a 12% decline

in exports to Peru.

Shipments from Brazil increased by 93% to US$ 1.,96

million compared to the same period in 2015. Turkey

remained the third ranked supplier with shipments worth

for US$1,24 million. Arauco Peru was the largest importer

accounting for just over 52% of all fibreboard imports.

Masisa Peru and the Martin Group each imported around

US$1.7 million.

Fibreboard imports by the local subsidiary of Duratex,

Duratex Andina totaled US$434,000 representing around

4% of total fibreboard imports. Duratex is a major

manufacturer of fibreboard in Brazil.