US Dollar Exchange Rates of 10th June 2016

China Yuan 6.558

Report from China

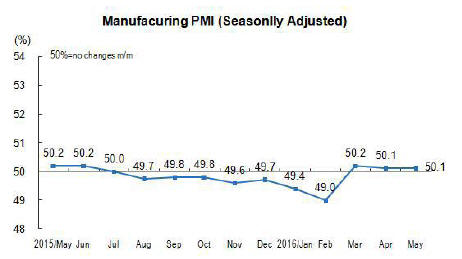

China's PMI positive for three months in a row

The May manufacturing purchasing managers index

(PMI), announced by the National Bureau of Statistics,

remained at the same level as in April just marginally in

positive territory where it has hovered for three

consecutive months.

The National Bureau of Statistics says among the five subindices

comprising the official PMI, the production index,

new orders index, supplier delivery time index were above

the negative threshold while the employment and raw

materials inventory indices were below the threshold.

The PMI was held up say analysts due to aggressive

monetary stimulus in the first quarter.

Made in China 2025 - centre-piece of the latest 5 year

plan

The Hong Kong Trade Development Council (HKTDC)

has published a thoughtful overview of China¡¯s 13th Five-

Year Plan: The Challenges and Opportunities of Made in

China 2025.

The HKTDC paper can be found at:

http://economists-pick-research.hktdc.com/businessnews/

article/Research-Articles/China-s-13th-Five-Year-

Plan-The-Challenges-and-Opportunities-of-Made-in-

China-

2025/rp/en/1/1X000000/1X0A6918.htm?DCSext.dept=12

&WT.mc_id=6143966

The HKTDC writes ¡°The 13th Five-Year Plan states

clearly that efforts will be made to optimise development

of the modern industry system, whereby structural reform

will be implemented on the supply side.

In particular, the development strategy of building China

into a manufacturing powerhouse under the Made in China

2025 initiative will be implemented in greater depth in

order to enhance the innovation capability of the

manufacturing industry and strengthen the industrial base.

This includes manufacturing key basic materials and core

parts and components, developing new-type

manufacturing such as smart production, enhancing

quality and brand building, as well as advancing

traditional industry upgrading and eliminating outdated

production capacity in order to add a new competitive

edge to the manufacturing industry.¡±

The plan describes the steps to be taken to streamline

industrial and business management, raise administrative

efficiency, reform the financial system and enhance the

efficiency of the financial services sector in support of

modernizing manufacturing.

Ambila dominates redwood furniture market

Observers report that the current demand in China for

ambila (Pterocarpus erinaceus) is for between 8- 9,000

containers per month. However, existing container arrivals

total only 4,100 with around 2,000 coming through

Guangdong, 500 via Dongyang in Zhejiang province, 500

through Shanghai and Zhangjiagang with a further 300

containers landing in both Zhejiang and Hebei Provinces.

Ambila also goes by the names bani, tolo and ban.

The sales of ambila furniture in the top tier cities account

for 5% of total sales. This jumps to 15% in second tier

cities, 50% in third tier cities and 10% in rural areas.

Ambila furniture products comprise around 50% of the

redwood furniture market.

First okoume logs through Zhenjiang Port

Over 8,000 cubic metres of okoume logs from Equatorial

Guinea were recently imported through Zhenjiang Port,

Jiangsu Province. This was the first time for African

timbers to enter China through Zhenjiang Port. The port of

Zhenjiang is on the south bank of the Yangtze

River between Nanjing and Changzhou.

After inspection and quarantine the okoume logs were

trucked to Linyi City of Shandong Province. Zhenjiang

Port is becoming entry point in support of the national

strategic timber reserve policy and is the first purpose built

timber port.

The species and volumes of timber imports through

Zhenjiang port have been increasing this year in tandem

with the opening of special timber wharf at the port. Up to

the end of April some 450,000 cubic metres of logs have

entered China through this port.

Imported laminated flooring is popular amongst young

consumers

According to a recent market survey young Chinese

consumers prefer imported laminated flooring over

domestic products.

The main reasons cited for this preference were the wide

choice of colours especially if available in ¡®pavement¡¯

styles, even at the expense of foot comfort.

Other reasons for the preference for imported laminated

floorings were convenient installation as imported

laminated flooring can be glue-less with an interlocking

slot design which is easy for consumers to install by

themselves.

Consumers also reported that imported laminated flooring

is durable and with better anti-slip features than domestic

flooring.

Prices for imported laminated flooring are considered

reasonable for many middle class Chinese. Current retail

prices for imported laminated flooring are in the region of

RMB3-700/panel, well down on the RMB8-1,000 seen in

2012.

Consumers also rate the environmental performance of

imported flooring higher than domestic products.

The Standard E0 for European flooring is less than

0.9mg/L formaldehyde emission while the Standard for

domestic flooring (E1) is ¡°not exceeding 1.5mg/L

formaldehyde emissions¡±.

Local experts note that the market share of imported

laminated flooring is less than 20% in Guangzhou City but

anticipate sales of imported laminated flooring could reach

a 50% market share within the next five years.

Furniture enterprises relocate to Qingfeng

It has been reported that furniture enterprises in Beijing

and Xianghe (Hebei Province) have been relocating to

Qingfeng County in He¡¯nan Province and this is being

encouraged by the administration in Qingfeng County.

It is reprted that as many as 400 furniture enterprises have

relocated which in 2015 earned Qingfeng County the title

of ¡®Furniture Industry Base ¨C 2015¡¯. The administration

has been encouraging furniture clusters in the county.

|