|

Report from

North America

Consumer confidence rebounds

Consumer confidence rebounded in early May, according

to the University of Michigan Index of Consumer

Sentiment. Consumers reported income gains, an

improved job outlook, and they expect of lower inflation

and interest rates.

The largest improvement in confidence was amongst

lower income and younger households. Consumer

confidence rose in all regions of the country.

Builder confidence unchanged

Builder confidence in the market for new single-family

homes was unchanged in May, according to the National

Association of Home Builders/Wells Fargo Housing

Market Index. Builders expect more house sales in the

coming six months, but building lot shortages affect many

regions of the country, especially in the West.

Sixty-four percent of builders said the supply of lots was

¡°low¡± or ¡°very low¡± according to the May survey by the

National Association of Home Builders.

Housing starts expected to grow throughout 2016

Housing starts in April were at a seasonally adjusted

annual rate of 1,172,000, according to US Census Bureau

data. This is 7% up from March, but slightly below the

April 2015 rate.

Both single and multi-family home construction recovered

in April, with stronger growth in the multi-family sector.

Single-family homes were started at a rate of 778,000 in

April.

Developers of multi-family housing remain cautiously

optimistic about the market, according to the National

Association of Home Builders. Overall housing starts will

likely grow in the summer and fall of 2016 with steady

economic growth and an improving job market.

The number of building permits issued in April was at a

seasonally adjusted rate of 1,116,000, up 4% from March.

In Canada, housing starts declined 5% in April at a

seasonally adjusted annual rate because of lower multifamily

starts. A moderation in housing starts is expected

for 2016, especially in the oil producing regions of the

country. Moreover large forest fires shut down oil

production facilities northern Alberta and partially

destroyed the nearby city of Fort McMurray.

Low mortgage rates support home sales

Sales of existing homes increased for the second

consecutive month, according to the National Association

of Realtors. Home sales were up 6% from April 2015, and

the median home price was also up 6% from last year.

Sales rose in the Midwest and Northeast, but declined

slightly in the South and West. In the West housing

shortages and high prices slowed down sales.

Mortgage rates remain low. According to Freddie Mac, the

average commitment rate for a 30-year, conventional,

fixed-rate mortgage was 3.61% in April, which is the

lowest since May 2013 (3.54 percent).

Tropical sawnwood imports up in March except sapelli

The US imported 80,626 cu.m. of sawn hardwood in

March, down 16% from the previous month. However, the

value of imports grew 4% largely due to higher tropical

imports.

Overall sawn hardwood imports were worth US$41.1

million in March. Tropical sawnwood accounted for half

of the import value at US$20.4 million.

Tropical sawnwood imports increased 21% in March to

19,828 cu.m. Year-to-date imports remained lower than in

March 2015 (-24%). Imports of all major species grew in

March, with the exception of sapelli which remained

unchanged from the previous month at 2,003 cu.m. Yearto-

date sapelli imports were only half the volume at the

same time last year.

Ipe sawnwood imports increased 53% month-over-month

to 3,001 cu.m. in March. Year-to-date imports were still

25% lower than in March 2015.

While most species had lower year-to-date imports than in

2015, balsa and mahogany imports grew in 2016 up to

March. March imports of balsa sawnwood were 4,562

cu.m., up 2% year-to-date. Imports of mahogany

increased 31% year-to-date to 1,644 cu.m. in March.

After declining in February keruing sawnwood imports

almost doubled from the previous month to 1,881 cu.m. in

March.

Ecuador was the largest source of tropical sawnwood

imports in March, followed by Brazil, Malaysia and

Cameroon.

Of the smaller sawnwood suppliers, Guatemala increased

shipments to the US to 987 cu.m. in March. Imports from

India on the other hand, declined from over 1,218 cu.m. in

February to almost zero in March.

Canada imported more balsa in March

In March the value of Canadian imports of tropical

sawnwood was down 4% from the previous month due to

lower imports of sapelli. Imports were worth USUS$1.67

million. Year-to-date imports were still higher than in

March 2015.

Sapelli sawnwood imports declined 10% month-overmonth

to USUS$504,207, but sapelli remains the main

tropical species imported into Canada.

At USUS$30,767 March imports of mahogany were up

from February. Imports of virola, imbuia and balsa

(combined) grew by one third to USUS$451,344 in

March. Much of the growth was in balsa imports from

Ecuador.

Sawnwood imports from Cameroon fell to USUS$357,498

in March, while imports from Congo (formerly

Brazzaville) increased to USUS$306,074. Brazil¡¯s

shipments to Canada declined in March, but the year-todate

value is 43% higher than at the same time last year.

Hardwood plywood

US imports of hardwood plywood, moulding and wooden

furniture declined in March from the previous month.

Only wood flooring imports grew, but they remain lower

than at the same time in 2015. Much of the decline was in

imports from China, while most other countries were able

to expand their share in US imports in March.

Drop in plywood imports from China

Hardwood plywood imports declined again month-overmonth

in March (-9%). A total of 234,473 cu.m. were

imported in March, worth US$133.2 million. Year-to-date

import volumes were 2% higher than in March 2015, but

the value in current US dollars was down 5%.

The drop in imports was almost entirely in shipments from

China, which fell by 29% to 112,275 cu.m. in March.

Imports from Indonesia, Malaysia and Russia increased

from February.

Plywood imports from Indonesia grew 22% from the

previous month to 37,325 cu.m. Year-to-date import

volumes from Indonesia were down 5% from March last

year, but the value of imports grew 7% year-to-date.

Imports from smaller plywood suppliers to the US market

expanded significantly in March, most notably from Spain

(4,056 cu.m.), Uruguay (3,885 cu.m.) and Brazil (2,948

cu.m.).

Moulding imports from China down, Brazil up

Hardwood moulding imports were worth US$13.8 million

in March, down 12% from the previous month. Year-todate

imports were unchanged from March 2015.

Moulding imports from China and Malaysia fell in March,

while Brazil and Canada increased shipments to the US

market. Imports from Brazil recovered from February and

were worth US$3.6 million. China¡¯s moulding shipments

dropped to US$3.3 million in March.

Hardwood moulding imports from Italy were

exceptionally high in March at US$1.2 million.

Growth in assembled flooring panels from Thailand

Wood flooring imports grew month-over-month in March,

but year-to-date imports remained below March 2015

levels for both hardwood and panel flooring. Hardwood

flooring imports were up 10% (US$2.6 million), while

imports of assembled flooring panels increased 11% to

US$10.5 million.

Hardwood flooring imports from Malaysia were

US$667,504 in March, up 70% from February. Indonesian

shipments more than tripled in March from the previous

month to US$612,429.

Hardwood flooring imports from China decreased from

the previous month to US$347,254, but remain higher

year-to-date than in March 2015.

China¡¯s shipments of assembled wood flooring panels

grew 3% month-over-month in March to US$4.1 million.

Imports from most other suppliers increased as well in

March. Thailand has recently become a significant

supplier to the US market, exceeding imports from

Indonesia year-to-date 2016. March imports from Thailand

were worth US$767,521.

Assembled flooring panel imports from Europe also

increased in March, especially imports from Poland.

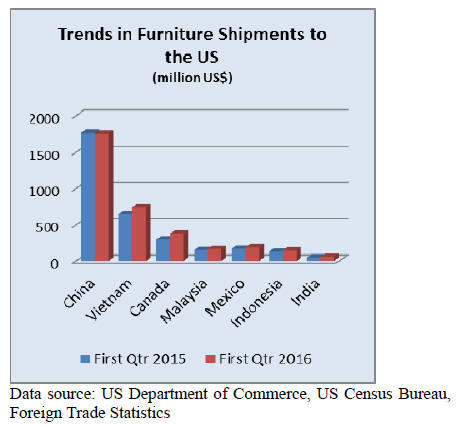

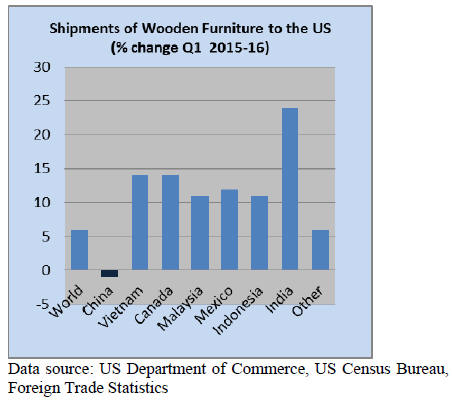

Wooden furniture imports down 22%

Wooden furniture imports fell 22% in March to US$1.08

billion, but imports from most countries grew. The largest

decrease was in imports from China (US$397.2 million, -

41%) and Vietnam (US$180.7 million, -36%).

Year-to-date imports were still 6% higher than in March

2015.

Furniture imports from Malaysia declined to US$51.6

million in March, while imports from Indonesia grew 17%

to US$53.1 million.

Canada¡¯s furniture exports to the US increased in March

and its share in total imports was over 11%, up from under

8% in previous months. China¡¯s import share was only

37% in March, down from almost 50%.

Furniture imports from India increased to US$23.9 million

in March. Europe also grew its market share in the US

helped by a favourable exchange rate. Italy was the largest

supplier at US$50.1 million in March, followed by Poland

and Germany.

Imports of all types of wooden furniture declined in

March, but the drop was greatest in upholstered furniture.

Office furniture imports decreased the least.

Office furniture demand expected to grow 7.4% in 2016

US demand for office furniture appears to be growing

more strongly than household furniture consumption,

based on international trade data and forecasts by IHS

Global Insight and the Business + Institutional Furniture

Manufacturers Association (BIFMA).

In 2015 US office furniture imports were higher than in

2008 before the recession hit the country. 2015 imports

were worth US$1.4 billion. Wooden furniture accounted

for 65% of total office furniture imports.

US production of office furniture is expected to reach

US$10.4 billion in 2016, according to predictions by

BIFMA and IHS Global Insight. This would be a slight

increase from 2015, while consumption is forecast to grow

7.4% to US$14.0 billion.

A major area of work for BIFMA has been the

sustainability of office furniture.

The association is currently working on revising the

ANSI/BIFMA e3 Furniture Sustainability Standard. More

than 60 manufacturers certify over 7,000 product lines

through the third-party certification program for the

sustainability standard. The revision of the standard will

clarify support for green building rating systems, update

the chemistry assessment and include for life cycle based

assessments.

Wood product industry leads growth in manufacturing

Economic activity in the manufacturing sector expanded in

April for the second consecutive month, according to the

Institute for Supply Management. The overall economy

also grew in April.

Wood product manufacturers reported the strongest

growth of all manufacturing industries, while the furniture

industry contracted in April, according to the institute¡¯s

survey. Furniture manufacturers reported higher new

orders and production, but regarded their customers¡¯

inventories too high in April. New orders for export drove

growth in the wood products industry.

Development of architectural woodwork standard

diverges

The Architectural Woodwork Manufacturers Association

of Canada and the Woodwork Institute based in California

plan to develop a new architectural woodwork standard for

North America.

The announcement in March follows a dispute with a third

industry body, the Architectural Woodwork Institute based

in Virginia. The latter received official approval as an

American National Standards Institute (ANSI) Accredited

Standards Developer of architectural woodwork standards.

All three organizations collaborated on the existing

Architectural Woodwork Standards publication, which

serves as a reference manual for design professionals to

clarify guidelines, information and principles required for

fabrication, and finishing and installation of architectural

woodwork.

Previously the goal of all three associations was to provide

a single architectural woodwork standard for Canada and

the US. Now the Architectural Woodwork Institute will

develop an ANSI Standard, while the other two

organizations will update the Architectural Woodwork

Standards, currently in its second edition.

Higher interest rates likely this summer

GDP increased at an annual rate of 0.8% in the first

quarter of 2016, according to the second estimate released

by the US Department of Commerce. The unemployment

rate was unchanged in April at 5.0%. Both the

unemployment rate and the number of unemployed

persons have changed little since August 2015.

The US Federal Reserve may raise interest rates again in

either June or July, despite slow economic growth in the

US, economic troubles in Brazil and China, and the UK¡¯s

vote in late June on whether to leave the EU. Federal

Reserve Chair Janet Yellen announced on May 27 that

higher rates may be set in the coming months.

|