Japan

Wood Products Prices

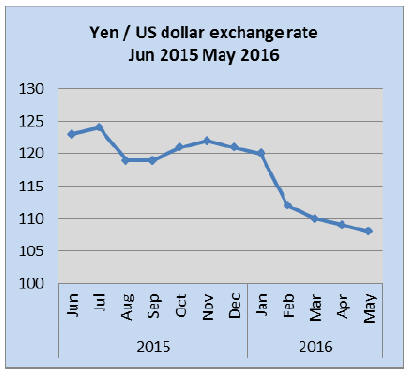

Dollar Exchange Rates of 25th

May 2016

Japan Yen 109.76

Reports From Japan

JCER- Only thorough opening the economy can

a

crisis be averted

The 42nd Medium-Term Economic Forecast from the

Japan Center for Economic Research (JCER), a private

non-profit research institute, makes for very sober reading

and is of relevance to the medium term prospects for wood

product exporters to Japan. Four main conclusions from

the report are highlighted:

Potential Growth Rate: Currently below 1%,

will turn negative by FY 2030 due to population

decline

Economic Growth Rate: Toward negative

growth in late 2020s

Fiscal deficit: Bad to worse, outstanding debt to

nominal GDP ratio will rise to 250%

Industrial structure – Currently this limits

growth, structural reforms are pressing

The report opens saying the outlook for the Japanese

economy appears extremely harsh given its declining

population, aging society, sluggish investment and

declining efficiency and productivity.

The impact of the aging society and population decline is

gradually coming to a head says the report and the writers

expect the prospects for growth to weaken after the Tokyo

Olympics in 2020 and to turn negative by FY 2030.

At some time in the near future, says the report “Japan will

be forced to make bitter choices between confronting the

crisis of economic collapse or submitting to a substantially

reduced standard of living”.

The authors point to the need to reform the social systems

such as harnessing the abilities of women who remain in

the home, increasing immigration and extending the

working age of elderly residents.

It is reform that would make it possible to reverse what is

seen as an inevitable decline. The report says “reforms

would be needed at a level that will change the shape of

the country.

The path to avoiding economic collapse and overcoming

the “Japanese disease” of giving maximum priority to

maintaining the status quo may be narrow and austere, but

it is not an impossible distance to cover”.

The conclusion of this analysis is that only

thorough

opening the economy can growth be achieved.

In the words of the report: “Following the lead of the

Meiji Restoration and the postwar era to assimilate

demand from abroad, the point is to open up the country

for a third time to free up the movement of people, goods

and money”.

For the full analysis see:

http://www.jcer.or.jp/eng/pdf/m42_final.pdf

The helicopter money option looms

Japan’s exports fell for a seventh consecutive month in

April as the yen continues to strengthen and further

strengthening came after heated discussions on currency

management during the recent G7 Finance Ministers

meeting.

At the G7 Finance Ministers meeting there was no support

for Japan's appeal for currency intervention to reverse the

appreciation of the yen. This say analysts, may mean the

country could resort to what is known as "helicopter

money" . This is a term used to describe the situation when

a country drastically increases public spending or cuts

taxes.

In the face of a firming yen and weak economic growth

the Bank of Japan is quickly running out of options to hold

down the yen/dollar exchange rate.

The yen firmed to 108 in mid-May marking a more than

6% rise against the US dollar which is hurting exporters.

On the other hand importers, including wood product

buyers are returning to the international market.

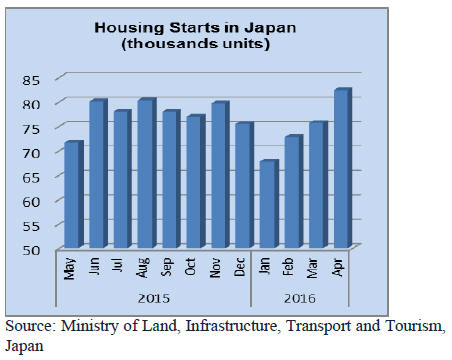

Housing starts continue steady rise

Growth in new residential property developments begun

last month in Japan defied expectations with a mild rise

that didn’t quite fall in line with activity elsewhere in the

economy.

New housing starts grew close to 10% in April to 82,398,

this was double what analysts had expected and the April

rise continued the upward trend seen over recent months.

At the current rate of expansion annualised housing starts

would come in at 995,000 well above forecasts made

earlier in the year.

The pace of growth, when set against overall consumer

spending trends suggests that the driving force for housing

starts is most likely the availability of low interest

mortgages.

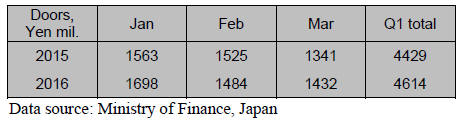

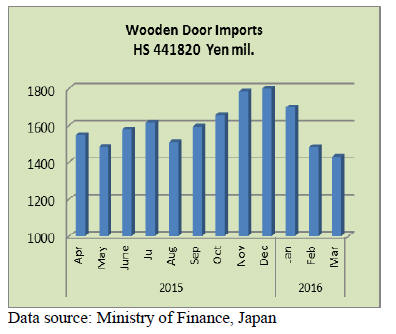

Import round up

Doors

Japan’s first quarter 2016 imports of wooden doors were

around 4% higher than in the first quarter 2015.

March marked the third straight decline in wooden

door

imports into Japan. China remains the main supplier of

wooden doors to Japan followed by the Philippines and

Indonesia. These three suppliers dominate imports of

wooden doors accounting for over 80% of all imports of

doors in March.

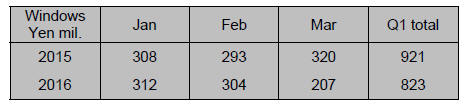

Windows

Wooden window imports into Japan continued the

downward trend first noticed in December 2015. First

quarter 2016 imports of wooden windows were some 10%

below that in the first quarter of 2015. Year on year

Japan’s March 2016 wooden window imports were down

a massive 35%.

The top three suppliers remain China, Philippines

and the

US accounting for over 85% of March 2016 imports.

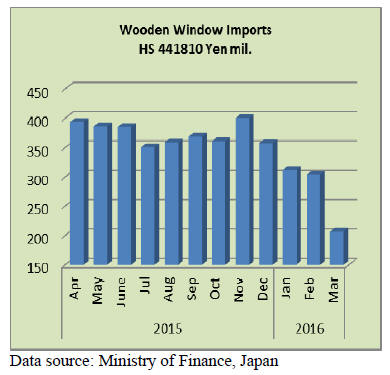

Assembled flooring

In contrast to the downward trend door and window

imports Japan’s imports of assembled flooring rose 6.5%

in the first quarter of 2016 compared to the same period in

2015.

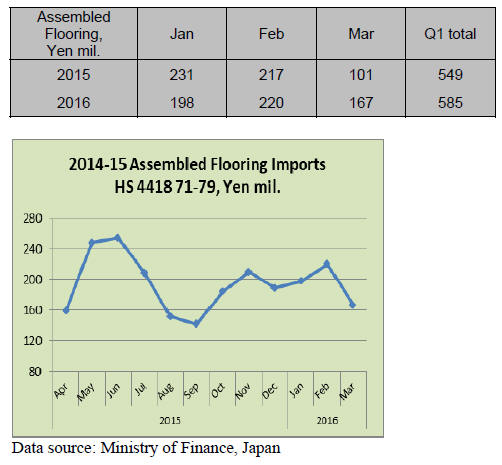

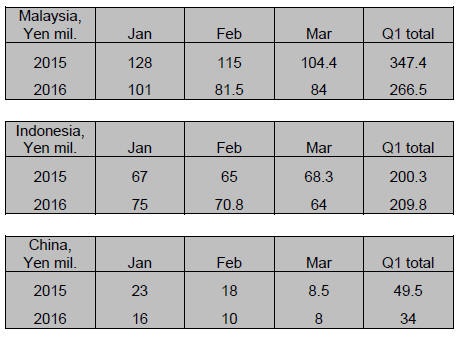

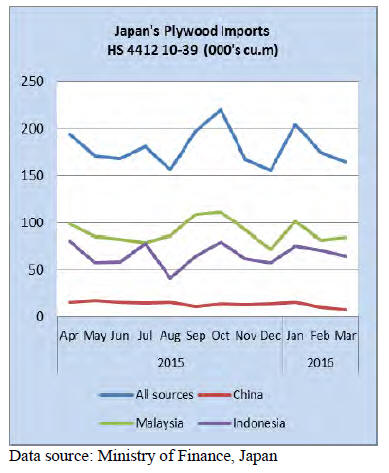

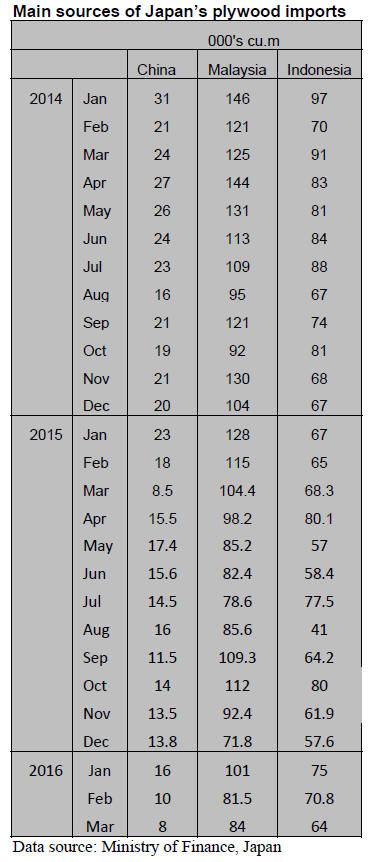

Plywood

In the first quarter of 2016 Malaysia was the largest

supplier of plywood for the Japanese market followed by

Indonesia and in distant third was China. Malaysia’s

shipments of plywood to Japan during the first quarter

2016 were well down (-23%) from levels recorded in the

same period in 2015.

On the other hand shipments from Indonesia rose slightly

above levels in the first quarter of 2015. First quarter 2016

shipments of plywood from China into Japan were down a

hefty 35% compared to the first quarter of 2015 but

shipments of plywwod from China into Japan are a

fraction of those from both Malaysia and Indonesia.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood demand in 2015

The Ministry of Agriculture, Forestry and Fisheries

disclosed wood demand statistics of 2015. According to

this, total wood material demand was 25,092,000 cubic

meters, 1.9% less than 2014. This is two consecutive

years’ decline despite new housing starts in 2015 were

1.9% more than 2014.

Not only domestic products but also imported wood

products from foreign countries decreased. In domestic

consumption of materials, domestic wood demand

continues increasing so in total material supply, domestic

wood was 20,049,000 cbms, 0.7% more than 2014.

Meantime imported materials were 5,045,000 cbms,

11.0% less. Therefore, share of domestic wood was

79.9%, 2.1 points more than 2014.

Log demand for lumber was 16,182,000 cbms, 2.9% less,

out of which domestic logs were 12,004,000 cbms, 1.7%

less and imported logs were 4,178,000 cbms, 6.1% less so

decline of imported logs was larger. Shipment of lumber

decreased to 9,23,000 cbms, 3.8% less. Imported lumber

also declined. Softwood lumber from North America was

0.6% less. European softwood lumber was down by 4.6%

and structural laminated lumber was down by 3.1%. Not

only Japanese manufacturers but also foreign

manufacturers suffered declining market.

Imported logs for lumber manufacturing were down from

all the sources but log import from North America, which

took 78% in all log import, decreased to 3.259,000 cbms,

3.2% less. Demand for North American logs was steady

by large sawmills but demand from smaller sawmills was

slow then on supply side, there were several negative

factors to reduce the supply like forest fires, labor dispute

at the West Coast ports and strong dollar.

Logs for plywood manufacturing were 4,218,000 cbms,

4.2% less, out of which domestic logs were 3,356,000

cbms, 5.2% more and increasing trend continues while

imported logs were 864,000 cbms, 28.8% less so share of

domestic logs for plywood manufacturing reached about

80%. Standard plywood production was 2,756,000 cbms,

2.0% less. Imported plywood was down by 17.

Legal wood use promotion law

Draft of the bill to recommend use of legally approved

wood the Liberal Democratic Party plans to submit to the

Diet is revealed. It calls attention of wood materials

manufacturers like construction companies, paper and

furniture manufacturers to use legally certified wood and

sets up registration system for users of such proven wood.

However, it does not either prohibit using illegal wood or

impose penalty. It simply promotes using legally proven

wood to create environment to shutout illegal wood. It is

the law to promote using and distribution of legally proven

wood.

The government works out basic plan regarding

distribution and use of legal wood then how to confirm

legality and measures in case it is uncertain, necessary

measures in case of transfer and management of record.

Details will be stated in related ministerial ordinance of

the Ministry of Agriculture, Forestry and Fisheries, the

Ministry of Land, Infrastructure and Transport, the

Ministry of Economy, Trade and Industry.

Regarding legality, there will not be uniform standard and

wood supplied in compliance with the government law of

producing country is regarded as legal wood.

The law says one has to make every effort to use

legally

certified wood and registration system will be made for

ones which use legal wood actively and ones can advertise

as legal wood users by registration organization.

March plywood supply

March plywood supply was 486,800 cbms, 3.8% more

than March last year but this is two straight months

decline of less than 500,000 cbms because imported

plywood volume dipped below 220,000 cbms for two

consecutive months.

Meanwhile domestic softwood production recorded the

highest monthly production in March so that share of

domestic plywood surpassed the imports for two straight

months. The first quarter total of domestic production is

52% in total supply.

Imported plywood was 218,000 cbms, 6.9% less than

March last year and 0.4% less than February. Because of

depressed market of imported plywood, the importers and

wholesalers restrain from making future purchase

considerably, which reflects low import volume. This

trend seems to continue for some time.

Malaysian volume was 87,500 cbms, 17.8% less and 3.5%

more. Monthly average import from Malaysia during

September and December last year was 95,500 cbms while

the first quarter monthly volume of this year is lower at

92,000 cbms.

Indonesian volume was 69,400 cbms, 7.6% less and

10.2% less. However, the volume stays unchanged much

since average monthly volume for November and

December last year was 74,300 cbms then the first quarter

volume is 76,000 cbms.

Domestic production in March was 267,800 cbms, 14.6%

more and 7.2% more. Softwood production was 253,500

cbms, 14.6% more and 7.5% more, which is the highest

monthly production. The shipment in March was 238,100

cbms, 11% more and 1.8% more. This is the six

consecutive months with over 230,000 cbms. The

inventories are 128,400 cbms.

Plywood

Softwood plywood market was shaken by two unexpected

incidents. One is fire at Akita Plywood and

another is Kumamoto’s strong earthquake.

The largest plywood manufacturer, Akita Plywood’s

second plant burnt down by fire on April 6. Plywood

market settled down in February and March from

overexcited market and there were dumping sales in

March by wholesalers and trading firms since March is

book closing month but the mood changed all at once by

this fire and everybody rushed to secure the volume but

after a short while, calmness is back at the market.

Then came Kumamoto earthquake in 16th of April. The

quakes have been continuing even after three weeks after

the first strong one hit the area.

However, plywood plant in Kumamoto area continues

normal operation but transportation is hampered by

damaged highway system.

Since last April, which is a new fiscal year, the importers

do not accept low offers by the buyers and stick to higher

prices but the demand itself has not improved at all.

Adamant attitude of importers props up further decline of

market prices.

Tight feeling is showing up with declining inventory after

future purchase volume decreased. Supply side plywood

manufacturers continue holding aggressive attitude since

last March but are not able to increase the export prices

because orders from Japan are not so much.

New lumber mill in Myanmar

Mos Lumber Products Ltd. (Myanmar) celebrated

completion of lumber mill in April 29. This company was

established in December 2014 in Myanmar as jointventure

company with Oji Forest & Products Co., Ltd.

(Tokyo), Sumitomo Forest Singapore (subsidiary of

Sumitomo Forestry) and local furniture company, Moe

Mya Chai Co., Ltd (Myanmar)-MMC.

Oji has 54% share, Sumitomo has 26% share and MMC

has 20%. Total capital is US$2,250, 000. Function of each

company is production management and marketing of

products in Japan and overseas markets by Oji and

Sumitomo then raw materials procurement and mill

operation by MMC.

Raw material is planted rubber wood. The mill makes

lamina for laminated lumber of about 8,000 cbms a year.

Lumber is treated by pressurized wood preservative and

finished S4S. The product is used for furniture like chair

and counter top.

This is the first overseas joint venture business by both

Ojiand Sumitomo Forestry. The idea is to cooperate by

providing knowhow so synergy effect should be expected

then also contributes promotion of local employment in

Myanmar.

|