Japan

Wood Products Prices

Dollar Exchange Rates of 10th

April 2016

Japan Yen 108.60

Reports From Japan

Business confidence slips in face of

uncertainty in

global markets

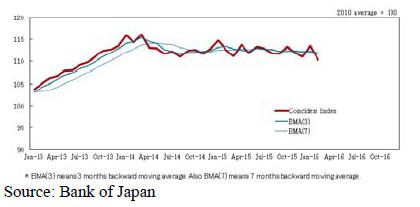

The Bank of Japan’s (BoJ) quarterly survey of business

sentiment at large sized enterprises fell sharply in the first

quarter of 2016 compared to the final quarter of 2015. The

first quarter index on sentiment amongst the large firms

was the lowest since 2013. In its report the BoJ says the

outlook by large companies was for a further fall in

confidence.

Weakness in the manufacturing sector raises the likelihood

of the BoJ further easing monetary policy, it also

underlines the fact that the adoption of negative interest

rates has not yet revived business sentiment.

Consumer confidence rebounds confounding

observers

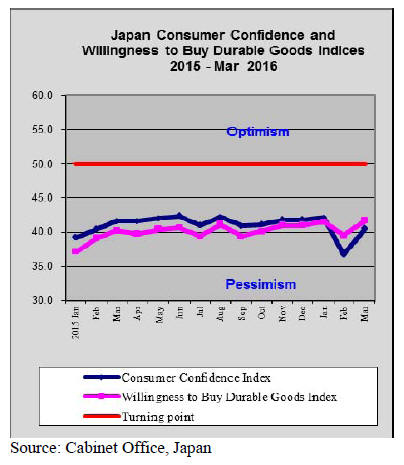

In its report on March consumer confidence the Cabinet

Office says overall sentiment rose after dropping for the

two previous quarters. This upswing came as a surprise to

most analysts.

The overall Livelihood Index improved in March from a

quarter earlier as did expectations for Income Growth

which came in at 40.6 versus 39.8 in February. The

Willingness to Buy Durable Goods index also improved

but all indices are below the threshold indicating

continued pessimism.

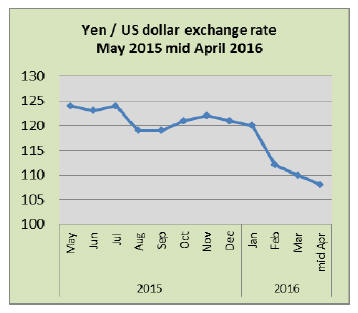

As anticipated, yen continues to strengthen

The yen has surged against the US dollar over the past

month rising to the highest level since 2014. The

strengthening of the yen has become a major challenge for

the BoJ which has, over the past 12 months, done all it

could to keep the yen at around 115 to the dollar.

The Japanese currency has gained about 11% against

the

US dollar in just 3 months and the government is

concerned that if the yen continues to strengthen the

competitiveness of Japanese exports will be undermined.

OECD ‘Territorial Review of Japan’

In early April the Secretary-General of the OECD was in

Japan to launch the OECD’s Territorial Review of Japan.

This report offers an insightful review of the challenges

and opportunities for the Japanese economy.

In a press release the OECD reports “Japan’s future

prosperity depends on its ability to tackle two substantial

and intertwined challenges: the first is demographic

change, and the second relates to productivity.

With the labour force shrinking as a share of the

total

population, output per worker will have to rise even faster

if per capita incomes are to increase. This will require

efforts to stimulate innovation and entrepreneurship and to

strengthen the international integration of the Japanese

economy.

Over the last decade, productivity performance has

improved relative to other OECD economies, but this has

been insufficient to offset the impact of demographic

change. Japan’s income per capita fell due to a number of

factors, but primarily it has been driven by a demographic

effect – the decline in the working-age share of the

population.

The share of 15-64 year olds in the total population, which

peaked at almost 70% in the early 1990s, is now about

61% and is projected to fall to around 51% at mid-century.

A rapidly shrinking labour force and a rapidly rising

dependency ratio imply that even productivity growth of

2% or more will deliver very low aggregate or per capita

growth.”

For more see:

http://www.oecd.org/about/secretary-general/launch-of-the-2016-

oecd-territorial-review-of-japan.htm

and

http://www.oecd.org/regional/regional-policy/Japan-Policy-

Highlights.pdf

Land prices in major cities surge

Every March results of the land price survey by the

Ministry of land, Infrastructure and Transport are released.

The most recent report says nationwide land prices in

Japan have risen for the first time in eight years.

The main driver of this change was the steep rise in

investments especially for accommodation for overseas

tourists. Naturally, the biggest increases in land prices

were in Tokyo and the other major cities.

In early 2016 the Bank of Japan pushed down interest

rates and this has encouraged speculative real estate

purchases. In contrast, land prices fell in most rural areas.

Overall, the report indicates that the average price

of land

nationwide rose by a mere 0.1% as the steep rise in urban

prices was pulled down by an equally sharp drop in rural

land prices.

Japan’s furniture imports

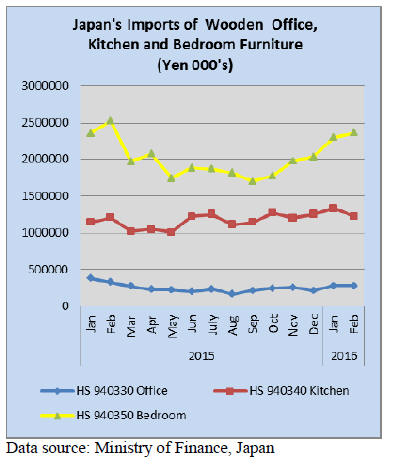

The value of Japan’s imports of wooden office, kitchen

and bedroom furniture dipped in the first half of the 2015

and then revesed direction (see graphic below).

From mid 2015 the yen value of bedroom furniture

imports steadily increased and, while not so robust,

imports of kitchen furniture edged up. Japan’s imports of

office furniture move in a narow band and 2015 saw a

steady decline in the value of imports until mid year when

a sligt up-tick was observed.

While data for January and February furniture imports are

available it is difficult to detemine any trend as imports

during this period were affected by the New Year holidays

and a genearl slowing in house building because of the

winter weather.

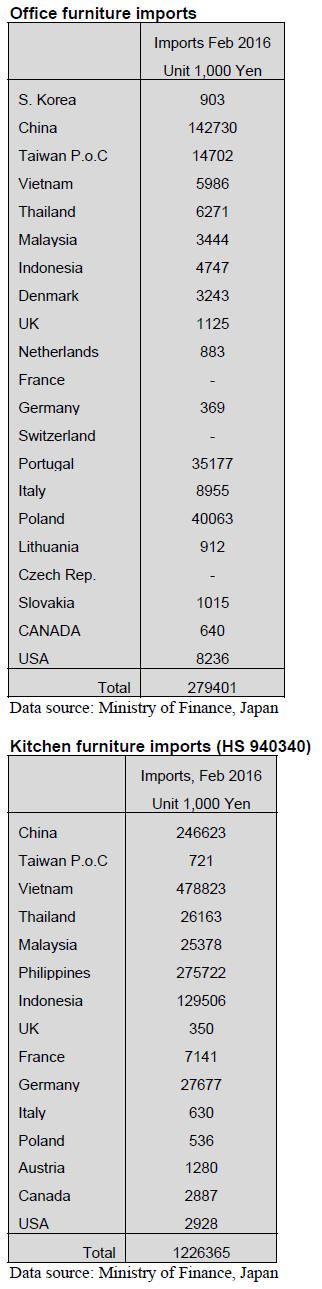

Office furniture imports (HS 940330)

Compared to January, the level of imports of office

furniture in February this year was flat. China remains as

the main supplier of office furniture to Japan accounting

for just over half of all wooden office furniture imports.

European suppliers capture a reasonable share of Japan’s

office furniture imports with Poland and Portugal being

the second and third ranked supplier to Japan.

Year on year February 2016 office furniture imports were

down 14% but the level of imports in February 2015 was

exceptionally high. Only when March statistics become

available will it be possible to discern any trend.

Kitchen furniture imports

The top four suppliers of kitchen furniture to Japan

accounted for 92% of February 2016 imports. Vietnam

alone accounted for 39% followed by the Philippines

22.5%, China 20% and Indonesia 11%.

Year on year February 2016 imports of kitchen furniture

were up slightly but compared to levels in January this

year an 8% decline was observed. Of the four main

suppliers in February Vietnam posted a 14% drop, imports

from the Philippines were flat as they were from Indonesia

and suppliers in China posted gains in February.

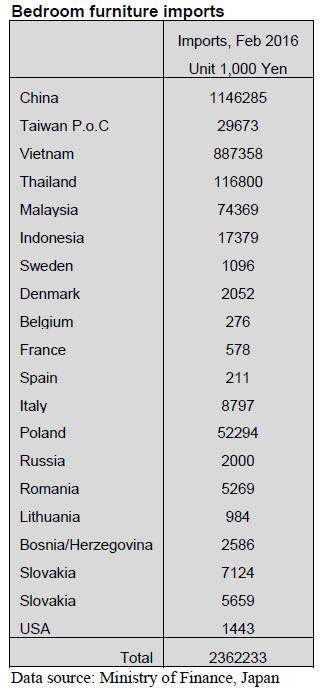

Bedroom furniture imports (HS 940350)

Japan’s imports of bedroom furniture continue to trend

higher. Since September 2015 when the turn-around in

imports became apparent until February this year Japan’s

bedroom furniture imports have risen 39%.

The top three suppliers of bedroom furniture in February

this year accounted for over 90% of all Japan’s wooden

bedroom furniture imports.

China is the main supplier at 48.5% but saw the

value of

shipments to Japan drop about 15%. Vietnam, the second

ranked supplier to Japan posted a 32% gain in February

shipment compared to a month earlier.

The third ranked supplier Thailand saw February

shipments to Japan sky-rocket by around 60%. However

Thailand only accounted for around 5% of Japan’s

February wooden bedroom furniture imports.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

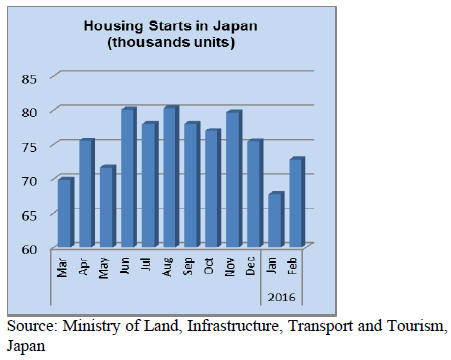

Wood demand projection for 2016

The Forestry Agency held the meeting for wood demand

projection for the first three quarter of 2016 by items and

by source. Presupposition is the consumption tax increase

would come in 2017.

According to the projection, logs, plywood and laminated

lumber would increase compared to 2015 but imported

lumber would decrease for the second and third quarter in

2016. Projection on North American logs, European

lumber, radiate pine logs and lumber from New Zealand

and Chile, imported plywood for the first half of 2016 was

revised downward from former projection made in

December last year.

Domestic logs for lumber manufacturing are expected to

increase quarter by quarter this year. For 0lywood

manufacturing, total year demand would be lower than

2015.

Total log import in 2016 from North America, South Sea,

Russia and New Zealand would increase after two years

since the first quarter of 2014.

On imported lumber, because of low operations of

precutting plants, the importers are cautious for future

purchase. Lumber from North American would decline for

the first half then climb some in the second half.

On European lumber, because of production curtailment

due to log supply tightness by major sawmills, the volume

would decline for the second and third quarter.

On radiata pine logs and lumber from New Zealand and

Chile, which is mainly used for crating lumber, by slow

demand and excessive inventories, import for the first half

would be less than 2015.

Domestic softwood plywood demand would continue

expanding for both housing and general construction so

the increase would continue through 2016.Imported

plywood would decrease in the first quarter then by active

demand for concrete forming panel and floor base, it

would increase later. Structural laminated lumber demand

would increase in every quarter but oversupply is

forecasted for the third quarter.

Forecast of housing starts by 13 think tanks average for

2015 is 909,000 units and for 2016 is 928,000 units.

Import of South Sea (tropical) logs in 2015

Import of tropical hardwood logs in 2015 was 248,100

cbms, 7.4% less than 2014. This is the lowest record ever.

Log supply from Sarawak, Malaysia considerably

decreased and the volume from Sarawak is less than

Sabah, Malaysia.

Sarawak supplied of more than six million cbms at peak

time of early 1990 then it has been declining year after

year and now it is only 89,000 cbms. In tropical hardwood

logs, 243,300 cbms came from South Sea countries then

4,800 cbms came from Africa. In South Sea sources,

Sarawak declined then Sabah increased. Other sources like

PNG and Solomon Islands increased and covered shortfall

of Sarawak.

In Malaysia, log supply is stable in Sabah while Sarawak

supply is largely affected by new regulations on illegal

harvest.

Also, India’s presence is large factor in Sarawak. India

buys about 65% of Sarawak logs. India was tired of Sky

rocketing Sarawak log price and went to PNG and

Solomon Islands then Sarawak supply sources got bearish

instantly. India has not come to Sabah yet so that the

export log prices are stable in Sabah while Sarawak

market depends on India’s purchase. For Japan, Sabah

supply can supplement Sarawak’s unstable supply.

Plywood

Busy demand for domestic softwood plywood up until last

February settled down for a time being in March but the

manufacturers ‘ inventories of structural panels are very

low at about 100,000 cbms, 0.4-0.5 months.

Some mills run on one week inventories so they are not

able to accept orders from wholesalers. Thus, the

shipments from the manufacturers are slowing but they

ship out what they produce.

Despite slow housing season in winter, orders from large

builders, which put up units built for sale, are increasing,

which keeps precutting plants busy.

With this firm demand, plywood mills reduced production

of non-structural panels in February and March to catch up

delayed orders of special length and tongue and groove

panels.

The marketers are worried about what would happen when

the demand increase sharply like last year with this low

inventories.

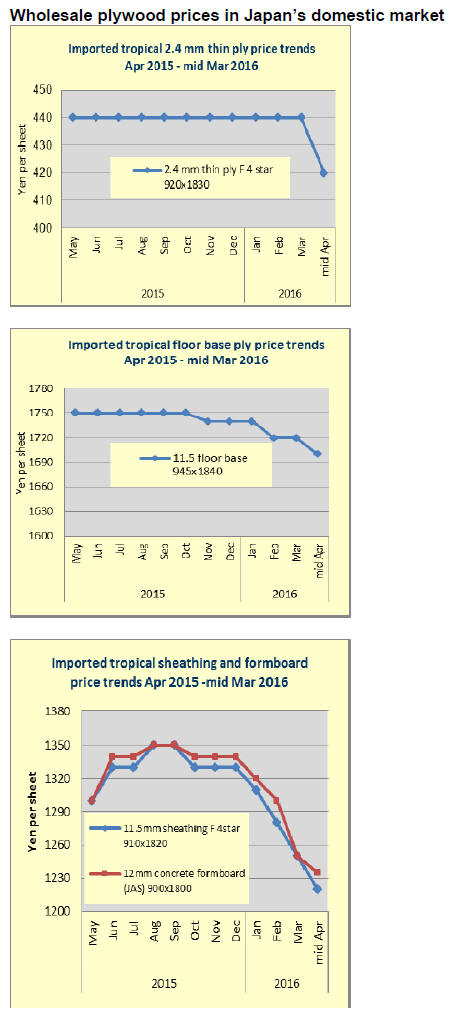

Imported plywood market shows some sign of bottoming

out. In January and February the market further dropped

by strong yen and the importers and wholesalers had to

sell for inventory disposition and maintain the sales

amount.

This was money losing business and they cannot

afford to

keep such unjust business so March was quiet month with

the importers declining to accept low purchase offers any

longer. The shipment from port warehouses has been

steady.

Importers and wholesalers on-hand inventories are low.

Meantime, the largest Malaysian supplier announced to

stop the supply for Japan for some time so it looks like

whole situation has been changing so the second quarter

may be a new ball game for this business.

Large Malaysian ply-mill to cut shipments to

Japan

Shing Yang, the largest plywood manufacturer for Japan

in Malaysia decided to stop sales of panels like concrete

forming temporarily. The reason is to restore deteriorating

market in Japan.

The president of Shing Yang commented that this may be

unusual measure to restore Japan market but the plan is to

reduce the production by 30%. The main target is to

reduce total inventories in Japan down to proper level and

the market of imported plywood gets back to normal level.

Imported plywood market in Japan has been suffering

poor demand since August last year and export prices have

kept dropping.

Total supply in 2015 was 17.3% less than 2014 but the

market stayed stagnant without seeing the bottom for more

than six months. Orders for Malaysian plywood

manufacturers are down by

about 20%. The market in Japan further deteriorated in

2016 so the orders to Malaysia dropped further.

In this shrinking market, the export prices of 3x6 JAS

coated concrete forming panel are down by about $50

compared to November last year. Fortunately Malaysian

Ringgit was weak to cover lower dollar export prices but

now Ringgit is rebounding so minor mills are suffering

loss.

The president stated that it is not reasonable thinking that

the export prices should be reduce according to Japanese

market prices and tired of looking at endless downward

spiral of Japan market, Shing Yang decided to withhold

the supply until the inventories in Japan are properly

reduced and the market improves markedly.

Plywood mills in Sarawak are facing severe log supply

shortage after one year by tight control of illegal harvest

law so cost of logs climbed considerably and it is urgent

matter to improve profitability.

Shing Yang considers shifting from limited sources of

natural grown trees to low cost planted trees then also

reviews average sales prices by looking at other markets

like India, Australia, the U.S.A., Africa and South

America.

|