Japan

Wood Products Prices

Dollar Exchange Rates of 25th

March 2016

Japan Yen 113.09

Reports From Japan

To raise the consumption tax or not?

The Japanese government has reassessed the state of the

economy and citied weakness in consumer and corporate

sentiment as undermining the progress made to-date.

Domestic weakness is exacerbated by due to uncertainty in

global markets and a slowdown in emerging economies.

The Cabinet Office, in its latest assessment, says the

economy is “on a moderate recovery, while weakness can

be seen recently,” a more negative picture than last month

when it said weakness in the economy was “in some areas

only”. The March assessment is the first downward

revision since October last year.

Over the next few months the government will decide

whether to go ahead with its 2017 increase in the

consumption tax but the Prime Minister has always said

the change will only be made if conditions are right and

that it will not go ahead if, for example, there is a

significant contraction in the global economy.

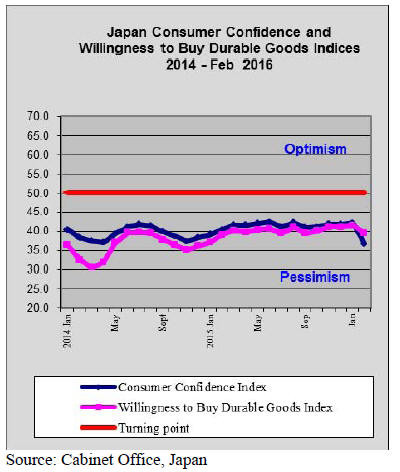

The February consumer sentiment report released by the

Cabinet Office reported a decline in the consumer

confidence index for the second straight month.

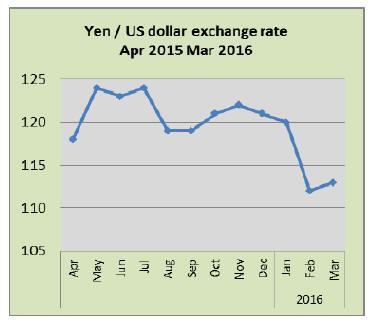

Analysts expect the yen to continue to strengthen

With little room to seriously impact the yen dollar

exchange rate the Bank of Japan (BoJ) will be looking for

the US Federal Reserve to come to its rescue with an

interest rate rise. The BoJ has the option of lowering rates

further into negative territory but experience from the

most recent dip into those waters was less than successful.

Over the past few months the yen has strengthened

significantly against the US dollar and major currencies

and analysts expect the yen to continue to strengthen.

A spike in the yen is anticipated in April when

Japanese

companies repatriate overseas earnings to close their

2015/16 books.

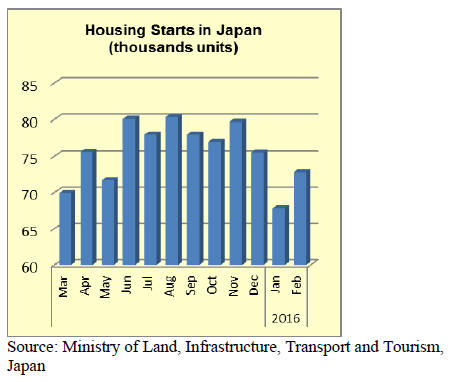

Cheap money pouring into the Japan’s housing

market

Outside of the main urban areas land prices in Japan

continue to fall, the result of urban drift and the aging

population in rural areas.

Recent data from the government shows that January 2016

prices for land in 31 of the country's 47 prefectures were

down year on year. In some areas the decline is extreme,

for example in, Akita prefecture commercial land values

are now 40% below their 2008 level.

In contrast to the situation in rural areas prices in urban

areas are rising fast as cheap money pours into the real

estate market. The extent of recent increases in

condominium prices in the main cities is making

conveniently located housing unaffordable for families.

Negative interest rates have driven down mortgage rates

and efforts by commercial banks to expand housing loans

have boosted demand for property.

Import round up

Doors

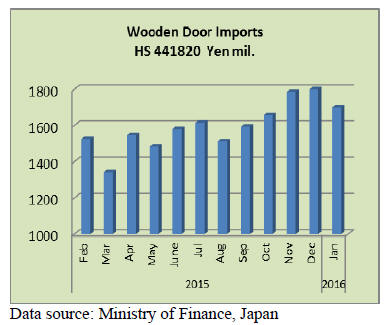

Year on year January 2016 imports of wooden doors were

up 8% but compared to December last year there was a fall

in imports.

China remains the main supplier of wooden doors to Japan

followed by the Philippines and Indonesia. These three

suppliers dominate imports of wooden doors accounting

for over 85% of all imports of doors.

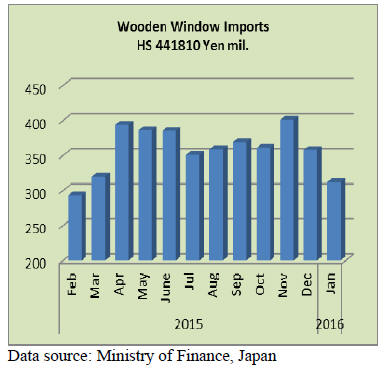

Windows

Year on year, Japan’s January 2016 wooden window

imports were slightly up but this disguises the sharp

decline in imports of windows since November 2015. In

fact, January 2016 marked the lowest point in imports

since March 2015.

As is the case with wooden doors, China is the number

one supplier accounting for almost 40% of January

imports. The other main suppliers are the Philippines

(28%) and the USA (20%). Suppliers in the EU accounted

for just over 11% of January imports.

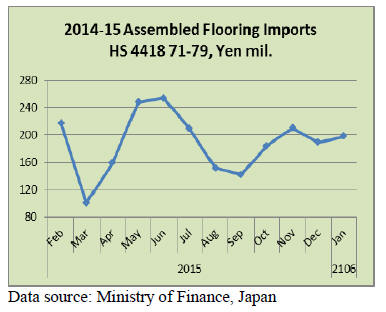

Assembled flooring

Year on year, January 2016 imports of assembled flooring

dropped 7% but were up on levels seen in December 2015.

Suppliers in Asia dominate Japan’s imports of assembled

flooring accounting for over 85% of imports. Suppliers in

the EU captured a 12% share of January 2016 imports.

Since September 2015 imports of assembled flooring have

trended higher but have not yet reached the levels recorded

in May and June last year.

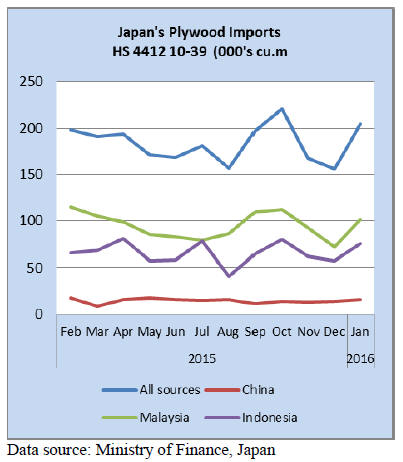

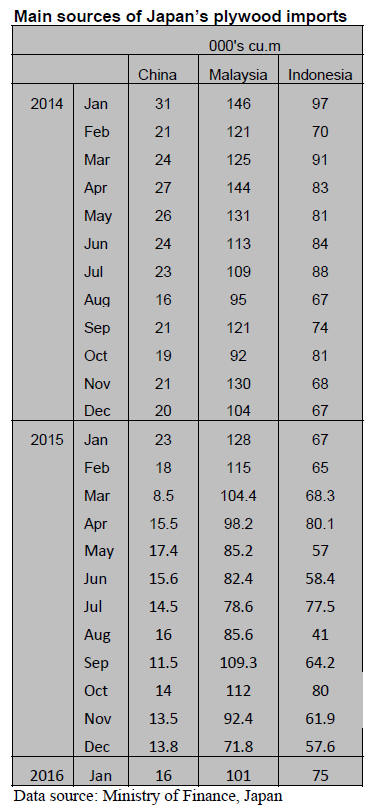

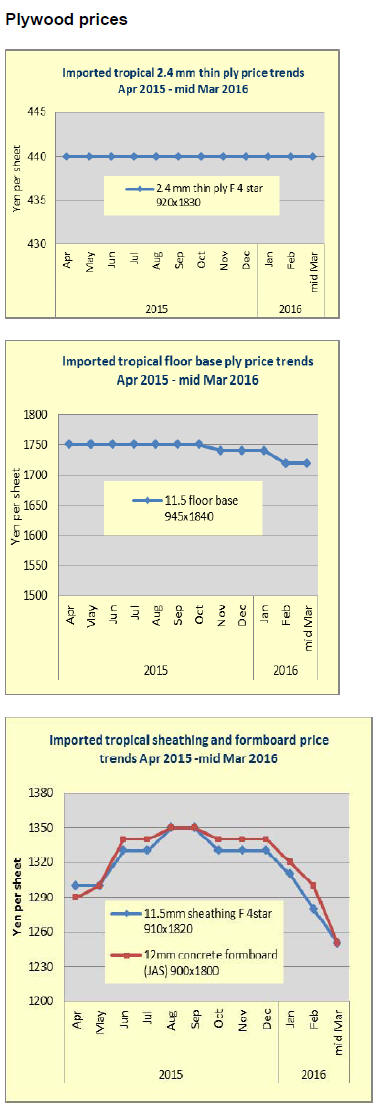

Plywood

January 2016 plywood were the second highest since

January 2015 and edged closer to the peak recorded in

October last year. But, year on year, January 2016

plywood imports were down 12% because January 2015

imports were very high.

The top three suppliers accounted for 94% of all Japan’s

January plywood imports. However, China’s shipments

dropped 30% year on year, Malaysia shipments were

down 21% in January this year but Indonesia secured an

advantage as shipments increased 12%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Business collaboration with Indonesian MDF

manufacturer

Sumisho & Mitsui Bussan Kenzai Co., Ltd. (Tokyo),

SMBK and Noda Corporation (Tokyo) concluded business

collaboration agreement with Indonesian MDF

manufacturer, IFI (Indonesia Fiberboard Industry,

Jakarta).

The agreement includes technical advice and marketing of

MDF in Japan. Two Japanese companies intend to expand

demand of MDF made of tropical hardwood species,

which has high water resistant performance. It is used for

building materials and fixtures.

IFI has MDF plant south of Jambi in Sumatra, which

started the operation in September 2012. It had been

selling the products to Indonesian domestic and

neighboring markets then it acquired JIS certification on U

type in September last year and M type in March this year

so it is ready for Japan market.

IFI’s monthly production is 20,000 cbms and three

companies aim to ship 3,000 cbms a month for Japan by

the end of 2016.

SMBK has an exclusive importing right for Japan and

Noda will market all in Japan. Noda will use MDF as base

material for its own building materials and sell it at open

market with brand name of ‘Hi Bestwood’. Noda will

market through SMBK to other building materials

companies and processing companies.

Radiata pine log and lumber import in 2015

Import of radiata pine logs and lumber in 2015

considerably decreased from 2014 because demand for

crating lumber and pallet remained sluggish despite weak

yen of about 120 yen per dollar.

Imports of New Zealand radiata pine logs was 421,850

cbms, 20.2% less than 2014 and radiata pine lumber was

75,936 cbms, 10.5% less. Chilean radiata pine lumber

import was 222,353 cbms, 14.3% less.

Weak yen should be favorable factor for export industry of

Japan but there was difference by items. Particularly,

export for China dropped by dwindling Chinese economy

then export for neighboring countries like Korea, Thailand

and Philippines, which were also influenced by slowdown

of China market, also dropped, which impacted overall

demand of crating lumber.

Because of slump of crating lumber demand, radiate pine

sawmills in Japan reduced the production by about 20%,

which resulted in lower demand for radiata pine logs.

Chilean radiata pine suppliers planned eight shipments to

Japan in 2015 but the last one delayed into this year to

become the first shipment of 2016.

In 2014, demand for the U.S.A, and China was very active

so that Chilean sawmills operated in full but in 2015,

Chilean sawmills reduced the production because China

demand slowed down and competition with European

lumber in the Middle East market got fierce.

By worldwide retreat of the demand, Chilean lumber

supply has more room so that the export prices have been

revised downward, trying to take market share back,

which Chilean lost in competition with Japanese radiata

pine sawmills. Radiata pine crating lumber competes with

domestic larch and cedar crating lumber.

South Sea (tropical) logs

In Sabah and Sarawak, Malaysia, log harvest and

transportation were temporarily disrupted by the Chinese

New Year in February so price negotiations stopped since

late January then the business resumed since late February.

Log procurement was difficult since late last year

through

late January. Particularly, supply of large logs with

diameter of more than 60 centimeter, which Japan market

looks for, has been tight. Unless combining with small and

super small logs, it is impossible to have necessary

volume. Japanese users would rather pay higher prices for

quality regular logs as recovery and production efficiency

are better.

Despite lower log production, the log suppliers sales

attitude is not bullish because India, the largest log buyer,

has been absent since last December so the export log

prices are unchanged from last month.

Log supply in Sarawak is limited by new restriction of

monthly harvest. Even if harvest exceeds allowed monthly

volume, carryover to next month is not allowed by law so

the suppliers limit the harvest about 90% of allowable

volume.

In Sabah, some supplier has acquired new timber tract,

which produces about 1,500-2,000 cbms of logs for Japan.

Present export prices are US$265-275 per cbm FOB on

Sarawak meranti regular, US$245 on small and US$230

on super small. They are all weakly holding.

Toyo Materia markets 100% FSC certified plywood

Toyo Materia (Tokyo) announced that it will start selling

100% FSC certified coated concrete forming plywood

since this month.

This is the first time to have 100% certified plywood of

tropical hardwood. Toyo Materia has been importing

certified plywood since 2008 about 1,500 cbms a month.

The supplying company is Intracawood Manufacturing of

Indonesia. This company uses logs from FSC certified

timberland of 195,000 hectares. Coating is done by Sen-ei

Co., Ltd. (Kishiwada, Osaka prefecture). Oil urethane

coating is done four times. Color is olive green, which is

different from other coated concrete forming panels.

Monthly production is 30,000 sheets.

FSC.COC project chain is certified including Sen-ei so

that distribution channel to final shipment is certified.

Each sheet has FSC certified stamp on the back so it is

easily acknowledged. Domestic coating is convenient for

users by easy delivery.

Specifications on export lumber to be made

The Japan Wood Products Export Association has set up a

committee to make up specifications of lumber exported

for other countries. It also plans to have a permanent

display ‘Japan Wood Station’ in Vietnam, where all kind

of Japanese wood products are exhibited. This is to

develop the market in Vietnam.

Wood products export in 2015 was 26.3 billion yen,

24.8% more than 2014. Initial target was 25 billion yen by

2020 so the target has already been achieved way ahead of

time. In this, logs were 690,000 cbms, 32.7% more then

lumber was 60,000 cbms, 10.6% less. In order to increase

lumber export, the committee will prepare export

specifications on lumber such as quality and sizes.

China and Taiwan are two major target. The export

specifications is voluntary system but the main objective is

to give more reliability of Japanese made lumber in

foreign markets.

In the past, the main markets were China, Korea and

Taiwan. Now Vietnam is another target so the exhibition

of wood products should advertise to use Japanese lumber.

Vietnam has large whitewood furniture processing

industry for export so there should be ample demand of

Japanese softwood such as cedar and cypress, which are

used for export furniture to the U.S.A. and European

countries then also for interior finishing materials for

Vietnamese housing.

The Association is also considering to invite Vietnamese

furniture manufacturers to Japan to show what type of

material Japan can supply For Taiwan, the main item is

logs but in future, target is to develop demand for

plywood, LVL for window and door frame. Also Taiwan

is active in exporting furniture so it will investigate to see

if Japanese wood can be used for furniture manufacturing.

|