2. GHANA

Joint Team Review Ghana Timber Trade

Agreement

The Government of Ghana and the European Union (EU)

recently met in Accra to review progress towards

implementation of the Voluntary Partnership Agreement

(VPA).

The Ghana-EU VPA Joint Monitoring and Review

Mechanism (JMRM), which included representatives of

stakeholder groups, was tasked to oversee implementation

of the agreement.

The JMRM reviewed the status of development of Ghana's

timber legality assurance system and also discussed

outstanding issues to be addressed in the joint action plan,

the last step before ratification of the agreement and the

start of FLEGT licensing.

Speaking to the media the Minister of Lands and Natural

Resources, Mr. Nii Osa Mills, said when the FLEGT

licenses are issued Ghana's timber products would enter

the European market without the EU importers having to

comply with the due diligence obligations of the EU

Timber Regulation.

According to the Minister, the country has made progress

in forest governance by clarifying its forest management

plans and improving transparency which has brought

Ghana closer to licensing and easier access to the EU

market. The development of the national timber legality

assurance system would also help Ghana resolve legality

issues in the domestic market.

To track progress in the national timber legality assurance

system, the JMRM decided to meet in August for the next

assessment. Ghana signed the VPA with the EU in 2009

aiming to ensure verified legal wood products are

produced for export and the domestic market.

The issue of legality is of particular importance in the

domestic market where large volumes of illegally sourced

and chainsawn timber are sold.

UNIDO training for Timber and Furniture Lab

UNIDO recently concluded a training programme for staff

at Ghana¡¯s Timber and Furniture Laboratory in the

Forestry Research Institute. The training focused on

building capacity for ISO/IEC 17025 certification. This

training programme was supported by UNIDO¡¯s ¡®Trade

Capacity Building Programme.

Mr Victor Mills, the National Project Coordinator for

UNIDO, said the training at the Forestry Research Institute

was part of a series of events for all agencies and

institutions to assist them meet international market

demands.

Forestry Research Institute of Ghana (previously named

the Forest Products Research Institute) is located at

Fumesua near Kumasi in the Ashanti Region of Ghana.

Forestry Commission needs better resources to

protect forests

Samuel Afari Dartey, Chief Executive Officer of the

Forestry Commission of Ghana, said during Forestry Day

celebrations his organization is in dire need of more

trained personnel and better logistics. He said if the

Commission is to meet the demands of government in

protecting the country¡¯s forests it need more resources.

According to the Forestry Commission in Ghana the 293

forest reserves covering an area of 2.4 million hectares and

the 23 wildlife protection areas (about 1.34 million

hectares) serve as important watersheds and in some cases

headwaters of important rivers.

Mr. Darty reported that Ghana is losing large areas of

forest to un authorised bush burning, illegal mining and

unauthorized settlements.

Mr. Dartey mentioned the adoption and implementation of

a new Forest and Wildlife Policy-2012, the national forest

plantation programme, the Voluntary Partnership

Agreement (VPA) and Forest Investment Programme

(FIP) as some initiatives that have already been launched

to reverse the trend of deforestation and land degradation.

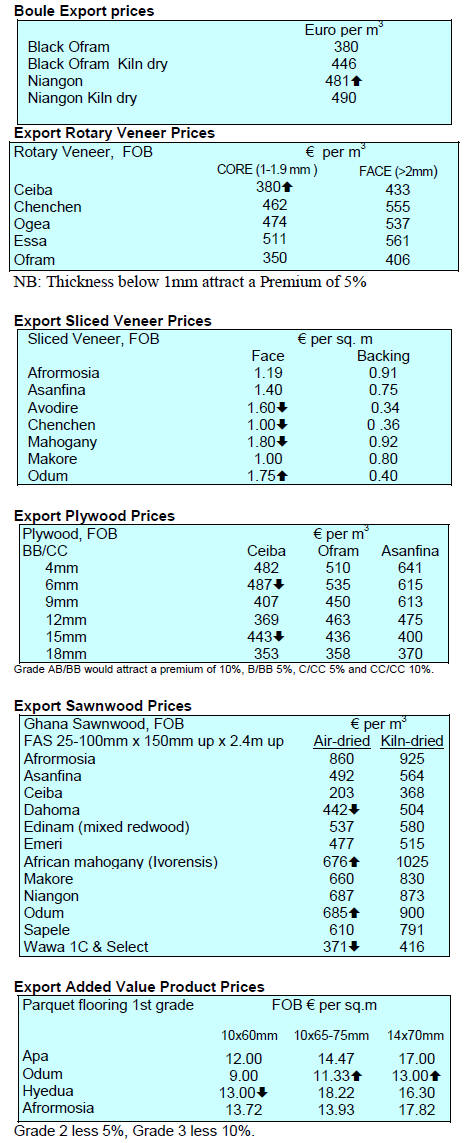

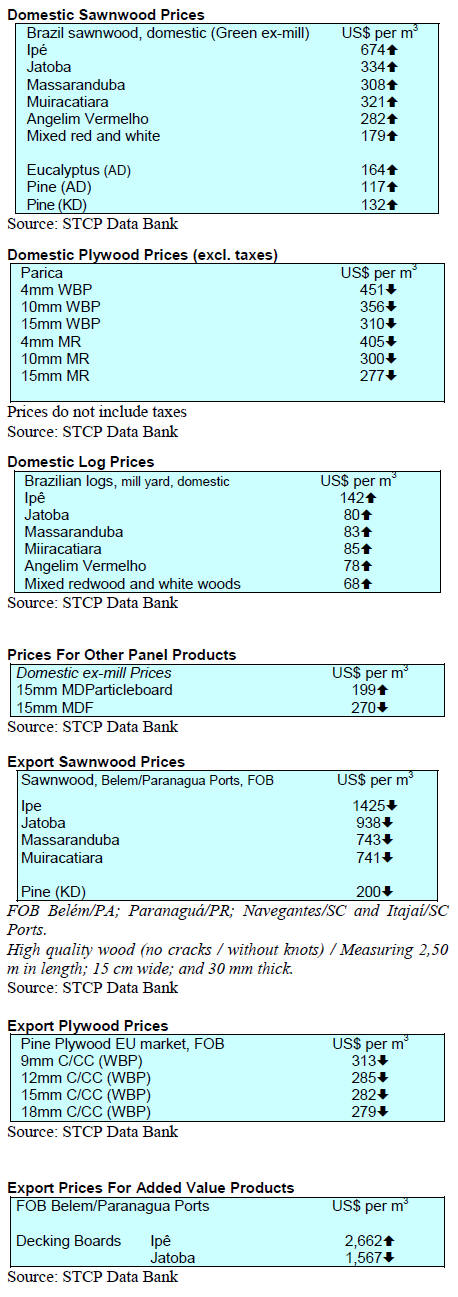

March prices

Prices for wood products remained unchanged as of 30

January.

3. MALAYSIA

Regional markets to be foundation

of 2016 exports

The Malaysian Timber Council (MTC) is optimistic of

maintaining the momentum in wood product exports this

year despite global challenges.

MTC Chief Executive, Dr. Abdul Rahim Nik, revealed

that Malaysia¡¯s 2015 exports of sawnwood, plywood,

veneer and furniture increased 6.5% year on year to

around US$5.5 billion.

Furniture exports alone increased 14% last year and

overall, the timber sector provided just over 18% to total

exports earnings in the commodity sector. Rahim said the

outlook for the industry was quite positive, especially in

terms of the opportunities for sales within the region. India

is a market with huge potential as is the furniture market in

China.

To capture the opportunities in these markets Rahim said

¡°Continued growth and progress are largely dependent

upon industry¡¯s ability to shift from the current

manufacturing-based mind-set to one that is more

innovation centric, providing more value-added products

to international markets¡±.

Japan, the major market for Sarawak wood products

The value of Sarawak¡¯s 2015 timber exports fell 9% to

RM6.6 billion compared to RM7.2 billion in 2014. Export

earnings for the first two months of 2016 are also trending

lower.

The State Minister of Resource Planning and

Environment, Awang Tengah Ali Hasan, reported that

only sawnwood exports have held up with all other

products posting losses. To-date products that contributed

most to 2016 export earnings were plywood (48%), logs

(27%) and sawn timber (12%).

In the first two months of the year Japan continues to be

the major market accounting for 36 % (RM373 million) of

total wood product exports. Other markets included India

(21%), Taiwan P.o.C (9%), Middle East countries (9%),

Korea (8%), the Philippines (6%), Vietnam (3%) and

Thailand (2%).

Efforts to combat illegal logging in Sarawak have been

intensified. The Chief Minister, quoting official statistics

for the period 2009 ¨C 2014, said that the volume of illegal

logs seized was less than 1% of total log production and

that none of the main logging companies had been found

to be logging illegally.

Sarawak plywood prices

Plywood Traders in Sarawak reported the following export

prices:

Floor base FB (11.5mm) US$580/cu.m FOB

Concrete formboard panels CP (3¡¯ x 6¡¯)

US$500/cu.m FOB

Coated formboard panels UCP (3¡¯ x 6¡¯)

US$580/cu.m FOB

Standard panels

S Korea (9mm and up) US$390/cu.m FOB

Taiwan P.o.C (9mm and up) US$400/cu.m FOB

Hong Kong US$400 FOB/cu.m

Middle East US$380/cu.m FOB

4. INDONESIA

Calls for support to aid industry

upgrading

Furniture and craft enterprises have alerted government of

a looming crisis, a serious shortage of skilled technicians

for the sectors. Spokespersons from the two sectors have

urged government to offer support to companies so that

they can fully meet export targets.

The Secretary General of the Indonesia Rattan Furniture

and Craft Association (AMKRI) said expanded training

facilities and support for enterprises as they upgrade their

technologies and management are essential to ensure

growth of the industry. Last year furniture exports were

almost US$2 billion, just a fraction of the estimated

US$140 billion global furniture market.

The International Furniture Expo (IFEX) 2016 has just

concluded and this year Indonesian manufacturers secured

orders worth around US$325 million.

Rebound in exports welcomed

According to Indonesia¡¯s Central Statistics Agency (BPS),

compared to a month earlier Indonesia¡¯s February 2016

exports to Japan rose by 5.3% and exports to China

increased 6.6%.

The Head of the BPS reported that exports to Japan and

China have improved significantly with 17 of Indonesia¡¯s

24 export commodities recording an increase in February.

In addition to wood products, Indonesia¡¯s commodity

exports to the US, Japan and China included textiles,

electronics, rubber products, palm oil, footwear,

automotive products as well as fishery and agricultural

products.

Legality verification opens way to expanded exports

Speaking at IFEX 2016, Agus Justianto of the Ministry of

Environment and Forestry, said his Ministry appreciated

the commitment of the EU and other countries in

combating the trade in illegal timber. These efforts, he

said, have created new opportunities for through the

national SVLK increase exports.

In support of the statement by the Ministry spokesperson,

Maria Murliantini, a handicraft manufacturer and exporter

said her company had seen an increase in trade and in

profits since the company secured SVLK certification.

New opportunities had opened up for the company in

Germany, France, Australia, the United States and

Sweden.

Forest fires in Jambi intentional

The Governor of Jambi province in Central Sumatra has

said almost all forest fires in the province were

intentionally started as a means to clear land for

agriculture.

Fire control efforts by provincial authorities include

sending trained staff to fight fires and also calling on

volunteers to extinguish the fires. The province has banned

slash-and-burn methods used by farmers to clear land and

will cancel operating licenses for companies found guilty

of starting fires to clear land.

5. MYANMAR

U Ohn Win named forestry minister

The incoming administration in Myanmar has announced

the number of ministries will be cut from 36 to 21. The

Ministry of Environmental Conservation and Forests and

the Ministry of Mines are to be merged as the Ministry of

Resources and Environmental Conservation.

The former Deputy Rector of the Institute of Forestry, U

Ohn Win, has been named Minister. Private sector

spokespersons have welcomed the merging of two

ministries saying there had been times when there was a

conflict of interests between the two ministries. Win¡¯s

appointment has also been greeted by forestry personnel as

this will be the first time for decades that the ministry is

headed by someone with a forestry background.

U Ohn Win was once a professor at the University of

Forestry, Yezin. He received his Master of Science in

watershed management from Colorado State University

and has special interests in research management,

hydrology, watershed and soil conservation, climate

change adaptation and bio diversity conservation. Before

his appointment he was on the advisory board of

the Myanmar Institute for Integrated Development, a nonprofit

organisation.

MTE to get new General Manager

In a related development, analysts in Myanmar anticipate

an experienced General Manager of the Myanma Timber

Enterprise (MTE), also a Forestry graduate, will be

appointed as Managing Director of the organisation.

MTE is a state-owned institution which has sole

authority

to harvest and extract logs in Myanmar. Since 1988 the

military commanded MTE.

Appointments suggest significant policy shift

Analysts point to these appointments as indicative of a

significant in policy towards forest conservation and this

has raised concern in the timber sector. One manufacturer

said that although environmental conservation is of

importance for the country there needs to be a balanced

approach between conservation and sustainable utilisation.

The fear in the industry is that the new administration

could impose a logging ban given the high media coverage

of illegal logging, deforestation and forest degradation.

The domestic newspaper, Weekly Eleven, has reported the

out-going administration allowed the extraction of 700,000

tons of teak and hardwood logs during the 2014 financial

year. The highest recorded harvest was in 2011 when 2.3

million tons were extracted.

An article in the Voice Newspaper is advising a ban on

teak extraction as past harvests were unsustainable. The

article says more than 5 million tons of teak logs were

harvested between 1996 to 2015 while the permitted cut

for the period was only 3.38 million tons.

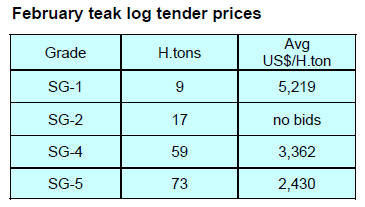

Data in the article illustrates that while there has been a

steady rise in harvest volumes this was accompanied by a

fall in average prices.

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for February fell to 174.0 from

175.7 in January. The year on year annual rate of inflation,

based on monthly WPI, stood at ¨C0.91% (provisional) in

February 2016 compared to -0.90% in January.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

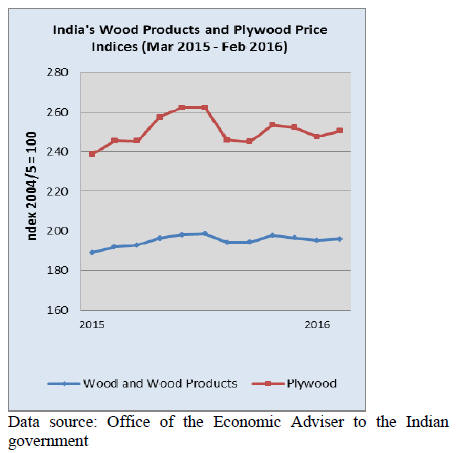

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

Foreign investment in construction sector

welcomed

The construction sector is included in the list of sectors for

which the Indian government wishes to attract foreign

investment.

The Invest-India website ( http://investindia.gov.in/) has

the following to say.

¡°The Government of India is in the process of launching a

new urban development mission. This will help develop

500 cities, which include cities with a population of more

than 100,000 and some cities of religious and tourist

importance. These cities will be supported and encouraged

to harness private capital and expertise through Public

Private Partnerships (PPPs), to holster their infrastructure

and services in the next 10 years.

To provide quality urban services on a sustainable basis in

Indian cities, the need of the hour is that urban local

bodies (ULBs) enter into partnership agreements with

foreign players, either through joint ventures, private

sector partners or through other models.¡±

A data snapshot indicates that:

US$ 1 Trillion investments for

infrastructure

US$ 1 Trillion investments for

infrastructure

sector are projected during 2012-17.

US$ 650 Billion investments

in urban

US$ 650 Billion investments

in urban

infrastructure are estimated over next 20 years.

100% Foreign Direct

Investment (FDI) is

100% Foreign Direct

Investment (FDI) is

permitted through the automatic route for

townships, cities.

The construction sector contributes 8% of

the

The construction sector contributes 8% of

the

Indian GDP (at constant prices).

For more see:

http://www.makeinindia.com/sector/construction/

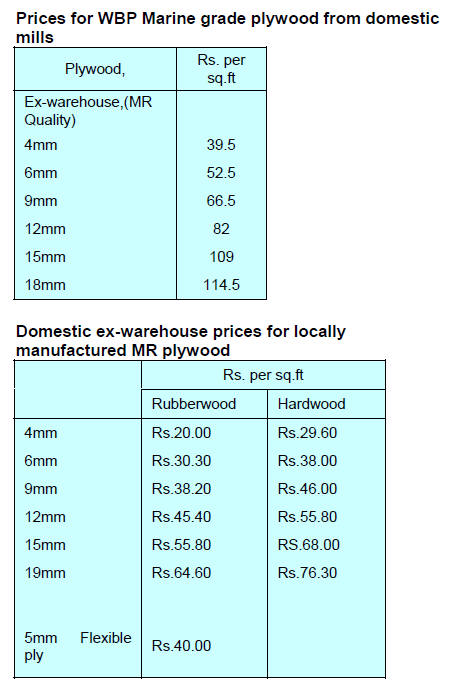

Plywood and particleboard losing market share to

alternatives

Rising prices for logs and process chemicals and the

continual shortage of labour are creating problems for

plywood and particleboard industries which have found

they are losing market share to MDF, HDF and WPC

(Wood Plastic Composite) boards.

Composite panels are finding wider acceptance in the

more sophisticated urban markets and are slowly eating

away at the market share held by plywood and

particleboard.

Pre-laminated particleboard and MDF panels are finding a

ready market as they are perceived as elegant and less

expensive than plywood. Plywood and particleboard

manufacturers were slow to embrace overlay lamination.

Because of this new enterprises spank up to buy raw

boards from the manufacturers and apply laminates but

this depended on finding skilled craftsmen to apply

laminates but now many such craftsmen have migrated to

Middle East and African countries attracted by higher

wages.

Today, many board manufacturers have invested in

laminating and sell ready to use panels to furniture and

flush door manufacturers. Board manufacturers without

laminating capacity now face marketing problems.

WPC boards are gaining popularity as they are strong and

water resistance and can be manufactured from a wide

range of residues. WPC boards are not only cheaper than

conventional panels but are suitable for a wide range of

enduses.

South Dangs log auction prices

Auctions in the South Dangs depots have been concluded.

Many log lots unsold from the previous auction because

buyers were unhappy at the high prices were on offer once

more.

Also on offer were some older logs so average prices

dipped. Over 10,000 cubic metres were sold. The range of

prices secured is shown below.

Good quality non-teak hardwood logs, 3 to 4 meters

long

having girths 91cms and up of haldu (Adina cordifolia),

Laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium logs fetched prices

in the range of Rs.600-700. Prices for medium quality logs

were in the range of Rs.350-450 per c.ft.

After a break of about six months sales were also held at

the Surat, Vyara and Rajpipla depots. Around 3,000 cubic

metres of logs were sold and prices were in the same

region as for those sold in South Dangs.

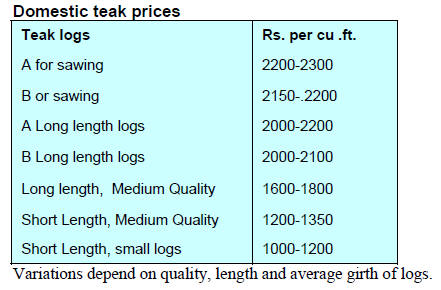

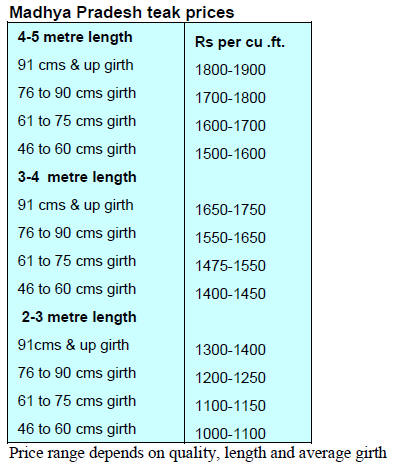

Special teak quality in Madhya Pradesh

Deliveries of teak logs to all depots of Madhya Pradesh

have been completed. Teak logs in this area are mainly in

2 to 5 metre lengths and mostly in girth class 120 cm and

below.

Logs from this area are generally straight and cylindrical

and the wood has a fine golden colour with black stripes.

The latest auctions were held at depots in Narmadanagar,

Timarni Khirakiya, and Ashapur and around 3,000 cubic

metres of teak logs were sold.

Bidders were mostly from local mills plus merchants from

Gujarat and South India. Prices realized at the recent

auction were higher than at earlier auctions.

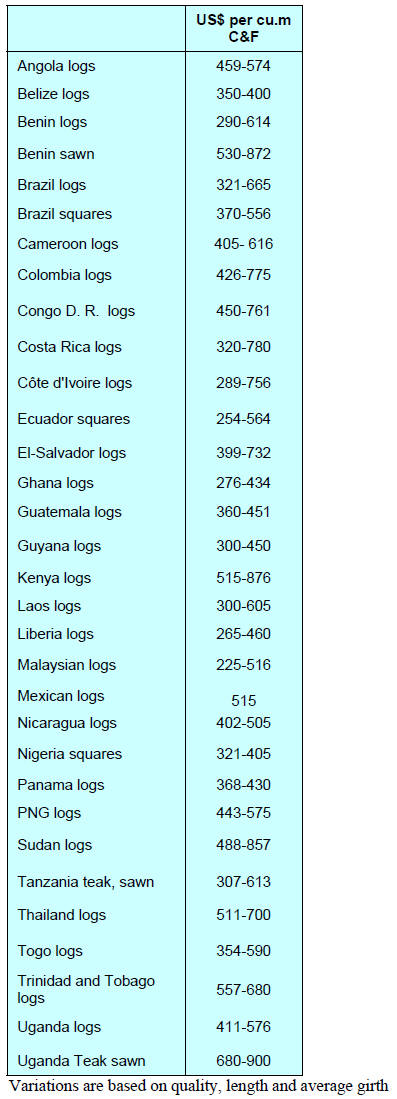

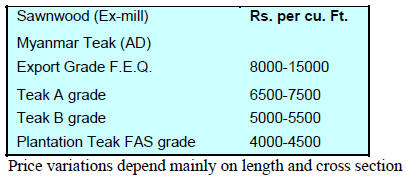

Imported plantation teak prices

Supply and demand in India for plantation teak remains

balanced such that, except for price changes reflecting log

dimensions, the market and prices remain stable.

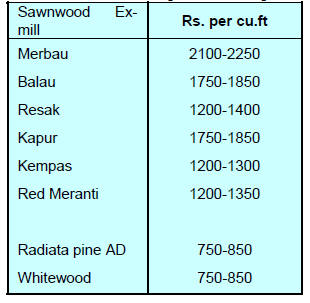

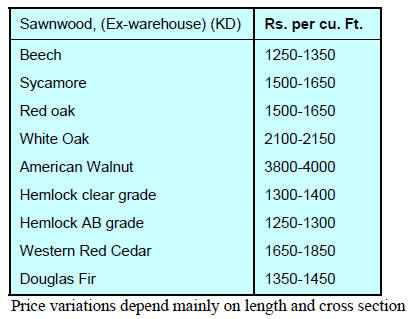

Prices for locally sawn hardwoods

As log prices rose many importers switched to importing

sawnwood which has stablised prices. But many local

sawmills which depend on imported logs are finding it

increasingly difficult to source logs at prices which allow

them to mill and compete with imported sawnwood.

Myanmar teak flitches resawn in India

Imports of sawnwood and flitches from Myanmar are

helping maintain saleable stocks of Myanmar teak. There

has been an upwards movement in prices for some

specifications.

Prices for imported sawnwood

Prices remain unchanged from two weeks earlier.

¡¡

7.

BRAZIL

Domestic economic crisis affecting timber

industry

The Wood Trade Brazil - Lignum Brazil Fair promoted by

the Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI), the Federation of Industries

of Paran¨¢ State (FIEP) and Malinovsky Events was held in

Curitiba early March. This brought together

representatives of the timber industry, log producers and

professionals involved in the wood supply chain.

During the event the state of the Brazilian economy and its

effect on the timber industry was discussed. The consensus

was that negative domestic economic growth is

diminishing opportunities in the domestic market and that,

to survive, industry must seek alternative markets.

At the beginning of this decade the timber industries in

Brazil were operating in a favourable economic climate

but this did not last and the sector soon began to

experience great difficulties to the point that output and

sales fell. In 2015 the timber industry saw production drop

by almost 5%.

As the situation deteriorated there was a fall in sector

employment but this was less so in the sawmilling sector

than in manufacturing. In respect of exports, although

volumes sales rose, prices dropped however, the impact on

the profitability of Brazilian companies was cushioned by

the weakening real against the dollar. Speakers at the Fair

concluded that throughout 2016 the lack of confidence and

rising uncertainty will remain intense.

According to the ABIMCI presentation during the Fair,

resumption of activity in the North American construction

sector should have a positive impact on Brazilian wood

product exporters. In addition, in other markets such as

Mexico as well as some African and Middle Eastern

countries demand remains firm. Even in Europe there is a

steady demand for Brazilian wood products especially

pine plywood.

Brazil has an advantage over some competitors in the

European market as ocean freight charges are low.

Brazilian exporters also benefit from good, long term

relationships and partnership with companies in Europe.

Such partnerships are the foundation for development of

new products such as cross laminated timber and other

prefabricated wood products for the EU market.

New regulation aimed to stem illegal logging

The National Environment Council (CONAMA) has

approved a resolution which strengthens rules for

transportation and processing of timber harvested in the

Amazon. Among other measures the volumetric log

conversion factor for sawmills will be reduced from 45%

to 35%.

CONAMA has reported that there is evidence that over 1

million cubic metres of logs are illegally harvested

annually and that its new measures are to promote

competitiveness and technological innovation in the

timber sector.

It is reported that mills have 12 months to establish

measurement procedures for implementation of the new

conversion factor. Sawmills that secure a volumetric yield

above 35% would need to provide evidence as to how they

achieved a high conversion rate.

Sawmills that have a documented record of above average

yields prior to the coming into force of the new regulation

will not have to provide additional evidence.

According to the Brazilian Institute for Environment and

Renewable Natural Resources (IBAMA) and the Brazilian

Forest Service (SFB), based on technical and scientific

studies and field work, the basis for deciding the new

conversion factor is unsound and the issue should be

examined further in consultation with the private sector.

Export volumes up, export values fall

In February 2016 Brazilian exports of wood-based

products (except pulp and paper) fell slightly (-0.8%) in

value compared to February 2015, from US$213.6 million

to US$211.8 million.

Year on year February pine sawnwood export values rose

by 63%, from US$16.8 million to US$ 27.4 million at the

same time export volumes rose over 95% from 71,400 to

140,900 cu.m.

Tropical sawnwood exports in February 2016

increased

13.2% from 24,200 cu.m in February 2015 to 27,400 cu.m

but export earnings fell almost 14% from US$ 13.7

million in February last year to just US$11.8 million this

February.

Pine plywood exports in February were down 4.2% year

on year in value from US$35.9 million to US$34.4

million. However, export volumes were up almost 40%

from 95,600 cu.m to 132,800 cu.m during the same period.

As for tropical plywood, export volumes in February rose

sharply year on year, from 7,600 cu.m in February 2015 to

11,000 cu.m. In contrast to other export products above,

the value of tropical plywood exports rose 7.5%.

Wooden furniture exporters did well in February

increasing sales from US$32.6 million in February 2015 to

US$34.1 million in February 2016, an almost 5% increase.

Timber industry takes advantage of falling real to

increase exports

With the recovery in export volumes the timber industry is

one of the few segments of the Paran¨¢ state industry that

managed to close 2015 in a good position. According to

the Federation of Industries of Paran¨¢ State (FIEP), wood

product sales increased by around 5% in 2015 in contrast

to the -8% decline for the overall industrial sector in the

state.

According to ABIMCI, 2015 wood product export values

topped US$90 million, the highest recorded since the 2008

crisis and 1.9% higher than in 2014.

Among the products that performed well was pine

sawnwood rising 31% for the year to a total of 1,304

million cubic metres. Other products which did well were

doors which recorded an 8% increase.

While export have held up reasonably well, the domestic

market especially the construction, furniture and

packaging sector have been affected by the domestic

political and economic crisis.

With the slowdown in the domestic economy and without

short-term recovery prospects, ABIMCI forecasts that in

2016 the timber industry will turn even more to the

international market. According to ABIMCI, this trend

generated oversupply of products for overseas market and

falling US dollar prices, damaging the entire segment.

In addition to the downturn in the domestic market and

dropping prices in US currency, producers were affected

by production costs. If it was not for these factors, the state

could further expand its participation in international trade

in wood products.

¡¡

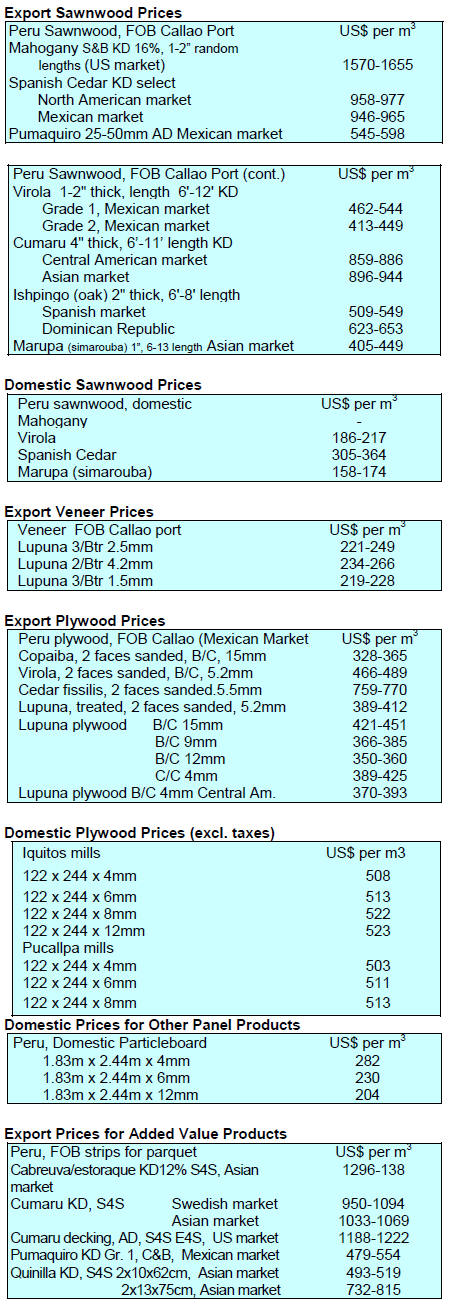

8. PERU

Peru¡¯s timber exports concentrated in

three markets

According to a report from the Association of Exporters

(ADEX) 75% of Peru¡¯s 2015 exports of wood products go

to three destinations: China, Mexico and the US. This

concentration is due to several factors, such as trade

agreements, market size and ease of access. These three

markets say ADEX are primarily interested in raw

materials rather than finished products and in the US such

products benefit from lower tariffs.

The head of the commercial intelligence unit in ADEX,

Marcel Ramirez, has said that despite having a wide range

of species available the current export trade pattern does

not encourage investment in downstream manufacturing.

The Chairman of Wood and Wood Industry division in

ADEX, Erik Fischer, has said there are many direct and

indirect barriers holding back production and export of

finished products.

One of the major concerns in international markets is the

issue of legality verification and in the respect Fisher said

that a robust legality verification scheme is required and

that this should be a joint effort between the government

and private sector. He commented that the recent

proposals from SERFOR (Servicio Nacional Forestal y de

Fauna Silvestre) should be discussed further in

cooperation with the private sector.

Road map for the forestry sector

According to Peru¡¯s Ministry of Labour and Employment

(PETM) enhancing the competitiveness of timber forest

sector depends on investment in raising productivity

through training and new technologies. PETM along with

the Center for Technological Innovation in Wood Products

(CITEmadera) recently met to outline such a roadmap.

The aim of the roadmap is to support coordination and

joint efforts by the private enterprise and SERFOR and has

four key elements; forest management, plantations,

Primary transformation and secondary processing.

Astrid Sanchez Falero, Director General of Vocational

Training and Job Training (PETM) said this initiative is an

important step for the forestry sector and she welcomes the

commitment of the private sector in the development of

the roadmap.

Community exports of certified timber

A press release from SERIFOR reports that six indigenous

native communities in Ucayali have just exported certified

wood products to the US. The communities involved are

in Caller¨ªa, Roya, Junin Pablo, Buenos Aires, New Loreto

and Pueblo Nuevo and they secured FSC forest

certification.

For more see: http://www.serfor.gob.pe/noticias/realizanprimera-

exportacion-de-madera-certificada-procedente-debosques-

de-comunidades-nativas-de-ucayali/

NA

NA