|

Report from

North America

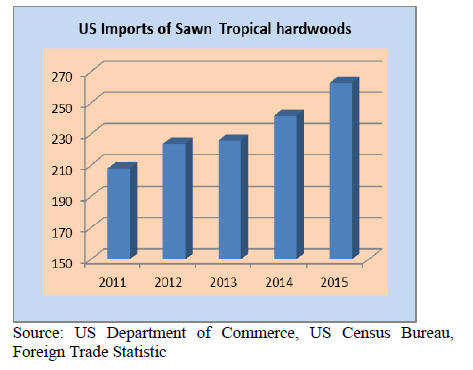

US imports of tropical sawnwood rise further in 2015

The volume of sawn tropical hardwood imports increased

9% in 2015 to 263,022 cu.m. valued at US$289.9 million.

The share of tropical sawnwood in total US hardwood

imports was 23% in 2015, unchanged from the previous

year.

In 2013 the tropical share was 27%, but the volume of

tropical imports was lower than in 2015.

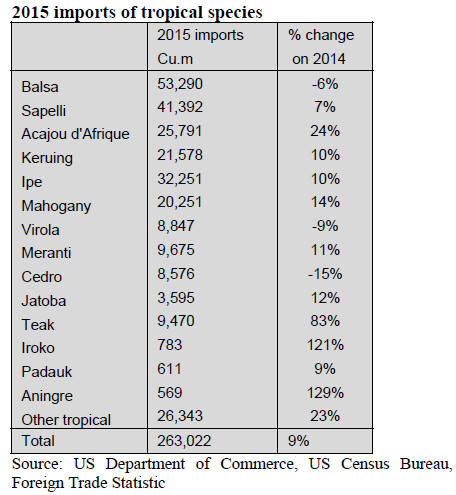

Imports of most species grew in 2015 with the exception

of balsa, virola and cedro. Balsa remained the most

significant imported species at 53,290 cu.m. but the

volume was 6% below 2014.

Imports of sapelli sawnwood grew 7% in 2015 to 41,392

cu.m., following a 23% increase in 2014. In third place

was ipe at 32,251 cu.m., up 10% from 2014.

Imports of acajou d¡¯Afrique sawnwood declined in 2014,

but in 2015 imports increased 24% to 25,791 cu.m.

Imports of keruing were 21,578 cu.m. in 2015, up 10%

from 2014. Mahogany imports grew 14% to 20,251 cu.m.

Amongst the fastest rates of increase in 2015 imports

iroko, aningre and teak sawnwood stand out. Teak imports

grew 83% to 9,470 cu.m. Much of the growth was in teak

imports from India which supplied 4,614 cu.m. to the US.

Imports from Africa grew faster in 2015 than shipments

from Latin America and Asia. Imports from Cameroon

and Congo (Brazzaville) increased significantly in 2015,

but Ghana and Cote d¡¯Ivoire shipped less than in 2014.

Ecuador and Brazil remained the largest suppliers to the

US market, despite lower balsa imports.

Imports from Brazil were 42,167 cu.m. in 2015, up 8%.

Sawnwood imports from Malaysia and Indonesia

increased by 9% and 15%, respectively, from 2014 due to

higher shipments of keruing and meranti.

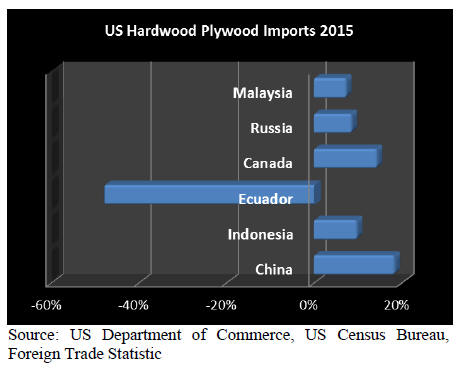

China increases hardwood plywood market share in

2015

US imports of hardwood plywood increased 12% in 2015

compared to the previous year. A total of 3.25 million

cu.m. of hardwood plywood were imported in 2015. The

antidumping duties on Chinese plywood were removed in

November 2013, but imports did not recover until 2015.

China exported 1.80 million cu.m. of plywood to the US in

2015. Its share in total US plywood imports grew from

52% in 2014 to 55% in 2015.

All other major sources of hardwood plywood increased

shipments to the US in 2015, with the exception of

Ecuador. Imports from Ecuador fell by almost half to

88,342 cu.m.

Indonesia remained the second-largest source of imports in

2015 at 491,965 cu.m., up 10% from the previous year.

Imports from Malaysia grew 7% from 2014 to 78,627

cu.m.

Imports of hardwood plywood from countries other than

Malaysia and Indonesia increased by 21% in 2015. Of the

others, Europe was the most significant supplier led by

Spain, Italy and Latvia (with Latvia producing mainly

birch plywood).

The US imported 38,908 cu.m. of plywood from Uruguay

in 2015, 25,400 cu.m. from Panama, and 25,017 cu.m.

from Brazil.

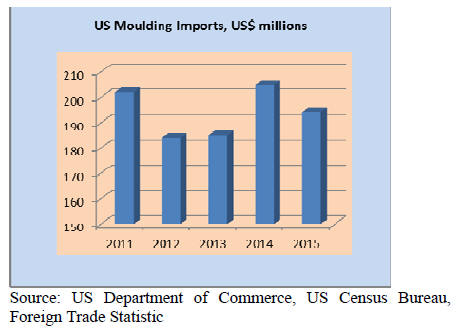

Decline in hardwood moulding imports

The value of hardwood moulding imports into the US

declined 5% in 2015 from the previous year, despite the

growth in home construction. Hardwood moulding imports

were worth US$194.2 million, down from US$204.6

million in 2014.

Imports from all major suppliers decreased. China

remained the largest source of imports at US$65.3 million.

Imports from Brazil were worth US$48.4 million, down

9% from 2014. Imports from Malaysia declined 10% to

US$13.4 million.

30% growth in hardwood flooring imports in 2015

US imports of wood flooring increased again in 2015,

following a year of significant growth in 2014.

Hardwood flooring imports were worth US$47.4 million

in 2015, up 30% from 2014. Imports from all countries

increased, but the strongest growth was in Canadian

shipments where manufacturers benefited from the weak

Canadian dollar.

Indonesia and Malaysia were the largest sources of

imports at US$10.7 million and US$10.1 million,

respectively. Hardwood flooring imports from Indonesia

grew by over half from 2014. Imports from China were

worth US$8.7 million, up 19% from the previous year.

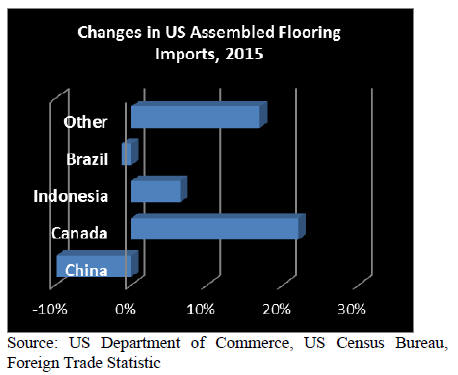

Imports of assembled wood flooring panels were worth

US$136.5 million, up 3% from 2014. The strongest

growth was in imports from Canada, while assembled

wood flooring imports from China fell 10% in 2015 to

US$60.7 million. Indonesia exported US$8.1 million

worth of assembled flooring panels to the US in 2015, up

6% from the previous year.

Strong increase in wooden furniture imports from

Malaysia and Vietnam

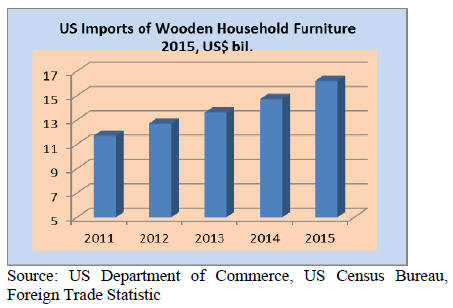

US furniture imports grew faster in 2015 than in the two

previous years. Wooden furniture imports were worth

US$16.23 billion in 2015. Imports from all major

suppliers increased.

China¡¯s share in total imports decreased slightly to 47.3%,

while Vietnam¡¯s share grew to 18.5%. Malaysia¡¯s share in

total imports increased from 3.8% in 2014 to 4.1% last

year.

The strongest growth was in imports from Malaysia and

Vietnam. Imports from Malaysia were worth US$673.3

million in 2015 (+20%). Vietnam exported close to US$3

billion worth of wooden furniture (+19%). Imports from

China increased 10% to US$7.67 billion in 2015.

Furniture imports from Mexico have grown in recent

years. In 2015, the US imported US$760.3 of wooden

furniture from Mexico, representing almost 5% of total

imports.

Imports from Indonesia were worth US$587.6 million, up

5% from 2014.

Wooden furniture imports from Europe did not grow as

strongly in 2015 as imports from Asia, Canada and

Mexico.

GDP growth 0.7% in final quarter of 2015

Real GDP grew just 0.7% in the fourth quarter of 2015,

according to the first estimate released by the Bureau of

Economic Analysis. In the third quarter, GDP increased

2.0%.

Stronger residential construction and consumer

consumption made positive contributions towards the

GDP, but investment in non-residential construction

declined in the fourth quarter.

Unemployment was almost unchanged in January 2016 at

4.9%. The Federal Reserve raised target interest rates by a

quarter point in December, but may leave the rate

unchanged in March because of global economic risks and

the slowdown in the Chinese economy.

Wood product and furniture manufacturing activity

improves

Economic activity in the manufacturing sector contracted

in January for the fourth consecutive month despite overall

growth in the economy, according to the Institute for

Supply Management. Based on the Institutes survey,

imports have grown while US exports slowed.

However, the wood products sector and furniture

manufacturing reported growth in January. Wood products

was the industry with the second-highest growth last

month.

2015 housing starts up 11%

An estimated 1,111,200 housing units were started in

2015. This is 11% above the 2014 figure of just over 1

million units.

Single-family housing starts declined in December to

768,000, while the multi-family market remained strong.

The number of building permits were at a seasonally

adjusted rate of 1.232 million in December, down 4%

from the previous month. Permits for single-family homes

increased, but multi-family construction permits declined

in December.

Share of first time home buyers increasing

Sales of existing homes increased across the country in

December. Total sales grew 15% at a seasonally adjusted

annual rate. Transactions that were delayed in November

contributed to the higher sales in December, according to

the National Association of Realtors. Buyers also were

motivated by the prospect of higher mortgage rates in the

New Year.

A positive sign was the higher share of first time buyers in

December. Their share increased from 30% in November

to 32% in December. On average in 2015 30% of all sales

were by first time buyers, lower than any other time in

almost 30 years.

The National Association of Realtors expects more first

time buyers in 2016 because of the positive employment

figures.

Office and commercial construction activity rebounds

Spending in non-residential construction was unchanged

in December from the previous month at a seasonally

adjusted rate, but overall levels remain below expenditures

during the summer according to US Census Bureau data.

Private office and commercial construction was a notable

exception. Both building categories had higher spending

levels in fall and winter than earlier in 2015.

The American Institute of Architects reported a softening

of business conditions in the commercial and industrial

towards the end of 2015. Conditions were stronger in the

South and West than in the Northeast.

Canadian housing construction slipping

Canadian housing starts fell 18% in December at a

seasonally adjusted annual rate. The decrease was in

multi-family construction in the major cities, while singlefamily

construction was unchanged from November.

Overall the housing market remained strong in 2015

despite low oil prices and a contraction in GDP in two

quarters. Low mortgage rates and relatively low

unemployment supported the housing market, except in

Alberta where job losses related to the oil industry were

high.

The Canadian Housing and Mortgage Corporation expect

a modest decline in home construction in 2016 and 2017,

but given the uncertainty in the global economic outlook

housing starts could also strengthen from 2015.

|