Japan

Wood Products Prices

Dollar Exchange Rates of 25th

February 2016

Japan Yen 112.99

Reports From Japan

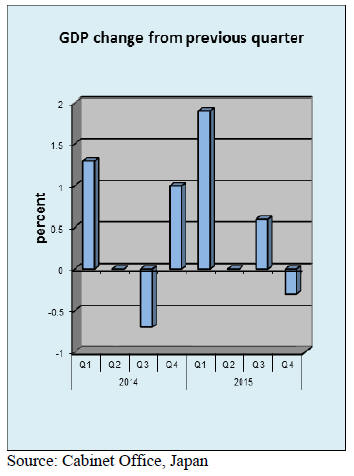

GDP data challenges government and central

bank

GDP in Japan fell 0.4% in the final quarter of 2015,

dragged down by weak private consumption and the slow

housing market. The last quarter 2015 data were worse

than expected and pose a major challenge to the

government and the central bank. Figures show that

domestic consumption fell, as did public investment.

While residential investment fell private non-residential

investment was shown to have grown which helped soften

the negative GDP data.

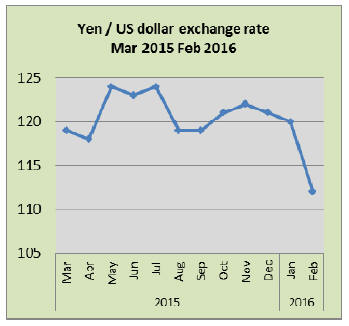

Flat-lined oil price steadies Yen/dollar exchange

rate

The yen has gained around 7% against the dollar since

January this year as investors have been pouring money

into Japan as a safe haven. The risk of Britain’s exit from

the EU along with wider global issues have driven a flood

of money to Japan which is threatening progress in the

government’s daring strategies to pull Japan out of

deflation.

At one point the yen was around 111 to the dollar

but has

since weakened slightly as oil prices appear to have

leveled out. A strong yen hurts the competitiveness of

Japanese exporters and if the rate hovers at the 110 level it

is likely the Bank of Japan will act to try and drive down

the yen.

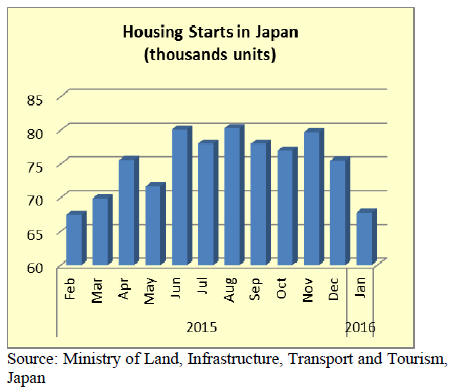

Negative interest rates stimulate mortgage enquiries

Perhaps the brightest note after Japan’s central bank drove

interest rates below zero is that it has spurred an interest in

the remortgaging of homes. Many analysts are forecasting

that enquiries for new home mortgages will rise which

would boost the housing market.

But, say financial planners, housing loan interest rates are

already very low and it is unlikely the banks would be

prepared to sacrifice profits by offering even lower rates to

home buyers.

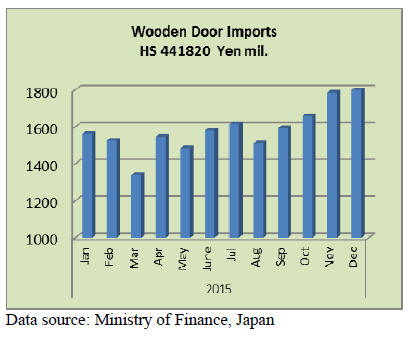

2015 Import round up

Doors

2015 saw a 4% decline in imports of wooden doors

marking the third straight annual fall in imports.

Throughout 2015 China was the largest wooden door

supplier to Japan securing 63% of all imports beating out

the Philippines (14%), Indonesia (8%) and Malaysia

(6.5%).

These top four suppliers of wooden doors accounted for

over 90% of all wooden door imports. Suppliers in SE

Asia accounted for 29% of Japan’s wooden door imports.

Even though housing starts have been flat the value of

wooden door imports has been increasing especially from

mid-2015 suggesting imports are capturing a greater share

of the wooden door market.

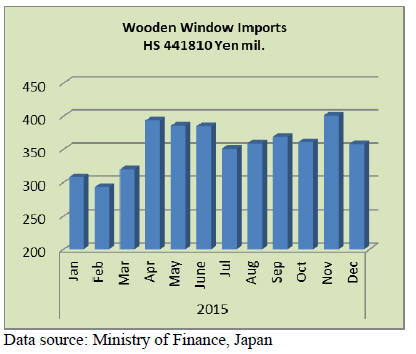

Windows

As is the case for doors, wooden window frame imports

have trended down for the past three years. In 2015

wooden window frame imports were down almost 15%

year on year.

The top four suppliers of wooden window frames in 2015

were, in order of rank, China, Philippines, USA and

Sweden accounting for 26%, 28%, 23% and 6%

respectively. The sources of supply of wooden window

frames is more diverse than for either wooden doors or

assembled wooden flooring.

Suppliers in the EU accounted for around 10% of 2015

imports of wooden window frames by Japan and the S.E.

Asian suppliers accounted for 31% of wooden window

frame imports.

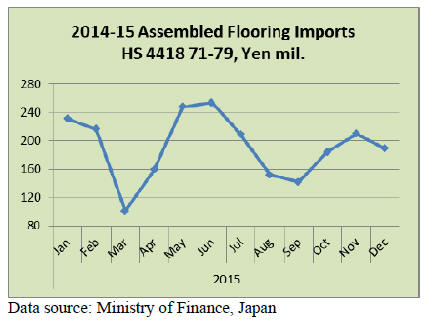

Assembled flooring

Japan’s assembled wooden flooring imports fall under 3

categories: HS441871, Assembled Flooring Panels for

mosaic flooring, HS 441872, Other Multilayered

Assembled Flooring Panels and HS 44179, Assembled

Flooring not falling in HS 441871 or HS441872.

Some 68% of Japan’s assembled wooden flooring in 2015

was recorded as HS441872 the balance being HS 441879

(30%) and HS 441871 (2%).

Of imports of HS441872, 74% came from China, 6% from

Sweden and 3% from Malaysia. Suppliers in SE Asia

accounted for 8.5% of 2015 imports while suppliers in the

EU accounted for 15%.

Of imports of HS441879, Indonesia was the largest

supplier in 2015 (29%) closely followed by China (27%),

Thailand (22%) and Vietnam (15%). The top four

suppliers accounted for 93% of imports of HS 441879.

Imports of HS 441871 are small and the main suppliers in

2015 were Thailand, Indonesia and Italy.

2015 imports of all three categories of assembled wooden

flooring (HS 441871-79) were down 34% from a year

earlier. Imports in 2014 were high, climbing 22% on 2013

levels but 2014 imports are an anomaly as the value of

annual imports has settled back to a general downward

trend.

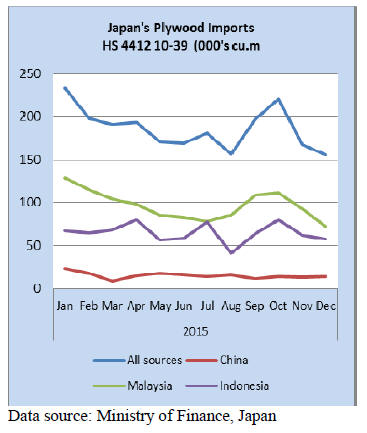

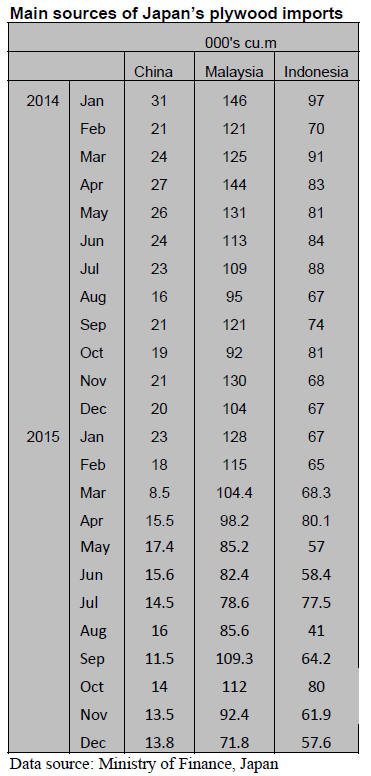

Plywood

Compared to 2014 plywood imports in 2015 fell 21% .

The top three supply countries, China, Malaysia and

Indonesia account for the bulk (95%) of Japan’s plywood

imports in 2015, a picture that has been repeated for the

past decade.

Malaysian suppliers secured the greatest propertion

of

Japan’s 2015 demand for imported plywood at 54%

follwed by Indonesia (35%) with smaller volumes coming

form China (8%).

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

2015 plywood supply

Total plywood supply in 2015 was 5,656,100 cbms, 10.2%

less than 2014. This is the first time that total volume

dropped below the level of six million cbms after five

years since 2010.

Specifically, imported plywood was the lowest in six years

since 2009 with 2,885,700 cbms, 17.3% less than 2014.

Meantime, domestic plywood production was slightly

down from previous year with 2,770,300 cbms, 1.3% less

than 2014. Accordingly, share of imported plywood

dropped down to 51%.

Domestic production dropped in 2009 and 2011 but since

then it has held steady pace so sharp drop of imported

plywood was the reason of drop of total supply in 2015.

There is no clear reason why demand for imported

plywood declined this much. General explanation is that

the source of tropical hardwood logs has been declining

then severe control on illegal harvest in.

Sarawak, Malaysia further reduced log harvest then

resultant high export prices become chronic so the users in

Japan have been shifting to domestic softwood plywood.

However, it is hard to explain when imported plywood

volume decreased by 17% and domestic plywood

shipment increased only by 6%.

The volume from Malaysia was the lowest since 1996.

Indonesian volume dropped below one million cbms, first

time that the volume dropped below one million cbms in

five years since 2010 then the volume from China also

recorded the lowest in five years.

Domestic softwood plywood production was 1.1% less

than 2014 but the shipment was up by 6.7%. In the first

half of the year, the demand was slow so that the

production exceeded the shipment and the inventory

swelled up to 260,000 cbms then in the second half of the

year, the demand picked up so that the production could

not catch up the shipment so the inventory had been

decreasing month after month.

It is totally different pattern in the first half and second

half. With very active demand in the second half, many

items were short in supply and the mills’ inventory was

minimal.

South Sea (Tropical) logs

Malaysia is in rainy season now and before Chinese New

Year starts, log suppliers are not so anxious to operate

logging activities thus late January log supply was low.

Bearish log market until last December stopped in January

so it is leveling off now. Actually besides foul weather,

low log prices discourage log suppliers so that log

production dropped considerably.

The Japanese log importers want to buy quality logs but

with limited supply, they have to take what’s available as

local suppliers’ log inventories are extremely low. Some

importers say that a ship is coming in three days but there

are not enough logs.

To fill up a ship, they have to make three ports loading so

it is risky attempt now without enough logs on hand before

a ship comes in. The worst case is that a ship has to wait

until logs become available at loading port.

Since January this year, in Sarawak as a part of controlling

illegal harvest, harvest quota becomes monthly base as

compared to quarterly allocation or yearly quota and any

harvest volume exceeding monthly quota is not allowed to

carry over to next month so log suppliers probably harvest

90 to 95 % of quota volume so log supply is likely to

decline more by this system.

Present FOB prices for export logs are US$265-275 per

cbm on meranti regular,US$245 on meranti small and

US$230 on super small. They are weakly holding.

Japan’s log export rise

In 2015, log export was 691,830 cbms, 32.7% more than

2014 and this was the record high number. Lumber export

was 61,621 cbms, 10.3% less.

Total forest products export in 2015 was 26,300 million

yen, 24.8% more. This exceeded the amount the Ministry

of Agriculture, Forestry and Fisheries drew up as a target

by 2020 ahead of time.

Log export was the main business in forest products.

Destinations are China, Korea and Taiwan and China took

more than 50% share. For China, share of Japan is about

1.5% with ranking of 15th. If the price is right, it is

possible to increase log export to China but there is

competition in Japan with biomass power generation

business, which consumes sizable low grade logs so log

exporters have difficult time to accumulate export logs.

Also exchange rate is important factor so when the yen

gets stronger, it will be tough to offer attractive dollar

prices. Log export for Korea also increased largely as

demand for Japanese cypress is strong for interior

finishing and furniture.

Lumber export for Korea and Taiwan increased but it

decreased some in total export. Plywood export in 2015

expanded rapidly with the volume of 67,049 cbms,

143.7% more than 2014, getting close to lumber export

volume.

Import of structural laminated lumber in 2015

Import of structural laminated lumber decreased for two

straight years but since 2013, the volume has been over

700,000 cbms every year so that the market in Japan

seems to be established. Meantime, the prices declined

because of sluggish market in 2015. Particularly in 2015,

laminated beam prices were in slump so that the prices

dropped by 6,000 yen per cbm compared to 2014.

Total import of structural laminated lumber was 705,000

cbms, 3.1% less than 2014.

The market in 2015 was slow because recovery from

demand drop after consumption tax hike in 2014. Users

like precutting companies restrained from future purchase

in fear of price drop and shifted to purchase from domestic

manufacturers, which have much shorter lead time of

delivery.

On supply side, medium size import dropped after closure

of Sorenau plant in Austria of Stora Enso while Radauti

plant of H.Schweighofer in Rumania started, which

increased the supply from Rumania.

Six stories 2x4 experimental house built

The Japan 2x4 Home Builders Association held study tour

to a 2x4 six stories experimental unit being built at

Tsukuba on February 4 and 5.

This is a first six stories wooden building. More than 400

visitors attended the observation tour. The Association has

acquired the Minister’s certificate in December last year

on partition wall and floor for two hours fire proof, which

is necessary to build wooden six stories building. It plans

to obtain the certificate on exterior wall and party wall for

apartment in 2017. Once this is obtained, conditions will

be fully prepared for six stories wooden unit.

The experimental unit has building area of 39.85 square

meters and floor space of 206, 09 square meters with

height of 17.309 meters. It will be completed in March this

year. The Association got subsidy from the Ministry of

Land, Infrastructure and Transport.

The Association and National Building Research Institute

will conduct technical research for next ten years.

In case of six stories building, exterior wall and partition

wall of first and second floor need to have wall strength

factor of fourteen times. In this unit, strength is secured by

double sided structural 12 mm plywood nailed in 50 mm

pitch.

Floor of each floor has different material to compare. CLT

for second floor, stressed skin panel (box shape LVL) for

third floor, LVL for fourth floor, I joist for fifth floor and

paralleled chord truss for six floor. With these materials,

usability and sound performance will be tested.

Mid ply wall is used for partition on third and fourth floor.

CLT (120 mm thick) is used for floor and entrance eaves

(2 meter overhang design).

Declining MDF inventories

MDF manufacturers in Japan have been running full with

maximum capacity. Since last October, the shipments

started climbing for large building materials manufacturers

so the MDF manufacturers’ inventory continued

decreasing despite full operation.

However, sales to other channels like wholesalers and

condominiums are flat so the orders to overseas

manufacturers, which are anxious to expand the market

share, are limited.

Actually the shipments to large building materials

manufacturers increased since last December and active

shipments seem to continue through the first quarter this

year.

Building materials manufacturers intend to establish

steady supply source of MDF before the consumption tax

increase in April of 2017 so they place orders with larger

volume.

Two of three domestic MDF manufacturers supplies MDF

for its own building materials products so the volume for

open market is limited so there is only one manufacturer to

cope with increasing demand.

Daiken makes new products with MDF

Daiken Corporation (Osaka) will market new MDF

product. One is Techwood-A (ace), which has twice as

much strength as other similar products. Another is super

light type, which has less than half of specific gravity.

Both have much more strength, water proof and

processing performance other MDF do not have. So it

could be used for not only flooring but wall and ceiling.

Daiken’s MDF manufacturing base is two plants in

Malaysia and the products have brand name of techwood

so a new product is named techwood-A. Then another

base is in New Zealand and a new light MDF is product of

Custom Wood, which brand name of New Zealand MDF.

Techwood-A has much higher strength and water proof

performance. Strength of normal MDF has 33-35N/square

mm but ace has more than 50N. This strength performance

is achieved by raw material of acacia. Now strength is as

strong as plywood and bending stress is better than

plywood since MDF has not fiber direction like plywood.

Daiken is looking at future market of wall and ceiling with

combination of MDF and sheet, which are now used for

more than 60% of floor base. Smooth surface of MDF

makes it possible to composite with much fancy

decorative sheet.

Main material for wall and ceiling is plaster board with

cloth overlay but Techwood-A has enough strength

without using sheathing plywood like floor base.

Weakness of MDF is strength and water-proofness but

now they are close to plywood then smooth surface is

advantage for interior design,

Super light type is made with radiata pine in New Zealand.

Specific gravity of common MDF is 0.7-0.8 but the most

low specific gravity of super light type is 0.35 with

thickness of 9 mm. Weight of 9 mm with specific gravity

of 0.8 is almost the same as 4 mm with specific gravity of

0.8. Light specific gravity means softer so it is much easy

to process.

Sumitomo Forestry starts business in India

Sumitomo Forestry (Tokyo) sets up a subsidiary company

in India to start wood and building materials business in

India. It is Sumitomo Forestry India Private Limited (SF

India).

SF India markets Japanese made building materials and

housing interior materials and will provide Japanese

technology, business style and services.

It also tries to contribute improvement of housing and

living environment of India through business it develops

including Spacewood Finishers, which has capital and

business alliance with Sumitomo Forestry.

SF India has two full time directors and two part-time

directors, who handle import and export of wood and

building materials, distribution of building materials in

India and manage relating companies in India.

|