|

Report from

Europe

Healthy growth in EU tropical wood imports during

2015

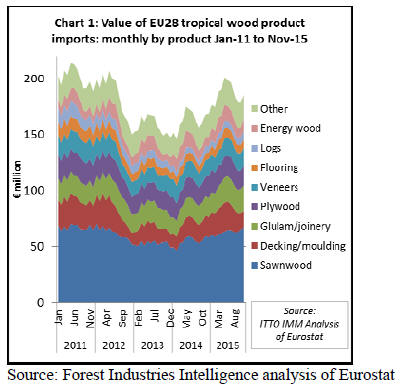

European imports of tropical timber showed healthy

growth between January and November of last year, with

total value rising 15% to euro 2.059bn (2014: euro

1.788bn).

The first quarter of 2015 was particularly strong, with an

increase of 20.5% over the still relatively weak first three

months of 2014. After a dip in summer 2015, imports

picked up again between September and November last

year (Chart 1).

Sharp increase in EU imports of tropical LVL,

mouldings and flooring

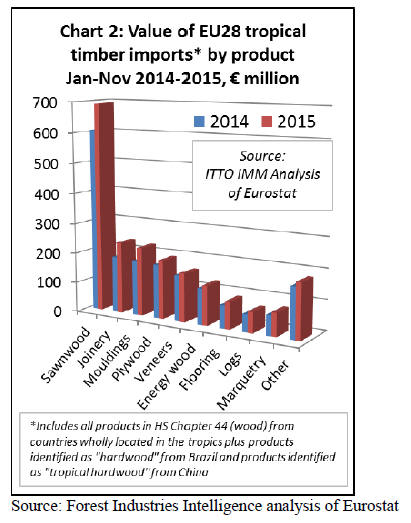

European imports of all major tropical wood products

increased in the first eleven months of 2015. There was

particularly strong growth in the value of EU imports of

tropical joinery products (mainly LVL) which increased

27.2% to euro 237.2 million, together with

mouldings/decking which increased 25.3% to euro 228.1

million.

There was also good recovery in the value of sawn wood

imports, which were up 14.3% at euro 692.3 million.

After many years of consistent decline, there was even a

minor rebound in EU imports of tropical logs, up 18%

from a small base to euro 67.4 million. A similar increase

(+18.7% to euro 89.7 million) was recorded in imports of

tropical wood flooring.

However imports of tropical plywood (+9% to euro

194m), veneers (+6% to euro 162m) and energy wood

(+9% to euro 130m) only increased by single-figure

percentages in each case (Chart 2).

Broader-based recovery in the EU tropical wood

imports

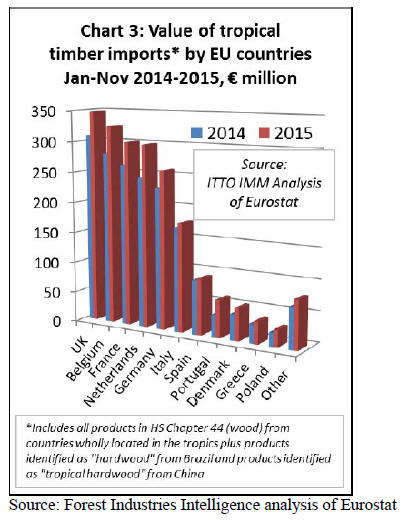

While the growth that occurred in EU tropical wood

product imports during 2014 was due mainly to rising

consumption in the UK, the 2015 recovery was much

more broadly based.

In the first eleven months of 2015, there was double¨Cdigit

growth in tropical wood import value into Belgium (+16%

to euro 325m), Denmark (+25% to euro 53m), France

(+14% to euro 301m), Germany (+12% to euro 258m), the

Netherlands (+22% to euro 298m) and the UK (+12% to

euro 348m).

Among crisis-ridden southern European countries,

Portugal fared very well, with a sharp 67.7% increase in

imports to euro 62m during the first 11 months of 2015.

The rise in imports into Italy (+4% to euro 177m) and

Spain (+4% to euro 92m) was more moderate but heading

in the right direction. Even Greece recovered ground last

year with import growth of 16% to euro 36m (Chart 3).

The rise in the euro value of EU imports is partly due to

exchange rate movements. The average euro/US$

exchange rate was 1.11 in 2015 compared to 1.32 in 2014

implying that inflated prices for many imported wood

products last year.

However closer analysis shows significant growth in the

volume as well as value of tropical wood imports in most

product sectors.

EU tropical sawn imports exceed 1 million cu.m in

2015

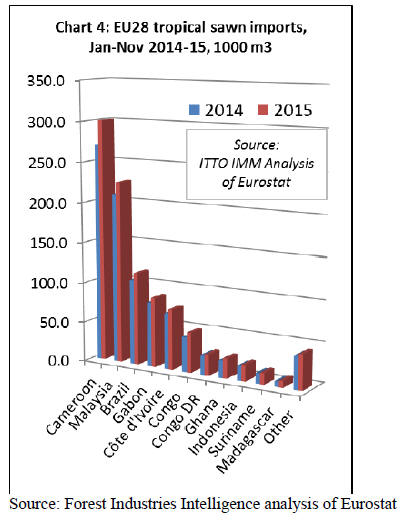

EU imports of tropical sawn wood in the first 11 months

of 2015 were 992,000 cu.m, 9% more than the same

period the previous year. It¡¯s therefore almost certain that

EU imports for the full year will exceed 1 million cu.m for

the first time since 2012.

While an encouraging landmark, this is still well down on

levels prevailing before the crises when annual imports

exceeded 2 million per year.

Cameroon, from which the EU imported 300,800 cu.m in

the first eleven months of last year, an increase by 11%,

cemented its leading position as the EU¡¯s most important

supplier of tropical sawn wood.

The four next largest suppliers all registered lower growth

rates than Cameroon: imports increased by 7% from

Malaysia to 225,700 cu.m, by 9% from Brazil to 115,700

cu.m, by 8% from Gabon to 87,200 cu.m, and by 8% from

Ivory Coast to 75,800 cu.m.

However there was an above average in imports from

several smaller suppliers including Congo (+15% to

50,200 cu.m.), Ghana (+14% to 24,700 cu.m) and

Indonesia (+12% to 20,400 cu.m ) (Chart 4).

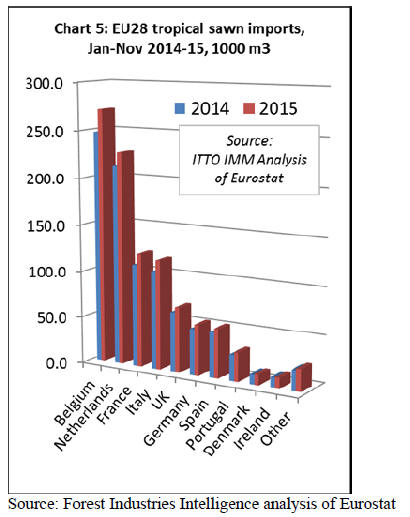

Consistent growth in tropical sawn imports across the

EU

All the largest EU markets imported more tropical sawn

wood in the first eleven months of 2015 compared to the

previous year. Growth rates were quite evenly spread,

ranging between +7% and +12% (Chart 5).

Belgium was the largest single importer of tropical sawn

wood in 2015, with volume rising 10% in the first 11

months of the year to 271,000 cu.m . Much of this volume

is destined for neighbouring EU countries rather than

consumed in Belgium. Imports into the Netherlands were

also on the rise last year, up 7% to 227,400 cu.m.

This is a reflection both of increased domestic

construction activity in the Netherlands and of the

country¡¯s important role as an entry-point for hardwoods

distributed throughout the continent.

There was 12% growth in imports by France and Italy, to

122,300 cu.m and 117,400 cu.m respectively, particularly

encouraging as these countries have been very slow to

recover from the market downturn.

Meanwhile the positive trend in imports by the UK and

Germany continued, with a 10% increase in each case to

69,400 cu.m and 53,900 cu.m respectively. Imports into

Spain and Portugal, too, experienced healthy growth rates:

Spain¡¯s imports rose by 9% to 52,800 cu.m and Portugal¡¯s

by 10% to 31,300 cu.m .

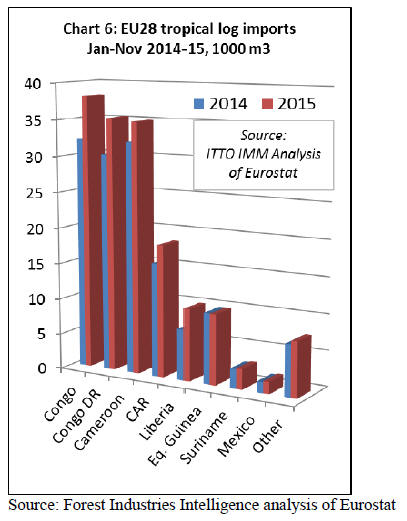

Log imports on the way up again

European imports of tropical logs gained ground in the

first eleven months of last year, rising 14% to 158,954

cu.m .

Imports were almost exclusively sourced from African

countries although Suriname is now established as a small

but consistent supplier of logs to the EU, particularly of

denser and FSC-certified wood for sea defence works and

similar heavy-duty applications.

EU imports of tropical logs increased sharply from Congo

(up 18% to 38,136 cu.m), Democratic Republic of the

Congo (up 17% to 35,277 cu.m), Cameroon (up 9% to

34,936 cu.m), and Central African Republic (up 16% to

18,471 cu.m).

There was also a resumption in log imports from Liberia,

which jumped 41% to 10,094 cu.m in the first 11 months

of last year (Chart 6).

Much of the growth in EU imports of tropical logs was

concentrated in Belgium and Portugal, the second and

third most important EU importers after France, which at

63,943 cu.m only imported 1% more than in 2014.

Belgium imported 28,979 cu.m between January and

November 2015, more than twice as much as the year

before (+122.6%).

Portugal shows a similar trend: at 28,226 cu.m the country

imported 57.9% more than in 2014. And Italy, too,

boosted its import volume by 49% to 15,583 cu.m .

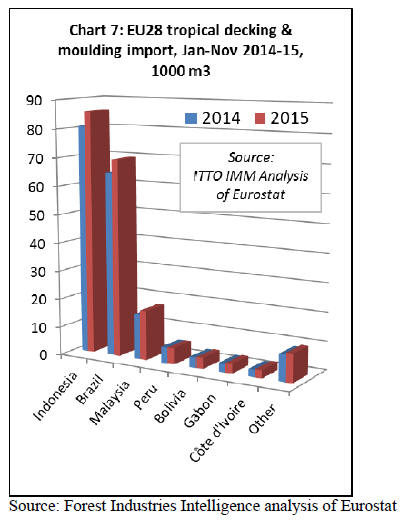

Imports of decking/moulding rise rising prices

EU imports of ¡°continuously shaped¡± wood (HS code

4409), which includes both decking products and interior

decorative products like moulded skirting and beading,

increased 7% to 199,000 cu.m in 2015.

EU imports of tropical decking and moulding products

increased from all the leading suppliers including

Indonesia (+6% to 85,800 cu.m ), Brazil, (+7% to 69,600

cu.m ) and Malaysia (+10% to 17,500 cu.m ) (Chart 7).

The 7% rise in the volume of EU imports of tropical

moulding/decking in the first 11 months of 2015 is

considerably less than the 25% gain in import value. This

is because most is sourced from South-East Asia and

Brazil where suppliers invoice in US$ dollars (in contrast

to African suppliers who generally invoice in euros).

It is also clear that the steep fall in container freight rates

experienced during the course of 2015 was insufficient to

offset the rise in US dollar-based prices. Nevertheless it is

encouraging that European import volume showed some

growth despite rising prices.

EU recovery ¡°at a moderate pace and amid risks¡±

It remains unclear whether these encouraging signs will

turn into a lasting growth trend. The German IFO

Institute¡¯s most recent Eurozone Economic Outlook

suggests that European economic recovery is likely to

continue ¡°at a moderate pace and amid risks¡±.

IFO estimates that real GDP in the euro-zone was 1.5% in

2015 and that growth will continue by 0.4% in both the

first and second quarter of 2016. Private consumption is

identified as the main driver behind the upturn stimulated

by a renewed drop in oil prices.

There is also expected to be a significant stimulus from

fiscal and social policy, particularly in Germany, not least

due to far higher government expenditure on consumption

and transfers related to the influx of refugees. Construction

investment is also expected to grow sharply in Germany

over the forecasting period.

According to IFO, main risks facing the European

economy are unrest in the Middle East, which could yet

lead to a surge in oil prices.

Moreover, the structural transformation of the Chinese

economy involves risks for Europe as well, as it could lead

to capital outflows from the emerging countries. ¡°This, in

turn, may cause strong financial market turbulence or even

exchange rate crises¡±, risks to which the euro-zone has

proven particularly vulnerable.

|