Japan Wood Products

Prices

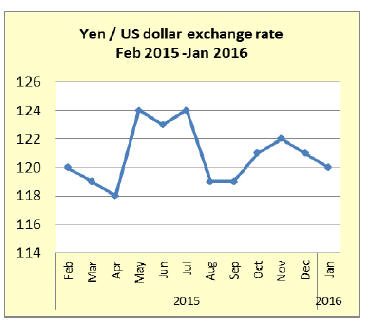

Dollar Exchange Rates of 25th

January 2016

Japan Yen 117.65

Reports From Japan

BoJ attempts another adventure – negative

interest

rates

Turbulence in stock markets around the world and news

that Chinese economic growth rates continue to slide unnerved

investors who rushed to the ‘safe-haven’ currency,

the yen.

Since the opening of trade in January the yen has risen

over 3% against the dollar making it one of the best

performing currencies for the year so far. A rising yen and

falling prices are not good for exporters but suppliers to

Japan welcome the slightly stronger yen hoping that

demand for imports will follow.

The government and Bank of Japan (BoJ) was warned by

many Japanese analysts that the rapid strengthening of the

yen threatens to undermine the gains made in stabilising

the economy and there were calls the Bank to act.

Clearly the Bank of Japan got the message as it surprised

economists and traders alike by adopting negative interest

rates for the first time ever at its 26 January meeting. This

unprecedented move came as pressure mounted on the

Bank to get the exchange rate and overall economy back

on track.

The BoJ will apply a rate of minus 0.1% on money lodged

by commercial banks at the BoJ and said further

reductions in rates are possible. A negative rate should

drive banks to lend more and should result in consumers

spending more because if they save the value of saving

will fall.

The move by the BoJ had an immediate impact on the

yen/dollar exchange rate. Over the past two weeks the yen

had strengthened which undermined confidence of

exporters. From yen 117 to the dollar on 25 January the

rate fell to 121 on 26 January.

Sales of high priced homes rise but, prices for

cheaper

homes fall

House prices in Tokyo and to a lesser extent in other major

cities in Japan are rising so fast as to become out of reach

of most ordinary buyers and this is driving down overall

sales of both new and second hand homes.

Japan’s Real Estate Economic Institute (REEI) data

illustrates the anomalies in the market. While apartment

prices in Tokyo rose over 9% to a five year high last year

and the number of people making offers on homes fell by

around 10%.

REEI data shows that sales of properties priced at yen 100

million or more rose over 80% while cheaper homes

(under yen 50 million) fell by almost 20%.

Extremely low interest rates combined with profits from

gains in Japan’s stock market last year increased the

amount of cash available to the wealthier segment of

society who turned to the property market as a secure

investment. This caused prices to rise beyond the reach of

the normal family.

Steep declines in stock values this year has un-nerved

investors and even though the big banks have cut

mortgage interest rates this may not be enough to sustain

prices so property developers may be in for tough times.

For house price data see:

http://www.reinet.or.jp/en/

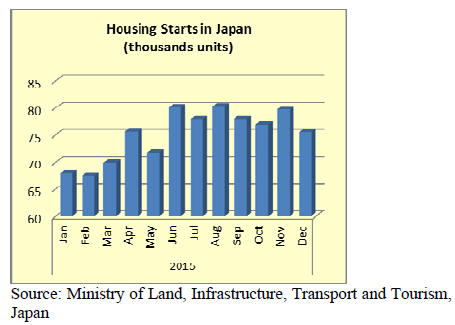

Ministry of Land, Infrastructure, Transport and Tourism

statistics on housing starts show an unexpected decline in

December 2015 after the advance made in November.

Year on year December housing starts fell almost 1.5% in

sharp contrast to the gain forecast by analysts. For the

calendar year 2015 housing starts came in at 901,300 up

just 1% compared to the January to December period in

2014. On the bright side, construction companies continue

to report healthy order book positions.

Import round up

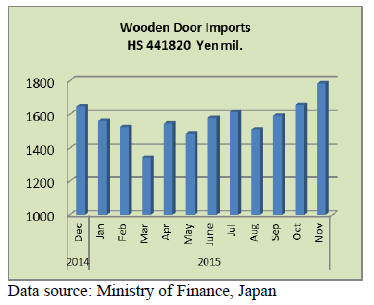

Doors

Year on year November 2015 door imports continued

upward by another 14%, marking the fourth monthly gain

in 2015. China remains the main wooden door supplier at

64% off total door imports to Japan followed by the

Philippines.

Malaysia became the third ranked supplier in November

displacing Indonesia. The top three suppliers accounted

for around 85% of all wooden door imports in November,

a slight drop from October.

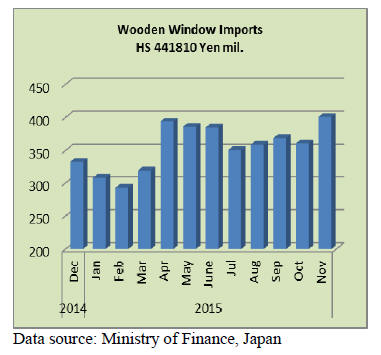

Windows

In November 2015 the top suppliers of wooden windows

to Japan were China and the Philippines together

accounting for approximately 64% of all wooden widow

imports. This was a significant drop on the 70% share the

two held in October and is explained by shipments of

wooden windows from the US to Japan.

China remains the main supplier of wooden windows to

Japan at 35% of all wooden window imports. November

2015 imports of wooden windows were the highest for the

past twelve months.

Year on year November imports were up 27% the same

rise as seen in October.

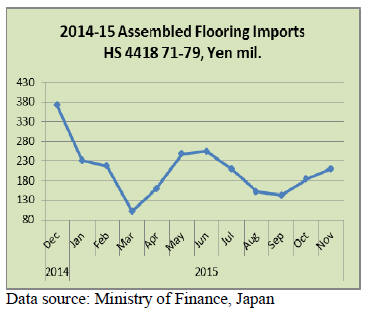

Assembled flooring

Year on year, Japan’s November 2015 imports of

assembled flooring continued downwards but compared to

October then imports in November rose sharply.

As in previous months China alone accounted for the

lion’s share of imports of this product (69% in November).

Japan’s November 2015 imports of assembled flooring

were from three main suppliers, Indonesia, Malaysia and

Vietnam but all together these three suppliers could only

capture just over 7% of Japan’s November import

requirements.

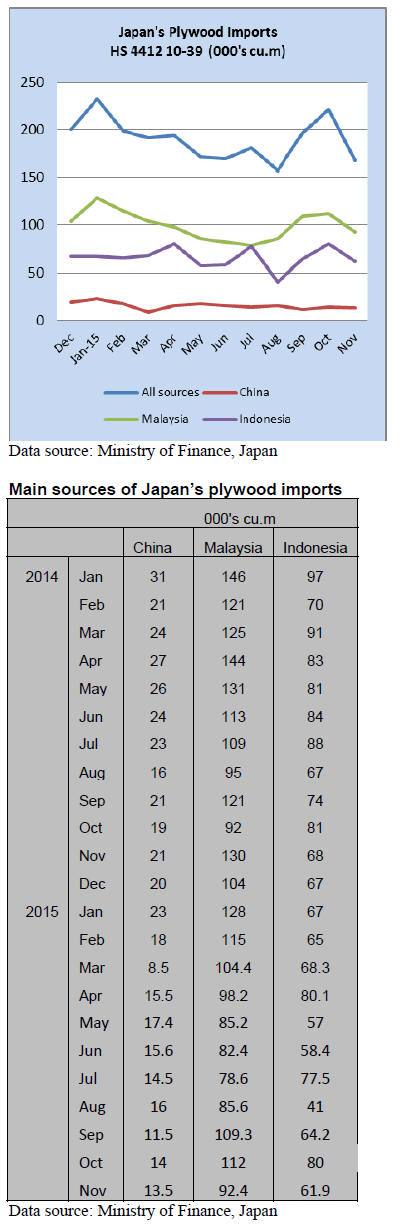

Plywood

The top three supply countries, China, Malaysia and

Indonesia account for the bulk (85%) of Japan’s plywood

imports.

The volume of plywood imports in November 2015 was

down 23% year on year. While the level of imports from

China stayed flat in November, sharp declines were seen

in the volume of imports from Malaysia (-17%) and

Indonesia (23%).

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

New Olympic National Stadium plan selected

The original plan for the National Stadium for the 2020

Tokyo Olympic Games were withdrawn in last July due to

extreme high cost then there are two new proposals. The

Ministers Conference selected plan A in late December.

The new stadium has theme of ‘wood and green’ and the

roof is hybrid structure with combination of steel and

wood.

Wood is laminated lumber made of all domestic officially

certified wood. Use of large amount of wood for the

Olympic Stadium should trigger building of more wooden

structures and common use of certified wood in Japan.

The new plan includes traditional Japanese design.

Structural laminated lumber of both cedar E65-F225 and

larch E95-F270 are used for the roof.

Materials are medium sized laminated lumber of 120x450

mm with length of less than 6 meters, which can be

manufactured by any domestic laminated lumber plants.

Total of 1,800 cbms of laminated lumber will be procured.

Use of forest certified products is inherited from the

London Olympic.

Demand projection of imported wood products in 2016

The Timber Supply and Demand Conference of Japan,

which is formed by five groups of imported wood

products, came up with the projection of demand for 2016.

According to the projection, there will not be any

significant change on both import of logs and lumber.

Housing starts are expected to exceed over 2015 then they

would decline again in 2017 so imports of wood products

are likely to decline again in 2017.

Total demand for imported logs and lumber is 9,608,000

cbms, almost the same as 2015. New housing starts in

2016 are estimated about 940,000 units as opposed to 910-

920,000 units in 2015, about 2-3 % increase. Rush-in

demand before the consumption tax increase to 10%

starting April of 2017 seems to be insignificant.

Noticeable change is import of North American logs,

which is estimated to increase by 2.6%. It decreased by

15% in 2015 from 2014, which was too much so this

seems to be recovering increase. Shifting to domestic

species and production curtailment by plywood mills in

2015 resulted in decrease of

North American logs

New Zealand radiate pine import seems to decline further

in 2016 because of high export log prices influenced by

Chinese market. Crating lumber demand seems to be

shifting to domestic species.

Demand for Russian logs continues shrinking as sawmills

cutting Russian logs continue decreasing. Russian lumber

volume is stabilizing at about 600,000 cbms.

Plywood

On domestic softwood plywood, the supply tightness

continues by demand increase. Since last fall, precutting

plants enjoys full operations so that plywood mills also

continue a full production.

Delay of deliveries by plywood mills got worse toward

December. Therefore, total plywood mills’ production in

October was 244,100 cbms then November was 232,400

cbms while the shipment in October was 244,100 cbms

and November was 243,300 cbms so that the inventories

dropped by 10,000 cbms every month and November end

inventories were down to 120,000 cbms compared to the

peak of last year in May with 261,400 cbms.

Every plywood mills’ inventories are down to less than

two weeks. In this situation, mills are bullish and increase

the sales prices. Present Tokyo market prices are about

890 yen per sheet delivered.

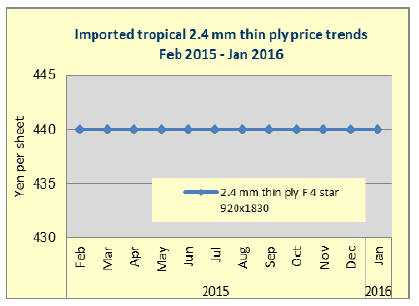

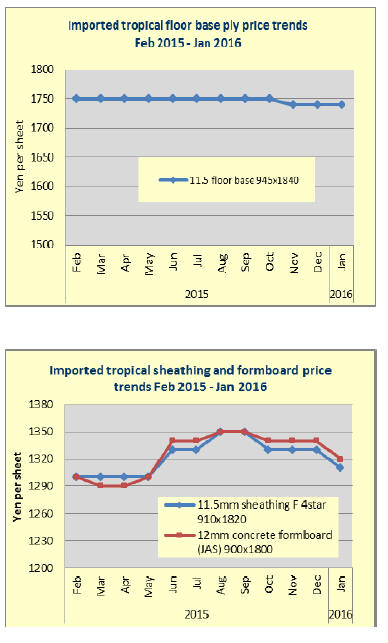

Meantime, imported South Sea hardwood plywood market

is weak because of declined demand. The shipment in the

market has been dull since last summer. Actually,

uncertainty increases month after month.

As a matter of fact, the prices dropped by one notch in last

December to move the inventories. Such weaker prices

made the market more sluggish and price spread between

actual cost and sales prices gets wider for the importers

and wholesalers. Problem is nobody knows how much

prices should be reduced to move the inventories

particularly when the actual demand is down so much.

Toyama to build a new sawmill

Toyama Co., Ltd. (Miyazaki prefecture) has purchased a

property of 198,000 square meters to build a new domestic

species sawmill at Shibushi, Kagoshima prefecture. New

mill will be completed in middle of 2018. It intends to

recapture market share of domestic wood from imported

products and at the same time to aim export of lumber.

Toyama has three sawmills in Miyazaki prefecture with

state of the art sawmilling machines. Annual log

consumption is about 160,000 cbms.

The new mill would have 15% more production with

annual log consumption of 100,000 cbms. Once this new

lines start up, total log consumption by all the group mills

would be about 300,000 cbms.

The president Toyama says that quality of lumber should

be upgraded as time goes by so having higher grade and

precise delivery period are the priority matter to give

satisfaction to the customers. Production items are mainly

solid wood housing materials including cedar 2x4 lumber.

Facing declining trend of new housing starts, the company

intends to overcome by grabbing market share the

imported wood products have then hopes to start lumber

export since the mill situates close to the port of Shibushi,

which is the top wood exporting port in Japan.

|