2. GHANA

Manufacturers face tough times ahead

As the timber industry restarted operations after the

holidays they learnt from the Ghana Statistical Services

that December inflation came in at 17.7%.

Along with increased taxes, higher utility costs and rising

fuel costs prospects for a profitable year receded and

companies are scrambling to adjust to the worsening

situation which is affecting employers, employees and

consumers.

Manufacturers also have to deal with yet another challenge

每 depreciation of the cedi. Since the beginning of business

in the New Year the local currency has depreciated by

some 3.9% causing many to doubt if they will break-even

this year.

Economists anticipate the cost of borrowing could rise to

26% when the Monetary Policy Committee of the Bank of

Ghana next meets. Analysts point out that a further

increase in the prime rate could lead to higher inflation in

turn leading to higher prices in the domestic market.

The pressure on the cedi stems mainly from fears

that the

economic trends are still volatile and need to be stabilsed

quickly. In its latest staff report the IMF said Ghana*s

economic recovery will depend heavily on addressing the

current power crisis. If this is achieved the way forward,

according to an economist Kwame Pianim, is expansion of

exports.

Widening trade deficit with China

The Chinese Ambassador to Ghana, Ms Sun Baohong

said the value of trade between Ghana and China in 2015

rose to around US$6 billion. She also commented on the

increased use of Chinese technologies by Ghanaian

companies, a trend she hopes will grow as investments

from China*s US$60 billion dollar support for African

countries begin to flow.

The Ambassador reported that not only did the 2015

China-Ghana increase but there was significant investment

by China in engineering projects in Ghana such that of all

China*s investments in Africa those in Ghana where the

highest.

However, despite the growth in Ghana-China trade Ghana

recorded a trade deficit in 2015. According to Bank of

Ghana exports amounted to around US$2.4 billion (mainly

from oil, gold and agricultural products) while imports

cost almost US$4 billion.

Ratify Trade Facilitation Agreement says Chamber of

Commerce

The Ghana Port Authority has said revenue from transit

trade has been falling as neigbouring countries switch to

lower cost ports in the region such as Abidjan, Dakar and

Conakry amongst others. Transit shipments via Ghana*s

ports began to decline when trucking regulations were

tightened and the Port Authority saw trans-shipment

volumes drop by around half to 500,000 tonnes annually.

The issue of high transaction costs was raised by Mr.

Emmanuel Doni-Kwame, a spokesperson for the &Alliance

for Trade Facilitation* under the International Chamber of

Commerce (ICC Ghana). The Alliance is urging the

government to ratify and implement the recently proposed

Trade Facilitation Agreement as this would have a major

impact on Ghana*s export competiveness.

For more see:

http://www.newsghana.com.gh/transit-trade-in-wa-via-ghanaslumps-

to-50/

and

http://www.newsghana.com.gh/trade-facilitation-agreement-willraise-

export-revenue/

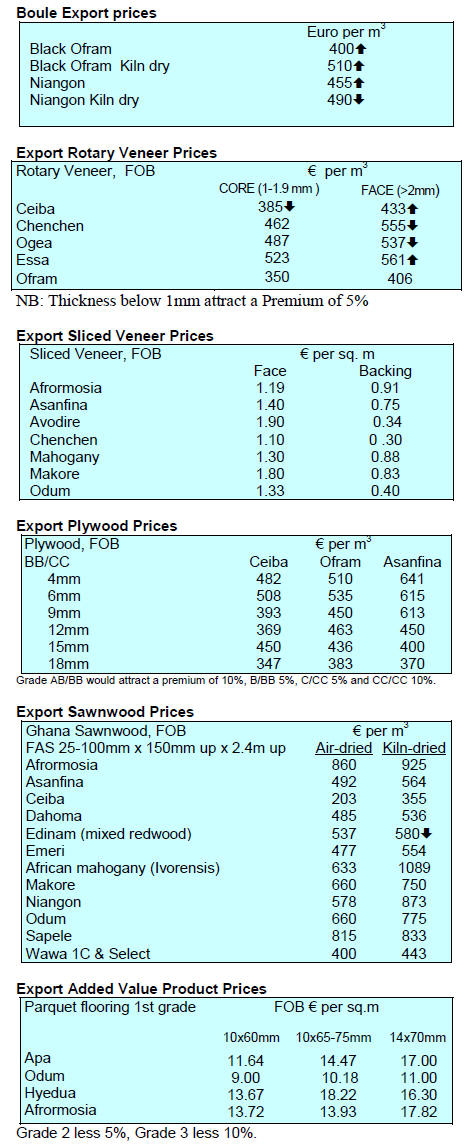

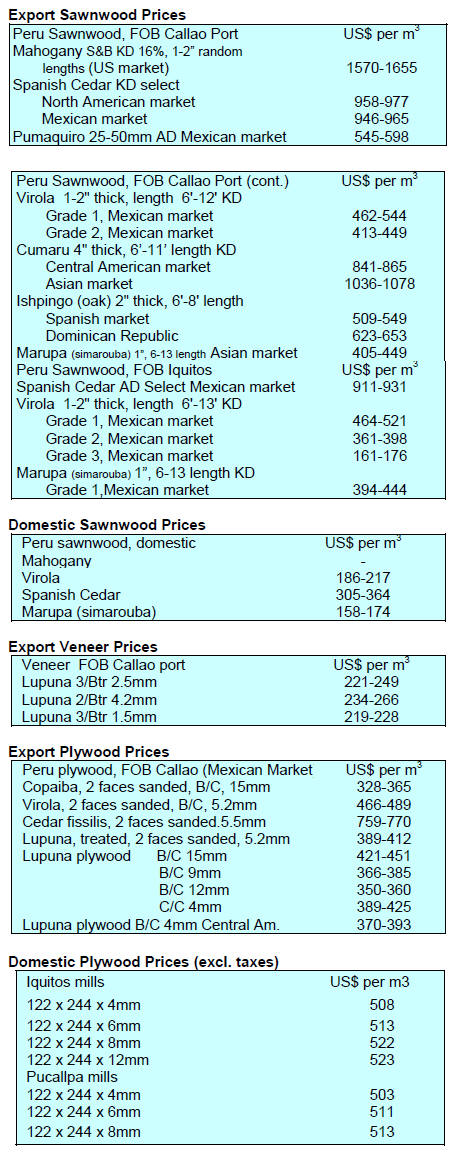

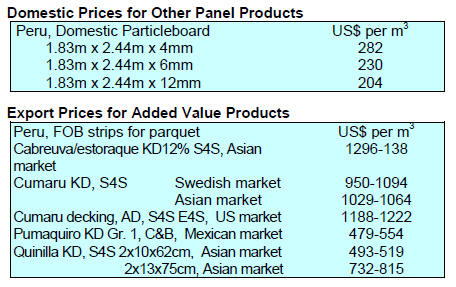

January prices

Prices for wood products remained unchanged as of 30

January.

3. MALAYSIA

Ringgit claws back some gains 每 prospects

for further

strengthening improve

The ringgit/US dollar exchange rate strengthened to a

three month high on the back of stabilisation in oil prices

and as traders welcomed the government*s budget realignment.

The Malaysian currency advanced against all

10 major currencies in the last week of January especially

the Indian rupee and South Korean won.

Pace of CoC certification applauded by PEFC

The Malaysian Timber Certification Council (MTCC) has

received an award from PEFC (Programme for the

Endorsement for Forest Certification) for the third highest

increase in the number of Chain of Custody (CoC)

certified companies in 2015.

Yong Teng Koon Chief Executive Officer at MTCC

reported that the MTCC registered 59 new CoC certificate

holders representing a 21% increase compared to 2014.

In a statement MTCC has indicated it would work to

ensure more domestic wood product end-users such

construction and building companies, furniture makers as

well as manufactures of composite boards and paper have

in place systems to secure raw materials from sustainably

managed forests.

Plantations to be at core of expansion of industry in

Sarawak

The Shanghai Taison Pulp-Making Group is considering

establishing a pulp and paper mill in Bintulu, capable of

handling as much as two million tons of pulp annually.

When complete the new complex could create over 10,000

job opportunities in the mills and in the plantations which

the company intends to establish.

Sarawak's plantation log production is set to rise to around

three million cubic metres in five years according to the

Sarawak Forestry Department. A Sarawak Timber

Industry Development Corporation (STIDC) publication

shows that plantation log production was over

530,000cu.m 2013. The STIDC plans to expand its

plantations areas to one million hectares by 2020.

Currently wood-based industries in Sarawak are mostly

primary processors producing plywood, sawnwood and

veneer from natural forest logs but, as natural forest

harvesting is scaled back, further expansion of these mills

is unlikely. However, as plantation resources become

available production of other primary and even secondary

products becomes a viable proposition.

New Deputy CEO for Malaysian Timber Council

In a press release the Malaysian Timber Council (MTC)

has announced the appointment of Richard Yu as Deputy

Chief Executive Officer.

Mr. Yu, a MBA holder from the University of Bath, will

be working with Chief Executive Officer Datuk Dr. Abdul

Rahim Haji Nik to lead the Council in their efforts to

further develop and promote the Malaysian timber

industry.

Mr. Yu was a Senior Director of one of Bank Negara*s

companies and has acted as advisor on areas corporate

finance, strategy and policy development, human resource

and talent management, risk management and ethics.

See: http://mtc.com.my/wp-content/uploads/2016/01/MTCAppointment-

of-Deputy-CEO.pdf

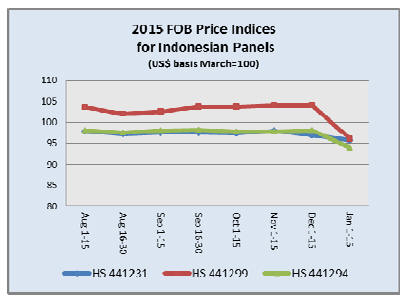

4. INDONESIA

Wood products at core of export growth

plan

An overall 9% growth in exports is the aim of the

Indonesian government for 2016 and greater emphasis will

be on non-oil exports. To support export growth the

government is improving infrastructure and has begun

deregulation to promote investment.

Ani Mulyati, of the Ministry of Trade said textiles and

wood products such as furniture and handicrafts will be at

the core of export growth in 2016.

Nus Nuzulia Ishak, DG for Export Development at the

Ministry of Trade, said special attention would be given to

developing markets in the Middle East especially Kuwait

and Saudi Arabia where Indonesian textiles, furniture and

other wood products were appreciated .

Head of Peat Restoration Agency appointed

At the 2015 Climate Change Conference (COP21)

President Joko Widodo announced the establishment of a

Peatland Restoration Agency charged with restoring fire

damaged peatlands. The new agency has been established

under Presidential Regulation No. 1 of 2016, dated

January 6, 2016.

To launch the new agency Nazir Foead, Conservation

Director at the World Wildlife Fund, has been appointed

as the head of the new agency.

The agency will prepare an action plan to restore fire

damaged peat lands in Riau, Jambi, South Sumatra, Papua

and across Kalimantan.

According to the World bank, last year, forest fires in

Indonesia resulted in a loss to the economy of around

US$16 billion or about 1.9% of Indonesia's GDP.

Interest rate cut

In a press release it was announced that the Board of

Governors of the Bank of Indonesia proposed a lowering

of interest rates to 7.25%.

This, said the Bank, was in line with view that there was

an opportunity for monetary easing as the macroeconomic

indicators remain stable. It is possible that further easing

will be introduced after an assessment of the domestic and

global economy.

Bank Indonesia Governor, Agus Martowardojo, said

that

while Indonesia*s economy had improved he will carefully

watch developments in the Chinese economy to assess

impacts on Indonesia since China is one of Indonesia*s

main trading partners.

5. MYANMAR

Commercial tax on timber

The Myanmar government has introduced new tax

structures. Under the new law a 25% sales tax will be

applied on sawn timber defined as 10 inch by 10 inch and

up of both teak and hardwoods. However, it is not clear

how the MTE will apply this. In fact, currently the MTE

include and collect a sales tax in their selling price.

One analyst said that the commercial tax was to be borne

by the buyer but if the MTE tries to collect an additional

tax on the sale of timber this will seriously affect the

competiveness of the industry.

Myanmar national timber plan

At a recent meeting with the Ministries of Forestry and

Commerce the private timber sector was invited to advise

on the content of the planned Myanmar Timber Industrial

Plan which is part of the National Economic Strategy

proposed by the Ministries of Forestry and Commence.

Investment by China in timber industries

According to the local media the Permanent Secretary of

the Ministry of Forestry is set to reject the proposal from

the China for setting up of a wood processing zone in the

northern border area with the aim of eliminating illegal

trading across the border. According to media reports over

100 NGOs and civil society organisations raised concern

on the plan.

Fixed exchange rate for import-export

The Custom Department has announced that the weekly

fixed exchange rate would be applied when calculating

taxation on items for import and export.

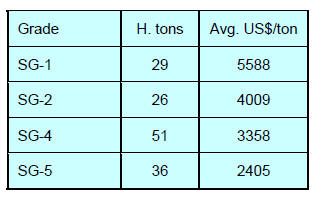

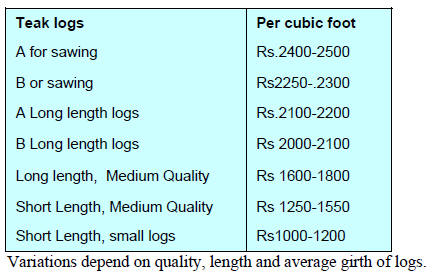

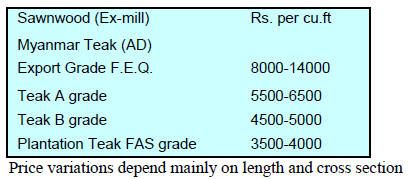

January teak prices

A total of 142 cubic tons of sawn teak was sold by open

tender at the January 2016 auction. Average prices are

shown below:

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for all commodities

(Base: 2004-05 = 100) for November rose 0.5% to 177.6

from 176.7 in October. The year on year annual rate of

inflation, based on monthly WPI, stood at 每1.99

(provisional) as of November 2015 compared to -3.81

based on data up to October.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

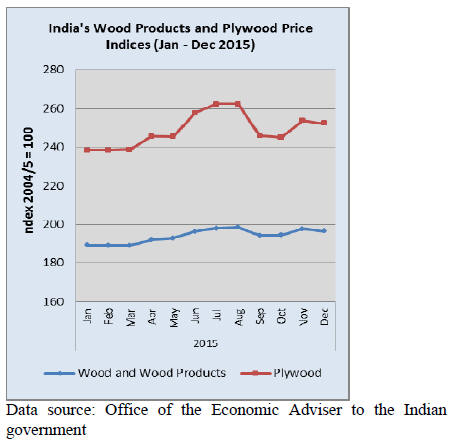

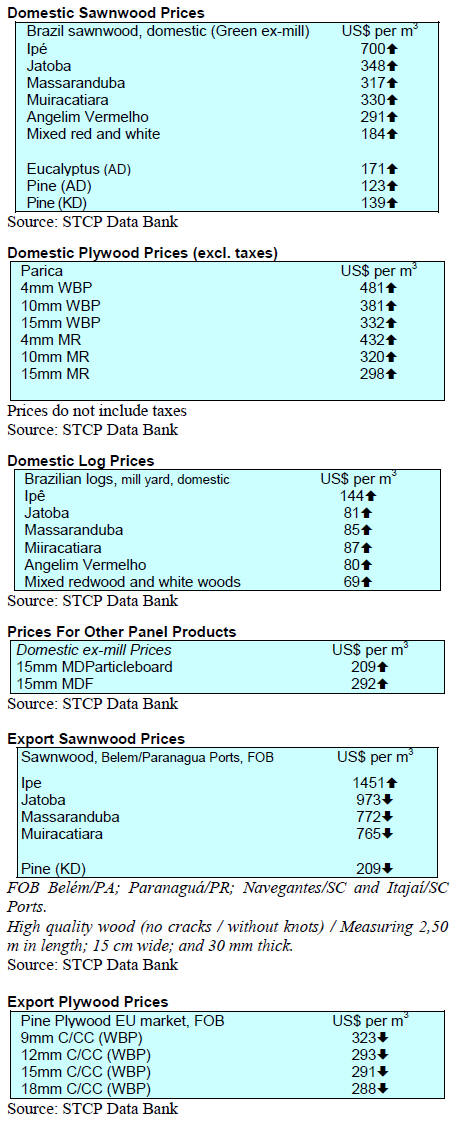

Timber and plywood price indices climb

The OEA also reports wholesale price indices for a variety

of wood products. The wholesale price indices for Wood

Products and Plywood are shown below.

Home sales fall in major Indian cities

Knight Frank India has just released its 2015 half-yearly

report on the 2015 India real estate market. This offers a

comprehensive view on the residential and office market

performance across seven cities for the period between

July每December 2015.

The headline is that 2015 ended with the lowest level of

housing starts and sales since 2010 however in the office

market the picture was quite different as occupancy rates

soared to their highest in years.

Home sales in the eight major cities fell 4% in 2015 to

come in at the lowest level since 2010 despite interest rate

cuts by the Reserve Bank of India which served to bring

down mortgage rates. The National Capital Region

continued to be the worst performing market. The report

notes that in the residential market unsold inventory levels

are so high that, at present rates of purchases, it would take

more than 2.5 years to sell all.

On house prices the Knight Frank report notes that there

was a sharp decline in the pace of price increases from 9%

to just 3% over the past 3 years.

For more see:

http://www.knightfrank.co.in/news/2015-ends-with-the-lowestnew-

launches-and-sales-volume-since-2010-for-residentialwhile-

office-market-records-highest-occupancy-at-84.2-

07961.aspx

INDIAWOOD 2016, one of the largest wood technology

shows in Asia

Over 650 domestic and international companies will be

exhibiting at INDIAWOOD to be held 25-29 February

2016 at the Bangalore International Exhibition Centre

(BIEC).

More than 650 companies offering furniture production

technologies, woodworking machinery, tools, fittings,

accessories, raw materials and products will be taking part

in one of Asia*s largest trade fairs for the woodworking

and furniture manufacturing sector.

A press release from the organisers says craftsmen,

woodworkers and furniture manufacturers; distributors,

dealers and manufacturers of hardware and accessories;

plywood and particle board manufacturers and traders;

manufacturers of wood-based products; architects, interior

designers and builders from India and South-East and

South Asian countries will participate in INDIAWOOD

2016.

According to a report from INDIAWOOD, production by

the Indian furniture manufacturing industry is worth

around US$20 billion annually and the sector employs

more than 3 million. people in the organised sector alone.

INDIAWOOD says the industry has seen an annual

growth of around 30% over recent years.

For more see: http://www.indiawood.com/press-releases.html

Greater focus on bamboo

Union Minister, Nitin Gadkari, plans to constitute a

bamboo sub-group under Niti Aayog of the Planning

Commission.

A recent meeting of senior ministers heard that the

domestic market for bamboo is estimated to be worth

around US$10 billion annually and this is set to grow

generating enormous job opportunities along the

production chain plantation development to

manufacturing. Production of ethanol derived from

bamboo for bio-diesel offers other opportunities for

investment.

The government is planning schemes to encourage farmers

to establish bamboo plantations along national highways

and the Road Transport and Highways Ministry has

unveiled a plan for &greening* extending along 100,000

km. of national highways.

K. Bhattacharya, the head of the National Green Highway

project said the world market for bamboo products has

been estimated at around US$360 billion with China and

Vietnam being the main suppliers. He said India*s exports

are no higher than those of the Philippines but could be

much higher.

The government is resolved to increase production of

bamboo to augment wood supplies for housing, furniture,

panel products packaging etc. The Indian Plywood

Industries Research and Technical Institute (IPIRTI ) has

begun work developing technologies for production of

bamboo products.

IPIRTI has already invested several years of research in

development of cost effective, eco-friendly technologies

for manufacture of several bamboo based products such as

bamboo mat board, veneer composites, corrugated sheets

and flooring, including high density flooring that can be

used in containers. At present laminated bamboo lumber is

being imported and is finding applications in the transport

sector especially Indian Railways.

Quality of teak logs results in high auction prices

Auctions at forest depots in South Dangs were scheduled

from 21 December 2015 up to 5 January 2016, but

continued till 9 January. More than 12,000 cu.m of teak

and other hardwoods were sold.

Good quality non-teak hardwood logs, 3 to 4 meters

long

having girths 91cms and up of haldu (Adina cordifolia),

Laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium logs fetched prices

in the range of Rs.800-900. Prices for medium quality logs

were in the range of Rs.300-350 per c.ft.

The quality of logs was reported as good but several lots

remained unsold as buyers felt that prices were unduly

high.

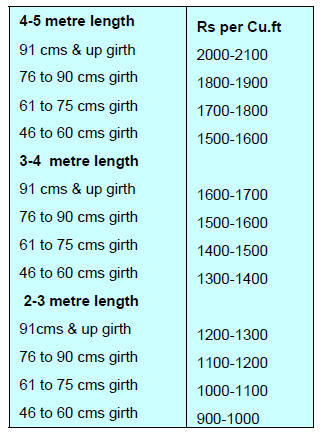

Teak sales in Central Indian forest depots

Deliveries of teak to all depots of Madhya Pradesh have

been good. Teak logs from areas recently harvested are

mostly of 2 to 5 metre lengths and in girth class 120 cms

and below. Observers say the logs available were of good

form and the timber was of a golden color with black

stripes.

The latest auctions were held at depots in Narmadanagar,

Jabalpur, Hoshangabad and Betul divisions. Over 22,000

cubic metres of teak logs were sold. Buyers were mainly

from local mills plus merchants from Gujarat and South

India. Average prices were higher than the previous

auctions and are shown below.

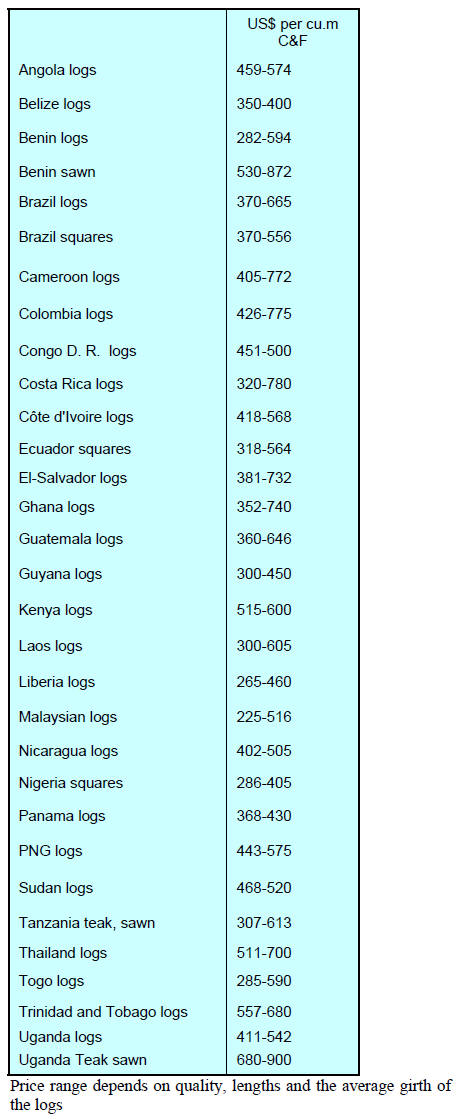

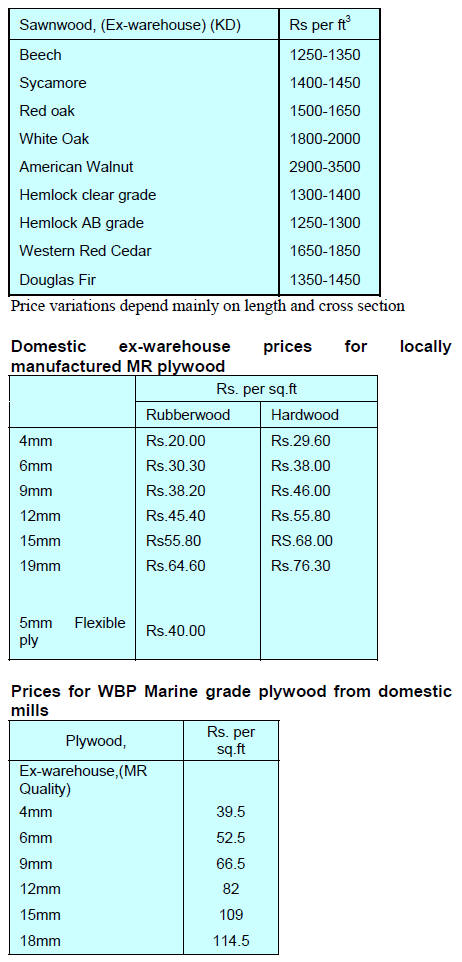

Prices for locally sawn hardwoods

Prices are unchanged from December but prices are

expected to change when new shipments arrive.

Prices for imported plantation teak, C&F Indian

ports

Demand and international shipments are balanced and

while FOB prices are unchanged landed costs are rising as

the US dollar strengthens against the rupee.

Myanmar teak logs sawn in India

No price movements have been reported.

Prices for imported sawnwood

Prices in rupee for imported temperate timbers have been

rising due to the appreciation of US dollar and are likely to

go up further if devaluation of the rupee continues.

﹛

7.

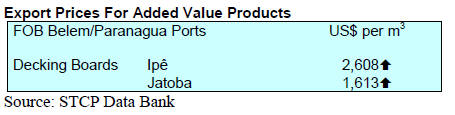

BRAZIL

Wood product exports at highest level

since 2008

Despite an uninspiring year, Brazil*s 2015 exports of

wood products matched that of 2007. In the case of pine

plywood, exports were over 1.5 million cu.m, or 14%

more than in 2014.

Exports of wood products such as particleboard, MDF and

OSB, traditionally uncompetitive at the international level,

increased significantly as manufacturers were forced to

turn to export markets in the face of weak domestic

consumption.

A measure of success was achieved with exports

especially to the US as the housing market is recovering.

Demand in the US was behind the rise in pine sawnwood

exports while the gains in plywood exports were driven

mainly by rising demand in Europe.

Although wood products export volumes are rising and

further gains are projected the competitiveness of

Brazilian companies is being affected by record inflation

which continues to push up internal costs.

December export performance

Brazil*s December 2015 exports of wood-based products

(except pulp and paper) fell 12.4% in value compared to

December 2014, from US$263.1 million to US$230.6

million.

Pine sawnwood export values increased 27% in December

rising from US$ 21.4 million in 2014 to US$ 27.2 million

in Decmber 2015. In terms of volume, December exports

increased 46% year on year over (90,800 cu.m to 132,300

cu.m.

On the other hand, tropical sawnwood exports fell 34% in

volume, from 38,000 cu.m in December 2014 to 25,100

cu.m in December 2015. The decline was more

pronounced in terms of value where year on year

December exports fell 47% from US$ 22.5 million to US$

12 million.

The growth in value of pine plywood exports could not

match the success of pine sawnwood and declined 12% in

value in December 2015 compared to December 2014

(from US$43.8 million to US$38.4 million). But, the

volume of pine plywood exports increased 25.5%

underlining the weakness in plywood demand at the end of

last year.

In contrast to the trends in pine plywood exports, tropical

plywood exports increased significantly in volume and in

value, from 6,300 cu.m (US$ 3.4 million) in December

2014 to 135,800 cu.m (US$43.5 million) in December

2015.

The much hoped for recovery in demand from Argentina

has not yet been achieved and as a result wooden furniture

exports fell from US$ 41.5 million in December 2014 to

US$ 37.3 million in December 2015, a 10% drop.

Brazilian timber industry prospects in 2016

Brazil*s timber industry experienced a mixed performance

in 2015 as a number of factors affected competitiveness

for example; rising production costs, volatility in the US

dollar exchange rate, uncertainty due to slowing growth in

China and weak domestic demand.

Continuing weak domestic demand and uncertainty over

the direction of the economy means that 2016 will be a

tough year for manufacturers.

The Brazilian timber flooring sector achieved good results

in 2015 due to firm export demand and favourable

exchange rates. 2015 solid wood flooring exports

increased 18% year on year.

Tropical veneer and plywood producers were expecting

increased demand in export markets especially the US but,

even though the US dollar appreciated, sales did not match

expectations.

ABIMCI anticipates that Brazilian companies will

increasingly turn to the export markets this year as there is

little prospect of a recovery in the domestic market.

Weak domestic demand for furniture of concern in

Santa Catarina

The combined value of output from the timber and

furniture sectors is ranked ninth in the top ten export

sectors in the State of Santa Catarina according to the

2015 Annual Trade Balance Report, published by the

Federation of Industries of Santa Catarina State (FIESC).

The sectors had combined revenues of over US$192

million in 2015 and were the only sectors to achieve an

increase in exports compared to 2014 however, 2015 was

a difficult year which saw overall output fall and

unemployment rise.

Product diversification, design, quality and competitive

pricing helped keep Santa Catarina furniture makers in the

market but despite the good performance the collapse of

the domestic market has created serious problems for

manufacturers.

Use of drones to monitor logging

This year unmanned aerial vehicles (UAV) will be

deployed by the Brazilian Forest Service (SFB) to monitor

logging concessions granted by the federal government.

UAVs have already been used on a trial basis and the idea

is that they could replace some of the tasks of technicians

in the field speeding up the tracking of timber. Trials

suggest using drones it is possible to assess sourcing and

movement of 25,000 cubic metres of timber (about 700

loaded trucks), within a few hours.

By the end of 2015 there were more than 875,000 hectares

of logging concessions supplying around 1 million cubic

metres of raw material annually. The Brazilian Forest

Service estimates that by 2022 the area of forest

concessions could reach 7 million hectares.

Inflation and interest rates

Inflation in Brazil stood at 0.96% in December 2015,

closing the year at 10.67%, the highest rate in 13 years.

The December figure pushed inflation for last year well

above the Central Bank target for the year. Interest rates

remains at 14.25% and the next meeting of the Monetary

Policy Committee (COPOM) of the Central Bank of Brazil

held on November 25. The next meeting is scheduled for

late January, 2016.

8. PERU

Wood product exports hit by falling

demand in China

Data from the Association of Exporters (ADEX) shows

that up to November 2015 total exports were down almost

9.5% year on year from US$154 to US$139 per cu.m

FOB.

Products which featured prominently in November exports

were profiled softwoods for strips and friezes which

accounted for around 32% of all wood product exports.

November exports of profiled timbers fell almost 4%

compared to November 2014. Other wood products of

significance were sawnwood but exports fell by over 38%

mainly because of a decline in purchases by importers in

China.

Despite the weakening demand in China it remains the

main market for Peru*s wood products accounting for

about 37% of all wood product exports. A market that

holds promise is Mexico. Compared to November 2014

there was a 7% increase in exports to Mexico in

November 2015.

Sawnwood exports up to the end of November 2015 were

worth US$45.54 million, a year on year drop of around

24% but for Mexico exports rose by almost 22% compared

to the same period in 2014.

Exports of semi-manufactured products were worth

US$64 million for the eleven months to November 2105

with most destined for China which accounted for around

70% of all exports of semi-manufactured wood products.

But demand in Denmark has bene sustained and expanded

35% year on year.

Peru*s exports of veneer and plywood dropped to US$15

million as of November, a decline of 5% year on year. The

main export markets for veneer and plywood were Mexico

and the United States but imports of veneer and plywood

by Mexico were down almost 2.5%.

Exports of furniture and parts for the year ending

November 2015 dropped 17% to US$5.96 million. The

US accounted for 58% of all Peru*s furniture exports

followed by Italy at 15%.

Steady acceleration of growth forecast

Peru*s Economy and Finance Minister, Alonso Segura, has

said Peru´s economy would continue on a recovery track

despite economic instability in the region and in

international markets.

His overall assessment of economic prospects for the

country were echoed by the International Monetary

Fund (IMF) which, in its latest assessment, felt that the

steady acceleration in growth will continue despite weak

commodity prices which impact Peru*s export earnings.

IMF analysis suggests that Peru´s economic growth will

be 3.3% this year higher than rates projected for Chile

(2.1%), Colombia (2.7%), Mexico (2.6%) and Brazil

(-3.5%).

GUYANA

GUYANA