|

Report from

Europe

Weak growth continues in EU

Over the last 5 years, the words ※flat§, ※stagnant§ and

※slow§ have frequently been used in relation to the

European wood market. At the start of 2016, the situation

has hardly changed. Overall growth in the European

construction sector and wider economy has picked up only

slowly since hitting bottom in early 2013.

The International Monetary Fund (IMF) estimates that

GDP in the 28 European Union countries will grow 2% in

2016, marginally up from 1.9% in 2015. But there is

mounting concern that the world economy will enter a

cyclical downturn before Europe regains the ground it lost

in the financial and euro crises.

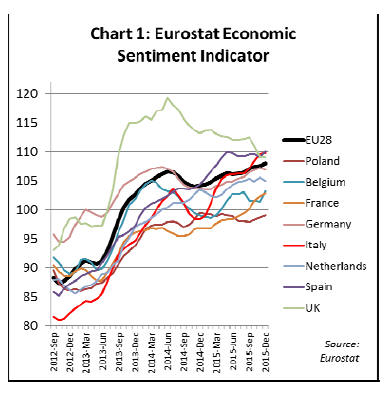

Overall there*s been some convergence in economic

performance between EU Member States since mid-2015.

This convergence is particularly apparent from the

Eurostat Economic Sentiment Indicator (Chart 1) based on

a monthly survey of perceptions and expectations in five

surveyed sectors (industry, services, retail trade,

construction and consumers) in all EU Member States.

Although still positive, over the last six months economic

sentiment has declined in the UK, the one large EU

economy that recovered relatively early from the financial

crises. Meanwhile sentiment has improved sharply in

several countries that were lagging, notably Italy, Spain

and France.

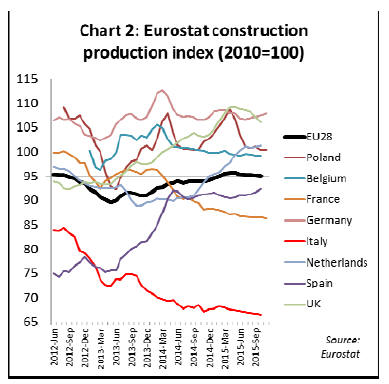

The Eurostat Construction Production Index (Chart 2)

shows that the recovery in EU construction effectively

stalled after March 2015, with activity stuck at only

around 95% of the level in 2010. Construction activity in

France and Italy was at historically low levels in 2015 and

continued to decline throughout the year.

Activity also lost ground in the UK and Poland, countries

which were driving recovery in 2014 and early 2015.

More encouragingly, activity remained robust in Germany,

was rising in the Netherlands and at least remained stable

at a higher level in Spain.

Slight uptick in building permits

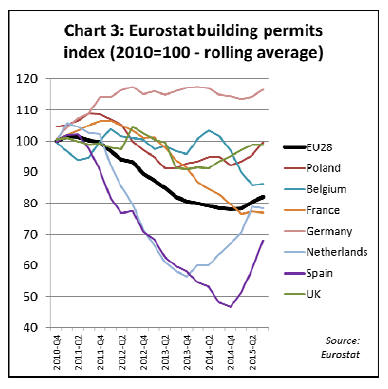

The Eurostat Building Permits index (Chart 3), a forwardlooking

indicator, also provides some encouragement that

the workload of the European construction industry will

improve in the near future.

There was an uptick in the level of building permits issued

across the continent in the second half of 2015. This was

particularly driven by a significant increase in building

permits issued in Spain and the Netherlands.

There was also a rise in building permits issued in the UK

and Poland suggesting construction sector growth in those

two countries will resume in 2016. Building permits

remain at a high level in Germany.

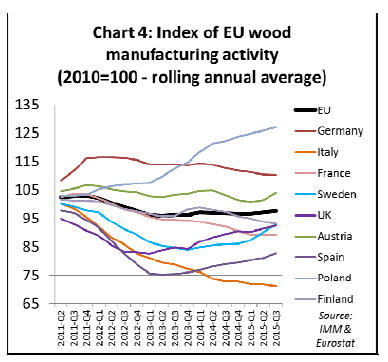

Demand for wood products has benefitted only a little

from Europe*s slow economic recovery in the last three

years. This is evident from the Eurostat index of EU wood

manufacturing activity which covers the sawmilling,

veneer, panels and joinery sectors but excludes wood

furniture (Chart 4).

European wood manufacturing activity remained stalled at

around 97% of the 2010 level between the start of 2014

and second quarter of 2015.

However there was an encouraging uptick in the third

quarter of 2015, with activity increasing in Poland,

Austria, UK, Sweden, and Spain. Rising activity in these

countries during this period was sufficient to offset a

slowdown in Germany and Italy, respectively the first

second largest wood manufacturing countries in Europe.

Wood yet to make significant inroads into market

share of other materials

The stasis in European wood manufacturing activity is a

reflection of the slow growth in the European construction

sector. It also suggests that wood has yet to make

significant inroads into market share of alternative

materials.

Competition between suppliers of different wood products

每 such as between panels and sawn wood and between

temperate and tropical hardwood - also remains intense.

While total European demand for wood products has

remained flat, there are on-going significant shifts in the

source of demand. Markets for sawn wood and woodbased

panels have been particularly hard hit by the

economic downturn and stagnation of the building and

furniture sectors.

The wood veneer sector has suffered profoundly from the

contraction of the southern European joinery

manufacturing industry and has come under intense

pressure from substitute materials and new finishing

techniques across the European continent.

However new opportunities are arising for value-added

engineered and other forms of modified wood products,

particularly in structural applications. The combination of

strong technical performance and reduced overall costs of

construction are the main drivers for uptake of these

modern wood products.

The carbon and sustainability message is a welcome bonus

for those specifiers and contractors keen to burnish their

green credentials. The relatively positive outcome of the

recent Climate Change conference in Paris (see below)

gives some confidence that this latter issue may become a

more prominent driver in the future.

Euroconstruct forecast 3% growth in construction in

2016

At their 80th conference in Budapest in December, the

independent research organisation Euroconstruct projected

that total construction output in Europe increased 1.6%

during 2015. This compares to their more optimistic

forecast of 1.9% growth made at the previous

Euroconstruct Conference in June 2015.

However Euroconstruct is now more optimistic about

prospects for 2016, forecasting 3% growth during the year

(compared to their June forecast of only 2.4% growth).

Euroconstruct also forecast growth of 2.7% in 2017 and

2% in 2018.

Euroconstruct estimate European construction output will

have a value of €1412 billion in 2016, €1450 billion in

2017 and €1478 billion in 2018. This compares to a peak

of €1532 billion just before the financial crises.

Euroconstruct forecast that the construction sectors of all

19 countries represented by the organisation will grow

between 2016 and 2018. They note that during 2015,

growth was particularly rapid in Ireland (+10.6%),

Slovakia (+10.3%), Czech Republic (+7.4%), and the

Netherlands (+6%).

In 2016-2018, annual construction growth is expected to

exceed 7% in Poland and Ireland. However, the five

largest construction markets in Europe 每 Germany, UK,

France, Italy, and Spain - are also expected to grow more

strongly and together will contribute more than two thirds

of the forecast market expansion in 2016.

In recent years, much of the growth in European

construction activity has been in repair, renovation and

maintenance. These activities were responsible for 60% of

the total residential market in 2015.

However, Euroconstruct suggest that much increased

growth in construction activity in 2016-2018 will be in the

residential new build sector. This will be driven by the

massive influx of migrants arriving in Western European

countries such as Germany, the Netherlands, and to Nordic

countries of Denmark, Finland, Norway and Sweden.

Using conservative assumptions, it has been calculated

that in the next three years, excess demand for social

housing will be at least 900,000 people, for whom the

current social housing capacity is insufficient.

Euroconstruct suggest that the non-residential market will

also grow in all 19 Euroconstruct countries during 2016

and that this growth will stall in only two countries 每

Finland and Sweden - in 2017.

Implications of Paris Agreement for forests

The UN climate summit in Paris that ended on December

12th did not deliver on all fronts, providing no guarantee

that the world will avoid the worst impacts of climate

change. However it did produce the most promising

international climate agreement in years.

Critically, the agreement built on initial commitments of

over 180 countries to reduce their carbon emissions and

includes a review clause to encourage countries to increase

their pledges in the near future.

As the only the economic sector to be referenced

explicitly, the Paris agreement also raised the political

profile of forestry and signalled that cutting emissions

from deforestation and promoting sustainable forestry is

now recognised globally as one the most efficient ways to

address climate change.

To make Paris a lasting success, it*s now important that

the key agreements on issues such as financial support, the

increase of emission-reduction pledges, and Reduced

Emissions from Deforestation and Forest Degradation

(REDD) are further developed and implemented in the

months and years ahead.

The agreement is built on the commitment of signatories

to deliver against ※Intended Nationally Determined

Contributions§ (INDC) to reduce greenhouse gas

emissions. By allowing countries to voluntarily declare

their own commitments, discussions in Paris side-stepped

the serious political conflict created in earlier negotiations

which sought to allocate specific targets for emissions

reductions to individual countries.

The downside of this approach is that, in aggregate, the

commitments made fall well short of what the scientific

community argues is needed to limit the global

temperature rise to 2 degrees Celsius above pre-industrial

levels, the widely recognised threshold for major

economic and environmental disruption.

The upside is that the agreement achieved unprecedented

levels of political support. Close to 150 world leaders were

in Paris to mark the start of the talks and negotiators from

195 countries signed off on the agreement when the talks

ended.

Paris was also significant for the high and positive levels

of business engagement, a testament to the growing

momentum behind global climate policy.

While the INDC*s in aggregate fall short of what is

required, some national commitments are ambitious and

together they signal that measures to reduce carbon

emissions will be an increasing factor in political and

economic decision-making worldwide in the future.

For example the EU committed to reduce GHG emissions

to 40% below 1990 levels by 2030. China indicated that it

will reduce carbon intensity to 60-65% of 2005 level by

2030, increase the non-fossil fuel in national energy

supply to 20%, and continue to expand forest area. The

United States stated that it would reduce GHG emissions

to 26-28% below 2005 level by 2025.

Many developing countries included action against

deforestation in their INDCs. For example Brazil

committed to ※strengthening policies and measures with a

view to achieve, in the Brazilian Amazonia, zero illegal

deforestation by 2030 and compensating for greenhouse

gas emissions from legal suppression of vegetation by

2030.§

Forestry related measures were also prominent in the text

of the agreement. Article 5 encourages countries to ※take

action to implement and support, including through

results-based payments§ REDD+ activities. It also

explicitly recognises ※the role of conservation, sustainable

management of forests and enhancement of forest carbon

stocks in developing countries.§

The overarching ※decision§ that Annexes the Paris

Agreement recognised ※the importance of adequate and

predictable§ finance for REDD+ activities. Although the

&rules of the game* for REDD+ were already agreed 每 thus

legitimising and &regulating* REDD+ activities 每 the

political signal of Article 5 is very important. It shows

forest nations that this is a long-term game.

This in turn should give added confidence to continue with

REDD+ strategy and readiness activities.

Several groups of nations used the opportunity offered by

the Paris Conference to launch new forestry-related

initiatives. African nations, with support from NGOs and

the German government, launched AFR100 at the Global

Landscapes Forum during the Paris meeting.

AFR100 is an initiative to restore 100 million hectares of

degraded forest lands before 2030. It is led by ten African

countries: the Democratic Republic of Congo, Ethiopia,

Kenya, Liberia, Madagascar, Malawi, Niger, Rwanda,

Togo and Uganda.

There was also a ※Leaders* Statement on Forests and

Climate Change§ issued jointly by the governments of

Australia, Brazil, Canada, Colombia, Democratic Republic

of Congo, Ethiopia, France, Gabon, Germany, Indonesia,

Japan, Liberia, Mexico, Norway, Peru, United Kingdom

and the United States.

The Statement included a commitment to intensifying

efforts to protect forests, to significantly restore degraded

forest, peat and agricultural lands, and to promote low

carbon rural development. It also included commitment to

large-scale implementation of national REDD+ and

sustainable land-use and climate change programs and,

importantly, to generate and reward verified results.

Leaders from developing and developed countries also

launched specific partnerships to help reduce

deforestation. For instance, Brazil and Norway extended to

2020 their partnership to reduce deforestation in the

Amazon Forest and Norway committed new financial

support. Norway, Germany and the UK also pledged to

provide US$5 billion from 2015 to 2020 for REDD+

programs.

Some private sector representatives of the private sector

were also keen to lend their support. The co-chairs of the

Consumer Goods Forum 每 M&S and Unilever 每 issued a

statement that they will preferentially buy agricommodities

from areas that have ※designed and are

implementing jurisdictional forest and climate initiatives§.

Building on their commitment to ※deforestation-free§

sourcing policies through the New York Declaration on

Forests, the two companies said in future they will

preferentially source from jurisdictions that demonstrate

commitment and progress towards an ambitious national

INDC which includes a strategy for reducing emissions

from forests and other lands whilst increasing agricultural

productivity and improving livelihoods.

But perhaps more significant for forest policy than these

statements of intent, was a pivotal reference in the Paris

Agreement to the importance of ※removals by sinks of

greenhouse gas emissions in the second half of the

century§ to rapidly reduce global emissions after they peak

※as soon as possible.§

There was combined with a transparency clause which

makes clear that removals by sinks must be included in

national emissions inventories.

The implication is that forests 每 a vast sink which can be

increased through active management 每 are acknowledged

to be central to the solution of global climate change.

Countries worldwide are also under an obligation to

account accurately and regularly for all the carbon stored

in the vegetation and soils in forests, as well as in

agricultural land and protected areas and in the products of

these lands (such as wood, crops, and biomass).

As this data is collected and analysed, new market

opportunities should arise for sustainable timber products

as it becomes increasingly clear that increased use of such

products is a particularly efficient way to reduce carbon

emissions.

|