US Dollar Exchange Rates of

10th January 2016

China Yuan 6.5713

Report from China

Signs of recovery in house prices

Compared to October last year November 2015 new home

prices in 70 medium and large-sized cities declined in 27

cities but remained unchanged in all others. For November

2015 the month-on-month change was positive. The

November data for Chinese house prices can be found in a

press release from the National Bureau of Statistics at:

http://www.stats.gov.cn/english/PressRelease/201512/t20151221

_1293029.html

Prices for second-hand residential buildings fell in a

minority of the cities surveyed but rose as much as 2% in

some others.

The improvement in house prices came as a surprise to

many but were greeted as a sign that there could be a

recovery beginning in a sector whose performance mirrors

the overall economy.

The housing market is a closely watch indicator for the

Chinese economy as it accounts for around 15% of GDP

and trends in housing impact many wood product

manufacturers.

Structure of forest industry has changed

According to the State Forestry Administration, the total

output value of China¡¯s forestry industry output in 2015

was RMB5.81 trillion just over 2.5 times higher than in

2010. The value of international trade in wood products

trade was US$140 billion some 1.5 times higher than that

in 2010.

China¡¯s forestry industry has developed significantly since

2010. Greater attention was given to environmental issues

and ¡®green¡¯ production and trade and there were

developments in the forest economy, forest tourism, and

non-wood forest product development. Over the past 10

years the sector has seen a sharp rise in e-commerce and

marketing.

Over the 10 years of the Twelfth Plan the structure of

forest industry has gradually changed and the proportion

of primary, secondary and tertiary forestry industries now

reflect a mix of 33:51:16 (2015) from a proportion of

39:52:9 in 2010.

Distribution and trade in ¡®redwoods¡¯

In China¡¯s national standard of ¡®redwood¡¯ (GB18107-

2000) 5 genera, 8 categories and 33 species are recorded.

Five species are distributed in China namely the native

scented rosewood, black rosewood and kamagony and two

species, Siamese senna and Bupadauk which have been

introduced.

The distribution of ¡®redwoods¡¯ in China:

Scented rosewood (Dalbergia odorifera T. Chen)

Hainan

Black rosewood (Dalbergia fusca pierre) Yunnan

Kamagony (Diospyros philippensis Gurke)

Taiwan P.o.C

Siamese senna (Cassia siamea Lam.) Yuannan,

Guangdong

Burmacoast padauk (Pterocarpus indicus Willd)

Guangdong, Guangxi, Hainan and Yunnan

Scented rosewood is endemic to China¡¯s Hainan province

and is categorised as a national protected plant. It is

mainly distributed in the west, southwest and south of

Hainan province. Currently the introduction and

cultivation of scented rosewood is going ahead in Hainan,

Guangdong and Guangxi provinces.

Large-scale cultivation of scented rosewood in Hainan

province has developed rapidly.

Black rosewood is also a protected plant and is mainly

distributed in Xishuanbanna and Simao in Yunnan

province there are also reports of scattered occurrence in

Luchuan county and Yuanjiang county of Yunnan

province. Kamagony is mainly distributed in Taiwan

P.o.C.

Siamese senna and Burmacoast padauk has been

introduced and cultivated in Yunnan, Guangdong,

Guangxi, Hainan, Fujian and in Taiwan P.o.C..

Trade in ¡®redwoods¡¯ has declined in recent years

There are about 11,000 ¡®redwood¡¯ processing enterprises

in China with 4,000 being in Fujian province, 2,000 in

Zhejiang province, 1,900 in Jiangsu province, 1,300 in

Guangdong province, 1,000 enterprises in Beijing and 800

enterprises in Hebei province.

Although prices for ¡®redwoods¡¯ are high there is little

interest in commercial platations as growth rates are very

slow and rotations very long. The vast majority of China¡¯s

¡®redwood¡¯ is imported but the trade in ¡®redwoods¡¯ has

declined in recent years.

According to the Chinese ¡®Redwood¡¯ Committee, China¡¯s

¡®redwood¡¯ log imports were 628,300 cubic metres valued

at US$705 million from January to September 2015, a

year on year decline of 57% in volume and 64% in value

compared to a year earlier. The average price for imported

¡®redwood¡¯ logs dropped 15% in the same period.

China¡¯s sawn ¡®redwood¡¯ imports totalled 89,000 cubic

metres in the first nine months of last year and were

valued at US$161 million, a year on year drop of 51% in

volume and 51% in value. However, the average price for

imported sawnwood fell only slightly.

The main sources of China¡¯s ¡®redwoods¡¯ were Africa and

Southeast Asia. In the first nine months of last year 62%

or 395,400 cubic metres was imported from African

countries and were worth US$D289 million, down 3% in

volume and 1% in value.

The balance of 339,200 cubic metres of ¡®redwoods¡¯ were

imported from Southeast Asian countries at a value of

US$557 million, up 4% in volume and 3% in value from

the same period of 2014.

Soaring ¡®redwood¡¯ imports through Taicang Port

According to the data from China¡¯s Customs, ¡®redwood¡¯

imports through Taicang Port in 2015 were 4,340 cubic

metres valued at US$4.72 million, a year on year increase

of over 400% in volume and 600% in value.

The number of species of imported ¡®redwood¡¯ entering

China through Taicang Port last year grew to 10 from 3

and were mainly from South America and Southeast Asia.

The average price of imported ¡®redwood¡¯ through Taicang

Port rose 40% to around US$1,000 per cubic metre.

Middle and high grade ¡®redwood¡¯ dominated imports last

year and the price differential between the different

varieties was considerable ranging from US$520 to

US$2600 per cubic metre.

Furniture manufacturers targeted for VOC emission

control

The government of Dongguan city in Guangdong province

has introduced policies to control air borne pollution from

furniture and other manufacturers as it has recorded the

highest increase in VOC emissions in the Pearl River

Delta.

It is reported that VOC emissions will be gradually

tightened and industries will be encouraged to relocate

away from urban areas.

The local authorities have identified that furniture,

shoemaking, printing, coating and chemical industries are

the main contributors to VOCs and such industries will

again be allowed to open in the dense urban areas. These

industries are the main contributors to air pollution in the

Pearl River Delta region.

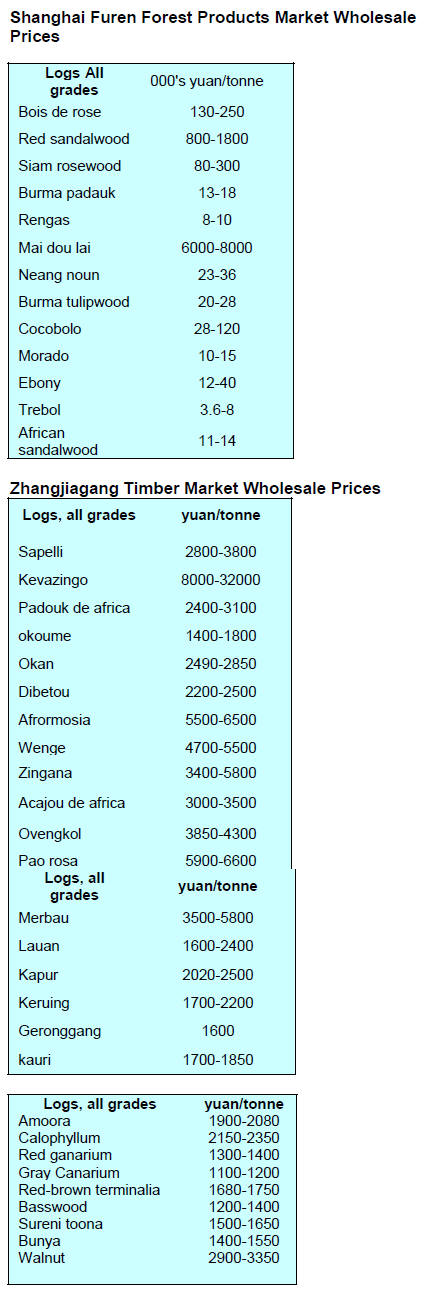

Russian sawnwood imports rise

Manzhouli Customs has reported that between January and

November 2015 sawnwood imports through the Port rose

18% to RMB4.66 billion, up 12% from the same period in

2014.

The increase in sawnwood imports through Manzhouli

Port was mainly the result of competitive pricing of

Russian export sawnwood. The 4.28 million cubic metres

of sawnwood handled by the Port were mainly transported

by rail with a small volume arriving by truck.

Traders at Zhangjiagang Port ready to head home for

New Year celebrations

Timber traders at Zhangjiagang Port are busier than in

previous years but operations in the Port have slowed as

traders wind down activity in advance of the New Year in

early February.

Many of the traders are expected to head back to their

family homes for the New Year and analysts say business

at the Port will not get back to full swing until the end of

February. The slow pre-New Year business has driven

down prices for imported timbers.

|