Japan Wood Products

Prices

Dollar Exchange Rates of 10th

January 2016

Japan Yen 117.65

Reports From Japan

First fall in machinery orders for three

months

Cabinet office data shows that in November, the latest for

which numbers are available, machinery orders fell just

over 14% from October. This marks te first decline in

three months and draws attention, once more, to the

hesitancy of companies to commit fully to capital

investment.

However the 2105 November figures are up slightly on

November 2014which, given the current global economic

situation, should be seen as a positive development.

Better than expected consumer confidence

The slight improvement in Japan's consumer confidence

index was a welcome sign. The December (seasonally

adjusted) index came in at 42.7 up from 42.6 in

November. The consensus amongst analysts was that a fall

in the index was more likely.

The index for income growth strengthened as did the

overall livelihood index.. The index for willingness to buy

durable goods remained at the same level as in November

2015.

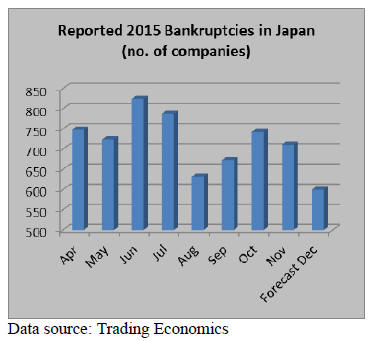

Bankruptcies at historic low

The availability of soft loans coupled with improving

finances has resulted in a sharp fall in the number of

Japanese companies going out of business in 2015.

Data from Japan’s Financial Services Agency suggests

that for the second consecutive year bankruptcies in Japan

could be 10,000. The last time Japan saw fewer than

10,000 bankruptcies for two consecutive years was in

1989.

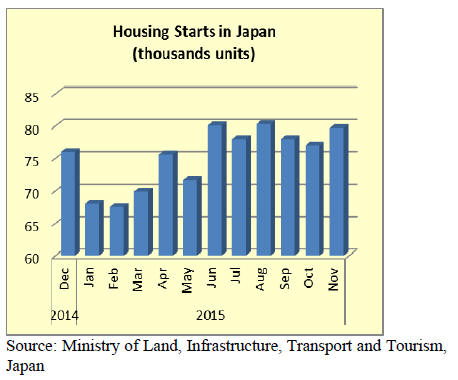

November housing starts lift expectations to

900,000

for the year

Ministry of Land, Infrastructure, Transport and Tourism

data show housing starts improved more than forecast in

November coming in much higher than the previous

month. October starts were particularly poor being 2.5%

down from September.

The good November figures have lifted expectations for

annual starts to close to 900,000.

BoJ attempts adventurous route to lift inflation

In a move that surprise analysts the Bank of Japan (BoJ)

has become a major player in the domestic stock market

such that asset managers are designing investment funds to

suit the new role of the BoJ.

Having lost patience with the slow pace of inflation

growth the BoJ Governor said the Bank would purchase

equity in companies that were "proactively making

investmenst in physical and human capital".

The government and BoJ have been urging companies to

release some of their massive reserves for capital

investment and wages. It was thought that the fiscal

stimulus measures over the past three years would trigger

this but this was not the case. Now the BoJ is attempting a

new adventurous route.

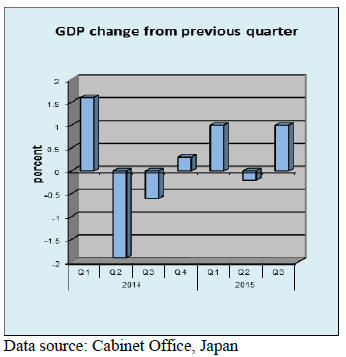

Government more optimistic on GDP than Bank of

Japan

The government is forecasting a 1.7% growth in fiscal

2016 (April 2016 to March 2017) having assumed a

recovery in consumer spending, the core of the Japanese

economy, and private sector investment.

However this projection is more optimistic than the

October forecast 1.4% made by the BoJ.

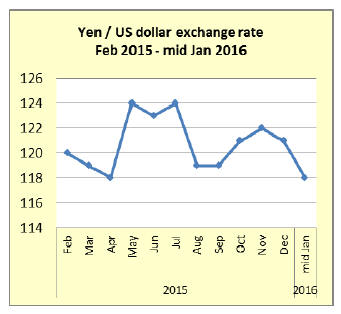

Era of easy profits from the weaker currency

fading

The yen strengthened sharply against the US dollar in

early January, rise by as much as 3% at one point. The

weakness in the dollar/yen exchange rate was the worst

since mid-2013.

The yen strength is mainly the result of movements driven

by risk aversion focused on the Chinese economy and

stock markets and on growing tensions in the Middle East.

Another factor pushing up the yen is the view of the

markets that the BoJ has exhausted its attempts to

stimulate growth through quantitative easing and this has

open the door once again for the yen to be the ‘safe

haven’.

The firmer yen has hit Japanese stocks as exporters sense

the era of easy profits from the weaker currency is fading.

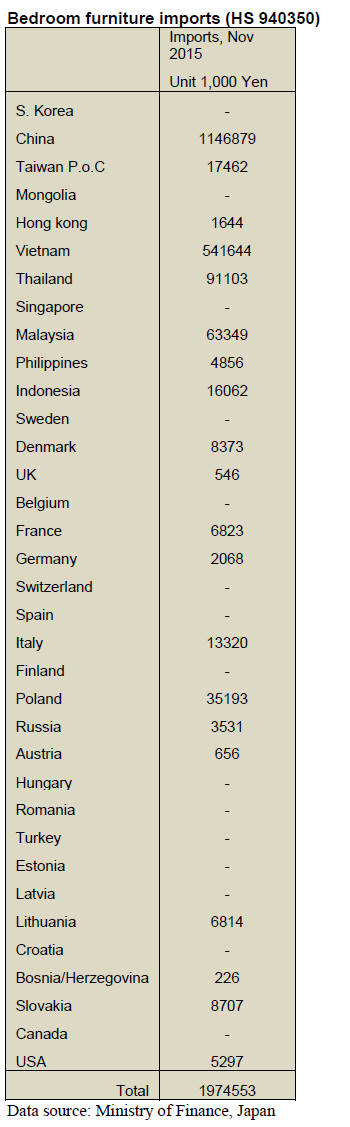

Japan’s furniture imports

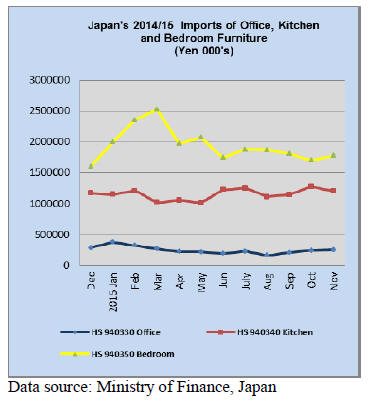

Japan’s imports of office and Kitchen furniture had been

growing since August but the upward trend in Kitchen

furniture imports came to an end in November.

Bedroom furniture imports in November picked up

slightly but the improvement did little to bring levels

anywhere near the monthly value of imports during the

first six months of 2015.

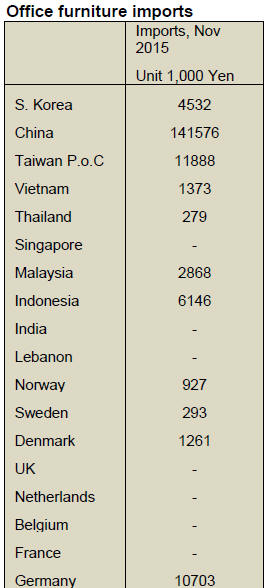

Office furniture imports (HS 940330)

Year on year November 2015 office furniture imports

were down 18% however, November 2015 imports were

up nearly 4% on levels in October.

China and Portugal dominate Japan’s office furniture

imports accounting for around 70% of all imports of this

category of furniture. Previously Poland was the number

three supplier but was replaced by Taiwan P.o.C in

November. Poland was the fourth largest supplier of office

furniture in November 2015.

The other significant supplier in November was Germany

which saw November exports of office furniture to Japan

more than double compared to a month earlier.

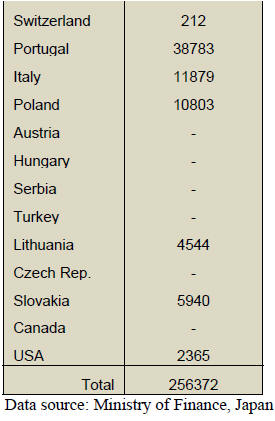

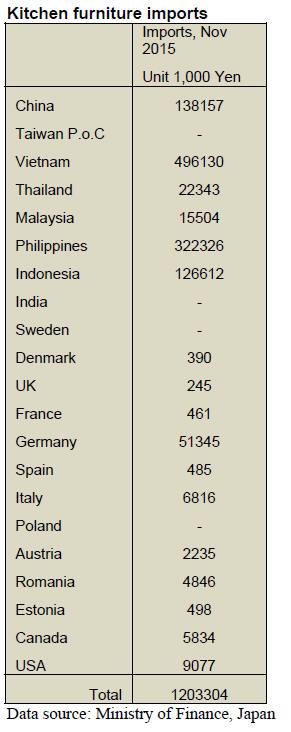

Kitchen furniture imports (HS 940340)

Vietnam and Philippines, in that order, continue as the

main suppliers of kitchen furniture to Japan alone

accounting for around 68% of November imports.

Year on year November kitchen furniture imports rose

20% but November 2015 imports were down 5.5%

compared to October. While Vietnam was the number one

supplier in November it saw a 10% drop in imports by

Japan compared to October.

In November 2015 suppliers in SE Asia (i.e. excluding

China) supplied over 80% of Japan’s kitchen furniture

imports.

Japan’s bedroom furniture imports rose steadily in

the first

quarter of 2015 but have been trending down ever since.

November 2015 imports were slightly up from a month

earlier but were down around 20% from the February 2015

peak.

Year on year, November 2015 bedroom furniture imports

were up 23% with supplies being dominated by China

(58% of all bedroom furniture imports) and Vietnam

(27%). Other significant suppliers in November were

Thailand and Malaysia

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

South Sea (Tropical) logs

Rainy season in Malaysia started in November. Sporadic

heavy rain hit various spots in Malaysia with some flood.

This hampers logging activities and log production is

decreasing. Some Japanese log importer planned to send in

twos ships in January before the Chinese New Year in

February but because of difficulty of buying enough logs,

it reduced to one ship instead of two.

Sabah is also in rainy season and log supply is dropping.

India, which stayed away from Sarawak since last

summer, started coming back quietly but their purchase is

not active yet. It shifted to other supply regions like

Solomon Islands because of extreme high prices in

Sarawak and weak Rupee then Sarawak log prices

dropped some in fall so they are back again but they are

aware that their active move would push the prices easily

up since they are the largest buyer. So their move is very

careful and cautious at this time.

Log suppliers are preparing to push the prices with

comeback of Indian buyers. Japanese importers comment

that since India buys 60% of Sarawak logs and if they

intend to buy logs to fill up ships’ space, the prices easily

jump up. Present Sarawak export log FOB prices are

U$275 on meranti regular per cbm, U$255 on meranti

small and U$240 on super small. They are all about U$5

down from November.

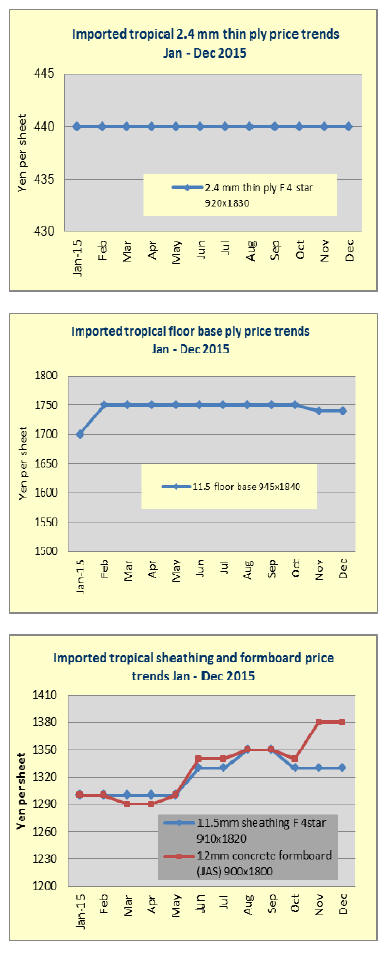

Imported hardwood plywood market

Imported hardwood concrete forming panel market is dull

and slow. The movement slowed since early September so

that importers and wholesalers have hard time to have

enough sales, let alone securing profit.

Monthly average imported volume between May and

August was 217,000 cbms then September volume was

246,100 cbms and October volume increased to 271,800

cbms.

There is another negative factor to the market. Some

Malaysian manufacturer shipped about 40,000 cbms of

concrete forming panel for coating with brown colored

water repellent spray from the end of stacked panels,

which stained surface of plywood. If this is used for

concrete forming, brown color stains concrete surface.

This is the first largest claim issue for imported plywood.

It was found in early October and the importers

immediately asked the manufacturer to stop shipping.

Stain can be removed by wiping hard but it is tough job to

wipe sheet by sheet. This work started since November at

different ports.

It will take two to three months to clean all the stained

plywood and the cost per sheet would be 200-300 yen.

This plywood is not ready to market so it is dead stock for

some time but the market remains quiet without any

shortage feeling.

Five stories 2x4 building to be built

Mitsui Home Co., Ltd. (Tokyo), the large 2x4 house

builder in Japan, announced that it would build the largest

2x4 building of five stories at Adachi ward in Tokyo with

midply shear wall system developed in Canada, which is

effective for earthquake jolt. This is a special nursing

facility for the elderly with total

floor space of more than 9,000 square meters and total

length of 81 meters.

The building is built with combination of 2x4 and midply

wall system, which makes it possible to build study high

rise wooden building.

Midply wall system is made with structural OSB

sandwiched with 2x6. Since shearing strength is about

80% higher than standard 2x4 by double shearing, which

makes buildings much studier and gives stronger

earthquake resistance.

The structure is that the first floor is RC then second to

fourth floor have midply wall for interior walls, which

reduces length of bearing wall so that it gives more open

room for common space. Mitsui uses its own original

metal fasteners to tie-down firmly.

Model house completed in Dalian, China

The Japan Wood Products Export Association completed

construction of Japanese style model house in Dalian,

China. The house is two stories post and beam wooden

unit with floor space of 214.65 square meters.

Construction materials are all Japanese domestic wood of

cedar and cypress for not only structural members but also

interior finishing, fixtures and furniture. The purpose is

to develop demand for such products in China.

The Association commented that this unit is the same as

units commonly built in Japan, which the Association

proposed to the Chinese wooden structure design standard

with introduction of metal fasteners and paneling.

Furniture is all cypress made. This is one of the Forestry

Agency’s new wood demand creation projects to promote

use of local wood in overseas markets.

The Chinese Wooden Construction Standards allows use

of Japanese cedar, cypress and larch for structural

members so the sample unit is built under advice and

supervision by both Chinese and Japanese experts of

wooden structures.

Japan Builders Network (JBN) surveys domestic use

of wood

Domestic wood committee of the Japan Builders Network

(JBN) sent out questionnaires on use of domestic wood

through its members’ contractors as one of subsidized

businesses of the Forestry Agency. It revealed that use of

domestic wood by the contractors is high.

The chairman said that members’ contractors are building

high performance houses same as large house builders put

up or higher with solid wood. The survey was made in last

October and 570 contractors replied.

By the replies, for sill, 80% is cypress, 6% hemlock, 4%

cedar, 2% Douglas fir, 1% of redwood and whitewood

each and 6% of others.

Sizes are 51% of 120 mm and 47% of 105 mm. For

exposed post, 47% is cypress, 41% is cedar, 5% is

whitewood, 2% is redwood, 1% is hemlock and Douglas

fir each then 3% is others.

For hidden post, 47& is cedar, 35% is cypress, 11% of

whitewood, 4% is redwood, 1% is Douglasfir and 2% of

others.

There is some difference between exposed and hidden but

percentage of domestic wood is high. 64% is kiln dried,

27% is air dried, 7% is laminated and 2% is green.

Percentage of dried solid wood is high with very little

laminated lumber.

For beam, 45% is Douglas fir, 31% is cedar, 9% is

redwood, 5% is cypress, 3% is whitewood, 2% is hemlock

and 5% is others.Douglas fir is predominant for beam.

Japan assists Myanmar’s development

On December 3, JMHU (Japan Myanmar Association for

Industry of Housing and Urban Development) and MCEA

(Myanmar Construction Enterprises Association)

concluded memorandum of understanding at Yangon,

Myanmar for business interchange on housing and urban

development then held seminar to understand each other.

At a seminar, 74 members from 32 companies from

JMHU and 92 from MCEA participated.17 companies,

represented JMHU’s subcommittee of housing, urban

development and housing materials, explained detail of the

company and present activities in Asian region and

Myanmar with future prospect.

MCEA started in 1996 with members of about 2,000 and

explained that there are new aggressive companies to

expand development of infrastructure.

The Japanese government has been assisting

modernization of Myanmar by dispatching housing policy

adviser to urban development department of Ministry of

Construction of Myanmar then to others like Myanmar

Harbor Bureau and Yangon City development committee.

|