|

Report from

Europe

European imports of tropical plywood down 2%

The EU imported 302,828cu.m of tropical plywood in the

first nine months of 2015, 2% less than the same period in

2014.

EU demand for tropical plywood in 2015 has been

negatively affected by the weakness of the euro relative to

the US dollar, slow growth in the building sector in most

European countries, as well as lower prices and short lead

times for competing temperate plywood products from

Europe, Russia and China.

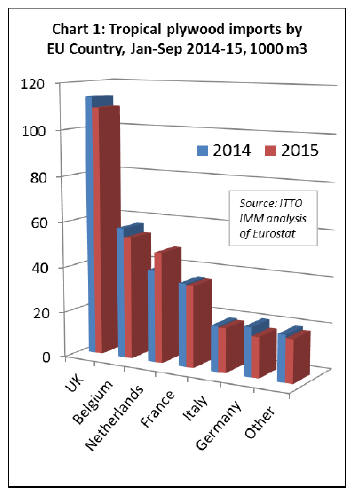

Imports of tropical plywood into the UK were

109,093cu.m in the first nine months of 2015, 4% less than

the same period in 2014.

Imports also declined into Belgium (-6.7% to

53,569cu.m), France (-1.7% to 35,746 cu.m), Italy (-2.6%

to 19,384cu.m) and Germany (-17.2% to 17,705cu.m)

during this period (Chart 1).

Of the six main tropical plywood consuming countries in

Europe, only the Netherlands increased imports during the

first nine months of 2015, by 20% to 48,471cu.m.

This aligns with the trend in imports of other tropical

wood products into the Netherlands, including sawn wood,

joinery and flooring, all of which have increased

significantly in 2015.

After several years of decline, the Netherlands market for

tropical wood has bottomed out and appears to be on the

way to sustained recovery.

EU plywood imports from Malaysia fall 10%

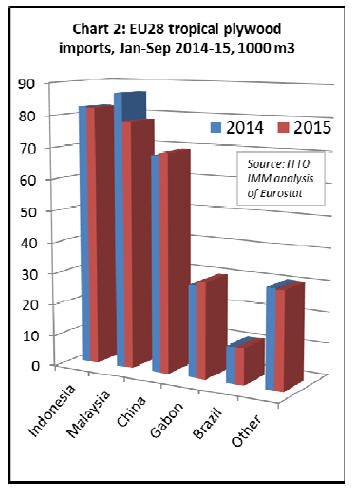

Much of the decline in EU imports of tropical plywood

during the first nine months of 2015 was due to lower

deliveries from Malaysia, which fell 10% to 78,148cu.m.

Tropical plywood imports from Indonesia, at 82,053

cu.m,, were close to the level of the previous year (Chart

2).

Indonesia¡¯s comparatively good performance is mainly

due to recovery in the Netherlands and increasing sales in

the UK. However Indonesian plywood has been losing

market share in Germany this year, both to alternative

European and Russian plywood and to wood plastic

composites.

Of the three remaining large suppliers of tropical plywood

to the EU, imports in the first nine months of 2015

increased from China (+1,9% to 69,346cu.m) and Gabon

(+4.8% to 30,627cu.m) and remained stable from Brazil

(at 11.646cu.m).

France and Italy increase tropical veneer imports

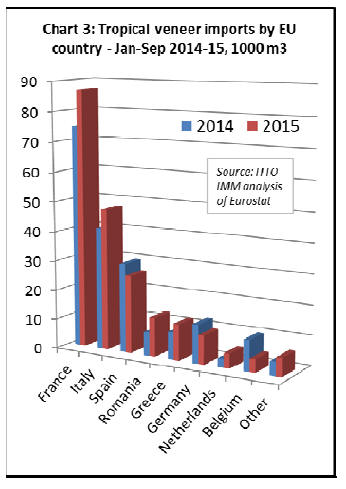

EU imports of tropical veneers increased 8.8% to

311,372cu.m in the first nine months of this year, mainly

due to recovery in the traditional markets in France and

Italy which together account for almost half of the EU¡¯s

tropical veneer imports.

Imports increased into France by 16.4% to 86,915cu.m

and Italy by 15.9% to 47,725cu.m. There were also gains

in imports by Romania (+64.8% to 13,073cu.m) and

Greece (+32.9% to 12,235cu.m).

However there was a sharp decline in imports into Spain (-

12.9% to 26,166cu.m) and Germany (-26.2% to

9,659cu.m) during the same period (Chart 3).

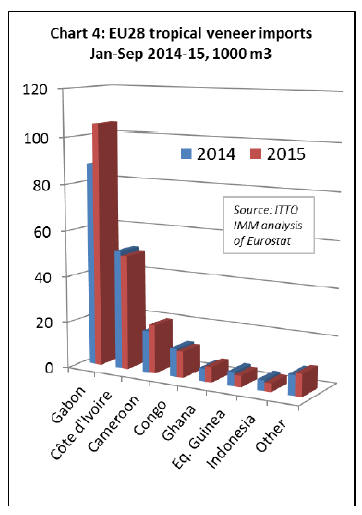

Much of the increase in EU imports of tropical veneer

during the first nine months of 2015 was due to a sharp

rise in deliveries from Gabon (+19.2% to 104,987cu.m)

(Chart 4).

French and Italian okoum¨¦ plywood producers, sourcing

veneer primarily from Gabon, have benefitted from

improved demand this year.

Demand has recovered in the Netherlands, while some

improvement is also reported in both the French and

Italian domestic markets.

Besides Gabon, Cameroon (+16.3% to 20,866cu.m) and

Ghana (+21.1% to 6,600cu.m) also stepped up deliveries

of tropical veneer to Europe during the first nine months

of 2015.

However, imports from all other major supply countries

declined this year, including from Ivory Coast (-3.6% to

49,469cu.m), Congo (-7.0% to 11,249cu.m), Equatorial

Guinea (-17.3% to 4,953cu.m) and Indonesia (-21% to

3.673cu.m).

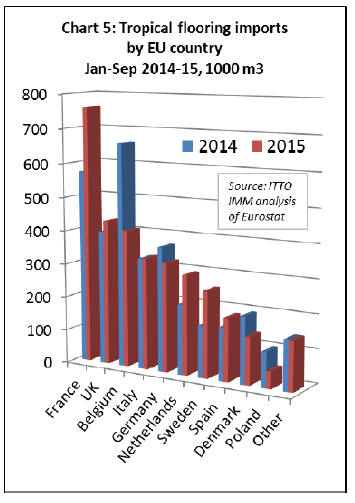

Tropical wood flooring imports shift from Belgium to

France

Total EU imports of wood flooring from tropical countries

were practically unchanged (+1% to 3.327 million sq.m)

in the first nine months of 2015. However import trends

varied widely between European countries.

Most notably imports into France increased 32.9% to

760,784 sq..m, a gain offset by a 38.3% decline to 407,264

sq.m in imports by Belgium (Chart 5).

These trends are more likely due to alterations in

distribution networks for wood flooring in north-western

Europe than to any significant change in consumption

levels.

The European Federation of the Parquet Industry (FEP)

reports that wood flooring sales in France were merely

stable in the first nine months of this year; an increase in

sales by around 3% in the first few months was followed

by a satisfactory second and a weaker third quarter.

FEP also reports stable sales and consumption of wood

flooring in Belgium in the first nine months of this year.

UK imports of wood flooring from tropical countries

increased 8.2% to 430,659 sq.m in the first nine months of

2015. This aligns with FEP estimates that overall wood

flooring sales in the UK increased by around 5% in the

first nine months of this year.

Italian imports of wood flooring from tropical countries

were stable at 330,829 sq.m in the first nine months of

2015, also in line with FEP estimates of stable overall

wood flooring consumption in Italy.

Imports of wood flooring from tropical countries into

Germany declined 12.2% to 323,661 sq.m in the first nine

months of 2015. FEP reports that luxury vinyl tiles (LVT)

remain a strong competitor to wood flooring assortments

in this market.

However, the total market for wood flooring in Germany

appears to be performing better than the tropical wood

segment. FEP records stable sales of all wood flooring in

Germany in the first nine months of 2015. The German

market continues to see a strong trend of using oak in both

flooring and furniture.

In the Netherlands, recovery in the building sector is

reflected in a 42.6% increase in imports (to 295,344 sq.m)

of wood flooring from tropical countries in the first nine

months of 2015.

Unlike Germany, imports of wood flooring in the

Netherlands from tropical countries increased more

rapidly than overall demand. FEP records no more than a

2% increase in overall wood flooring sales in the

Netherlands during the period.

However FEP confirms that the Dutch housing market has

¡°a better outlook than in the last seven years¡±.

Sweden (+66.4% to 255,746 sq.m) and Spain (+18.5% to

186,178m2) also registered significant increases in wood

flooring imports from tropical countries in the first nine

months of 2015, although from a very small base.

In contrast, imports declined sharply into Denmark (-

29.1% to 139,810 sq.m) and Poland (-51.5% to 50,486

sq.m), despite FEP reporting a slightly positive

development in overall wood flooring sales in both

countries during the same period.

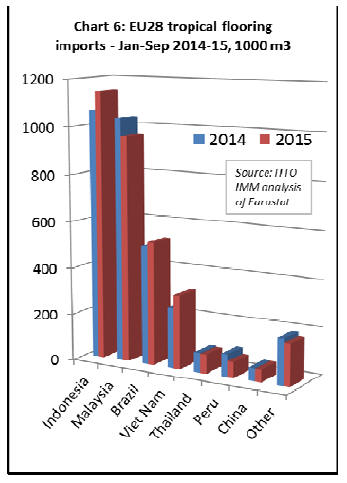

Indonesia, the largest supplier of wood flooring into

the EU

Indonesia is currently the single largest tropical supplier of

wood flooring into the EU market. EU imports from

Indonesia increased 7.6% to 1.144 million sq.m in the first

nine months of 2015. Imports also increased from Viet

Nam (+22.4% to 315,903 sq.m) and Brazil (+3.7% to

526,114 sq.m) during the same period.

However imports fell from Malaysia (-7.0% to 963,560

sq.m), Thailand (-4.1% to 80,609 sq.m), Peru (-29.9% to

66,562 sq.m) and China (-2.3% to 53,497 sq.m) (Chart 6).

|