|

Report from

North America

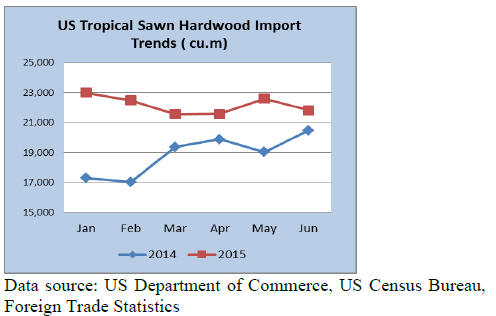

Virola sawnwood imports up in June

Total US sawn hardwood imports fell 56% from May to June, but tropical

sawnwood imports declined by only 3%. The steep decline in temperate

sawnwood imports was in imports (of unspecified species) from Bolivia.

Canada is the US¡¯ largest hardwood supplier, and its shipments grew in

June. Imports from Brazil and Germany, the second and third-largest

suppliers, fell 56% and 40%, respectively.

The US imported 21,823 cu.m. of tropical sawnwood in June, a 18%

increase in year-to-date imports from the same time last year.

Balsa imports from Ecuador grew in June, but year-to-date imports of

balsa remain below 2014 levels.

Imports from Brazil were almost unchanged from the previous month. Ipe

sawnwood imports from Brazil were slightly down from May, but virola

imports increased. Year-to-date imports from Brazi were up one third

from June 2014.

Sapelli and acajou d¡¯Afrique imports from Cameroon fell in June.

However, year-to-date total sawnwood imports from Cameroon were twice as

high as in June last year.

Malaysia showed a similar month over month decline due to lower keruing

shipments, but year-to-date imports from Malaysia remain 25% higher than

in June 2014.

By species balsa (3,971 cu.m.) and sapelli (3,825 cu.m.) were the main

imports in June, followed by ipe sawnwood (2,801 cu.m.). Mahogany

sawnwood imports were unchanged from May at 1,966 cu.m. Virola imports

more than doubled in June to 1,067 cu.m.

Higher Canadian imports from Brazil in June

The value of Canadian imports of tropical sawnwood increased by one

third month-over-month to US$2.04 million in June. Year-to-date imports

remain below 2014 levels (-30%).

The import growth in June was mainly in sapelli, red meranti and other,

unspecified species. Balsa sawnwood imports declined from May, but it

remained the most significant species (by value) imported into Canada.

US sawn hardwood imports from Brazil increased in June to US$386,425.

Imports from Congo (formerly Brazzaville) were US$291,815, up 53%

year-to-date from June 2014.

Indonesia supplied US$192,868 worth of sawnwood to Canada in June.

Year-to-date imports from Indonesia were almost unchanged from June last

year.

Tropical sawnwood imports from smaller supplier increased in June. Much

of the increase was in imports from Europe, Mexico and Thailand.

American hardwoods promotion continues in Middle East

The American Hardwood Export Council (AHEC) and the National

Hardwood Lumber Association (NHLA) will host seminars in Amman and Dubai

in September. The seminars target wood importers, manufacturers and end

users and aim to promote the understanding of American hardwood

properties, grades and potential applications.

The seminars are free, and the Jordanian Furniture Exporters Association

has partnered with AHEC for the seminar in Amman.

Demand for US hardwoods in the Middle East has continued to grow in

recent years. US exports of sawn hardwood to its four largest markets in

the region ¨C United Arab Emirate, Saudi Arabia, Jordan and Qatar ¨C was

35,084 cu.m. in 2014, up 22% from 2013. Year-to-date exports in 2015 to

the four countries were 42% higher than last year. By comparison, total

year-to-date US exports of sawn hardwood declined 10% from 2014 to 2015,

making the Middle East one of the fastest growing markets for US

hardwood exporters.

Much of the Middle East¡¯s growing demand for hardwoods is for interiors

of new buildings and in furniture manufacturing. Renovation of existing

buildings is a growing market for American hardwood products.

Large-scale transformation of temperate forests likely

Many areas of temperate forest will likely change substantially due

to climate change and a combination of disturbances and stress factors.

This is the conclusion of a study by the US Forest Service and US

Geological Survey published in the scientific journal Science (Temperate

forest health in an era of emerging megadisturbance).

Wildfires, severe droughts and warmer temperatures in particular

increase tree stress and forest mortality. Some temperate forests in the

US could convert to grassland or shrubland within the next decades.

The potential for timber production will be reduced or lost, while

important ecosystem services such as watershed protection and carbon

storage will be compromised. The study recommends further research to

identify vulnerable forests in the US and assist forest managers in

transitioning to new ecosystem states.

|