|

Report from

North America

Industry welcomes Trans-Pacific Partnership

agreement

After years of negotiation a comprehensive trade

agreement was reached in October among 12 Pacific

region countries, including the US and Canada. The forest

industry welcomed the deal.

This trade agreement is expected to improve access for

North American producers to growing markets in the

Asia-Pacific. Canada‟s forest industry in particular

depends on exports, but US producers also hope to

diversify markets and expand exports.

Significant tariffs on forest products still exist in several

Pacific markets. In Japan, duties are up to 10% on wood

and other forest products. Vietnam applies tariffs of up to

31%, Malaysia up to 40%, Australia and New Zealand of

up to 5% and Brunei up to 20%.

Plywood imports from Indonesia up

Plywood and wooden door imports declined in July from

the previous month while imports of other wood products

and furniture increased.

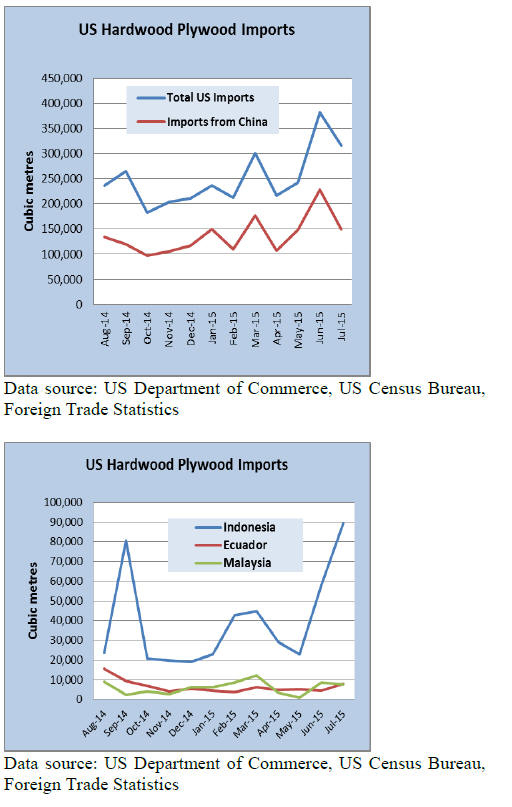

US imports of hardwood plywood were down 17% in July

compared to the previous month. A total of 317,408 cu.m.

was imported with just under half coming from China

(149,326 cu.m.). Imports from China fell 35% from June,

but year-to-July imports were 13% higher than at the same

period in 2014.

Plywood imports from Indonesia increased for a second

month in a row to 89,395 cu.m. in July. Year-to-date

imports from Indonesia were 9% higher than in July 2014.

Plywood shipments from Ecuador to the US grew in July

but year-to-July imports remain far lower than in 2014.

Imports from Malaysia, Russia and Canada declined in

July.

China expands hardwood moulding import share

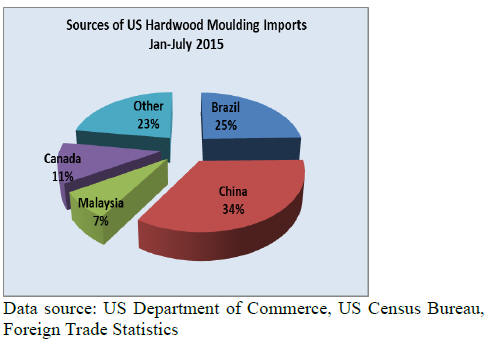

Hardwood moulding imports recovered in July, but they

remained below 2014 levels. July imports were worth

US$18.1 million, up 12% from the previous month.

The largest increase was in imports from China (US$6.7

million). Year-to-July imports from China were up 2%

compared to July 2014. Hardwood moulding imports from

Brazil increased by 8% in July to US$4.2 million. Year-to-

July imports from all major suppliers, except China, are

lower than in July last year.

Indonesia and Malaysia largest suppliers of hardwood

flooring

Hardwood flooring imports increased significantly in July.

July imports were worth US$5.0 million, a year-to-July

increase of 29%.

The greatest monthly gain was in imports from China

(US$761,565). Indonesia and Malaysia remain the largest

suppliers at over US$1 million worth of shipments each.

Year-to-July imports from Indonesia and Malaysia

increased 74% and 48%, respectively, compared to the

same time last year.

Imports of assembled flooring panels increased 5% monthon-

month in July to US$12.5 million. Imports from China

grew 10% to US$5.0 million, but year-to-July imports

were unchanged from 2014. Canada, Indonesia and Brazil

expanded their share in US imports from last year.

Steady growth in wooden furniture imports from

Vietnam, India

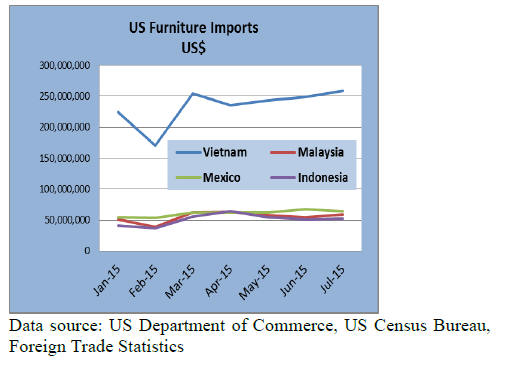

Wooden furniture imports increased again in July. Total

imports were worth US$1.44 billion, up 1% from June.

Year-to-July imports were 11% higher than in July 2014.

The growth in imports was in wooden seats (not

upholstered), kitchen furniture and other wooden furniture.

Imports of upholstered wooden seating declined in July.

Bedroom furniture imports were steady.

Furniture imports from China were steady from the

previous month at US$685.6 million. Imports from

Vietnam grew 4% to US$259.0 million in July. Indonesian

shipments were also up at US$52.9 million.

Furniture imports from Canada and Mexico increased

earlier this year but in July imports from both countries

declined.

India is becoming an increasingly important furniture

supplier to the US. Imports from India were worth

US$19.2 million in July.

Vietnam and Malaysia saw the strongest growth in yearto-

July shipments to the US compared to July 2014. In the

first 7 months Vietnam‟s share in US wooden furniture

imports grew from 16% in 2014 to 18% in 2015.

Housing market recovery continues despite lower

consumer confidence

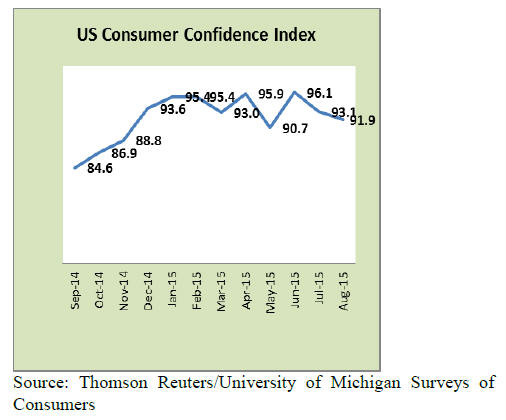

US consumer sentiment declined again in August. While

the US economy was regarded as overall robust,

Americans worried about a weakened Chinese and global

economy. Lower commodity prices were also viewed as a

negative economic indicator. Consumers believed that

these global trends can influence the US job market and

financial markets.

Builder confidence in the market for newly built, singlefamily

homes rose by one point in August according to the

National Association of Home Builders. The recovery in

the housing market continues, despite lower consumer

confidence.

Single-family starts up 10% in July

Housing starts declined 4% in July from the previous

month according to US Census Bureau data. However, the

decline was in the more volatile multi-family market.

Single-family home construction increased 10% in July.

The seasonally adjusted annual rate of residential

construction was 1,161,000 in July.

Combined single- and multifamily starts grew 20% in the

Midwest and 8% in the South. Housing starts decreased in

the Northeast and West. After several months of gains, the

number of building permits fell 16% in July. Much of the

decline was in multi-family permits.

Higher home sales across the country

Sales of existing homes increased by 2% from June to July

according to the National Association of Realtors. Sales in

July were at the highest pace since 2007. All major regions

experienced sales gains in June.

Lower unemployment and the prospect of higher mortgage

rates in the future supported the increase in home sales.

The share of first-time buyers fell, however, because of

rising home prices.

Consumer and business confidence down in Canada

Canadian housing starts decreased by 4% in July at a

seasonally adjusted annual rate. Single-family starts were

stable from the previous month, while multi-family

construction decreased. Inventory of unsold multi-family

units declined from June, but it is 10% higher compared to

the level one year ago.

Canada‟s central bank kept its key interest rate unchanged.

Earlier this year it reduced the rate twice when Canada‟s

economy contracted.

A low Canadian dollar and stronger demand from the US

market is helping the economy. In August the Canadian

dollar fell to its lowest since 2004.

A survey of Canadian corporate executives showed that

they are more negative about the economic outlook than

any time since the recession seven years ago. More than

half think the economy will decline in 2016. Consumer

confidence also declined in September.

Federal Reserve leaves key interest rates unchanged

The US Federal Reserve left interest rates near zero,

despite earlier expectations of an interest rate rise in

September.

However, Federal Reserve chair Janet Yellen expects

interest rates to gradually rise starting before the end of

2015. Weakness in the global economy are not significant

enough to change the central bank‟s plan to raise interest

rates.

GDP growth was an estimated 3.7% in the second quarter

of 2015, according to the Department of Commerce‟s

second estimate. GDP growth was revised up from the

previously estimated 2.3%.

Higher personal consumption, government spending

residential and non-residential construction contributed to

the GDP growth.

Manufacturing output expanded in August, according to

the Institute for Supply Management. Furniture

manufacturing companies reported continued production

growth. In the wood products sector output was unchanged

from July.

Demand for countertops to rise 4.1% per year

A recently released market study by Freedonia forecasts

demand for countertops in the US to grow 4.1% per year

through to 2019. Demand is expected to reach US$29

billion in 2019, or 74 million square metres.

The largest source of demand will be new home

construction, followed by renovation and repairs of

existing homes. The trend to larger kitchens and

bathrooms with more countertop surface will support

demand growth.

80% of the demand growth will come from the residential

market. The remaining 20% will mainly be in kitchens and

bathrooms of offices, commercial and institutional

buildings.

The ongoing recovery in non-residential construction will

therefore boost demand for countertops through 2019.

Laminate countertops with wood composite cores have the

largest market share. However, their market share fell

from 55% in 2004 to 48% in 2014. The trend is likely to

continue, but laminates will remain the most popular

countertop material over the next five years.

The fastest growing materials in countertop will be nonwood:

natural and engineered stone, polymers and niche

materials (including solid wood).

The Freedonia study ¡°Countertops¡± (Industry Study 3301)

was published in August 2015.

British Columbia invests in promotion of wood use

The government of British Columbia, Canada, is investing

US$2.2 million in its Wood First programme. The

programme promotes the domestic use of wood from

British Columbia as well as exports.

The funding goes towards research, product development,

marketing and skills training. Industry associations,

universities and research institutes will receive the funding

to carry out the programme. The forest industry will

contribute additional funds.

Disclaimer: Though efforts have been made to ensure

prices are accurate, these are published as a guide only. ITTO

does not take responsibility for the accuracy of this

information.

The views and opinions expressed herein are those of the

correspondents and do not necessarily reflect those of ITTO.

|