Japan Wood Products

Prices

Dollar Exchange Rates of 10th

October 2015

Japan Yen 119.74

Reports From Japan

Fall in consumer confidence raises risk to

economy

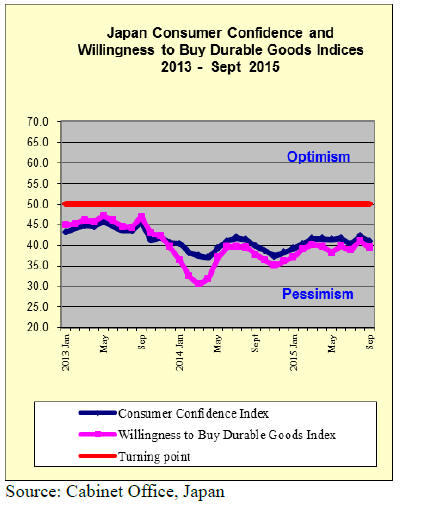

The latest Consumer Confidence survey results have been

released by Japan‟s Cabinet Office.

The latest survey shows consumer confidence in

September weakened more than forecast. The overall

consumer confidence index fell to 40.6 in September from

41.7 in August.

This survey was conducted on September 15th, 2015 and

covered 8,400 households.

The overall livelihood index in September stood at 38.8,

down from the previous month; the income growth index

stood at 39.4, also down from a month earlier.

The downward trend continued with the employment

index (44.9. down 1.4 points) and the willingness to buy

durable goods index (39.1.down 1.2 points month on

month).

TPP implementation a challenge for Japan’s agri and

timber sectors

The Japanese government has said it will introduce new

measures to support the country‟s agricultural sector

which will be affected by the TPP the trade agreement

which lowers tariffs in the 12 signatories countries. Japan

is set to eliminate import tariffs on over 800 agricultural

and wood products.

On the TPP the Japan Lumber Reports writes:

“Broad agreement has been reached by 12 participating

countries on Trans-Pacific Partnership (TPP). On lumber

and plywood, it is agreed that Japan can set up safeguard

and duty abolishment period in 16 years for the countries

from which import amount is large or growth of import is

remarkable. Such countries are Malaysia, New Zealand,

Canada, Chile and Vietnam. Also it is agreed to control

trade of illegal harvested wood.

On main items from Canada and Malaysia, Japan can

maintain safeguard even after the tariff is abolished. There

is no previous case in the world of setting safeguard on

forest products which are not agricultural products.

In case of Malaysian plywood, import duty rate will be

reduced from 6-10% to 3-5% in 16 years after the

agreement is ratified but if the volume reaches to a certain

level, the duty rate is automatically raised to the rate

before the ratification (1,044,000 cbms at the time of

ratification then 20,900 cbms increase every year and

31,300 cbms increase every year after 16 years).

For Canadian SPF lumber the import duty will be reduced

from 4.8% to 2.4% until 16 years after the ratification but

if the import volume reaches a certain level, the previous

duty rate before the ratification is applied (1,573,000

cbms at the time of ratification then 31,500 cbms increase

every year and 31,500 cbms increase after 16 years).

Duty on OSB, which substitutes plywood and lumber, will

be abolished step by step.

Meantime, on export of logs and lumber from Japan, main

destination of Taiwan, Korea and China do not participate

in the TPP.

The Japanese government announced in March 2015

‘Uniform calculation of economic effect in case import

duty is abolished’. In this, production value of forest

products will decline by about 49 billion yen by reduction

of duty and domestic products would be replaced by the

imports and resolution was made that utmost

consideration is necessary for import of plywood and

lumber.”

Tokyo property attracting overseas investors

Land prices in central Tokyo increased by just over 2% in

the first seven months of this year, a faster rate than

reported for the same period last year according to a report

from Japan‟s Ministry of Land, Infrastructure, Transport

and Tourism

However, residential land prices in Tokyo are still less

than 60% of what they were during Japan‟s property

bubble in the late 1980s.

See: http://tochi.mlit.go.jp/english/land-prices/landmarket-

value-publication

Property prices in Tokyo have been rising since the

government and Bank of Japan introduced measures to

tackle deflation. The relatively low house prices in Tokyo

compared to Hong Kong and even Shanghai for example

are attracting Chinese buyers looking for bargains while

the yen exchange rate remains favourable.

The recent downturn in stock values in China is prompting

investors to put money into „bricks and mortar” as a safe

haven.

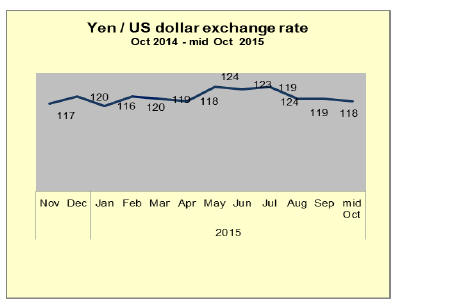

Yen remains under pressure

Expectations that the Bank of Japan (BoJ) could expand

the scope of its monetary easing policy sometime this

month put a downward pressure on the yen/dollar

exchange rate reversing the modest advance of the yen

early in the month.

At its latest meeting the BoJ maintained its policy but kept

open the avenue for further stimulus to try and reverse the

downward trend in growth.

In related news, Cabinet Office data for August machinery

orders show a decline of 5.7% from July in contrast to the

forecast rise. The drop in orders in August was the third

consecutive monthly decline and it was as long as 6 years

ago that the situation was worse.

Two factors have been quoted as being the cause of the

fall in machinery orders, slow growth in China and

weakening domestic demand.

In a separate report the Bank of Japan (BoJ) said that it is

now seeing an excess of manufacturing capacity with the

difference between available resources and their utilisation

fell below zero. This heralds a period of deflation which is

a major set-back for the BoJ as it tries to generate an

inflationary pressure in the economy.

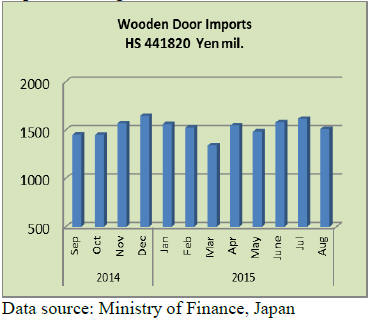

Doors

August 2015 imports of wooden doors were down on

levels reported for July but were similar to the value of

imports in August 2014.

August is a holiday month in Japan and construction

companies close for almost two weeks. In the first 8

months of 2015 wooden door imports fell 11.5%

compared to the same period in 2014.

China and the Philippines continue as the top wooden door

suppliers accounting for just over 75% of Japan‟s August

imports of this product.

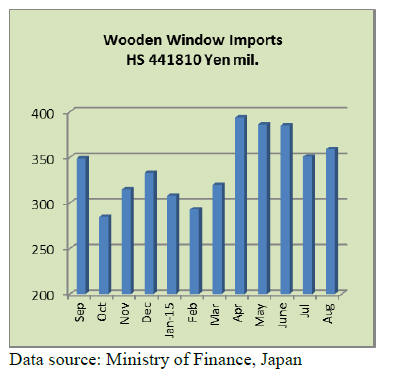

Windows

In the 8 months to August 2015 wooden window imports

were down 25% year on year. August 2015 imports were

sightly up on July but down sharply compared to the

value of imports in August 2014.

China continues as the number one supplier followed by

the Philippines and the US. The top three supplires

accounted for over 80% of all wooden window imports in

August.

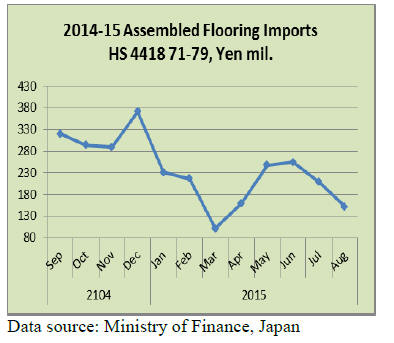

Assembled flooring

Japan‟s imports of assembled wooden flooring continued

the downward trend that began in July. August 2015

imports of assembled wooden flooring were down 40%

from the peak in June and were down 27% from July.

In the 8 months to August 2015 assembled wooden

flooring imports were down 28% compared to the same

period in 2014.

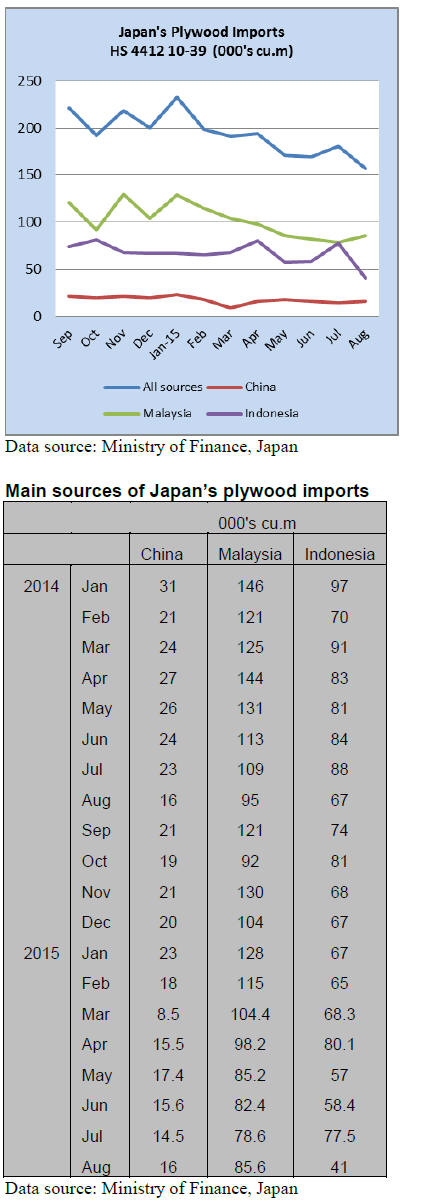

Plywood

Japan‟s August plywood imports were down 13% from a

month earlier continueing the downward trend that began

in April this year. In the 8 months to August this year

plywood imports from all sources were down 28%

compared to the same period in 2014.

Over the 8 months since Janaury 2015 the three main

suppliers: Malaysia, Indonesia and China have all seen

plywood demand in Japan wither. Over the first 8 months

plywood imports from Malaysia have fallen 10%, by 22%

for Indonesia and by 33% for China.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

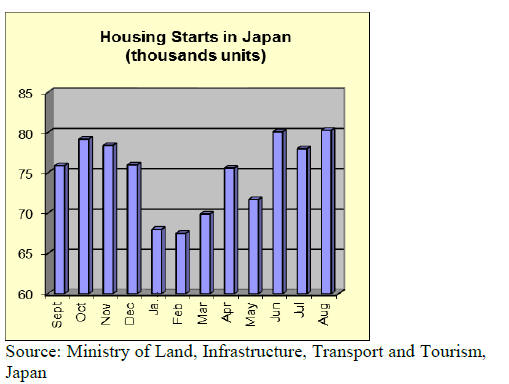

Improved wood self-sufficiency rate

The Forestry Agency disclosed supply and demand of

wood in 2014. Total demand of wood including wood chip

for biomass fuel, wood for charcoal, wood for export is

75,814,000 cbms for which domestic production is

23,662,000 cbms so a degree of self-sufficiency is 31.2%.

This is the first time that the degree recovered over 30% in

26 years since 1988. The domestic demand declined

because of decrease of new housing starts but wood for

biomass fuel and wood export increased largely.

Plywood

Domestic softwood plywood market is firmly holding in

Tokyo market but demand and supply vary by the area.

Since late August, orders from wholesale channels slowed

down but deliveries for large house builders and precutting

plants are increasing.

Therefore, August shipment was 222,400 cbms, 15.1%

more than August last year while the production was

198,500 cbms, 0.5% less so that the inventories dropped

down to 159,600 cbms, 23,000 cbms less than July

inventory.

However, many think large volume of manufacturers‟

inventory shifted from manufacturers hand to distribution

channels so the market is calming from panic buying.

Many manufacturers still suffer delay of delivery and

shortage of some items. In Hokkaido with fair weather,

speculative demand showed up for fall demand pickup so

there is shortage of softwood plywood supply.

The market in August and September was dull as sales

volume dropped by 20-30%. Trading firms and

wholesalers disposed of some of their inventories before

book closing for the month of September but the sales

were so slow and the volume was very limited.

August arrivals were 205,200 cbms, 17% less than August

last year and 11.9% less than July, which was record low

since September 2011. September arrivals are as low as

August but there is no shortage feeling in the market.

|