|

Report from

North America

US market continues to expand

The positive development in wood product imports

continued in June. Only hardwood mouldings and

hardwood flooring imports were lower than in the

previous month and compared to 2014. Indonesia

increased hardwood plywood shipments to the US in June.

US imports of hardwood plywood continued to grow in

June reaching 383,018 cu.m. Imports were up 58% from

May and year-to-June imports were 3% higher than in

June 2014. Hardwood plywood imports from China were

228,299 cu.m. in June, up 19% year-to-June from the same

time last year.

The largest month-on-month growth was in plywood

imports from Indonesia, which grew by 155% to 58,073

cu.m. However, year-to-June imports from Indonesia were

still lower than at the same time last year.

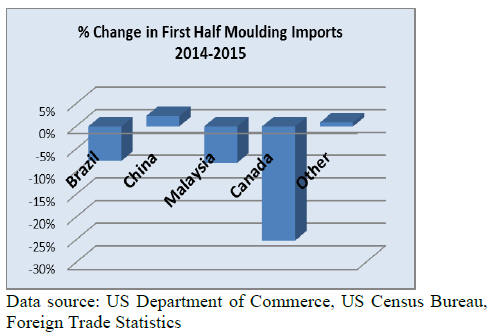

Decline in hardwood moulding imports

Hardwood moulding imports remain in negative territory

compared to last year. June imports were worth US$16.1

million, down 4% from the previous month.

China remains the largest supplier of hardwood mouldings

at US$5.0 million in shipments in June. Year-to-June

imports from China were up 2% compared to 2014.

All other major suppliers lost market share. Year-to-June

imports from Brazil and Malaysia were down 8% from

June 2014, while imports from Canada fell by 25%

compared to last year.

Significant increase in flooring imports from Malaysia

and Indonesia

Hardwood flooring imports declined from a peak in May

to US$3.2 million in June. However, year-to-June imports

were still much higher (+24%) than in June 2014. Monthon-

month imports from all major suppliers fell in June.

Indonesian shipments were worth US$884,131, while

imports from Malaysia were US$648,435, down from over

US$1 million for both in May. Imports from China fell by

more than half to just US$328,774.

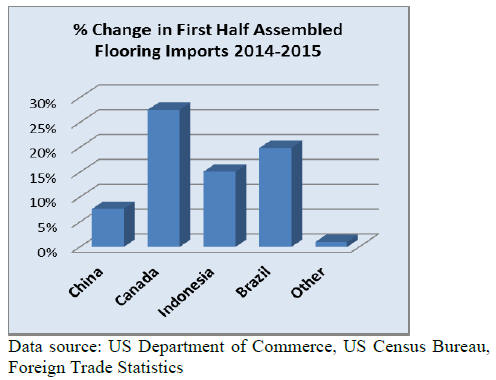

Imports of assembled flooring panels increased 21%

month-on-month in June and 12% year-to-June compared

to the same time last year. Imports from China were

US$4.5 million in June, up 26% from May.

Imports from Canada were unchanged. Indonesian

shipments almost doubled from May to US$791,977 in

June.

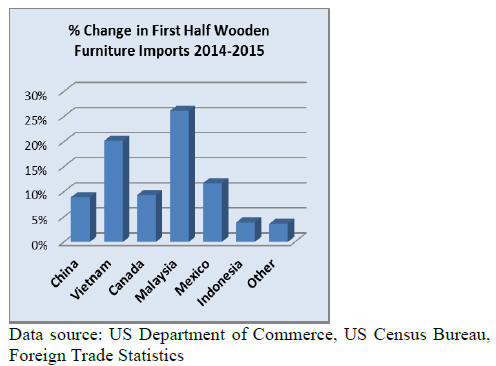

Wooden furniture imports rise

Wooden furniture imports continued to increase in June.

US imports were worth US$1.43 billion, up 3% from May.

Year-to-June imports were 11% higher than in 2014.

The strongest growth was in wooden office furniture

imports, which grew 9% from the previous month.

Kitchen furniture imports increased 5% in June, while

imports of wooden seats declined slightly. As was the case

in May, all major suppliers increased furniture shipment to

the US market with the exception of Indonesia and

Malaysia.

Wooden furniture imports from China grew 2% in June.

Year-to-date imports were up 9% from June 2014,

compared to a 20% increase in furniture imports from

Vietnam. US furniture imports from Canada rose 16%

from the previous month, helped by the weaker Canadian

dollar. Among smaller suppliers, India and Brazil saw

significant gains in June.

Consumer confidence down but builders optimistic

about housing market

US consumer sentiment declined in July but, overall,

consumers remain optimistic about the economy. The

University of Michigan's index of consumer sentiment

decreased to 93.1 in July from 96.1 in the previous month.

One year ago the index was at just 81.8.

Despite the lower consumer index, Americans feel

positive about the job market and wages. The negative

economic news from China may have contributed to lower

consumer confidence.

Builder confidence in the market for newly built, singlefamily

homes in June reached its highest level since 2005.

The National Association of Home Builders expects a

continued recovery of the housing market in the second

half of 2015 but the shortage of labour and building plots

remain a challenge for many home builders.

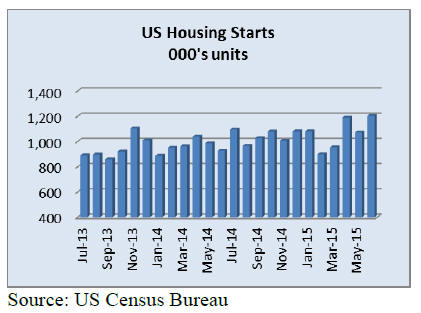

Multi-family housing starts up

Housing starts increased 10% in June from the previous

month, according to US Census Bureau data. The

seasonally adjusted annual rate of residential construction

was 1,174,000 in June. This is 27% above the June 2014

rate.

The growth was in multi-family construction, while

single-family starts declined slightly from May. The share

of single-family homes in new construction fell to a new

record low of 58%.

The number of building permits increased by 7% in June

to 1,343,000.

Home sales and prices at record high

Existing-home sales increased in June to their highest pace

in over eight years, according to the National Association

of Realtors. All major regions experienced sales gains in

June. At the same time home prices reached a record high.

Limited supply of both existing homes and new homes on

the market is pushing up home prices.

Stronger US demand for Canadian wood products

Canadian housing starts increased slightly in June at a

seasonally adjusted annual rate. Both multi-family and

single-family construction grew. The Canadian Housing

and Mortgage Corporation expects multi-family

construction to decline in the near future because many

completed units remain unsold.

Lower oil prices continue to have a negative effect on

Canada¡®s economy, although they are partly offset by the

strengthening US economy. Canadian exporters of nonenergy

products such as the wood products industry

benefit from growing US demand.

US trade deficit up due to higher imports

Manufacturing output continues to expand according to

the Institute for Supply Management. Furniture

manufacturing companies reported production growth,

while output declined in the wood products sector.

GDP growth was an estimated 2.3% in the second quarter

of 2015, according to the Department of Commerce¡®s first

estimate. First quarter economic growth was revised up to

0.6%. Higher consumer personal spending and residential

construction contributed to the greater GDP growth in the

second quarter.

The US trade deficit increased to US$43.8 billion in June,

up from US$40.9 billion in May. Compared to the same

time last year, the trade deficit grew 0.6%. The larger

deficit was mainly due to increased imports of goods.

Growth in furniture orders and shipments

Orders for new furniture increased by 5% in May from the

previous month according to the Smith Leonhard industry

survey of residential furniture manufacturers and

distributors.

Year-to-may orders were 5% higher than in May 2014.

More than half of respondents (55%) reported increased

orders for the year to date, down from 68% in April.

Furniture shipments were up 7% year-to-date from May

2014. 71% percent of companies reported higher

shipments in May.

Inventory levels at distributors and manufacturers were

unchanged in May from a month earlier but were higher

than in May 2014. Overall, inventory levels were normal

for business conditions.

Retail sales at furniture stores in the US declined 5% in

June from the previous month, according to US Census

Bureau estimates. Despite the drop sales were 9% higher

than in June 2014.

Furniture imports from China more competitive

The decline in US consumer confidence affects furniture

demand, but on the positive side unemployment remains

low and wages are growing. The strong growth in home

sales and new construction is excellent news for furniture

manufacturers and retailers.

China¡®s currency devaluation is expected to make

furniture exports from China more competitive compared

to US imports from Vietnam, Malaysia and Indonesia. At

the very least a weaker yuan will offset the rise in labour

cost in China. US companies that buy furniture parts from

China for assembly in the US should also benefit from a

weaker yuan.

The longer-term impact of a weaker yuan on furniture

supply chains may be even more important than short-term

price effects, according to the trade journal Furniture

Today. Manufacturers in China will be less likely now to

close plants and relocate to Vietnam or to other countries.

Exports of high-end furniture from the US to China have

experienced strong growth in recent years, and the

stronger dollar will force US companies to price their

products more competitively. China¡®s imports of US-made

furniture increased by 59% between 2013 to 2014 to

US$109.4 million.

|