|

Report from

Europe

Recovery in EU tropical wood imports

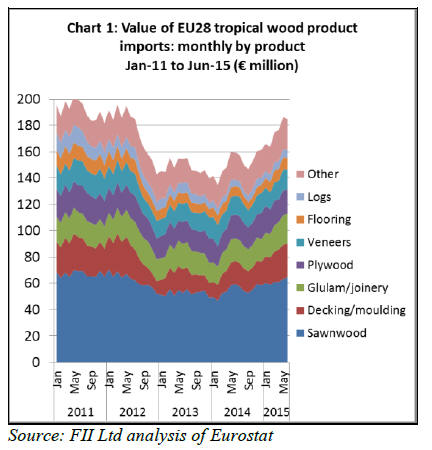

The rising trend in EU tropical wood product imports that

began in September 2014 continued into the second

quarter of 2015. EU imports of tropical wood products in

May 2015 hit €186 million, the highest monthly figure

since June 2012 (Chart 1).

Overall in the first 6 months of 2015, the EU imported

€1.07 billion of tropical wood products, an increase of

19% compared to the same period the previous year.

The strong growth in the value of EU imports this year

should be set against the background of particularly low

levels of import in 2014. The weakness of the euro on

currency exchange values also means that the value of

imports has risen more rapidly than quantity (since the

euro price of imported products tends to be higher).

It is too early to tell whether the recent growth in imports

is the beginning of a lasting recovery or driven mainly by

stock replenishment as importers take advantage of better

availability.

The supply situation for tropical timber in Africa, which

was difficult throughout 2014, has improved this year

from European buyers‟ perspective. Although China

continues to consume large quantities of African timber,

demand in China has eased creating a better balance

between supply and demand for European importers.

A positive trend on the consumption side in Europe is

continued good construction activity in Germany, Europe's

largest economy, and on-going recovery in construction in

the Netherlands, UK, Spain and Eastern Europe.

European furniture production is also improving, with

rising activity in Sweden and UK and strong growth in

Poland, Lithuania and several other Eastern European

countries.

This, together with continuing stability in Germany‟s large

furniture manufacturing sector, is offsetting historically

low levels of furniture production in Italy, Spain and

France.

A particularly encouraging sign this year is that the growth

in EU imports of tropical wood is occurring despite

continuing weakness of the euro-exchange rate which,

other things being equal, makes imported products less

price competitive in the euro-zone.

The growth trend has benefitted suppliers irrespective of

whether they typically invoice in euros or dollars ¨C hinting

that this may be driven more by improving EU

consumption than by short-term stock replenishment.

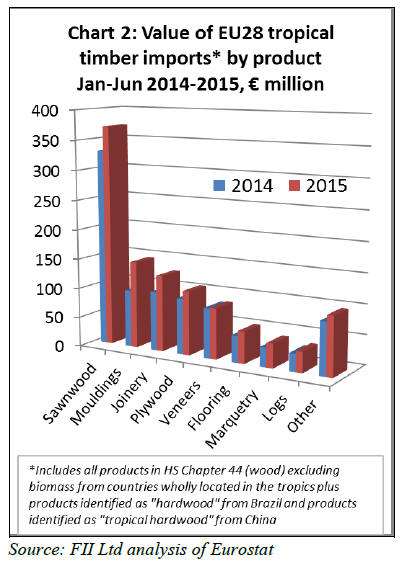

Imports rise across most tropical wood sectors

The growth also extends to a wide range of products and

market sectors. EU imports of nearly all tropical product

types have increased significantly in the first half of 2015

compared to the same period in 2014 (Chart 2).

EU imports of tropical sawnwood were €371 million in the

first half of 2015, 13% more than the same period in 2014.

Imports of tropical mouldings (including both decking and

interior mouldings) increased 52% to €146 million.

EU tropical plywood imports were 14% greater at €108

million. Imports of tropical joinery products (mostly LVL

for window frames) increased 29% to €128 million, while

tropical flooring products increased 18% to €53 million.

EU tropical log imports jumped 16% to €35 million in the

first six months of 2015, the first turnaround after several

years of continuous decline.

The first very tentative signs of improvement are also

evident in the EU tropical veneer trade. Imports were €86

million in the first half of 2015, 2.2% up compared to the

same period in 2014.

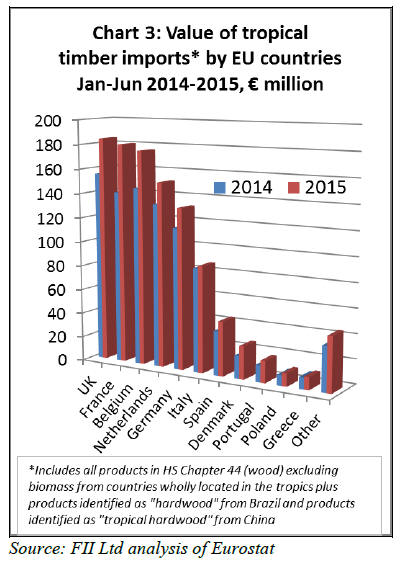

Key tropical timber markets are bouncing back

There was significant growth in the euro value of tropical

timber imports in nearly all the main EU markets in the

first half of 2015 (Chart 3).

The UK was the largest EU destination for tropical wood

products in the first half of 2015, although this position is

now threatened as France and Belgium are now bouncing

back more rapidly.

UK imports of tropical timber products were valued at

€184.4 million in the first half of 2015, 19% more than the

same period in 2014. During the same period, imports

increased 28% to €180.2 million in France and 21% to

€175.8 million in Belgium.

Amongst other western European markets for tropical

wood products, only Italy and Sweden have been

disappointing this year.

In the first half of 2015, Italy‟s imports of tropical wood

products were €87.1 million, only 2% above the

historically low levels recorded in 2014. Imports by

Sweden were €10.1 million in the same period, 5% below

last year‟s level.

Other western European markets for tropical wood are

gaining ground. In the first half of 2015, there was

significant growth in imports by the Netherlands (+13% to

€151.3 million), Germany (+14% to €132.1 million),

Spain (+23% to €44.6 million), Denmark (+44% to €26.9

million), Portugal (+29% to €17.8 million), Greece (+12%

to €10.4 million), and Ireland (+42% to €9.4 million).

Imports of tropical wood products into several Eastern

European countries also increased in the first half of 2015

notably Poland (+24% to €10.5 million), Romania (+26%

to €10.5 million) and the Czech Republic (+72% to €3.8

million).

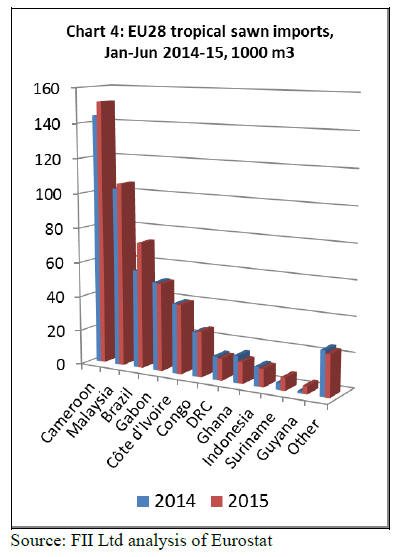

10% growth in EU tropical sawn hardwood imports

The EU imported 519,000 m3 of tropical sawn hardwood

in the first half of 2015, 6% more than the same period in

2014. The rise was broadly based being recorded across a

wide range of supply countries (Chart 4).

In the first half of 2015, EU imports of tropical sawn

timber increased from Cameroon (+5% to 151,700 m3),

Malaysia (+3% to 105,700 m3), Brazil (+29% to 72,900

m3), Republic of the Congo (+3% to 26,300 m3),

Suriname (+85% to 7,400 m3) and Guyana (+258% to

4,500 m3). Imports from Gabon (50,700 m3) and Ivory

Coast (40,100 m3) were the same as the previous year.

However imports declined from DRC (-7% to 12,600 m3)

and Ghana (-20% to 12,500 m3.

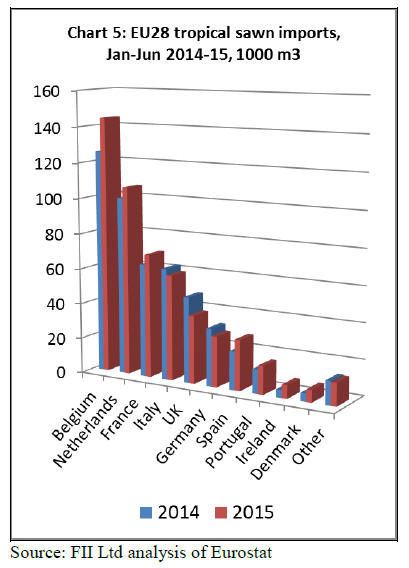

On the recipients‟ side, in the first half of 2015, imports of

tropical sawn hardwood increased into Belgium (+15% to

144,500 m3), the Netherlands (+6% to 106,500 m3),

France (+9% to 69,700 m3), Spain (+32% to 28,400 m3),

Portugal (+17% to 15,900 m3), Ireland (+68% to 7,500

m3) and Denmark (+50% to 6,900 m3).

However imports declined in the first half of 2015 into

Italy (-5% to 59,400 m3), the UK (-21% to 38,500 m3)

and Germany (-12% to 28,500 m3) (Chart 5). Imports into

Italy and Germany picked up a little in the second quarter

of 2015 after a slow start to the year.

In contrast, imports by the UK were good in the first

quarter of 2015 but slowed dramatically in the second

quarter.

Turnaround in tropical log imports

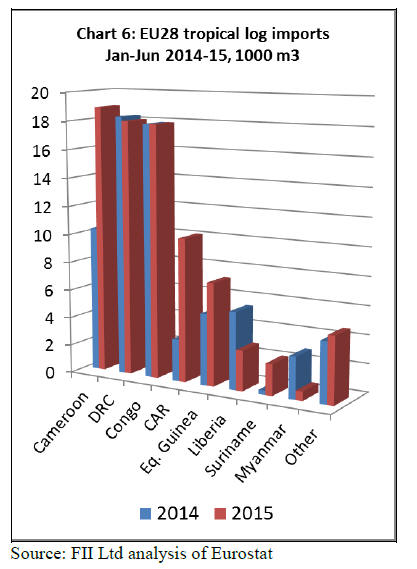

After roughly ten years of almost uninterrupted decline,

EU tropical log imports increased 22% to 82,679 m3 in the

first half of 2015. Much of this growth was due to an 84%

increase in imports from Cameroon to 18,912 m3.

The scale of the increase is partly due to the particularly

low level of imports from Cameroon in the first half of

2014 when trade was seriously disrupted by logistical

problems at Douala port.

There was also a surge in imports in the first half of 2015

from the Central African Republic (+241% to 10,152 m3)

and Suriname (+621% to 2212 m3).

In the first half of 2015, EU tropical log imports from the

DRC (18,016 m3) and Republic of Congo (17,883 m3)

were nearly stable compared to the previous year. Imports

from Liberia were down 48% at 2851 m3 in the first half

of 2015, with nearly all this volume arriving in the first

three months of the year.

Although Myanmar implemented a log export ban from 31

March 2014, Eurostat statistics indicate the EU imported

649 m3 of logs from the country in the first 6 months of

2015, 78% less than the same period in 2014 (Chart 6).

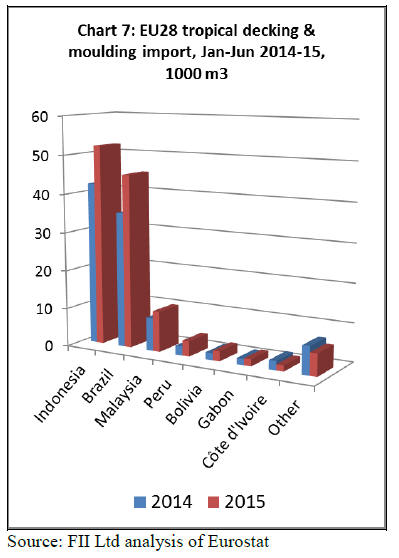

Sharp rise in imports of decking and mouldings

EU imports of ¡°continuously shaped¡± wood (HS code

4409), which includes both decking products and interior

decorative products like moulded skirting and beading,

were 123,436 m3 in the first half of 2015, up 22%

compared to the same period in 2014.

This increase was primarily attributable to much higher

deliveries from the two main suppliers, Indonesia and

Brazil (Chart 7). Imports from Indonesia increased 24% to

52,187 m3. Indonesia has profited from the better demand

in the Netherlands and Germany, traditionally major

markets for Indonesian decking.

Meanwhile EU imports from Brazil were up 28% at

45,142 m3, with a particularly significant increase in

imports by Belgium and France. Imports of Brazilian

decking were constrained last year after a Greenpeace

campaign raising concerns about the legitimacy of

documentation to demonstrate legal origin of Brazilian

tropical timbers.

This encouraged suspension of sales of Brazilian decking

products by several large European merchants and

blockage of shipments while Belgium‟s Environment

Ministry undertook EUTR-related investigations.

These subsequently confirmed the legality of the

shipments which were cleared for entry. The trade data

confirms that EU imports of Brazilian decking products

were flowing more freely during the first half of 2015.

Drilling down into due diligence

The Global Timber Forum (GTF) has published an

international Supplier and Consumer Due Diligence

Analysis which assesses how well companies understand

the concept of ¡°due diligence¡± as it is defined in the EU

Timber Regulation (EUTR), and to assess how far they

have been able to put it into practice.

Under report author George White, a team of interviewers

issued a questionnaire to 27 EU „operator‟ importers,

which have to undertake due diligence illegality risk

assessment of all suppliers under the EUTR. They also

quizzed 15 supplier companies (all in tropical countries),

which today face a mass of due diligence documentation

and inquiries from customers EU-wide.

Critically, they focused on small to medium sized

enterprises, which not only comprise a large part of the

timber sector, but may find due diligence more of a burden

as they have fewer resources to devote to it.

Among aspects the questions probed were:

whether companies properly

understood what whether companies properly

understood what

was expected of them in terms of due diligence

how much time, money and people

they devoted how much time, money and people

they devoted

to it

whether they used external due

diligence support whether they used external due

diligence support

and guidance

how EU companies viewed the

performance of how EU companies viewed the

performance of

Competent Authorities, responsible for

monitoring and policing the EUTR in each EU

country

Key conclusions included that most companies had a good

understanding of their due diligence obligations, but the

knowledge of some was seriously deficient. The report

also ranks due diligence understanding and performance of

EU company participants by country.

The GTF found that bigger businesses generally had more

comprehensive due diligence policies, but smaller

companies can also perform well. Those that used

external support also had more robust systems and,

interestingly, supplier country companies tended to put

relatively more money and time into due diligence than

their EU customers.

This last conclusion may go some way to explaining why,

as implied by the recent revival in EU imports, European

buyers now seem sufficiently confident of the legality

assurances provided by suppliers to increase purchases of

tropical timber products.

The report is available from the GTF website at:

http://gtf-info.com/uploads/documents/gtf-supplier-andconsumer-

due-diligence-analysis.pdf

|