Japan Wood Products

Prices

Dollar Exchange Rates of

10th September 2015

Japan Yen 120.59

Reports From Japan

Growth prospects undermined by falling exports and

weak domestic demand

The Japanese economy contracted in the second quarter of

this year ( -1.2% annualised). Falling exports, especially to

China, will make a second half year recovery very

difficult.

Public spending and slightly better housing starts, the

result of changed tax structures has encouraged home

owners to demolish and rebuild, were the only bright spots

in an otherwise disappointing second quarter.

Domestic demand, the main driver of growth, was

subdued in the second quarter and the efforts of the

government and Bank of Japan (BoJ) to stimulate inflation

have not succeeded as yet.

With prospects for growth in the second half of the year

looking dim many in Japan are calling on the BoJ to

consider expanded fiscal stimulus. The Economy Minister

has expressed fears that weak demand in China will

seriously affect Japan and will undermine growth in most

Asian economies further affecting Japan‟s exports.

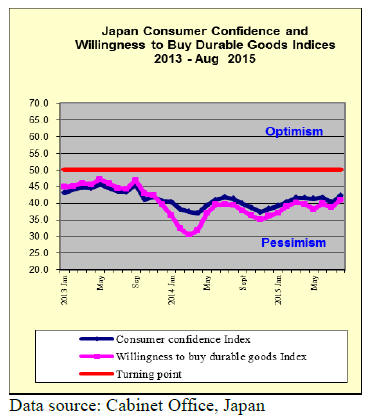

Robust improvement in consumer confidence index

The BoJ survey of consumer confidence during August

covered 8,400 households and response rate was 65.7%.

The overall Consumer Confidence Index in August rose to

41.7, up 1.4 points from the previous month, a surprisingly

robust improvement. The August figures for the various

components of the index (Consumer Perception Indices)

were as follows:

Overall livelihood: 40.1 (up 2.0 from July)

Income growth: 39.9 (up 0.3 from July)

Employment:46.3 (up 1.6 from July)

Willingness to buy durable goods:40.3 (up 1.5

from July)

The index measuring employment status improved as did

the income growth prospect index.

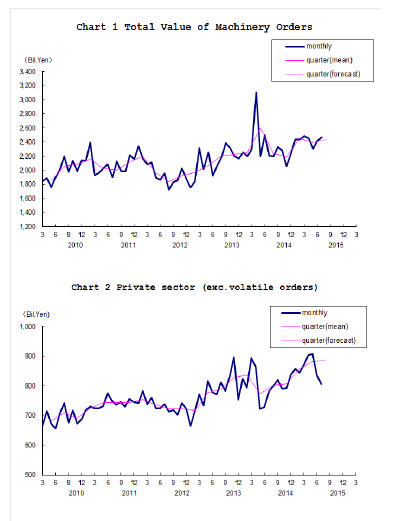

Second consecutive monthly dip in machinery orders

Machinery orders, a primary economic indicator in Japan,

fell in July. This was the second consecutive drop raising

the prospect that weak business investment will further

dampen the chances of sustained economic expansion.

August private sector machinery orders were down 3.6%

following on from the nearly 8% drop in July.

The Cabinet Office cut its assessment of core orders,

saying „the pickup is seen stalling‟ which has driven many

analysts, along with Cabinet Ministers, to call for further

economic stimulus measures.

For more see:

http://www.esri.cao.go.jp/en/stat/juchu/1507juchu-e.html

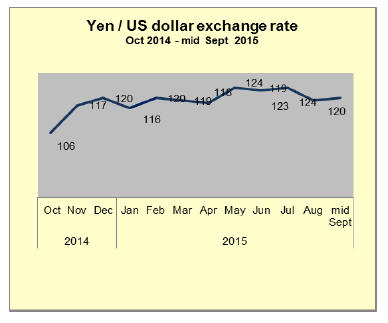

Rising profits of exporters not translating into higher

wages

With the yen already trading in the 120-124 range to the

US dollar, a 50% drop in just over two years, small sized

manufacturing companies that rely on imported raw

materials are facing tough times. With inflation stuck close

to zero manufacturers selling into the domestic market

cannot pass on the rising cost of production.

The rising fortunes of the big exporters due to the weak

yen have not translated into higher worker incomes and it

is here that Abenomics has run into a wall.

The weaker yen was the key to the early success of

government policy but the negative impact on small

companies which, after all, employ more works than any

other sector has economists and politicians worried.

Import round up

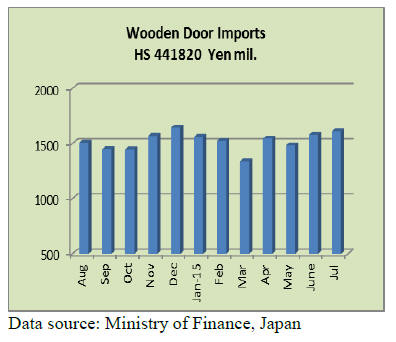

Doors

Japan‟s July 2015 imports of wooden doors rose again

climbing just over 2% month on month. The July imports

of wooden doors were almost at the record level set in

December 2014.

China and Philippines continue as the top wooden door

suppliers accounting for just over 75% of Japan‟s July

imports of this product. If imports from Indonesia and

Malaysia are included then over 90% of wooden doors are

accounted for.

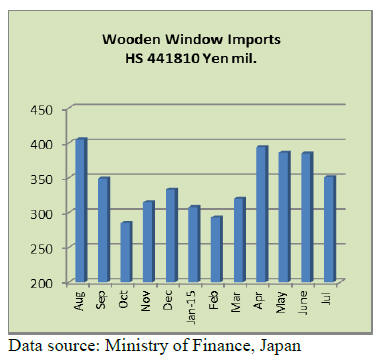

Windows

July wooden window imports were down around 9%

month on month and down 16% on July 2014.

China tops the list of suppliers (36% of all wooden

window imports) followed by Philippines (30%) and the

US (21%). The top three supplires accounted for over 85%

of all wooden window imports in July.

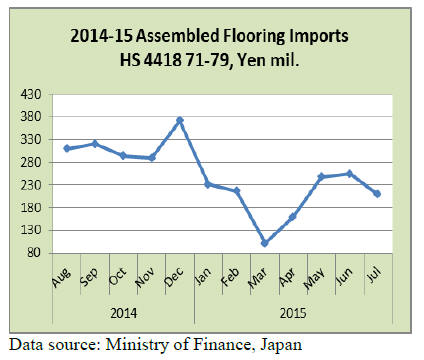

Assembled flooring

July imports of assembled wooden flooring dipped sharply

reversing the gains made in June. Month on month, July

imports were down 18% and year on year they fell 39%.

As in previous months China is the largest supplier of

assembled wooden flooring accounting for 57% of July

imports.

Imports from Vietnam and Malaysia were at around the

same level in July with each accounting for around 8% of

all assembled wooden flooring imports.

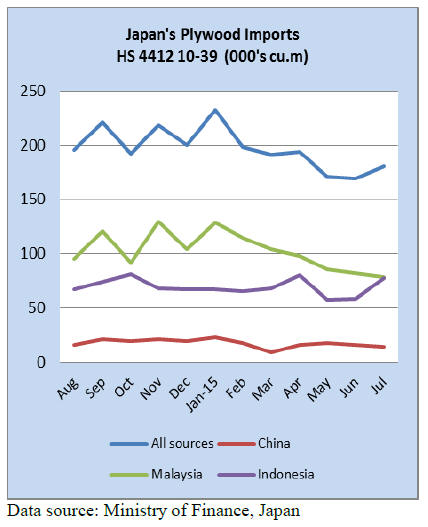

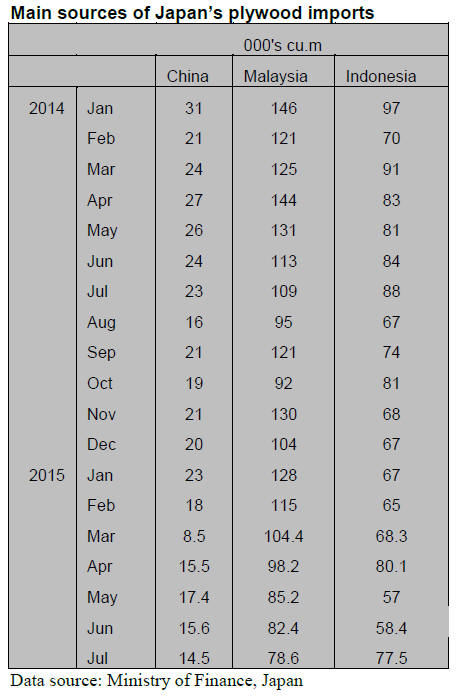

Plywood

While total plywood imports picked up in July, shipments

to Japan from the main suppliers were mixed. China does

not feature prominently in the ranking of Japan‟s plywood

suppliers as the main emphasis is on Indonesia and

Malaysia.

Plywood imports from Malaysia fell sharply in July (-

28%) while imports from Indonesia rose by over 30% to

fill the gap. However, despite the improvemment in

Indonesia‟s shippments in July 2015 they were down 12%

year on year. The good news for Indonesian plywood

exporters is that compared to June this year exports to

japan rose just over 33%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

First half 2015 log and lumber exports surge

Log and lumber export for the first half of this year were

10,960 million yen in value, 33.8% more than the same

period of last year. High growth continues and the value

exceeded ten billion yen in six month.

For Korea, log exports doubled in volume and lumber

increased by 50% but the volume is oversupplied so that

the shipments are slowing down now. Log shipments to

Taiwan are also slowing. Second half export depends on

purchase by China.

Log export in value is 4,628 million yen, 46.2% more with

the volume of 323,850 cbms, 36.2% more while the

lumber export was 1,690 million yen in value, 15.9% more

with the volume of 31,158 cbms, 5.3% less. Growth in

value depends on sales of higher value species like cypress

particularly for Korea.

In log export, China had 191,763 cbms, 37.1% more and

Korea had 85,920 cbms, 108.2% more. In lumber

shipments, Korea had 4,214 cbms, 51.7% more but China

had 13,591 cbms, 0.1% less.

Plywood mills continue production curtailment

Major plywood manufacturers of softwood plywood will

continue production curtailment in September.

July shipment was 252,500 cbms, renewed record high

monthly shipment next to last June and the inventories

were sharply down to 186,100 cbms, 46,100 cbms less

than June inventories so delivery period for new orders are

uncertain but the manufacturers think that supply

reduction is necessary to tighten the market.

August is vacation month so the production drops while

the users are anxiously pushing the mills early deliveries

in an anticipation of higher market in tight supply. The

manufacturers try to judge if such orders are based on

actual demand or speculative purchase. To find out if the

demand is real or not, the manufacturers decided to

continue production curtailment in September and see

what reaction the market shows in September.

Large users like precutting plants suffer some delay of

shipment but it is not serious stage yet. July production

was 199,500 cbms, 6.4% less than June. That in June 2014

was 230,000 cbms.

Back ground of this action by the manufacturers is long

deep market slump since last January through June. The

dealers minimized the purchase in down market. In this

situation, the only solution is production curtailment and

when the inventories decline, the dealers started buying in

large volume and recorded high shipment for two straight

months.

North American log and lumber imports for the first

half of the year

Import of North American logs and lumber decreased for

two straight years. Log import for the first six months of

this year decrease by nearly 30% from the recent peak of

2013. Total log import for the first six months of this year

was 1,281,723 cbms, 26.3% less than the same period of

last year.

European lumber imports for the first half of this year

Import of European lumber during January and June this

year was 1,144,000 cbms, 19.2% less than the same period

of last year due to slower demand. This is the lowest first

half import in last five years.

Structural laminated lumber market was inactive so that

import of lamina from major sources decreased. However,

since last spring, import from Austria, Estonia and Czech

increased after whitewood KD stud supply declined and

the inventory dropped in Japan.

The demand changed so much compared to the first half of

last year when the demand increased before the

consumption tax increase since April.

Monthly import during January and June last year was

about 250,000 cbms but for first three months this year,

monthly import had been less than 200,000 cbms although

it increased to 210,000 cbms in April and May.

South Sea (tropical) log and lumber imports for the

first half 2015

Imports of logs and lumber for the first half of the year

decreased by 15% compared to the same period of last

year. Import of logs from major sources of Sabah and

Sarawak, Malaysia declined by high FOB prices, weaker

yen and depressed market in Japan. See the chart for

volume by source.

Total log import was 114,800 cbms, 14.8% less out of

which Malaysian logs were 96,100 cbms, 15.8% less.

Malaysian supply takes about 85% of South Sea log

import so decline of Malaysian supply pulled down total

volume. If this low level continues, total year import

would be about 230,000 cbms, the lowest ever.

Limited supply in producing regions pushed FOB higher

then the yen depreciated since last summer so the yen cost

soared. The cost of Sarawak meranti regular was about

10,000 yen up until August last year then it has kept going

up and now it is about 13,000 yen per koku.

For plywood manufacturers, it is impossible to pass this

high cost onto sales prices in depressed market so they

seek substituting sources, which is another reason

Malaysian log import decreased.

|