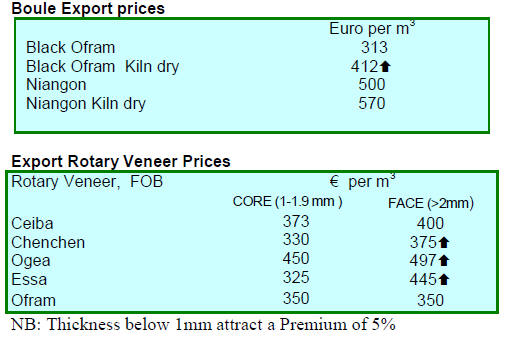

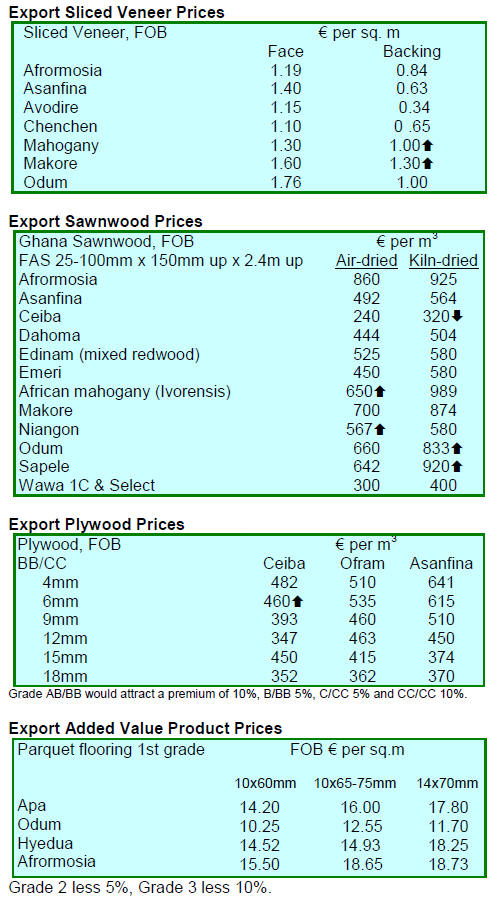

2. GHANA

Manufacturers express concern on economy

According to the second quarterly report from the

Association of Ghana Industries (AGI), industry members

have expressed concern on what they described as the

„worsening economic situation in the country‟.

In a statement the AGI said businesses in the country are

straining under the exchange rate volatility, the increased

taxes and the unrelenting power crisis all of which is

undermining business planning and consequently causing

losses.

The AGI members comprise small, medium and large

scale manufacturing and service industries and they are

urging the government to reduce government expenditure

and excessive borrowing in order to restore macroeconomic

stability.

In another development, the AGI has lauded the National

Development Planning Commission (NDPC) for its

initiative on a 40-year development plan but insists that

the plan should focus on developing an industrial-based

economy.

The development plan, which is still in the consultation

process, has sought comments from various stakeholders

such as political parties, professional bodies, civil

societies, social organisations and religious groups.

According to the chair of the Commission, the long-term

plan falls in line with public outcry for single development

framework that will guide successive governments.

Funding power generation

Funding from the World Bank has been secured for the

country‟s power generation. This follows the approval of a

record US$700 million in guarantees for Ghana‟s Sankofa

Gas Project - a project that will help address the country‟s

serious energy shortages by developing new sources of

clean and affordable natural gas for domestic power

generation.

PPI rises sharply

Ghana's annual Producer Price Inflation (PPI) rose sharply

to just over 23% in June from a revised figure of 18.8%

the previous month. According to the Statistical Office the

rise was caused by currency depreciation, higher cement

prices, and changes in the extractive and manufacturing

sectors.

3. MALAYSIA

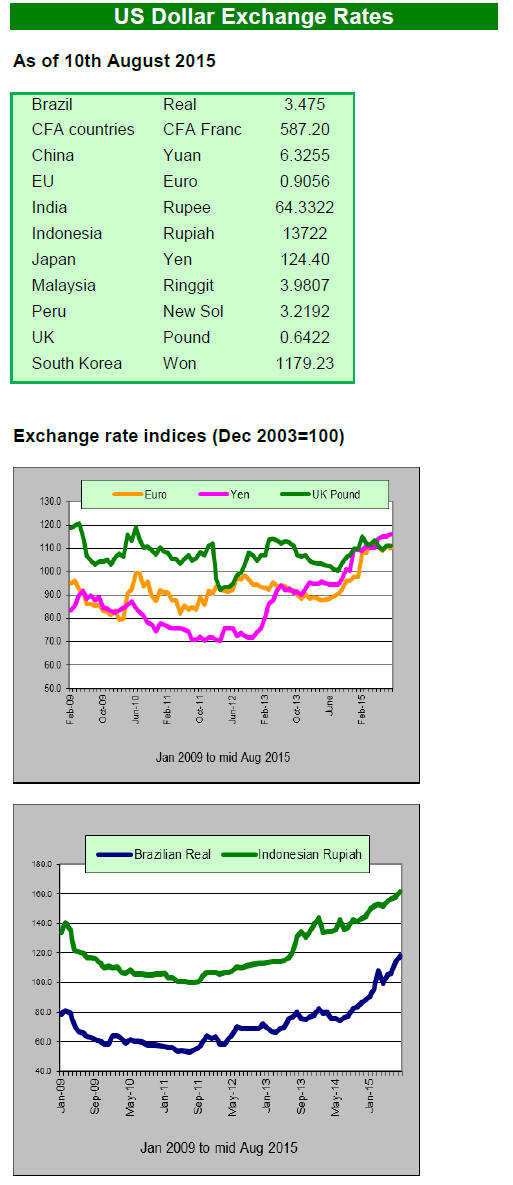

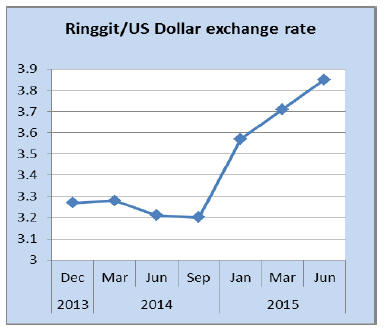

Weak ringgit pushing up production costs

The issue currently dominating business community

debate is the weakening ringgit/US dollar exchange rate.

The ringgit fell to 3.928 on 11 August, the weakest since

September 1998 during the Asian currency crisis when the

government pegged the currency to the US dollar.

From the beginning of this year the exchange rate was

stable but slowing demand, mainly in China, and domestic

issues served to undermine the domestic currency.

The Malaysian Central Bank (Bank Negara Malaysia) has

been forcefully supporting the ringgit but at a huge cost to

foreign exchange reserves which recent fell below US$

100 billion. This in itself undermined confidence and

exacerbated the situation.

During the early part of August, following the release of

data showing exports declined for the fifth consecutive

month, China began a round of devaluations of the yuan.

This impacted the ringgit/dollar exchange rate which

tipped to 3.9605 at one point mid-month. The ringgit is

Asia‟s worst performing currency over the past 12 months.

The Chairman of the Sarawak Timber Association,

Wong

Kie Yik, pointed out that while sales priced in dollars

resulted in higher ringgit earnings the increased cost of

raw material inputs is eating up the currency gains.

Sarawak Furniture Industry Association president, Lai

Kim Min, said manufacturers are disadvantaged by the

weakening ringgit. In addition Malaysian consumers are

finding that prices for imported goods from China and

Vietnam are rising.

Active promotion of high value goods key to increased

export earnings

The Director-General of the Malaysian Timber Industry

Board (MTIB), Dr Jalaluddin Harun, is forecasting wood

product exports of RM22 billion this year.

In a press release he said from January to May export

revenue from wood products increased 0.6% year on year

to RM8 billion. Third quarter exports traditionally rise

such that the target RM20-22 billion is attainable provided

promotion of high value added products is maintained and

Malaysia aggressively participates in international

exhibitions. In 2014 the top five export destinations Japan,

the US, EU, India and Australia.

¡®Go ahead, make my day¡¯ armed foresters set to patrol

in Sabah

The Sabah Forestry Department has set up an armed team

and a tracker dog unit in an effort to enforce the State's

forestry laws and regulations.

Forestry Director, Sam Mannan, told the press that 40

armed personnel supported by the canine unit will be

deployed and will not tolerate illegal activities. Initially

the canine unit would focus on tracking gaharu

(sandalwood) smugglers in forest reserves.

Sarawak company commissions new plywood mill in

Australia

Ta Ann has recently commission a plywood mill in North

West Tasmania after several delays. The investment began

at the time of the previous Australian government which

provided a large proportion of the capital required.

The mill will create some 120 jobs when at full production

producing panels for the Australian market. The company

hopes to capture 15 per cent of the Australian market for

plywood.

For more see:

http://www.fridayoffcuts.com/index.cfm?id=638#1

4. INDONESIA

Reviving the Economic Partnership

Agreement with

EU

Minister of Trade, Rachmat Gobel, said that the

Indonesian government plans to open negotiations with the

EU on resumption of the Comprehensive Economic

Partnership Agreement (CEPA) with the aim of improving

market access for Indonesian products into the EU.

This was discussed when the British Prime Minister

visited Indonesia. Trade between Indonesia and the UK in

2014 amounted to US$2.5 billion with Indonesia‟s exports

valued at US$1.6 billion and imports valued at US$894

million.

Investment funds for SMEs

Since 2007 the Ministry of Environment and Forestry has

had a revolving fund of IDR2.1 trillion to finance

community forest sector developments by furniture SMEs

and community forest groups. Unfortunately the funds

have not been accessed by local entrepreneurs.

Recently, community forestry entrepreneurs and SMEs

were invited to the forestry ministry for a Business

Investment Forum attended by representatives from the

Bank of Central Java and Bank of East Java.

During the Forum the reasons for the slow uptake of loans

was discussed along with issues related to implementation

of Indonesia‟s domestic timber legality verification

system.

Gearing up to tackle forest fires

Hot dry weather is affecting Indonesia and authorities are

concerned about the high fire risk brought on by the El

Nino phenomenon.

Indonesia suffered serious forest fires because of the 1997-

98 El Nino when fire destroyed millions of hectares of

forests and plantations valued at almost US$2.5 billion.

Impact of yuan devaluation

The surprise devaluation of the yuan on 11 August drove

Indonesian stocks lower on concern that China‟s imports

will slow which would weaken Indonesia‟s exports to

China, Indonesia‟s largest trading partner. Indonesia‟s

exports to China already fell a quarter in the first half of

2015.

On the possible impact on exchange rates, Bank of

Indonesia Deputy Governor, Mirza Adityaswara, reassured

markets that the yuan devaluation is unlikely to impact the

rupiah which is already at very competitive levels.

The International Monetary Fund welcomed China‟s

move

to devalue the yuan and said it doesn‟t directly impact

China‟s aim to win reserve currency status for the yuan.

5. MYANMAR

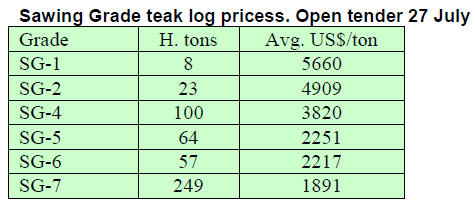

August market prices

The following timber was sold by the Myanma Timber

Enterprise (MTE) by tender on 24 and 27 July 2015. Log

volumes are expressed in hoppus tons (H.tons) and

volumes for „conversions‟ and sawn teak (including hewn

timber) are shown in cubic tons (C.tons).

Teak conversions (scantlings), Yangon MTE Sawmills

MTE sold 352 cubic tons of various sizes of teak

conversions produced from its own sawmills and 110 tons

Second Quality (grade) timber. Average prices were as

follows:

Long Lengths (6ft.& up avg. 8ft)

Second Quality US$1638

Short lengths (3ft. to 5.5ft.)

Second Quality - US$1554

Ultra shorts- (1ft. to 2.5 ft.)

Second Quality - US$1404

A total of 242 tons of Third Quality timber of various

lengths was sold at an average of US$564 per cubic ton.

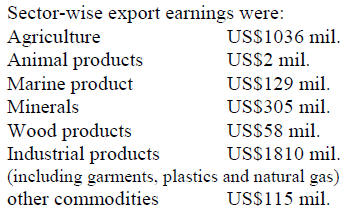

Export earnings FY 2015-16.

Export earnings for the first four months of FY 2015-16

were reported to be US$3,455 million.

Monsoon floods

Floods in the last week of July affected 12 out of 14 states

and divisions in Myanmar with the Chin and Rakhine

states as well as the Sagaing and Magway divisions being

declared disaster areas.

According to Ministry of Social Welfare between 16 July

and 8 August 223,700 families were affected.

These floods are the worst in decades. Kachin,

Sagaing,

Magway, Rakhine suffered the heaviest flooding.

Flooding has affected transportation of wood products.

Logs and other wood products are commonly transported

by barges but swollen rivers have brought shipments to a

halt.

6.

INDIA

Real estate companies under pressure from

unsold

units ¨C prices set to fall

Because of rapid urbanisation and increasing income

levels the Indian housing market is witnessing

considerable change.

RNCOS, a business consulting service firm, has released a

new report, ¡°Indian Housing Sector Outlook 2020¡±. The

report highlights the strong growth in the Indian housing

sector over the past few years driven by rising purchasing

power, continuously rising population, increasing

investments in socio-economic infrastructures,

urbanisation and migration of people from rural areas.

The press release says the report provides an overview of

the Indian housing market and provides a information on

opportunities in the different industry supply materials to

the sector. Forecast for housing market potential and

demand have been provided till 2020. For more see:

http://www.rncos.com/index.htm

In recent months Indian real estate developers have had a

difficult time in disposing of the stock of housing. While it

is difficult to get details on housing sales and indication of

the problem of poor sales can be gauged from reports by

the Reserve Bank of India (RBI). The Bank has recently

released details on lending by commercial banks to the

real estate sector.

The RBI notes that lending commercial banks to the estate

sector in March was down 0.7%. While this may not seem

a significant drop when viewed against overall lending the

reality becomes apparent.

Over a period of one year lending to housing developers

was around 1% below the rate of overall lending as

developers are holding back on new project developments

in the face of high levels of unsold units and this is

affecting sales of wood products in the country.

The pressure is now on developers holding high levels of

unsold units which should be good news for home buyers

as the indications are that house prices will have to come

down before further developments are started.

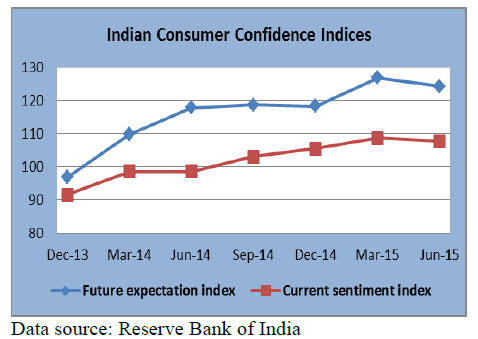

Slight weakening of consumer sentiment

India‟s Consumer Confidence Survey provides an

assessment of the perceptions of respondents on general

economic conditions and their financial situation currently

and looking ahead 12 months.

The survey determines if respondents consider their

financial situation likely to improve, be unchanged or

worsen. Respondents in Bengaluru, Chennai, Hyderabad,

Kolkata, Mumbai and New Delhi are surveyed.

The information collected is analysed in two parts- current

situation as compared with a year ago and the expectations

for a year ahead. The latest survey was conducted during

the second to third week of June 2015 and secured

responses from 5,400 people.

Findings from the latest survey show:

Consumer perception on the general

economic

Consumer perception on the general

economic

conditions for the current period and the

year

ahead continues to be positive.

Both the Current Situation Index (CSI)

and

Both the Current Situation Index (CSI)

and

Future Expectations Index (FEI), which had

steadily risen since September 201,3

remained

positive but there was moderation in

sentiment on

all the indicators except perceptions on

spending.

GST to level playing field and benefit Indian plywood

end-users

India is set to bring into law the Goods and Service Tax

(GST) Bill officially titled The Constitution (One Hundred

and Twenty-Second Amendment) Bill, 2014. This would

bring in a unified Central and State wide Value added Tax

as of April 2016. The GST will replace all indirect taxes

levied on goods and services by the Indian Central and

State governments.

The new tax regime will benefit the corporate sector

through reducing the tax burden on companies and

through reducing production costs. From a consumer view

point GST will herald a reduction in the tax burden on

goods which is currently around 25%-30%. Introduction

of the GST will improve competiveness at home and in

international markets.

Major plywood manufacturers are looking forward to the

introduction of the unified tax structure particularly as it

will level the playing field for them and plywood makers

in the so-called „unorganised sector‟ as the price

advantage enjoyed by „unorganised‟ manufacturers would

narrow. Existing corporate manufacturers pay 16% excise

duty and 4% sales tax on their products.

The Indian Plywood Industries Research and Training

Institute has said introduction of the GST will make

trading conditions tougher for the „unorganised‟ plywood

makers which generally produce low quality plywood and

undercut plywood from major producers.

It is estimated that „unorganised‟ plywood producers have

a 60-65% share of the domestic market for plywood.

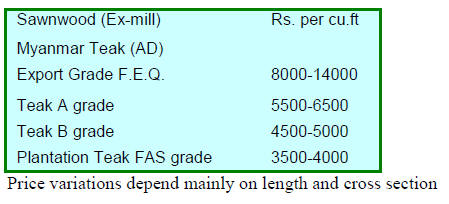

Current prices for Myanmar teak sawn in Indian

mills

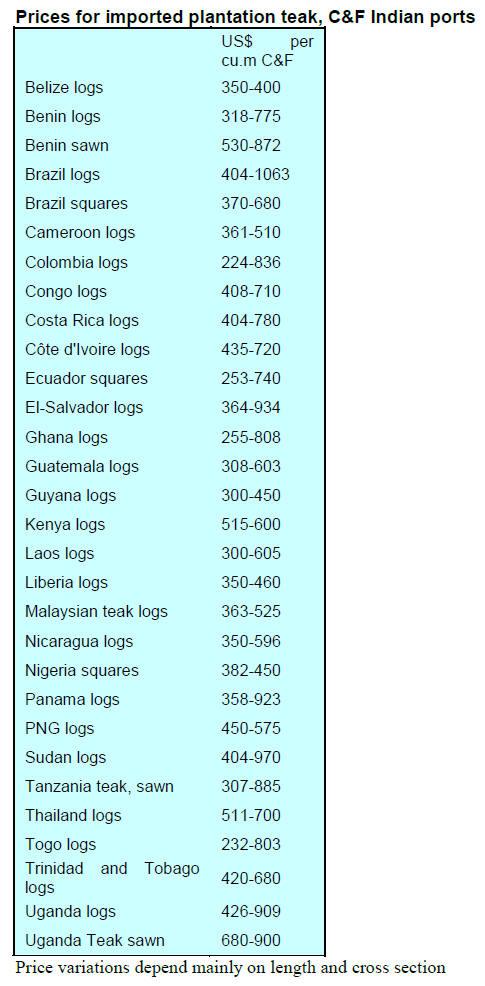

Durable tropical timbers from West Africa and Malaysia

are slowly replacing imported natural forest teak because

of its high price.

Even in traditional markets such as Middle Eastern

countries iroko is finding favour in place of teak because

of its quality and competitive price.

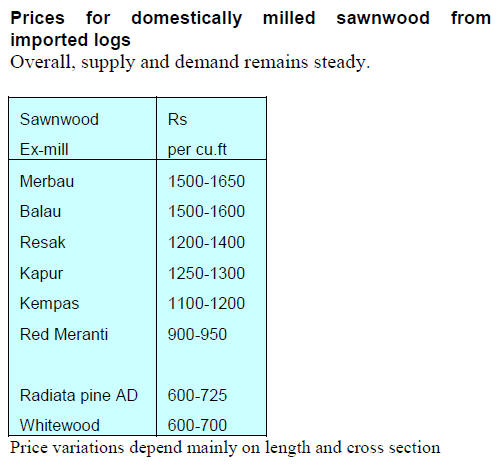

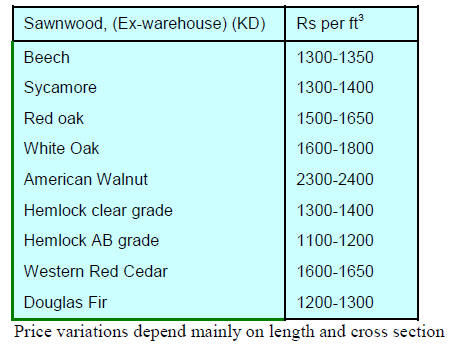

Imported sawnwood

Prices for imported sawnwood (KD 12%) shown below

are per cu.ft ex-warehouse.

No significant price movements have been reported.

Plywood prices

In the housing sector the problem of weak demand

persists. It has been reported that as many as 700,000

apartments are lying unsold in eight major cities in the

country. Compared to sales in the first half of last year

sales as of June 2015 were down 19% and there has been a

40% decline in the launching of new housing projects.

The weak housing market is affecting plywood sales but

because of their lower overhead costs small mills in the

so-called „unorganised‟ sector can offer high discounts to

maintain sales.

With the monsoon season continuing to cheer farmers with

a promise of good harvests demand in the building and

construction sector may pick up at the end of the rain

season.

¡¡

7.

BRAZIL

Forest products exports improve in the

first half 2015

In the first six months of 2015, revenue from exports of

pulp, woodbased panels and paper totalled US$3.6 billion,

about the same level as in the first half of 2014. The

January to June trade balance for the sector stood at

US$2.9 billion, a 6% increase compared to the same

period in 2014.

The volume of pulp exports in the first half of 2015

totalled 5.5 million tons, a 7% rise year on year.

Woodbased panel export volumes in the first six months of

this year totalled 289,000 cubic metres a 48% rise over the

same period in 2014.

Paper exports reached 987,000 tons between January and

June 2015, an almost 4% growth year on year.

Bahia forestry sector to create additional 45,000 jobs

by 2018

According to Forest Plantation Producers Association of

Bahia (ABAF) the state should achieve a 15% increase in

the number of jobs in the forestry sector by 2018 as the

plantation area increases.

Bahia is ranked fifth amongst the timber producing states

in Brazil as it accounts for around 10% of the total planted

area in the country.

Plantation growth rates in Bahia are good due to

favourable soil and climatic conditions especially in the

northeast. Output per hectare is said to be as high as 45

cubic metres while the national average is 33cubic metres.

95 forest-based companies operate in the State and provide

300,000 direct and indirect jobs and the forestry sector

contributes over 5% to State GDP.

Imaflora reviews new certification indicators

The Forest Stewardship Council is said to be reviewing its

international generic indicators in Brazil, the review will

result in changes in the Standards for Forest Management

in the Brazilian Amazon (natural forests and forest

plantations).

The standards will reportedly provide indicators for local

communities and small farmers as standards for small and

low intensity managed forests will be separated from the

new standard.

Professionals in the areas of natural forests and forest

plantations certification at the Institute for Agricultural

and Forest Management and Certification (IMAFLORA)

are debating appropriate indicators regarding small

producers and communities to ensure the new standards

reflect reality on the ground in Brazil. Public hearings on

the draft proposals are planned for late 2015 and early

2016.

8. PERU

Award for innovative prevention of

deforestation

Peru's embassy in London was the venue for the

"Environmental Finance Award - 2015".

The award was given to the authorities in Peru who, in

cooperation with the Fund of the Americas (FONDAM)

and the Association for Research and Integral

Development (AIDER),were recognised for efforts in the

Tambopata National Reserve and the Bahuaja Sonene

National Park in Madre de Dios.

The award recognises the innovative approach to the

conservation of landscapes in areas of greatest biodiversity

and the design of a sustainable financial model attracting

public and private funding for the development of

conservation programmes that combine conservation and

economic and social development.

Furniture Fair MADEXPO

The MADEXPO furniture and wood products fair will be

held 11 to 14 November. The fair aims to promote

technological developments in the timber sector and

present a wide range of products and services available for

the sector.

Tropical Forest, the event organisers, say MADEXPO is a

perfect opportunity for entrepreneurs in southern Peru to

interact and observer the latest technologies.

9.

GUYANA

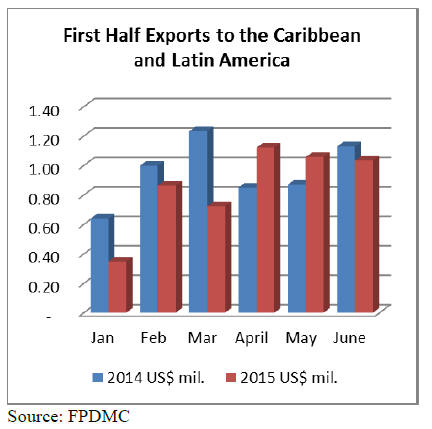

Caribbean and Latin America market in

first half 2015

Economies of Caribbean countries and some Latin

American countries continue to strengthen and this is

driving demand for a significant part of Guyana‟s exports.

In the first half 2015 earnings from the export of wood

products to Caribbean and Latin America markets totalled

US$5.14 million.

First half year 2014earnings in the same markets

amounted to US$ 5.72 million. Despite the over 10%

decline in first half 2015 earnings these markets remain

firm and stable.

Both the Caribbean and Latin American markets

account

for the major portion of Guyana‟s exports of added value

products such as doors, indoor and outdoor furniture, craft

items, spindles, mouldings, prefabricated building

components, window frames and wooden utensils as well

as non-timber forest products.

The Forest Products Development and Marketing Council

(FPDMC) is taking initiatives to promote the manufacture

of value added forest products for both domestic and

international markets utilising both commercial and lesser

used timbers.

Logging companies told to comply with concession

agreement

The international and domestic media in Guyana has

reported that China Forest Industry and Vaitarna Holdings

of India could have their concession agreements nullified

if they fail to establish wood processing plants as required

under their concession contracts with the government.

Minister of Governance, Raphael Trotman, has said that

following discussions with the two companies each had

agreed to address this issue and establish milling capacity.

Both companies have large forest concessions and both

have benefitted from the tax concessions and other

incentives on the understanding the companies will to

install processing capacity.

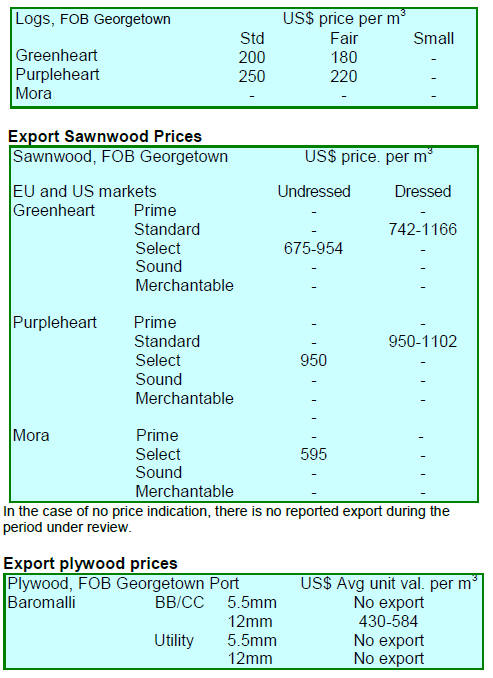

Export prices

There were exports of greenheart and purpleheart logs but

not mora logs in the period reviewed.