|

Report from

North America

US interest rate hike possible in September

GDP growth in the first quarter of 2015 was revised down

to -0.7%, according to the second estimate by the US

Department of Commerce. Higher imports and lower

private investment were the main reasons for a contraction

in the economy.

Unemployment was 5.5% in May. The unemployment rate

has changed little since February.

The Federal Reserve announced in June that interest target

rates will likely increase, possibly by an average of one

percentage point per year over the next three years. The

interest rate has remained unchanged for now. Most

analysts expect the first rate hike for September.

The manufacturing industries noted growing demand and

better flow of imported goods through the West Coast

ports, according to the Institute for Supply Management.

Furniture manufacturing and the wood product industries

reported production growth in May.

Consumer and builder confidence down in May

Consumer confidence in the US economy fell in May to a

six-month low. The University of Michigan¡®s consumer

confidence index declined from 95.9 in April to 90.7 in

May.

Weak economic growth in the first quarter and few

changes in the unemployment rate affect consumers¡®

outlook. Growth in wages has been low, while the price of

gasoline is rising again.

Builder confidence in the market for new single-family

homes decreased in May, according to the National

Association of Home Builders/Wells Fargo Housing

Market Index.

Builder confidence reflects lower consumer confidence in

the economy and the slow recovery in the housing market.

Builders were most positive about market conditions in the

South and Northeast.

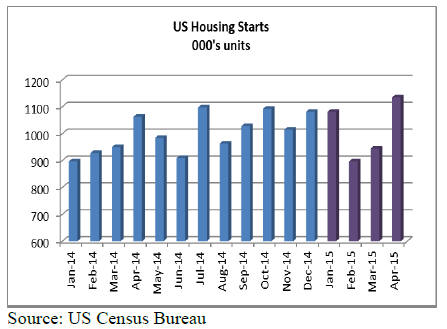

Home construction up expect in US South

Housing starts were low in the two months up to March

but they finally gained in April. Starts were 1.135 million

at a seasonally adjusted annual rate, a 20% increase from

March. Single-family housing starts grew 17%, while

multi-family construction increased by 27%.

Home construction increased in all regions of the country

except the South. The value of building permits issued

increased by 10% in April to US$1.143 million. Much of

the growth was in permits for multi-family construction.

Homes sales (as opposed to Starts) on the other hand

slowed in April, according to data collected by the

National Association of Realtors. The association believes

sales declined because of low supply on homes on the

market relative to demand, which has increased prices.

Mixed signals in non-residential construction

Growth in non-residential construction appears to

accelerate. Investment in non-residential construction

increased by 3% in April (a seasonally adjusted annual

rate). The US Census Bureau also revised up the March

investment in private construction.

All categories of non-residential construction grew in

April, except health care facilities. Despite the positive

data, the American Institute of Architects reported a

downturn in business conditions for firms in the

commercial and industrial market. The institutional

construction sector was more positive.

Growth in home remodeling to slow in 2015

Homeowner spending on home remodeling grew 5% in

the third quarter of 2014, according to estimates by the

Joint Center for Housing Studies of Harvard University.

For 2015, the center predicts growth in the remodeling

market, but at a lower rate than in 2014.

After a strong start in 2015, growth in remodeling

spending is projected to decline to less than 3% in the

second half of the year. Growth rates are based on a fourquarter

moving rate of change which removes seasonality

effects.

The recent slowdown in home sales has a negative effect

on home renovation, repair and other remodeling

activities.

Homes sales is the largest driver of remodeling as new

home owners tend to purchase new flooring, kitchen

cabinets or build home extensions.

The expected rise in interest rates will likely encourage

home owners to invest in their homes sooner rather than

later.

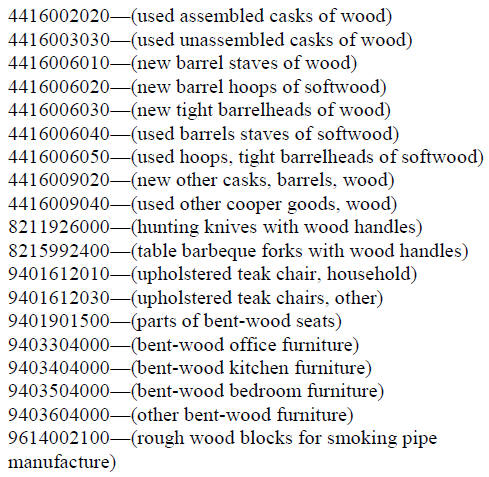

Wood products requiring declaration under Lacey Act

The following additional wood products will require

declarations for US import starting August 6, 2015 (by HS

code).

The list of all wood products that require declarations is

available at

http://www.aphis.usda.gov/plant_health/lacey_act/downlo

ads/ImplementationSchedule.pdf

Lacey Act amendment bill in Senate

An amendment of the Lacey Act would change penalties

from criminal to civil and reduce the maximum fine. Most

significantly, it would also remove all references to

¨Dforeign law¡¬ within the Lacey Act. The change would

make it easier for companies to comply with the

legislation. If they do not comply the consequences would

be less severe.

The proposed amendment will need to be approved by the

US Congress. A previous attempt at similar Lacey Act

change failed in 2012 the Lacey Act failed.

Import round-up

Imports of several wood product types declined in April,

despite better supply chain flow through West Coast port.

However, compared to the same time last year US imports

are up except for hardwood mouldings. Demand is likely

to recover before the summer as house construction and

home sales grow.

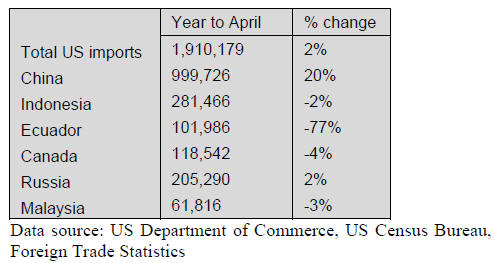

Lower hardwood plywood imports

US imports of hardwood plywood decreased 28% monthover-

month to 216,763 cu.m. in April. Year-to-date

imports were 2% higher than in April 2014.

China¡®s share in imports declined to 50% in April because

of a drop in Chinese shipments to107,532 cu.m. Year-todate

imports (January to April) were 20% higher than in

2014 when the US anti-dumping duties had already been

lifted.

Hardwood plywood imports from Russia grew in April to

32,868 cu.m., up 28% from the previous month. All other

major suppliers to the US market shipped less year-to-date

than in April 2014. The largest drop in shipments was

from Ecuador.

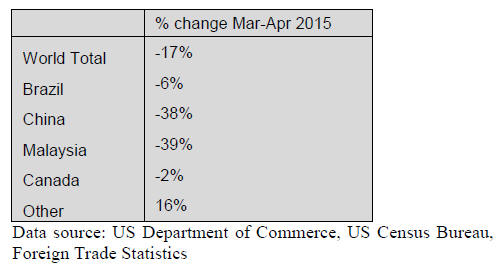

Decline in hardwood moulding imports

April hardwood moulding imports fell 17% to US$13.3

million. Year-to-date hardwood moulding imports were

lower than in April 2014.

Despite the overall decline, imports of hardwood

mouldings from China have grown this year. April imports

from China were worth US$3.8 million, compared to

US$3.0 million from Brazil.

First four month hardwood moulding imports from

Malaysia were also up. 2015 imports were 7% higher than

in April last year but compared to March there was a sharp

drop.

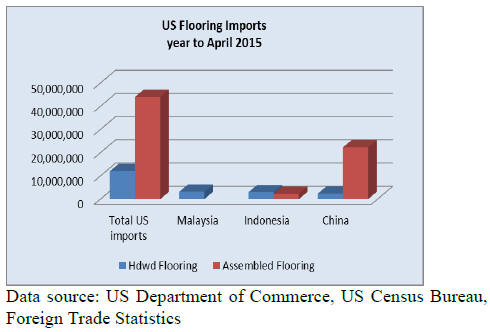

Indonesian flooring shipments up in April

Wood flooring imports decreased in April, but remains

higher year-to-date than in April 2014.

April hardwood flooring imports declined by 6% from the

previous month to US$3.3 million. Imports from Indonesia

grew 80% month-over-month to US$995,495, making

Indonesia the largest supplier in April.

Both Indonesia and Malaysia had higher shipments yearto-

date compared to last year.

China¡®s hardwood flooring shipments were down in April

and growth in imports year-to-date was low compared to

Malaysia, Indonesia and Canada.

Imports of assembled flooring panels fell 23% in April to

US$9.7 million. Year-to-date imports were up 23% over

April 2014. Imports from all major supplier countries

declined in April.

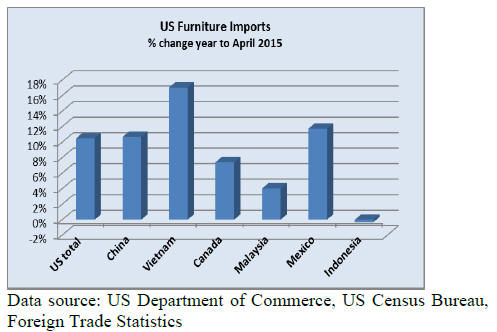

Vietnam, Indonesia, Malaysia and Mexico grow

furniture import share

Wooden furniture imports were worth US$1.21 billion in

April, down 13% from March. Year-to-date imports were

10% higher than in April 2014.

The largest month-over-month decline was in imports

from China. Furniture imports from China were worth

US$505.8 million in April, down 23% from March.

However, year-to-date imports were 11% higher than in

April last year. China¡®s import share remains unchanged

from 2014 at over 46%.

Vietnam¡®s furniture import share increased by one

percentage point from March to 19% in April. Imports

from Vietnam were worth US$235.1 million in April.

Wooden furniture imports from Indonesia and Malaysia

increased in April to US$65 million and US$63 million,

respectively. Mexican shipments declined in April, but

year-to-date furniture imports from Mexico were 12%

higher than in 2014.

Decline in furniture retail sales

Retail sales at furniture stores in the US fell an estimated

7% from March to April, according to US Census Bureau

data. Furniture sales remain higher (+5%) than at the same

time last year. The decline in April sales of furniture and

overall in retail reflects lower consumer confidence in the

economy.

|