Japan Wood Products

Prices

Dollar Exchange Rates of

24th July 2015

Japan Yen 123.81

Reports From Japan

Marked improvement in business sentiment among

large companies

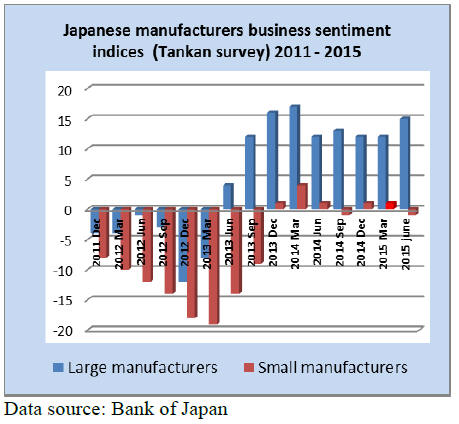

The latest Bank of Japan (BoJ) survey of business

sentiment (June Tankan survey) has shown that for the

first time in three months sentiment amongst Japan‘s large

manufacturers improved.

The Tankan survey seeks opinions on investment plans

and business conditions from around 10,000 large

medium and small companies and generates an index

useful in gauging the likely direction of production and

exports in the short-term.

The latest quarterly Tankan for the second quarter shows

that the index for large manufacturers rose to 15 from 12

in March, well above expectations. However the index for

small companies remained firmly negative.

In terms of trends, analysts remind that investment plans

tend to expand in the second quarter as companies always

appear more optimistic after the traditional slow start to

the year.

For details see: http://www.statsearch.

boj.or.jp/index_en.html#

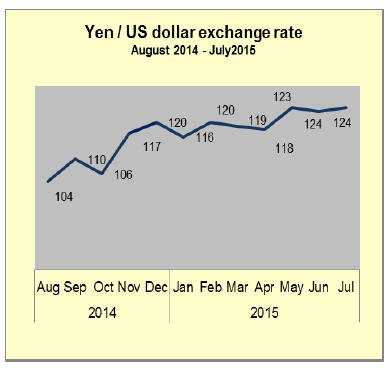

For large companies the yen exchange rate will be

watched very carefully. A yen dollar exchange rate over

115 is seen as good news for exporters. A weak yen boosts

overseas earnings and lifts profits when foreign currency

earnings are repatriated to Japan. The downside is that a

weak yen increases the cost of imports and it is this that

impacts small companies the most.

BoJ Governor says no more monetary easing

Bank of Japan (BoJ) Governor, Haruhiko Kuroda, has said

the Bank still expects to meet its inflation target by the

first half of 2016 but many economists consider this too

optimistic given falling commodity prices, a weakening of

import growth in China and worries over growth prospects

in Europe.

At a news conference the BoJ chief confirmed his view

that he did not see any need to expand the scope of

quantitative easing but was ready to do so if required.

Kuroda‘s comments and data showing demand for labour

is currently the strongest for more than 20 years gave a

boost to the yen but this was not sustained and the dollar

yen exchange rate settled back to 124 in July.

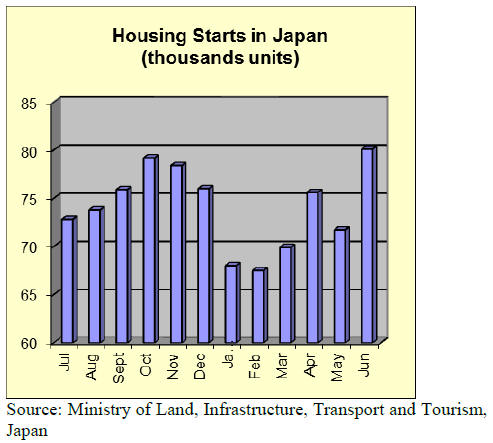

Double digit growth in June housing starts

The 12% month on month and 6% year on year rise in

June housing starts were much higher than forecast and

according to data from the Ministry of Land,

Infrastructure, Transport and Tourism, orders placed with

large construction companies grew by over 15% in June.

However, first half 2015 starts, at 434,000 units, are well

below the 508,000 units reported in the first half of last

year.

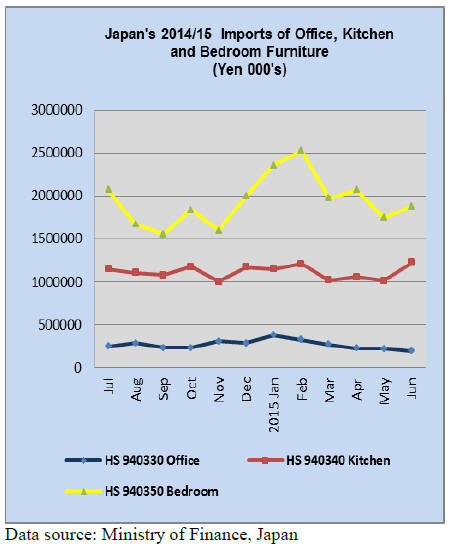

Japan‟s furniture imports

Japan‘s imports of kitchen and bedroom furniture are

showing signs of recovering but imports of office furniture

continue to slide. Compared to levels in May, Japan‘s

imports of kitchen and bedroom furniture rose in June but

imports of office furniture fell.

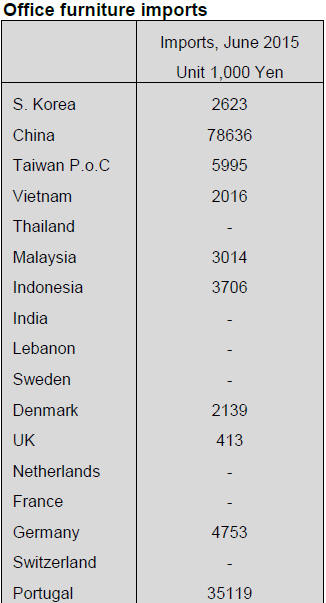

Office furniture imports (HS 940330)

June imports of office furniture were down 13% on May

figures with suppliers in China, Portugal and Poland, the

top three suppliers, registering declines (-8%, -18% and -

26% respectively).

The top three supply countries account for 74% of Japan‘s

total office furniture imports. Suppliers in Asia; Malaysia,

Vietnam, Indonesia, South Korea and Taiwan P.o.C

accounted for just 9% on June office furniture imports by

Japan. Imports of office furniture in the first six months of

2015 were down 9% on the same period in 2014.

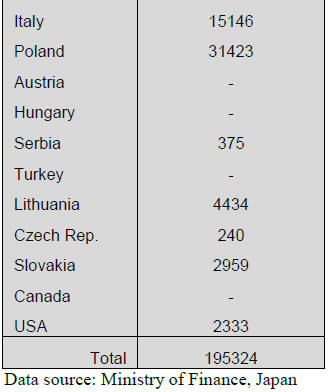

Kitchen furniture imports (HS 940340)

June imports of kitchen furniture were 21% higher than in

May but year-on-year first half imports fell marginally (-

1.5%).

Three suppliers dominate Japan‘s imports of kitchen

furniture; Vietnam is the number one supplier followed by

Philippines and China. Shipments from Indonesia in May

were almost equal to those from China.

The top three suppliers accounted for 78% of total June

imports of kitchen furniture and, if shipments from

Indonesia are included then the total comes close to 90%.

The only significant non-Asian supplier in June was

Germany which captured 2.5% of the June import.

Bedroom furniture imports (HS 940350)

Japan‘s bedroom furniture imports are more than the

combined total of office and kitchen furniture imports.

The 8% rise in June imports of bedroom furniture reversed

the sharp decline seen in May but first half 2015 imports

are running at around the same level as recorded in the

first half of 2014.

In the second half of 2014 bedroom furniture imports

skyrocketed and it will be interesting to see if this pattern

is repeated this year.

Two countries dominate Japan‘s imports of bedroom

furniture, China (58%) and Vietnam (27%). The third and

fourth ranked suppliers, Thailand and Poland, could only

muster another 7-8% of total imports. In June both

Thailand and Poland saw their share of imports more than

double as did suppliers in the US.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

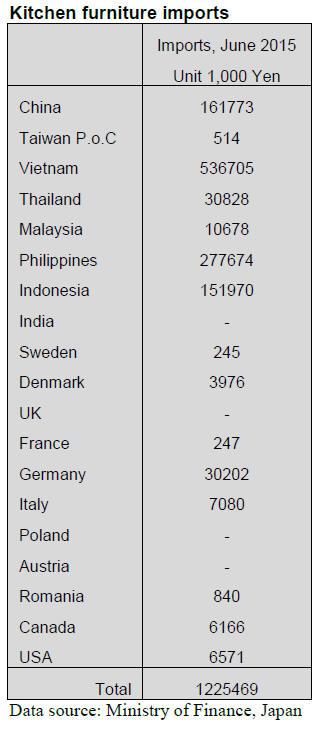

Shift to softwood plywood for floor base

It is now apparent that log supply shortage in Malaysia is

chronic and supply of hardwood plywood for floor base

continues tight and the prices keep climbing. Japanese

buyers are placing more orders of floor base plywood to

Indonesian suppliers and increasing orders results in

higher export prices.

Therefore, it is urgent issue for the Japanese flooring

manufacturers to replace tropical hardwood plywood to

domestic softwood plywood to solve supply instability and

spiraling high prices of imported plywood now.

Indonesian floor base prices were about $700 per cbm

C&F on meranti overlay better up until October 2014 then

sudden depreciation of the yen by about 15% pushed

arrived yen cost higher for floor manufacturers. At the

same time, new housing starts slowed down so floor

manufacturers reduced orders to Indonesia so the

Indonesian export prices kept dropping.

Prices of floor base produced in Sarawak, Malaysia were

much lower than Indonesian floor base so the Japanese

buyers had been buying Malaysian products first.

Quality of Indonesian floor base is higher than Malaysian

products. Actually utility better A grade of Indonesian

product is the same as Sarawak products or better but the

prices are high. Meantime, Japanese floor manufacturers

need low cost product.

Cost of Indonesian floor base is about 1,700-1,800 yen per

sheet delivered with exchange rate of 120-125 yen while

domestic softwood floor base is way lower in prices so the

floor manufacturers hurriedly test and inspect quality of

domestic softwood plywood to see if replacement is

possible.

However, there is uneasiness of quality of softwood

plywood in terms of workability and aging quality

deterioration over 10 years.

In particular, problem may arise when it is used for floor

heating. It is hard to guarantee the same quality as

hardwood plywood so at some point, users need to realize

difference before softwood plywood is widely accepted

and used.

Japan‟s log exports increase

Total volume of log export during January and May this

year reached to 259,515 cbms, 47.5% more than the same

period of last year. If this pace continues, total export for

the year would be about 700-800 M cbms. However, log

export for April and May from Kyushu, which took 80%

share last year, slowed down.

There are active inquiries from China with price advantage

by weak yen but ships‘ space is short so that logs are piled

up at loading ports. Shipments for Korea has been slowing

down by economic slump in Korea and there is surplus of

supply as log length for Korea is 2.4 meters, which is not

common length in Japan.

According to Kagoshima customs house, which covers

shipping ports like Shibushi and Sendai in Kagoshima,

log export in last January doubled, 34.2% more in

February, 71.9% more in March, 36.2% down in April and

14% more in May.

Total value of log export in the first five months were

1,068. 56 million yen (estimated volume of about 90,000

cbms), 23.7% more than the same period of last year but it

slowed down in April and May. Another port of

Yatsushiro, Kumamoto prefecture in Kyushu doubled the

volume for the first five months of this year.

In Kyushu, domestic log demand for lumber and plywood

since start of the year has been sluggish and cedar logs

with sweep are rushed for export and the prices are soft

but with steady inquiries from overseas buyers, cedar log

prices for export maintain 8,000 yen per cbm delivered

port yard.

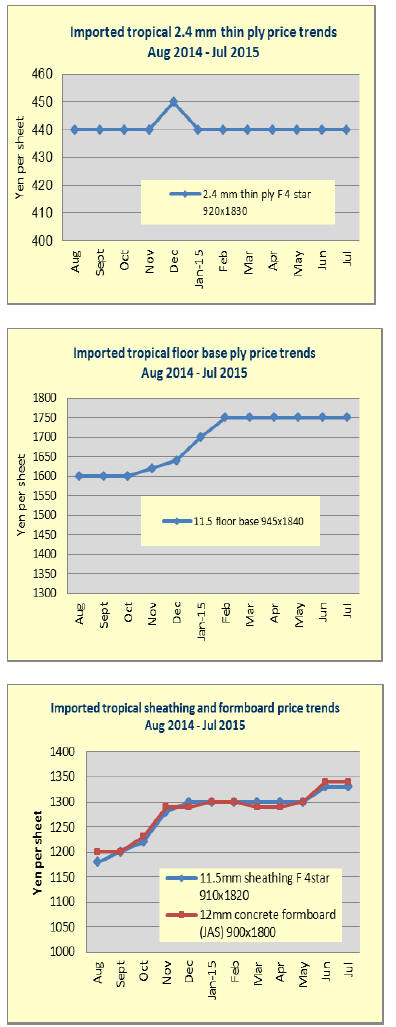

Plywood

Tide of domestic softwood plywood market changed after

the manufacturers announced 20-30% production

curtailment in middle of June. At the same time, they

refused to accept low bid from the buyers.

There was downward pressure to 650 yen per sheet

delivered in the market, which is loss prices for the

manufacturers. Since July the prices the manufacturers

propose are 700 yen per sheet and they have ample orders

with this price and next target is 50 yen by late July. By

production cutback, deliveries are uncertain in July.

In Western Japan, commodity item of 12 mm 3x6 panel

supply is tight since the manufacturers have many special

items orders by direct deliveries to precutting plants and

house builders.

Imported South Sea hardwood plywood market continues

firm because of limited supply with high export prices

although the demand in Japan lacks strength. Malaysian

plywood suppliers continue being bullish because log

supply is limited.

High export prices and weaker yen make arrived yen cost

higher so the cost of the importers continues climbing and

they have to insist on higher prices so the market prices

have been inching up. Distributors are aware that they

would lose money if they accept higher importers‘ offers

so they manage to buy low priced offers the importers

releasing at the end of the month for inventory adjustment.

Distributors sales prices have been gradually edging up

but purchase prices are also go up so that there is no profit.

May arrivals were extremely low at 216,300 cbms and low

level arrivals are expected to continue.

Noda started shipping its own softwood plywood

Noda Corporation (Tokyo) started manufacturing

softwood plywood with local species like cedar and

cypress at newly built plywood plant in Fuji, Shizuoka

prefecture. In May it started running and recent

production reached 40% of capacity of 6,000 cbms.

Structural panels to be shipped will be 12,24,28 mm thick

3x6 with cedar and cypress veneer and for 12 mm panel,

all cedar is made. In June, for the customer, which

requests certificate of origin of local logs, thick panels of

24 and 28 mm were shipped.

Originally, the products are intended to be consumed inhouse

assembling so Noda is careful in marketing

structural panels. It appeals end users of cypress panel as

high value of unique cypress nature. Noda uses cypress

panel for its own housing and it offers roof, sheathing and

floor panel with stable prices and some users request

cypress panel only. Shipment of unique product of

composite floor base will start in late this month.

Presently, cypress logs are sent to its subsidiary company

of Ishinomaki Plywood in Miyagi prefecture to make

plywood then Fuji plant does secondary processing. The

product of combination of plywood and MDF with

popular decorative veneer of natural wood on surface has

been sold steadily since imported hardwood floor base is

tight in supply and high cost with weak yen.

Shipment of concrete forming panel is scheduled to start

after September. In late May, paint coating line at Fuji

plant is renovated so that it is ready to make coated

concrete forming panel.

Daiken to build door plant in Indonesia

Daiken Corporation (Osaka) announced that it would build

a new plant to manufacturer door in suburb of Jakarta,

Indonesia. Total investment will be about one billion yen.

It will finalize the plan of production and marketing as

soon as Indonesian Investment Agency approves the plan.

Daiken hopes to start up building within this year.

Daiken has made up long term business plan named

‗GP26‘ to give vision of corporation after ten years and

target of sales in 2026 would be 250 billion yen. This

intends to become international corporation from domestic

corporation and this is one of this growth plans.

Daiken opened up Jakarta office in October of 2012 to

conduct market research of fast growing Indonesian

building materials market. In January 2014, it established

a company‗Pt. Suseta Daiken Indonesia‘ to conduct

interior furnishing works and marketing of the materials

jointly with local company, Pt. Sumber Setia Abadi, which

has been importing and marketing building materials in

Indonesia.

In the past, Daiken has been marketing imported materials

but now with its own manufacturing plant in Indonesia, it

will market locally produced materials.

Wooden model house in Dalien, China

The Japan Wood Products Export Promotion Council

announced to build a post and beam wooden model house

in Dalien, China, which will start up in late July. The

council has been campaigning Japanese wooden house in

China, which builds more than ten million units of house

annually.

It tries to give correct understanding of Japanese wooden

materials, housing equipment and techniques in China. It

decided to put up a model unit as a subsidiary business of

the Ministry of Agriculture, Fisheries and Forestry after

Japanese species of cedar, cypress and larch are approved

in the Chinese standard of wooden structure design.

The house will be used and managed as a permanent

exhibit by voluntary companies, which have been

developing business in China. Design and construction

works of the unit have been discussed by experts and

experienced people by both China and Japan.

|