|

Report from

North America

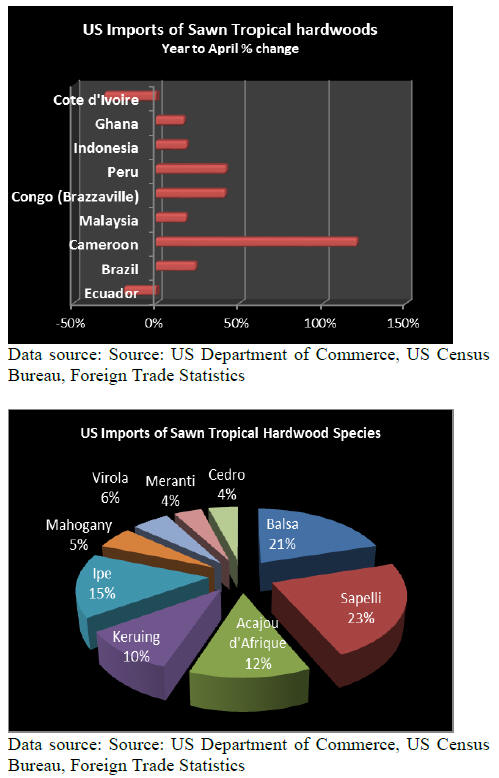

Sapeli, ipe, keruing and mahogany imports up

Imports of sapelli, ipe, keruing and mahogany grew in

April compared to March imports. Keruing imports were

over 2,000 cu.m. with year-to-date imports 17% higher

than in April 2014. The US imported 4,863 cu.m. of

sapelli, up 10% from March and a 49% increase year-todate.

Mahogany imports were up in April at 1,246 cu.m., but

year-to-date imports were 8% lower than at the same time

in 2014.

US imports of temperate sawn hardwood increased in

April, while tropical sawnwood imports were unchanged

from the previous month.

Temperate imports almost doubled to 95,553 cu.m. in

April compared to 21,594 cu.m. of tropical imports.

Imports of most tropical species actually grew in April,

but a decline in balsa sawnwood imports resulted in

overall unchanged import volumes.

Year-to-date tropical imports were 20% higher than in

April 2014.

Imports from Cameroon and Malaysia increased

significantly in April due to the higher sapelli and keruing

imports, respectively. Sapelli sawnwood imports from

Cameroon reached 3,635 cu.m. in April, while sapelli

imports from Congo (Brazzaville) fell by half to 946 cu.m.

Ipe sawnwood imports from Brazil were up at 2,721 cu.m.

in April, but Brazilian shipments of other species (jatoba,

virola and other species) declined from the previous

month.

Higher Canadian sawnwood imports from Indonesia

March imports of tropical sawn hardwood were revised

upward, but in April Canadian imports declined further

(-9%) to US$1.44 million. Year-to-date tropical

sawnwood imports were 27% down from April last year.

Sapelli remained the main species imported, but imports

fell one third to US$360,934 in April. March to

US$567,568.

Combined imports of virola, imbuia and balsa fell monthon-

month (-40%) and year-to-date (-17%). While not

reported separately, country-level data shows the decline

was mainly in balsa imports from Ecuador, which fell by

almost half from March.

Year-to-date Ecuador and Cameroon remain the largest

sources of tropical hardwood imports, followed by Congo

(Brazzaville) and Indonesia. Indonesian shipments to

Canada increased 27% month-over-month in April and

year-to-date shipments are 8% higher than at the same

time last year.

IWPA develops training for Lacey Act compliance

The International Wood Products Association, which

represents US importers of wood products, is developing a

training programme to help companies comply with the

Lacey Act.

The US Lacey Act bans trade in endangered or illegally

harvested species, including wood. The goal of the

training program is to provide buyers and sellers of wood

products with the latest information about resources and

procedures how to comply with the legislation.

It has sometimes been difficult for companies to comply

with the Lacey Act since it was introduced for forest

products in 2008. Even a large retailer like Lumber

Liquidators is being investigated for trade in illegal wood

products.

The association¡¯s first training session for Lacey Act

compliance will take place this October.

Softwood producers target Indian market

The fast-growing Indian market has caught the attention of

softwood producers in North America and Europe.

Tropical hardwoods are generally preferred in India, but

with tropical supplies tight, especially of teak logs, Indian

manufacturers increasingly use temperate hardwoods and

even softwoods.

More than half of the wood consumption is in doors,

windows, furniture and millwork, where manufacturers

have started to substitute hardwoods with softwood

species. New Zealand has exported pine logs to India for

many years now, but a more recent trend is the import of

higher-value sawn softwood.

The US exports southern yellow pine to India, while

Germany ships pine and spruce sawnwood. Canada aims

to grow its sales of Douglas-fir, western red cedar and

hemlock to compete with tropical species in appearance

applications.

|