Japan Wood Products

Prices

Dollar Exchange Rates of

10th July 2015

Japan Yen 122.78

Reports From Japan

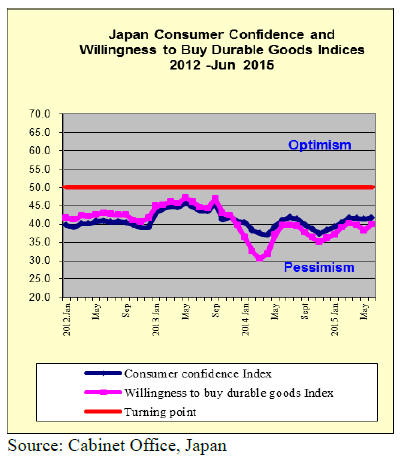

Consumer confidence rebounds

Results of the June consumer confidence survey were

released by the Cabinet Office on 10 July. Consumer

sentiment improved in June after the decline reported for

May.

The overall consumer confidence index rose to 41.7 in

June and sentiment in all sub-sectors in the survey were

positive. The June survey reveals that most respondents

expect prices to go up in the next twelve months which

will hearten the Bank of Japan which has set an ambitious

inflation target.

For the full details see:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

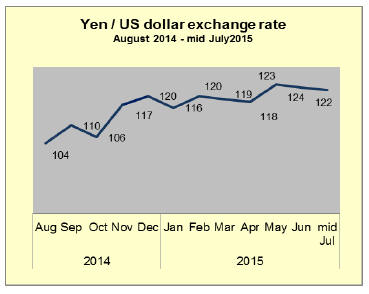

Caution on US interest rate rise pushes up yen

The yen rose against the US dollar mid-month after the US

Federal Reserve signaled its caution on raising interest

rates in the short term.

The US Federal reserve expressed concern about the pace

of growth in major economies, specifically in China, as

well as its concern on the Greek debt crisis. At one point

in early July the yen rose to 120 to the US dollar the

strongest for almost three months.

Manufacturers continue to increase capital spending

While the total value of May machinery orders by

Japanese manufacturers fell from the previous month,

core machinery orders unexpectedly rose marking three

monthly increases. The rise in core orders, a data series

regarded as an indicator of capital spending, beat

expectations.

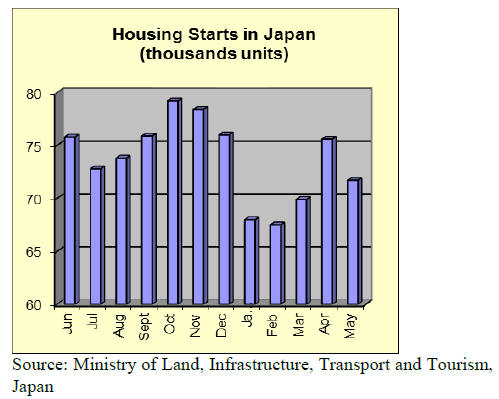

May housing starts rise year-on-year but prospects

uncertain as orders fall

Housing start data for May released by the Ministry of

Land, Infrastructure, Transport and Tourism showed an

increase in May 2015 compared to May 2014 marking the

third consecutive year-on-year rise.

May 2015 housing starts grew by around 6% year-on-year

improving on the pace of improvement in April. However,

compared to levels in April this year, starts were down

about 5%.

Construction companies report orders received for the

ministry’s survey and have indicated orders fell just over

7% in May following the 12% fall in orders in April.

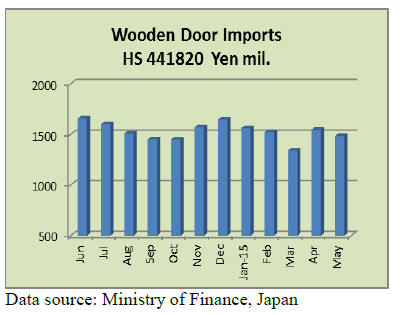

Import round up

Doors

Japan’s May imports of wooden doors fell 4% from the

previous month and were down around 5% year on year in

May. Average imports in the first five months of 2015

were down 17% compared to the first five months of 2014.

China, Philippines and the USA continue to be the main

suppliers accounting for more than 80% of total wooden

door imports.

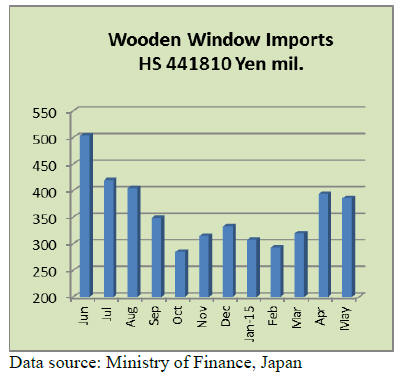

Windows

Wooden window imports by Japan in May 2015 were

down sharply year on year (-21%) and compared to the

previous month, May imports were down 4%. The modest

month on month fall disguises the massive 29% drop in

average monthly imports in the first five months of 2015

compared to the same period in 2014.

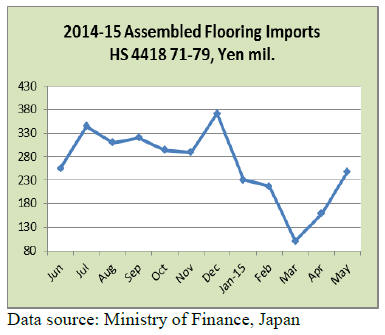

Assembled flooring

Imports of assembled flooring have increased for three

consecutive months and May imports were a massive 56%

above those a month earlier. However, May 2015 imports

were down 10 from the same month in 2014.

In spite of the impressive upward trend in imports of

assembled flooring in 2015, especially over the past two

months, average imports for the first five months of 2015

were down 25% on the same period in 2014.

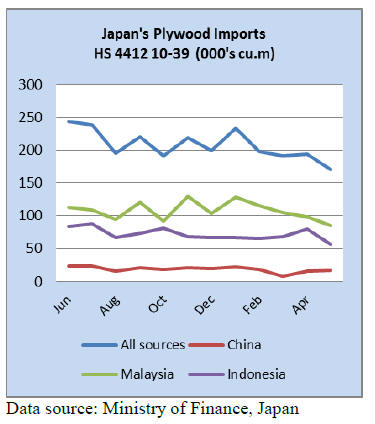

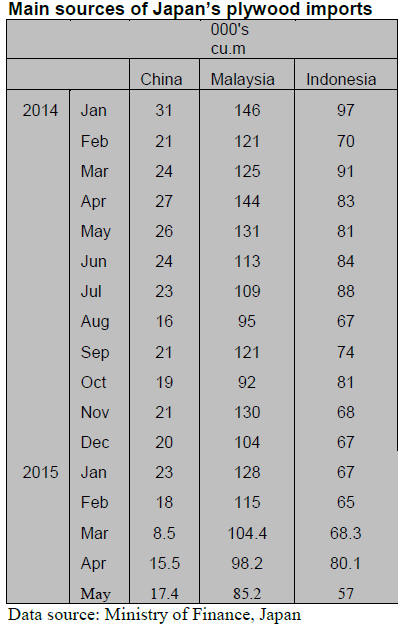

Plywood

All three major suppliers of plywood to Japan saw a

decline in business in May. Total plywood imports in May

fell 32% year on year and compared to the previous month

May imports were down12%. The big loser was China

were year on year imports in May were down around 35%.

Both Malaysia and Indonesia also saw business with Japan

slide as plywood imports by Japan from each country fell

20% in May 2015. First five month average imports in

2015 were 25% less than in the first five months of 2014.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

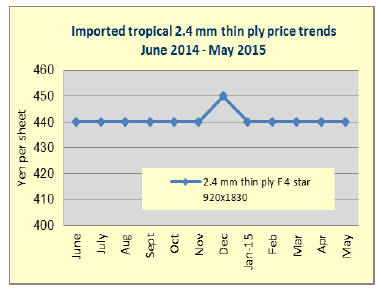

Progressive depreciation of the yen

Spiraling cost by thirteen years’ low of the yen. With

outlook of early increase of interest rate of the U.S. dollar

by improvement of employment statistics, U.S. dollar has

been strengthening to all the other currencies and the yen

dropped down to close to 126 yen to the dollar, which is

the lowest since June 2002.

The yen shot up to less than 80 yen to the dollar in fall of

2012. After having marked record high, the yen has been

falling to the U.S. dollar and Euro for last two years.

Although there was momentary demand pick-up before the

consumption tax increase since April 2014, cost of

imported building materials has been climbing and transfer

to the sales prices faces tough going by weak demand.

Particularly since middle of last year, the reactionary drop

of the demand was conspicuous so the importers and

wholesalers suffer chronic loss.

Higher cost of imported materials continues but price

increase related to the cost is difficult in demand

depressed market. It is uncertain if depreciation of the yen

would tighten the market or reduce suppliers’ export

prices to ease higher yen cost. This would influence future

supply of imported materials in slump market.

JLIA’s to maintain focus on securing verified legal

wood products

The Japan Lumber Importers Association held the general

meeting and elected Mr. Satoru Yasuda for the new

chairman of the Association.

The new chairman commented that the Association would

make every effort to have balanced steady supply of

imported wood materials by having friendly relationship

with overseas related groups with close communications to

have smooth trade. Also it is now important to pay

attention to domestic wood supply.

Mr. Yasuda is currently managing director of Sojitz

Building Materials Corporation. Mr. Yasuda is 57 years

old, who was working for former Nissho-Iwai

Corporation. Focus of this term is to maintain

authorization system of legal wood use and continue

asking overseas wood products suppliers to supply legally

certified products and the Association will lead market to

use legally certified wood products.

In fiscal year of 2014, a percentage of imported legally

certified sustained yield wood by the members of the

Association was 69.9%, 2.7 points up from the previous

year, out of which 26.2% was sold as certified wood, 4.5

points up.

As to communication with overseas groups, the

Association joins the Canada Wood seminar in June held

by COFI as joint planner. Then in September, it will hold

plywood conference in Tokyo by three countries, Japan,

Malaysia and Indonesia. It will continue information

exchange with Russian and European related groups.

The Association made outlook of imported wood products

in 2015. It shows decrease of import on both logs and

lumber. Log import will decline by 9.5% and lumber by

6.9%. Russian log volume will be less than 200 M cbms

while North American lumber will increase by 2%.

European lumber import will drop by nearly 20% due

toimport adjustment in the first half of the year.

Seihoku group stops plywood production

Softwood plywood market has been in slump with weak

demand then the supply has been more than the shipment

so that the inventories have been swelling. In this supply

glut, the market continues weakening so the major

manufacturer, Seihoku group, which has more than 50%

share in softwood plywood market, announced to reduce

the production to restore the market.

April softwood plywood inventories were 256 M cbms,

2.3 times more than April of last year and the market

prices of 12 mm 3x6 panel prices are down to 700 yen per

sheet delivered or less from 850 yen in early January and

the prices have not bottomed out in June yet.

The Seihoku group now decided to reduce the production

by 30% and shift the product from structural panel to nonstructural

panel like concrete forming panel. Concretely, it

will reduce production of structural panel by 30% so that

by the time fall demand shows up after three months, the

supply should balance out and the price should recover.

The president Inoue says that unless plywood market is

stabilized, stable supply of local logs with certain level of

prices would become difficult, which hampers

revitalization of forest resources. Another measure is to

change product mix from heavy percentage of structural

panel to non-structural panel.

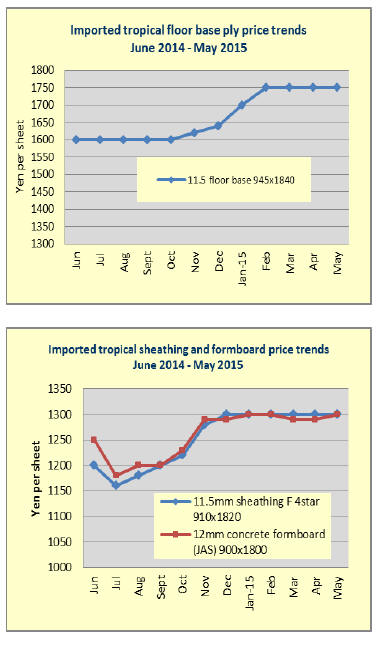

In the past, concrete forming panel and floor base panel

have been mainly South Sea imported hardwood plywood,

which would be about 100,000 cbms a month. This is

equivalent to five million sheets of 3x6 12 mm panel. If

softwood panels can replace this market, this would

become a great help for softwood plywood. It needs

technical improvement but it is necessary to solve the

problems to change product mix.

Daiwa House starts housing in Malaysia

Daiwa House Industry Co., Ltd (Osaka) concluded an

agreement to develop and market prefabricated detached

units with the largest developer in Malaysia, Sunway SDN

BHD on June 11 and established a joint venture company,

Daiwa Sunway Development SDN BHD, (DSD).

Malaysia.

DSD will start building 100 detached houses in 5.3

hectare’s property of Sunway Iskandar project since

summer of 2015. Daiwa House has built seven Japanese

plants in Malaysia since 1964 then opened Kuala Lumpur

representative office in 2012 and has studied industrialised

housing to match tropical rain forest climate of Malaysia.

In 2013, it put up Malaysian type experimental light steel

prefabricated unit in Sunway Eastwood property for sale

in lots, which is in Selangor province near Kuala Lumpur.

This completed in March 2014.

‘South Sea’ (tropical) logs

Weather in Sarawak has been good since rainy season was

over but because of tight control of illegal harvesting log

production has been low.

Log export prices have stayed up high. Meranti regular

prices are firm at US$290-295 per cbm FOB. Small

meranti prices are US$260-265 and meranti low grade for

India are up at US$270-280.

Keruing regular are US$420-430 and kapur regular are

US$410-420. They are up by US$10 from May. With slow

production, quality logs are scarce but the prices keep

climbing on all the grades.

Unlike Chinese buyers, who buy any kind of species for

the volume, Indian buyers are choosy and select hardwood

like kapur and keruing but it becomes hard to have enough

volume of these species in Sarawak and Sabah so they are

sending more ships to PNG and Solomon Islands.

China has been slowing their purchase then India is filling

a gap but log production in PNG is dropping. In Solomon

Island, for last two weeks, heavy rain hinders log

production.

Domestic logs and lumber

In general, by increasing log production and weak lumber

market, log prices are falling across the board

all over Japan. In some areas, with strong demand of low

grade logs for biomass generation, log prices were high

but now the supply is fully satisfied and the prices are

softening.

Asahi Woodtec changes base raw material mix

Asahi Woodtec Corporation (Osaka), building materials

manufacturer, announced change of base materials mix of

floor board.

In the past, a percentage of imported materials such as

plywood and domestic materials such as particleboard was

nine to one. It will change it to three to one so domestic

share is 2.5 times more to stabilize cost of base materials

of flooring.

The company manufactures and markets floor products of

about 792,000 square meters a month. Floor base materials

have been 75% of South Sea hardwood plywood like

meranti, 15% of plantation wood like falcate and 10% of

domestic products like particleboard.

Looking at recent trend of South Sea hardwood plywood,

decline of supply of virgin timber, tight control of illegal

harvest and chronic high export price of plywood

continues so future outlook is very severe for stable supply

and price then came recent weakening of the yen, which

pushes cost of imported materials so fundamental issue is

to shift from imported tropical hardwood products to

others since passing higher cost to the floor customers is

difficult.

Now it decided to change mix of base materials to 50%

meranti plywood, 25% of plantation wood plywood,

making total percentage of 75% of plywood then 25% of

domestic products like particleboard.

|