|

Report from

North America

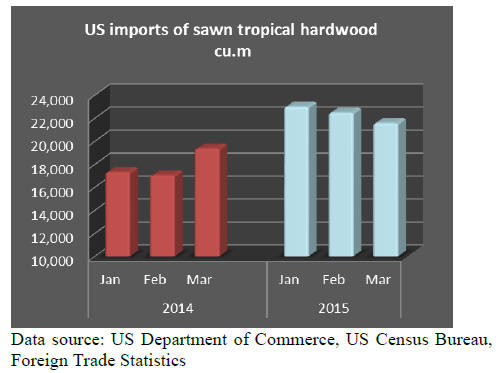

N. American markets head in different directions

The trend in tropical sawnwood imports into the US and

Canada during the first quarter of 2015 are a reflection of

the direction of the economies in each country. US

imports of sawn tropical hardwoods increase by around

25% in the first quarter while Canadian imports of the

same product fell by the same amount.

US imports jump reflecting west coast port agreement

US March imports of tropical sawnwood fell by 4%

month-on-month but this downturn was not confined to

tropical timber as temperate sawn hardwood imports fell

even more sharply. Just over 21,000 cu.m. of tropical

sawnwood were imported in March, accounting for 31%

of total sawn hardwood imports Processed wood product

imports on the other hand increased significantly in

March.

The rise in March imports of furniture, flooring, plywood

and other added value products was, say analysts, most

likely linked to the resolution of the West Coast port

stoppages.

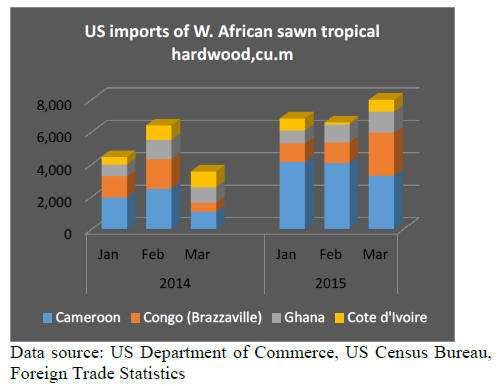

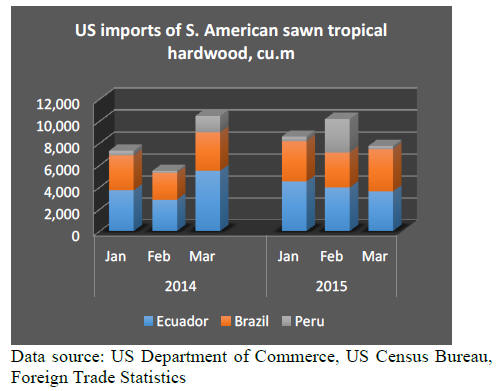

Despite the overall lower imports in March, almost all

major suppliers have shipped significantly more this year

than in 2014. The largest increase compared to the same

time last year was in imports from Cameroon (+108%) and

Peru (+78%).

Sapelli imports from Cameroon declined to 2,160 cu.m. in

March while imports of the same species from Congo

Brazzaville doubled to 2,059 cu.m. Imports of acajou

d‟Afrique (2,730 cu.m.) had the highest month-on-month

increase followed by mahogany (1,119 cu.m.) and cedro

(1,167 cu.m.).

Brazil‟s shipments of sawnwood to the US grew 20%

month-on-month in March. While ipe sawnwood imports

from Brazil were almost unchanged from at the previous

month (2,307 cu.m.), imports of virola and other species

increased.

US imports of Malaysia‟s keruing sawnwood in March fell

to just 808 cu.m. and it was this which contributed to the

over 40% drop in US imports from Malaysia from the

previous month. However, March sawnwood imports from

Indonesia and Ghana increased month-on-month, which in

the case of Ghana was largely due to higher acajou

d‟Afrique imports (871 cu.m.).

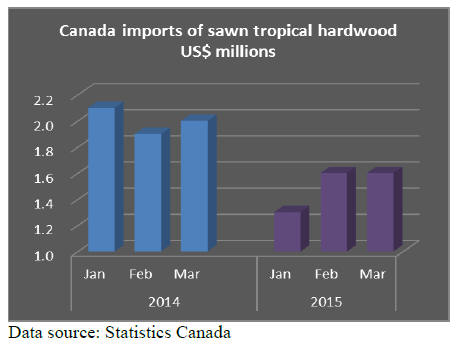

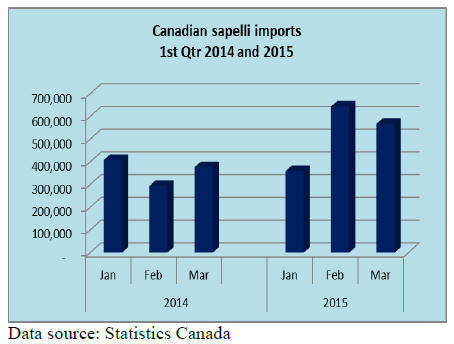

Canadian imports of sapelli and balsa grow despite

overall decline

Canadian imports of tropical sawn hardwood declined

from the previous month to US$1.59 million in March and

first quarter imports are down 24%. However, Canadian

Sapelli imports have held up well despite the dip in march.

First quarter imports of sapelli were significantly higher

than in March 2014 (+46%).

Canadian the combined imports of virola, imbuia and

balsa almost doubled from the previous month to

US$444,154 in March. The increase was mainly in balsa

imports from Ecuador but, first quarter imports from

Ecuador are down 11%.

The growth in Canadian tropical sawnwood imports in the

first quarter of this year has been from Congo Brazzaville

(especially sapelli), Malaysia and Indonesia.

The weaker tropical sawnwood imports reflect the slowing

of the Canada‟s economy which shrank 0.6% in the first

quarter of 2015, the first decline in GDP in four years.

Income from mining, oil and gas extraction fell 30% in the

first quarter and this has had a marked impact on

businesses.

The problem of weaker earnings from the oil sector spilled

over to other parts of the economy, including construction.

At the same time manufacturing output and exports have

fallen despite a weaker Canadian dollar. But the forestry

sector was among the few domestic industries that

expanded in the first quarter.

Lacey Act enforcement threatens Lumber Liquidators

The US Department of Justice is seeking criminal charges

again retailer Lumber Liquidators saying Lumber

Liquidators‟ imported flooring, which the Justice

Department alleges contains illegally sourced wood.

Unlike previous high-profile Lacey Act investigations that

focused on tropical and usually threatened wood species,

this case is about common temperate hardwood species

from Russia.

Lumber Liquidators is already the target of many classaction

lawsuits over elevated formaldehyde emissions

from laminate flooring sourced from China. The company

recently announced that it suspended the sourcing of

laminate flooring from China and sells European and

North American products instead. Lumber Liquidators

estimates the loss from the Justice Department‟s action at

about US$10 million according to a company‟s release.

For some time the Environmental Investigation

Agency(EIA) has accused Lumber Liquidators of

importing flooring made from illegally sourced birch and

oak from Siberia used by a Chinese flooring manufacturer,

a supplier to Lumber Liquidators.

AHEC promoting thermally modified hardwoods in

Middle East

At the recent Dubai WoodShow the American Hardwood

Export Council (AHEC) promoted temperate hardwoods

that were thermally modified saying this treatment offers

better dimensional stability and decay resistance.

AHEC is targeting competition from tropical hardwoods

and has raised questions on the sustainability of the

sources for some tropical species and pushing the

sustainability and legality of American hardwoods.

The United Arab Emirates is the US‟ largest hardwood

export market in the Middle East. The Gulf state imported

US$13 million worth of sawn hardwood from the US in

2014, up from US$10 million in 2010. Other major

markets are Saudi Arabia and Jordan.

|