|

Report from

Europe

Emerging signs of recovery in the EU joinery sector

The European construction and joinery sectors continue to

recover slowly. The rate of recovery in the UK, which was

rapid in 2014, weakened again in the first quarter of 2015.

However there is confidence that the UK market will pick

up again over the summer months.

The large German market remains stable with good

consumption. There is improving activity in the

Netherlands, Poland, Spain and Belgium. The Italian and

French construction markets are still weak and declining

but there are signs of improving economic conditions in

both countries.

Imports of finished joinery products from outside the EU

increased slightly in 2014, but the weak euro is acting as a

drag on imports in 2015.

Total GDP across the EU expanded by 0.4% in the first

quarter of 2015, the same rate of growth as in the previous

quarter. Growth in the UK and Germany slowed in the

first quarter of 2015. However growth in France, Italy and

Spain was stronger than anticipated.

Overall the data suggests that economic recovery is

becoming more resilient and widespread across Europe.

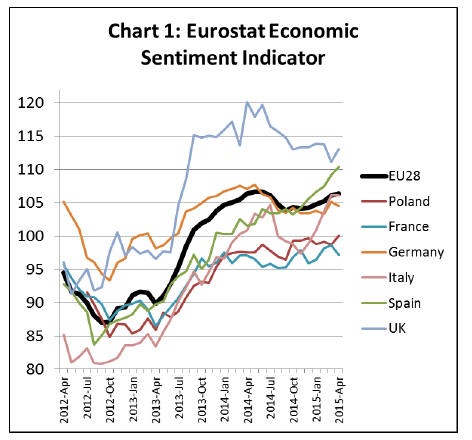

Economic Sentiment in the EU was falling in the second

half of 2014 but has been improving again in 2015.

Overall economic sentiment has improved significantly in

Spain and Italy this year, although this has yet to filter

through into a significant increase in construction activity.

(Chart 1).

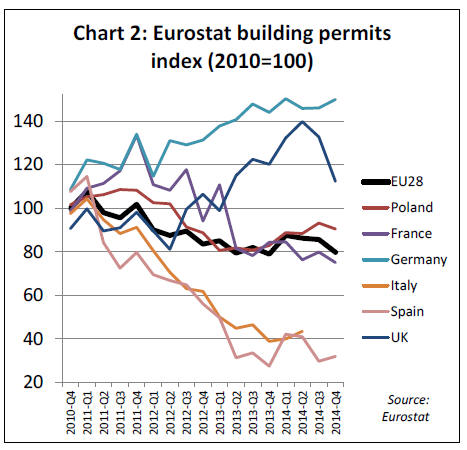

After a brief surge in the number of building permits

issued across the EU in the first quarter of 2014, these

declined again in the second half of the year. This was

mainly due to a sharp rise and fall in building permits

issued in the UK during 2014 (Chart 2).

EU construction forecast to remain flat in 2015

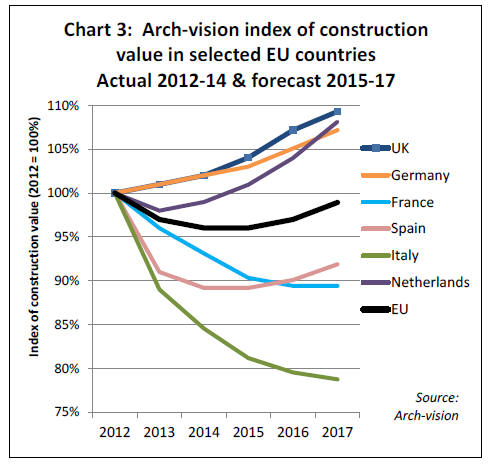

The independent research organisation ¡°Arch-vision¡±

estimates that total EU construction value may have

declined 1% from around €830 billion in 2013 to €820

billion in 2014.

Construction value is expected to remain level at around

€820 billion this year before rising 1% to €830 billion in

2016.

These forecasts draw on the latest European Architects

Barometer (EAB) survey of 1,600 architects undertaken

by Arch-Vision in eight European countries for the first

quarter of 2015 combined with analysis of other European

construction industry data (Chart 3).

More detailed consideration of construction sector activity

at the national level is provided below.

United Kingdom: the construction market continues to

improve in 2015 but at a slightly slower pace than in 2014.

According to Eurostat, construction confidence in the UK

fell in the first 3 months of the year, but increased sharply

in April.

Most construction companies expect continuing growth in

the market in 2015. Arch-Vision‟s survey in the first

quarter of 2015 indicates most architects have good order

books and expect rising turnover for the rest of the year.

Arch-vision‟s forecasts are more conservative than those

of the UK Construction Products Association which

forecasts that construction output may increase by as much

as 5.5% in 2015.

Germany: most construction market indicators remain

positive. Building permits are high and stable. Arch-

Vision‟s survey suggests that architect‟s order book and

turnover development were positive in the first quarter of

2015. The Eurostat construction confidence indicator is

higher than in most other EU countries.

However it is still negative ¨C indicating that German

construction companies remain cautious about the future.

Arch-Vision expects 1% growth in German construction

value in 2015 followed by 2% growth in 2016.

France: although the French economy improved

significantly in the first quarter of 2015, the construction

sector is not yet showing any improvement. Construction

confidence remains very low.

The Arch-vision survey indicates that French architects

order books continue to decline. Arch-Vision predicts that

French construction value will decrease 3% in 2015 and a

further 1% in 2016.

Spain: after several years of serious depression in the

Spanish construction sector, there was a significant rise in

both confidence and production last year. However this

trend has levelled off in 2015. Building permits also

remain at historically very low levels.

The results of the Arch-vision survey are equally mixed.

Spanish architects continued to report improving order

books in the first quarter of 2015. But they also reported

an increase in the number of cancelled or postponed

projects. Arch-Vision concludes that overall construction

value will remain flat at historically low levels in 2015,

before rising 1% in 2016 and 2% in 2017.

Italy: the construction sector is still in deep recession.

Construction production value remains static at only

around two thirds the level of 2010. Construction

confidence has improved a little in 2015 but remains deep

in negative territory.

The Arch-vision survey indicates that architects order

books and turnover development continued to decline in

the first quarter of 2015. Arch-Vision predicts that Italian

construction value will fall 4% in 2015 with further falls

of 2% in 2016 and 1% in 2017.

Netherlands: the construction market is showing signs of

significant improvement. The Arch-vision survey indicates

that architects order books and turnover were improving

throughout 2014. This positive trend strengthened in the

first quarter of 2015.

The Eurostat confidence indicator and the number of

building permits has increased sharply since the start of

2014. The construction production index has been rising

gradually over the same period. Arch-Vision forecasts

construction value will increase 2% in 2015, with growth

rising to 3% in 2016 and 4% in 2017.

European joinery product import trends

With the exception of flooring products, imports

contribute only a small proportion of total EU

consumption of joinery products. In terms of value, only

around 4.5% of doors and glulam, and around 0.5% of

wood windows installed in the EU are imported from

outside the region.

This is indicative of the very strong commercial benefits

from proximity to the consumer in the joinery sector and

the essential need for detailed knowledge of national

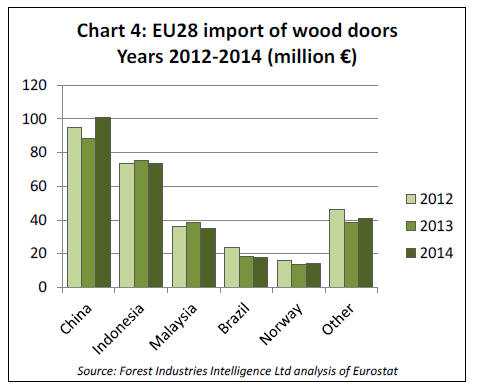

construction markets. The EU imported wooden doors

with total value of €285.3 million in 2014, 3.8% more than

the previous year. The value of wooden door imports from

China, the largest non-EU supplier, increased 13.7% to

€100.7 million in 2014.

However imports decreased from Indonesia and Malaysia

- the second and third largest non-EU suppliers. Imports

from Indonesia declined 2.6% to €73.4 million in 2014.

Imports from Malaysia declined 8.7% to €35.1 million

(Chart 4).

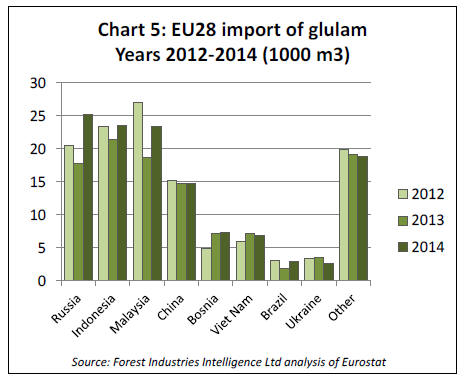

The EU imported 125,200 m3 of glulam in 2014, 12.1%

more than the previous year. Most glulam imported from

outside the EU consists of Laminated Veneer Lumber

(LVL) for window frames and other smaller dimension

products rather than larger structural beams.

During 2014 there was a significant increase in imports of

LVL from Russia, Indonesia and Malaysia, the three

largest external suppliers of this commodity to the EU.

Imports from Russia increased particularly strongly, by

41% to 25,100 m3, boosted by the weakness of rouble in

the second half of 2014.

Imports from China, the fourth largest external supplier,

were at a similar level to the previous year (Chart 5).

Competition from European LVL production is expected

to increase significantly in 2016 with development of new

domestic capacity.

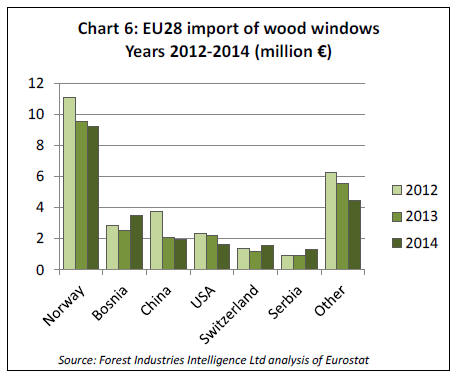

EU imports of wood windows were €24.8 million in 2014,

7.3% more than the previous year. Most of these imports

derive from other European countries, notably Norway,

Bosnia, Switzerland and Serbia. Imports from China, the

largest supplier outside Europe, were only €1.9 million in

2014, 5.3% less than the previous year (Chart 6).

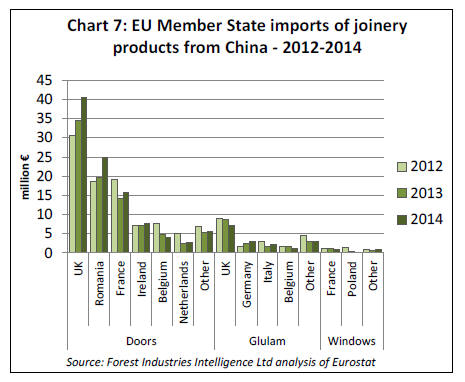

Chart 7 provides more detail of recent trends in EU

markets for joinery products imported from China.

Imports of wooden doors from China increased into the

UK, Romania, France and Ireland during 2014, but

declined into Belgium.

German and Italian imports of Chinese glulam increased

slightly in 2014, but this was offset by a decline in imports

into the UK. EU imports of wooden windows from China

were mainly destined for France in 2014. Exports to

Poland, previously a significant market, were negligible

last year (Chart 11).

Large increases in LVL capacity in Europe and Russia

The German trade journal EUWID reports that LVL

capacity in the EU is expected to rise from the current

level of 410,000 m3 to 590,000 m3 by the middle of next

year. Current capacity consists of a 230,000 m3 line

operated by Metsa in Finland and a 180,000 m3 line

operated by Pollmeier in Germany.

An additional 80,000 m3 of capacity is now being

installed by Steico in Poland and a further 100,000 m3 by

Stora Enso in Finland.

Meanwhile, MLT which operates in western Russia

currently has 120,000 m3 of installed LVL capacity. New

investment by MLT is expected to increase this capacity to

150,000 m3 by the middle of next year.

This production is believed to be based on softwoods, with

the exception of Pollmeier in Germany which utilises

beech.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|