US Dollar Exchange Rates of

10th May 2015

China Yuan 6.2073

Report from China

Third interest rate cut in five months

The People‟s Bank of China has announced that the

lending rate would be reduced by a quarter of a percent to

5.1 percent seen as a move to boost spending and lift the

economy. This is the third time in five months that the rate

has been cut.

Weaker than expected export figures, with April exports

dropping over 6% along with signs of weakness in other

areas of the Chinese economy are beginning to worry

policy makers.

A reduction in interest rates would normally drive up

business investment but the business community in China

has a watchful eye on developments in major export

markets and is unlikely to look for loans until the global

economy strengthens further.

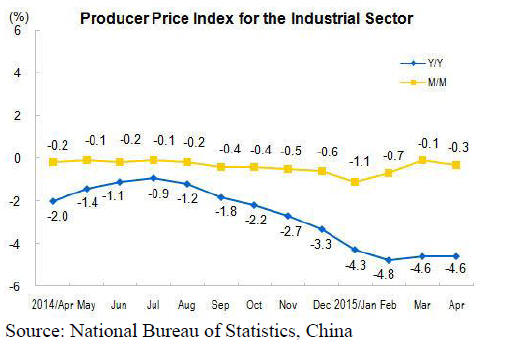

Weaker than expected industrial producer prices

The National Bureau of Statistics released the April

Producer Price Index (PPI) for manufactured goods in

early May showing a decline of 0.3% month-on-month

and a 4.6% drop year-on-year.

In the same month the purchasing price index for

manufactured goods fell 0.2% month-on-month and was

down 5.5% year-on-year.

At the same time consumer inflation increased at a much

slower rate than anticipated and the April figure marked

the 37th consecutive month of declining pace of growth.

¡¡

Importers reminded of suspension of imports from

Laos

On 6 April 2015, the CITES Secretariat received an

adequate national ivory action plan from the Democratic

Republic of the Congo. The plan has been made available

on the Secretariat‟s national ivory action plan web portal

at http://cites.org/eng/niaps.

CITES has now informed participating countries that its

recommendation to suspend commercial trade in CITESlisted

species with the Democratic Republic of the Congo

has been withdrawn.

China‟s National Endangered Species and Import

Management Office has reminded timber importers not

import CITES listed timbers from Laos as the directive

from CITES Standing Commission still applies to CITESlisted

species from the Lao People‟s Democratic Republic

due to the failure to submit a National Ivory Action Plan.

http://cites.org/sites/default/files/notif/E-Notif-2015-

021.pdf

The total output value of China¡¯s forestry industry in

2014

According to the State Forestry Administration, the value

of output from China‟s forestry sector in 2014 was

RMB5.26 trillion, up 11% over 2013.

The contribution from the secondary and tertiary sectors

was over 65%. The report notes that in 2014 100,000

different forest products were produced; there were more

than 1 million forestry enterprises and millions of forest

farmers. It was been reported that the annual average

growth in the value of output from the national forestry

sector was 22% since 2001.

Calls for the legalisation of the China-Myanmar timber

trade

A national workshop on the China-Myanmar timber trade

was held on 22 April in Kunming City, Yunnan Province.

The workshop was sponsored by the Southwest Forestry

University and the FLEGT foundation of the European

Forest Institute (EFI) and hosted by the Greater Mekong

Sub-Region Forestry Development Research Center of

Southeast Forestry University.

Participants shared the preliminary results of a China-

Myanmar timber trade study and discussed the challenges

and difficulties encountered by timber traders who aim to

see the legal and sustainable development of the China-

Myanmar timber trade. Experts called for immediate

action to bring the trade under the law.

The workshop heard that some timber from Myanmar is

processed in Yunnan while some is transported to

manufacturers in Southern and Eastern China who then

sell into the domestic market as well as export products to

Japan, the USA and Europe.

China is one of Myanmar‟s important markets for wood

products and China accounted for around 37% of

Myanmar‟s wood product exports in 2013 valued at

USD621 million.

But clouding the legitimate trade remain some

considerable challenges as illegal timber is also crossing

the Myanmar/China border.

Myanmar and China recently agreed to implement a series

of measures proposed by authorities in Yunnan Province

aimed at cooperative management of Myanmar‟s timber

and mineral trade. These measures require timber

importers to submit registration certificate and trade

contracts approved by the central government in

Myanmar. Controlling the Myanmar/China timber

presents huge challenges.

Investigation show that the redwood trade between

Myanmar and China slowed after June of 2014. However,

workshop participants heard that it was difficult to judge if

the slowdown was the result of the log export ban in

Myanmar or factors such as the rainy season, armed

conflict in Kachin or other factors.

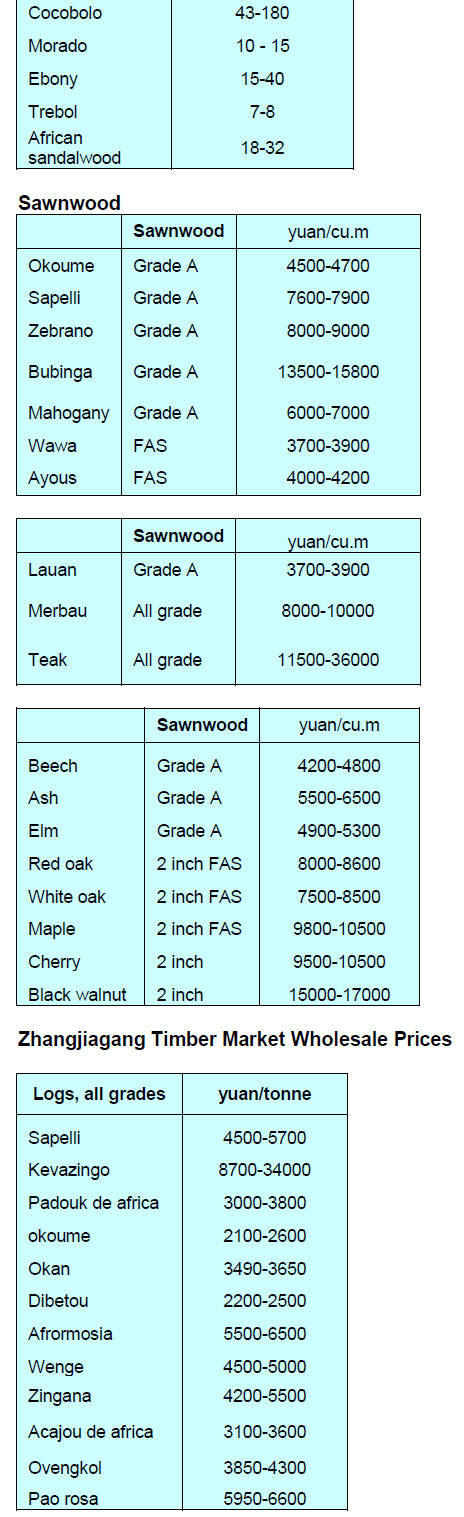

Lower imports from Guyana

According to the statistics from Zhangjiagang Entry-Exit

Quarantine and Inspection Bureau, deliveries of timber

from Guyana through Zhangjiagang port have fallen and

only 6,000 cubic metres was delivered in the first quarter.

The species from Guyana include purpleheart and koraro

and these timbers were transported to China in containers.

|