|

Report from

North America

Consumer spending forecast to increase 3.3% in 2015

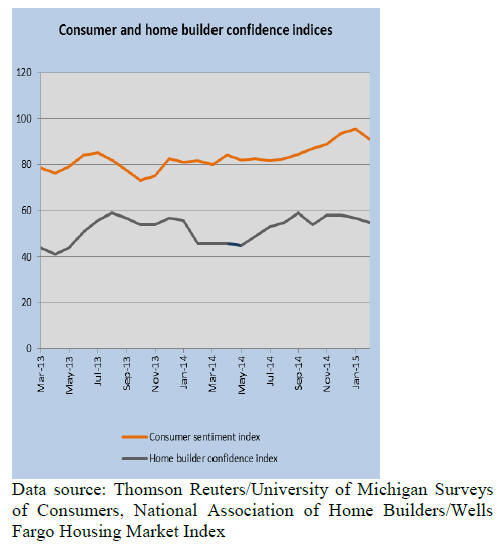

Confidence in the US economy declined among lower and

middle income households in March. The main concerns

were lower incomes and higher costs. High income

households reported higher confidence in the economy.

Overall confidence in the economy remains favourable.

Personal expenditures are still expected to grow by 3.3%

this year.

Winter weather affected builders¡¯ confidence

Builders‟ confidence in the market for newly built singlefamily

homes declined in February. The decline was

mainly due to unusually high snow levels in many parts of

the country, which limited construction activity.

Underlying demand for new housing remains strong,

according to the National Association of Home Builders.

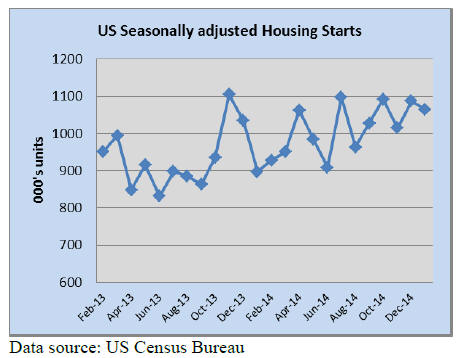

Housing starts down due to cold weather

Housing starts fell by 2% to a seasonally adjusted annual

rate of 1.065 million units in January, according to data

from the U.S. Commerce Department. The decline was

mainly due to a 22% decrease in construction in the

Midwest.

Single-family housing starts fell 6.7%, while multifamily

starts rose 7.5% in January.

Severe winter weather in the Midwest and other areas of

the country are mainly to blame for the slowdown in

construction.

The number of building permits was almost unchanged in

January at 1.053 million units. Permits for single-family

homes declined, while multi-family permits increased.

Existing-home sales declined in January to their lowest

rate in nine months, according to the National Association

of Realtors but home prices continued to rise above the

pace of inflation. Low housing supply and rising prices

contributed to lower sales.

Little change in non-residential construction

Investment in non-residential construction declined

slightly in January, according to US Census Bureau data.

Private investment decreased by 1.5% at a seasonally

adjusted annual rate, while public construction fell by

3.6%.

The American Institute of Architects reported improving

business conditions for companies in the institutional

market (education and health care buildings).

High Canadian household debt

Canadian housing starts grew 4.5% in January to 187,000

at a seasonally adjusted annual rate. The growth was in

multi-family construction, while single-family home starts

declined.

Concerns are growing about the Canadian housing market

and household debt. Canadian home prices are overvalued

by between 10% and 60%. Household debt levels reached

a new record in the 4th quarter of 2014. The ratio of

household debt to income was 163%, which poses a

financial risk if mortgage rates go up.

Economic activity in manufacturing sector continues

to expand

Unemployment declined to 5.5% in February.

Construction was among the sectors with job gains. The

unemployment rate is close to what analysts consider full

employment, but other indicators are less positive. Wage

growth has been low and a large number of Americans are

underemployed or have given up looking for a job.

The Federal Reserve has kept interest rates near zero until

now. With lower unemployment and good economic

growth interest rates are likely to increase for the first time

since the recession. The low growth in wages and the

rising US dollar remain a concern for the economic

recovery.

Economic activity in the manufacturing sector continued

to expand in February. However, growth in production and

new orders slowed, according to the Institute for Supply

Management. Furniture manufacturing reported growth in

February, while the wood products sector saw no change.

Positive outlook in cabinet market

US demand for cabinets is forecast to increase 6.6%

annually in the next four years. Freedonia‟s latest market

study on cabinets projects demand to reach $16 billion in

2018. Cabinet demand will be driven by a strong growth in

home construction. Increasing residential improvements

and repairs will also support demand growth for cabinets.

The strongest growth will be in kitchen cabinets. Kitchen

cabinets accounted for 81% of total demand in 2013.

Current design trends include larger kitchens with more

cabinets and the use of cabinets with special features, such

as pull-out shelves, storage racks and LED lighting.

Stock cabinets will remain the most widespread cabinet

type installed due to availability, price and ease of

installation. However, Freedonia forecasts growing

demand for custom cabinets beyond 2018.

Demand growth for bathroom cabinets will be based on

more new homes being built and a trend towards multiple

bathrooms in the house.

Office, commercial and institutional construction is

expected to boost demand for cabinets in the nonresidential

sector as well. Specific growth markets to 2018

will be hotels, office buildings, health care facilities and

retail stores. The smaller market of recreational vehicles,

recreational boats and business jets is also forecast to grow

following several years of low production.

Wood product imports were higher in January compared

to the same time in 2014, with the important exception of

wooden furniture. Total wooden furniture imports fell in

January, but imports from Europe grew.

Lower furniture imports and higher share from Europe

Wooden furniture imports were down in January, both on

a month-over-month basis and compared to the same time

in 2014. Total wooden furniture imports were worth $1.25

billion in January, down 2% from January 2014.

Almost all major supply countries saw a decline in

shipments to the US. Imports from China were worth $618

million, down 5% from December. Vietnam‟s shipments

fell by 6% to $224.9 million. Only imports from Malaysia

remained unchanged at $51.7 million.

Imports from Europe grew, helped by the low euro value.

Italy, Poland, Germany and Lithuania expanded furniture

exports to the US in January.

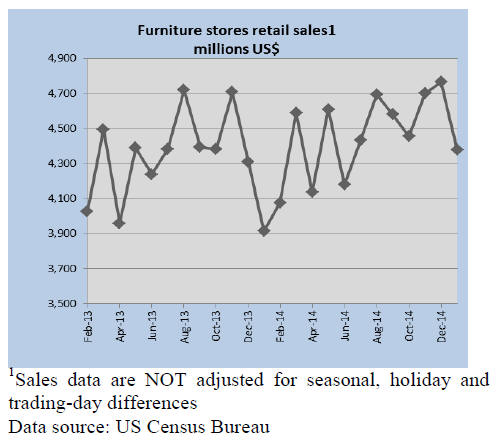

Seasonal decline in furniture retail sales

Retail sales at furniture stores in the US fell by 8% from

December to January, according to US Census Bureau

data. The decline was mainly seasonal and retail sales

were significantly higher than in January 2014 (+12%).

|