Japan Wood Products

Prices

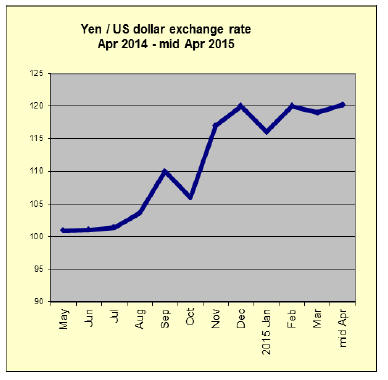

Dollar Exchange Rates of

10th April 2015

Japan Yen 120.20

Reports From Japan

Weaker yen and low energy import costs improve

trade balance

The Ministry of Finance has reported that the February

current account surplus was the highest in almost four

years but much of the improvement stemmed from the

conversion to yen of companies overseas income but was

also helped by falling import costs due to lower oil prices.

Analysts expect the current account to remain in surplus as

long as the yen remains weak and oil and natural gas

prices do not rise.

Medium and small Japanese firms look to international

markets

In January the Japan External Trade Organization

(JETRO) conducted a survey of domestic Japanese firms

engaged in exports of agricultural, forestry, fishery and

food products.

The survey assessed attitudes towards exports of

agricultural, forestry, fishery and food products,

challenges and issues, competitors in export destinations

and future strategies.

The following summarises the main points in the JETRO

report.

Attitude to exports

82% of respondents are placing more

emphasis 82% of respondents are placing more

emphasis

on exports due in part to shrinking domestic

demand.

56% intend to increase exports over the

next three 56% intend to increase exports over the

next three

years. Food makers noted the rise in popularity of

Japanese foods overseas.

Challenges and issues

Amongst export destinations in which Japanese firms face

challenges are China followed by the US, South Korea, the

EU then Taiwan P.o.C.

Specific issues identified include difficulties in

understanding local regulations and rules particularly in

the US, China and the EU.

51% of firms reported a lack of

information 51% of firms reported a lack of

information

regarding consumer trends in export markets.

50% indicated that they were not able

to gather 50% indicated that they were not able

to gather

sufficient information on local buyers including

credit ratings and other commercial data.

Exporters reported high logistic and overall

transaction cost.

Competitors in export destinations

Chinese and S. Korean firms are major competitors in all

markets. Regarding the strengths of competitors, price was

ranked first followed by efficiency in distribution and

sales.

Future strategies

Regarding specific measures to expand exports,

strengthening of the sales functions (personnel, bases, and

promotion) and strengthening product development were

commonly cited.

For the full details see:

https://www.jetro.go.jp/en/news/2015/20150409737-news

Yen down on expectations of rate rise in US

The yen fell slightly to 120.20 to the US dollar in mid

April as the dollar continued to gain strength on

expectations the US Federal reserve will soon begin to

raise interest rates.

In related news the Bank of Japan (BOJ) steered clear of

any additional monetary easing at its last meeting. After

the meeting the BOJ Governor voiced optimism that the

dampening effect of last years‟ tax increase has dissipated.

Widely divergent land price trends to be addressed

The Ministry of Land Infrastructure and Tourism reports

that land prices in Tokyo Osaka and Nagoya, the three

major cities, rose 0.4% in February following the 0.5%

rise in the same month a year earlier. Commercial land

values also rose (plus 1.8%) after the 1.6% in February

2014.

Interest rates on housing loans are currently very low and

this has helped drive up land prices. However, nationwide

land prices continue to fall highlighting the persistent

deflation.

The difference in land price trends between the large cities

and the rest of Japan is a challenge for the government and

the risk is that current efforts to boost the economy are not

addressing issue outside of the export manufacturing

sectors.

Those with investments in land or the stock market are

benefitting from current fiscal policies but the average low

and middle income family are having to cut back on

expenditure prices of imported goods rise because of the

weaker yen.

The weak yen is also hitting small sized companies,

especially those which depend on imported raw materials.

For more see: http://tochi.mlit.go.jp/english/landprices/

land-value-look-report

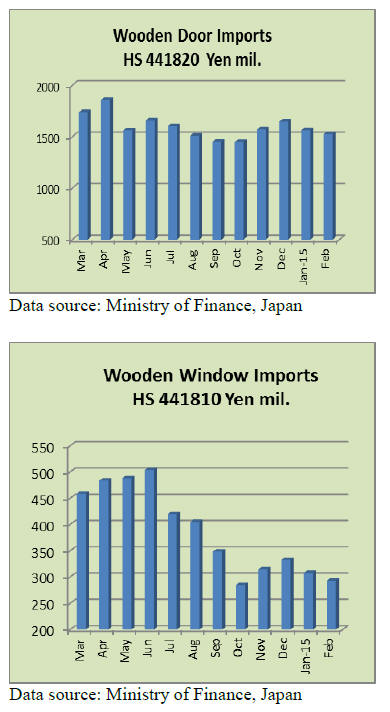

Import round up

February 2105 wooden door imports were down 19% year

on year and compared to levels in the previous month

imports fell 2.5%.

Wooden window imports in February 2015 fell by a

massive 40% year on year and were down 5% from

January.

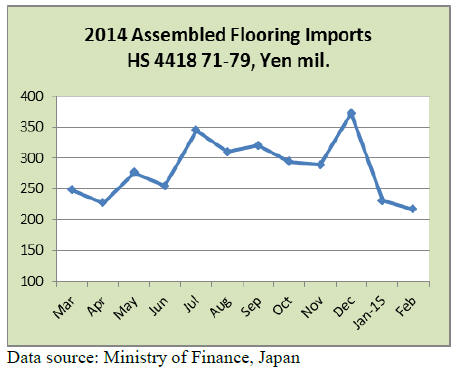

February 2015 assembled flooring imports into Japan rose

2.4% year on year however they fell 6% compared to

levels in January this year.

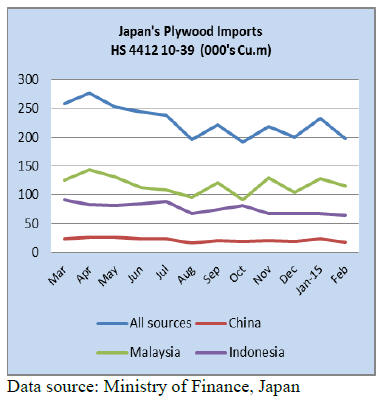

Malaysia is the largest supplier of plywood to Japan but

February imports fell 5% year on year and by 10%

compred to import levels in January.

China‟s exports of plywood to Japan also fell year on year,

dropping 14%. Compared to the level of imports in

January this year February imports fell 2%.

A similar trend was seen with imports from Indonesia

where year on year February 2015 imports fell 7% and

compared the January this year, February imports were

down 3%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Full liberalization of electricity market

Revised Electricity Business Act was approved by the

cabinet meeting on March 3. The main revision is

separation of generation and transmission of electricity.

This means transmission system major electric companies

have monopolized for years is now open for newly

participating business, which is scheduled to start in April,

2020.

This is revolutionary change and this is the final target of

reform of electricity system the government is aiming.

This should support reduction of electricity price and

diversification of the services of power companies.

It is already decided that electricity retail sales is

liberalized since April 2016. With the revision of this time,

each household is allowed to select supply source of

electricity so that renewable natural energy like solar and

biomass power generation should draw more attention.

Accounts of large electricity consumers like industrial

plants have already been liberated but it is not certain if

the cost is lower than before since the contract is made

individually. For common household, there has not been

any choice but to buy electricity from the electric company

in residential area but now consumers have option to select

what type of energy power each company is using to

generate electricity.

Liberalization does not always guarantee lower electricity

cost since other countries experienced higher electricity

cost after banning nuclear generation because of

maintenance cost of transmission system and higher cost

of recyclable materials but significance is that consumers‟

mind decide what kind of electric business is formed in

future. It‟s consumers‟ choice if electricity is generated by

nuclear power or biomass energy, which is renewable

energy and should help vitalize forest resources.

Sumitomo Forestry increases export of domestic logs

Sumitomo Forestry (Tokyo. Akira Ichikawa, the president)

announced to increase forest products export business as a

part of overseas business expansion plans. This year‟s

target volume is about 80,000 cbms, about four times more

than 2014.

Up until last year, the main item of export was logs. About

80% of the market is China then 13% for Korea, 6% for

Taiwan P.0.C and 1% for Vietnam.

China has variety of demand and the price is priority

matter. Any buyer, which designates species is exporter of

finished products to foreign markets. Sumitomo Forestry

Forest Service is in charge of log procurement in Japan

then Sumitomo Forestry will handle shipment and

marketing.

Species are 70% cedar, 20% cypress and 10% larch and

fir. Main supply source is Kyushu with about 60% then 7-

8% from Hokkaido.

In Japan, demand for low grade materials for biomass

generation will increase so to increase procurement may

not be easy but there is a possibility of large expansion of

the demand if the price is right for huge softwood market

in China

South Sea (tropical) logs

firming as all the log yards are almost empty after rainy

season. In Sarawak, Malaysia, weather has been

improving gradually since late February. Control on illegal

logging is severe and in tight supply market, Indian buyers

kept paying high prices for logs to fill up their ships so

FOB prices had kept going up week after week in

February but after meranti regular FOB prices shot up to

$300 per cbm, India finally stopped buying at high prices.

In late February, meranti regular log prices for Japan

market were $280-295, small meranti were $245-260 and

super small meranti were $230. FOB prices for late March

shipment will probably be up again in tight supply and

competition with other countries. Local plywood mills are

running out of log inventory and they compete grabbing

low cost small logs. In late February, many plants had to

shut down because of log shortage.

In PNG and Solomon Islands, weather continues unstable

and cyclone hit in middle of March. Chinese purchase has

been slowing as its log inventories in China are rather

heavy but India is buying aggressively to replace Sarawak

logs. So prices remain high, particularly the logs for Japan,

which are selective in quality.

AI Ply’s price hike

AI Ply, marketing company of Seihoku group, announced

to increase the sales prices as of April 1. In Tokyo market,

12 mm 3x6 structural softwood plywood prices in middle

of February dipped below 800 yen per sheet delivered so

the plywood manufacturers‟ business turned unprofitable.

Then in early March, the prices further dropped.

Major wholesalers held exhibition and spot sale fairs,

which move rather large volume at one time so it could be

turning point to firm up the market but this time, it turned

adversely and the prices further dropped to 760-780 yen.

This triggered price war among wholesalers and trading

firms, which need to close their books at the end of March

and inventory clean-up is their priority matter.

AI Ply thinks that this should be time to bottom the prices

and after closing books, the market should turn round so it

decided not to accept any more low offers after April 1.

Plywood manufacturers in the group have been curtailing

the production by 15% compared to last June then during

the Golden Holidays in early May, the plants will stop

running for a week or ten days to reduce the inventory.

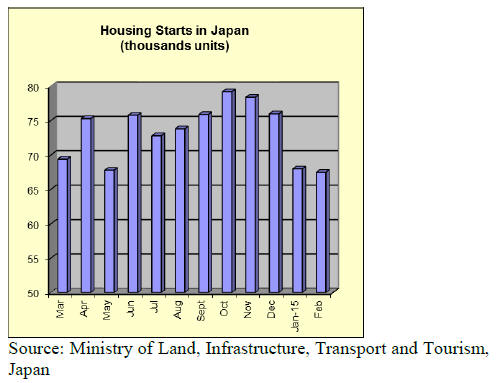

Domestic production of laminated lumber

Japan Laminated Lumber Manufacturers Association

disclosed domestic production of laminated lumber in

2014. Total is 1,555,000 cbms, 5.6% less than 2013. In

structural materials, production of medium and small sized

lumber declined because of demand drop by increase of

consumption tax but large sized lumber increased.

Production of interior finishing lumber stopped declining

since 2011 on both solid wood and veneer overlay lumber

then in 2014, solid wood decorative lumber increased.

The demand expands as construction of large buildings

increased and decorative lumber is heavily used.

Structural lumber recorded the third largest production

behind 2006 and 2013. The production did not drop as

much as 2014‟s housing starts, which dropped by 9%.

However, imported volume in 2014 dropped by 4.4% with

728,000 cbms so total of both imports and domestic

production was in proportion to drop of housing starts.

Large sized lumber is used for large buildings, which

increased in number then imported products lost

competitiveness by weak yen.

Also for medium and large buildings, use of domestic

species is encouraged, which pushed the domestic large

size lumber production up. Percentage of lamina is 63.3%

of European softwood and 24.3% of domestic softwood. A

balance is North American softwood. It looks like share of

60% of European, 30% of domestic and 10% of North

American is fixed.

|