|

Report from

North America

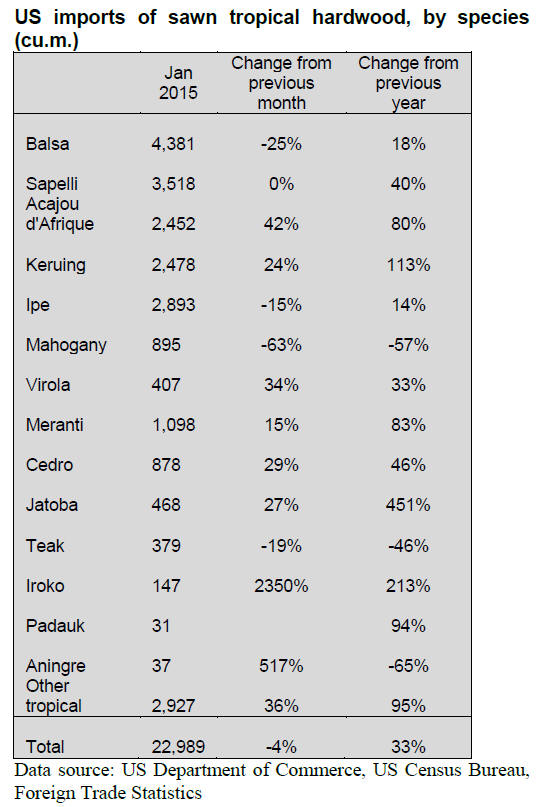

Increased imports of acajou d¡¯Afrique, keruing and

meranti

Tropical sawnwood imports declined 4% month-on-month

in January to 22,989 cu.m. However, despite the overall

decline in imports, shipments from Cameroon and

Malaysia to the US market increased.

Imports from Cameroon were up 42% from the previous

month (4,124 cu.m.). Sapelli imports from Cameroon

reached 2,259 cu.m., while acajou d‟Afrique imports were

1,479 cu.m. Malaysian shipments to the US increased by

24% from December (2,978 cu.m.).

Imports from most other tropical sawnwood suppliers

declined in January, including Brazil (3,686 cu.m.),

Congo/Brazzaville (1,153 cu.m.), Indonesia (943 cu.m.)

and Ghana (815 cu.m).

Balsa imports from Ecuador fell by one quarter in January

to 4,381 cu.m. On the other hand sapelli imports remained

unchanged from the previous month at 3,518 cu.m.

Imports of ipe were 2,893 cu.m. (-15%), while imports of

acajou d‟Afrique and keruing increased in January to

2,452 cu.m. and 2,478 cu.m., respectively.

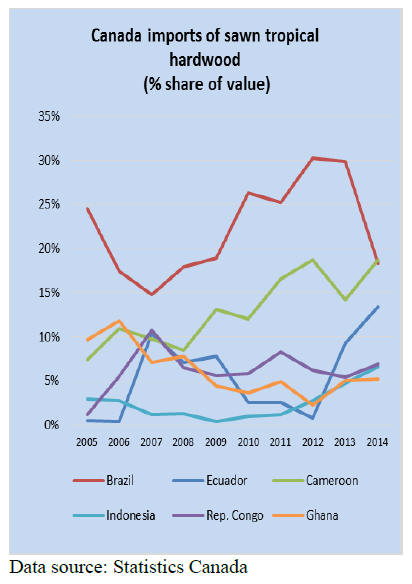

Higher Canadian sapelli imports

Canadian imports of tropical sawn hardwood were valued

at US$1.25 million in January, up one third from

December but total imports are only half the value seen

last summer. Africa remains the largest source of imports

for Canada, followed by South America (mainly balsa)

and then Asia.

Balsa imports from Ecuador were worth US$296,183 in

January. The second-largest source of hardwood imports

was Cameroon at US$208,387, although the value of

imports fell from December.

January imports from Indonesia declined slightly from

December, but at US$182,700, they were higher than in

January 2014.

In January the value of sapelli sawnwood imports by

Canada increased by 18% from the previous month to

US$357,500. Imports of mahogany were worth

US$55,3400 and the combined value of virola, imbuia and

balsa imports amounted to US$312,600.

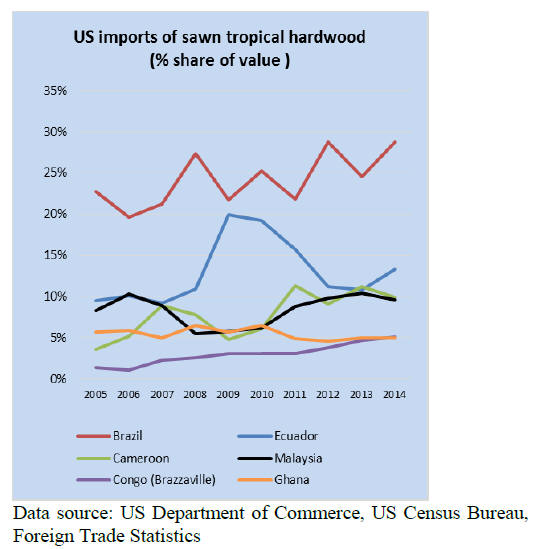

Growth in Africa¡¯s share of sawnwood imports

US Imports of tropical sawnwood plummeted in the years

the market share of the main suppliers fluctuated widely

from then on. Overall, Brazil remained the largest supplier

to the US but Canada has imported slightly more from

Cameroon than from Brazil recently.

Cameroon gained a significant import share in Canada at

close to 20% based on the value of imports in current US

dollars with much of the growth being in sapelli

sawnwood shipments. Cameroon also gained market share

in the US, but the growth was slower.

Of sawnwood imports from Asia, Malaysia is the primary

supplier to the US while Canada imports mainly from

Indonesia. US imports from Indonesia have declined since

2005 although the import share has increased to 4% since

the end of the recession. Malaysian sawn hardwood

shipments to the US have been very stable over the past

ten years.

In both the US and Canada the share of imports from

Africa has increased over the last ten year, while South

America‟s imports share declined. South American

countries‟ share in US imports fell from approximately

56% in 2005 to below 50% in 2014. During the same

period Africa‟s share increased by about ten percentage

points to 26%.

In Canada the trend was similar, although African supplier

countries always had a higher share in imports than in the

US. Southeast Asia‟s import share in the US market

remained relatively unchanged around 20% in the last ten

years.

New US homes increasingly ¡°green¡±

The US National Association of Home Builders reports

that more and more home buyers are looking for

sustainable features in homes, higher energy efficiency

and renewable energy facilities such as geothermal heat

pumps and solar panels.

Energy Star certifications are a priority for young home

buyers. Builders are responding to the demand and build

more green single and multi-family homes. Home buyers

are also concerned about indoor air quality, sustainable

materials and products, and locally manufactured

products.

|