|

Report from

Europe

EU tropical wood imports rebound after record low

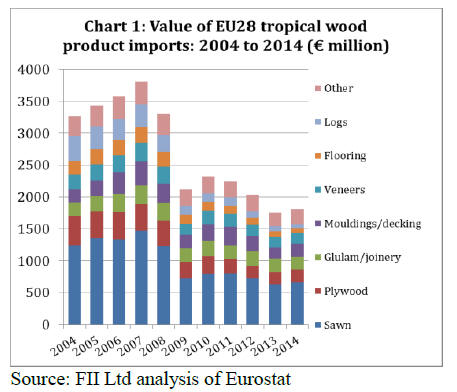

The EU imported tropical wood products worth €1.81bn in

2014, which represents a 3% increase over the ten-year

low of €1.76bn registered in 2013.

Between 2012 and 2013 imports had dropped sharply by

13.2 % and fell below the €2bn threshold for the first time.

Even with the slight recovery, the EU‟s 2014 tropical

wood imports did not even reach half of what they were

less than ten years ago (Chart 1).

The different product groups were showing mixed trends

last year. Mouldings and decking (+12.9 % to €200

million) as well as ※other§ products (+10.1% to €240

million) grew by double-figure percentages and sawn

wood also booked healthy growth of 5.5% to €663 million.

Imports of plywood (+2.2% to €201 million) and veneers

(+1.3 % to €166 million) climbed at a more moderate

pace. At the same time, however, tropical log imports

dropped again sharply, down 24.3% to €60 million. And

deliveries of flooring (-5.8% to €83 million) and

glulam/joinery (-3.8% to €200 million) were also lower

than in 2013.

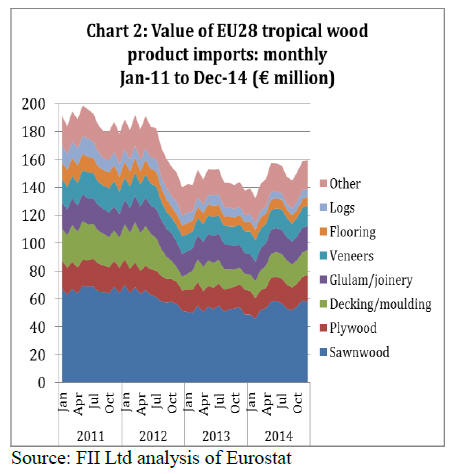

Closer analysis of monthly and quarterly data indicates

that European tropical wood imports increased especially

towards the end of last year. In fact, throughout the first

quarter of 2014, imports were still lower than in the same

period of the previous year.

In the April to June period, imports then rose slightly over

the same quarter in 2013. The rate of growth remained

modest during the third quarter as well.

However, in the final quarter of the year the European

countries imported tropical wood products worth €469

million, which is 10.6% more than in the last quarter of

2013 (Chart 2).

EU construction has firmed in 2014

The slight growth in European tropical wood imports last

year can be attributed to the continuing 每 if frequently

slow 每 recovery in several important sales markets. Most

notably the UK has reported strong demand for timber in

general and also for tropical wood products last year.

The Netherlands and Spain are showing signs of recovery

as well and Germany has remained stable at a satisfactory

level. France, on the other hand, has seen an economic

slow-down which led to a further contraction in

consumption of tropical timber last year.

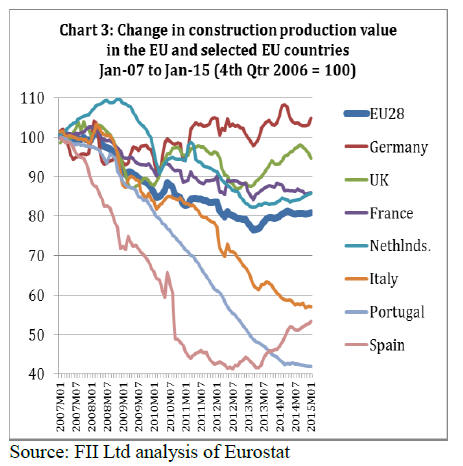

These trends are also reflected in EU construction activity.

Chart 3 shows that the construction production value has

continued to pick up in several key markets during 2014,

even though the overall construction value throughout the

EU still remains clearly below pre-crisis levels.

Construction in the UK picked up strongly from the start

of 2013 and this trend continued throughout 2014.

However growth slowed at least temporarily at the

beginning of 2015. Construction value in France declined

slightly during 2014. The same is true for Portugal and

Italy.

On the other hand, construction in the Netherlands

continued its steady recovery last year. Spain has also

shown a steady uphill trend since the start of 2013,

although the recovery is from a very low level.

EU sawn tropical hardwood imports still lower than in

2012

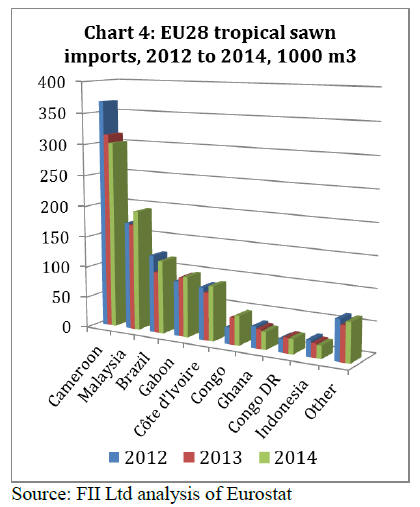

The recent 5% increase in European sawn tropical

hardwood imports to 985,000 m3 was insufficient to offset

the 8% drop in deliveries experienced in 2013. A closer

look at the most important supplier countries reveals that

Malaysia (+13%), Brazil (+19%) and Ivory Coast (+15%)

boosted their deliveries to Europe significantly last year.

This came after decline in imports from these three

countries in 2013. Deliveries from the Congo Republic

and Gabon also continued their positive trend last year.

EU imports from Cameroon (-4%), Ghana (-9%) and

Indonesia (-8%) continued their downhill slide in 2014.

EU imports from the Democratic Republic of the Congo

fell by 3% in 2014 following an increase in 2013.

Chart 4 reveals that Cameroon remains by far the most

important supplier of sawn tropical hardwood to the EU,

despite the steep drop in 2013 and the renewed decline in

deliveries in 2014. The EU countries imported 302,000 m3

of tropical sawn timber from Cameroon in 2014, after

315,000 m3 in 2013 and 367,000 m3 in 2012.

The supply problems for sapele timber and associated long

lead times, the main cause for declining deliveries in 2013,

continued into 2014.

Moreover, shipments from Cameroon have been seriously

affected by logistical problems in the country‟s main port

of export in Douala. A strike at the port at the end of 2013,

as well as problems related to the depth of the port‟s

navigation channel, a broken loading crane and general

logistical problems caused a backlog of goods at the port.

According to information from importers, these problems

continue to persist for break bulk shipments and container

shipments are also occasionally subject to delay which

makes transportation times hard to calculate.

The new deep-water port in Kribi/Cameroon could help

ease this situation. The port is apparently operative now.

However, a European company that operates sawmills in

the region said in March 2015 that they had not yet

received any offers from the major shipping lines for

shipping from Kribi.

In 2014, Gabon was once again the second largest African

supplier of tropical sawn wood into Europe. European

demand for timber from Gabon had started to grow as

early as the end of last year. And throughout 2014 the

country‟s okoume exports remained rather competitively

priced compared to tulipwood from the USA, for example.

European imports from Ivory Coast also increased in

2014. This was due to strengthening demand for framire in

the UK combined with importers‟ increasing confidence in

legality assurance documentation.

In Malaysia, the second most important tropical sawn

wood supplier overall, prices for meranti lumber have

been comparatively low and stable throughout last year,

which may have fuelled demand.

Moreover, both the UK and the Netherlands, two of

Malaysia‟s largest European sales markets stepped up their

tropical timber imports last year (Chart 5). It total, the EU

countries imported 194,000 m3 of sawn timber from

Malaysia last year, 13% more than in 2013.

The anticipated drop in deliveries due to the change in

Malaysia‟s GSP status as of 1 January 2014 and related

rise in import duties from 3.5% to 7% has therefore not

materialised. Recognition of the Malaysian Timber

Certification System (MTCS) in the Dutch government

procurement policy in 2013 may have boosted sales in the

Netherlands during 2014.

The 19% increase in EU tropical sawn wood imports from

Brazil in 2014 has to be seen against the background of a

21% fall the previous year. At 118,000m3, last year‟s

tropical timber deliveries from Brazil still fell well short of

the 125,000m3 delivered back in 2012, before the EU

Timber Regulation entered into force.

The May 2014 Greenpeace report about alleged illegal

logging titled The Amazon‟s Silent Crisis has prompted

some European companies to take an even closer look at

their supply chains in Brazil. Nonetheless, European

tropical sawn wood imports from Brazil recovered last

year.

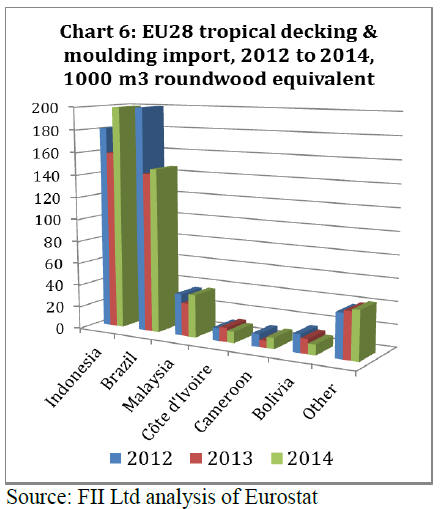

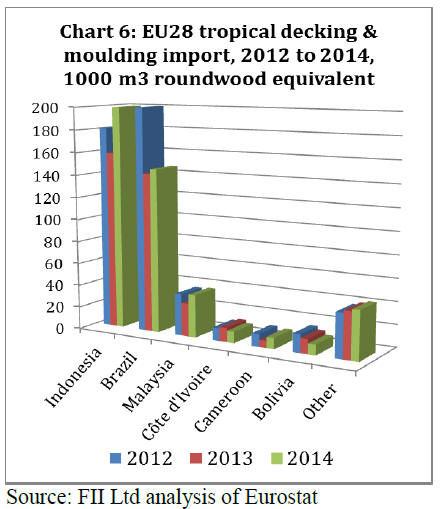

Recovery in EU decking and mouldings imports

Imports of ※continuously shaped§ wood (HS code 4409)

show a similar picture: after falling by 19% in 2013 they

rose again by 13% to 457,000 m3 in 2014. Continuously

shaped wood products listed under HS code 4409 include

both decking products and interior decorative products like

moulded skirting and beading.

Imports from the main supplier, Indonesia, in particular,

recorded a healthy trend and rose by 26% in 2014. The

same is true for imports from Malaysia, which recorded an

increase of 29%. Brazilian deliveries, on the other hand,

only rose by 3% after plummeting 30% the year before

(Chart 6).

﹛

The European market for decking, both in general and for

tropical hardwood, recovered a little in 2014, after a

sluggish performance in 2013. Indonesian bangkirai

decking, in particular, regained market share last year, due

primarily to its competitive pricing. Prices for bangkirai

decking in Indonesia had dropped by around 20% between

2012 and 2014 and have not recovered since.

However, market insiders suggest that demand for other

tropical decking products increased more slowly and that

the overall market share of tropical timber in the decking

sector continued to decline in 2014.

Bangkirai products have tended to take market share from

other tropical timber decking 每 especially from Brazilian

products such as garapa, cumaru, or massaranduba 每 rather

than from other competing materials. The strongest growth

was again registered for Wood Plastic Composite decking

last year.

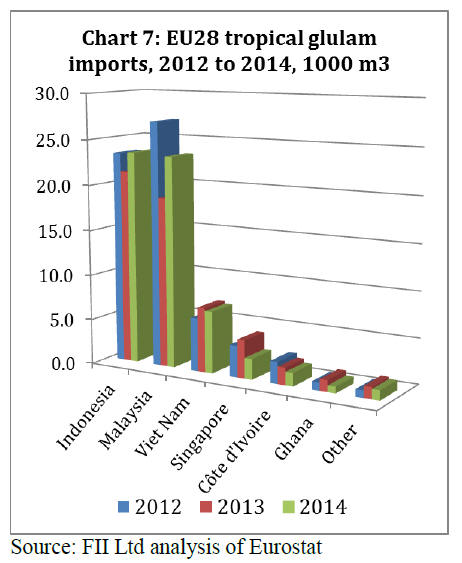

Window scantlings imports have grown but at a lower

value

Competition from other materials, mainly plastics but also

temperate hardwoods, continues to put pressure on the

EU‟s imports of tropical glulam, which consist primarily

of scantlings for the window sector. Imports in this

product group totalled 59,200 m3 last year, 6% more than

in 2013 but still 12.5% less than in 2012.

Moreover, the value of EU glulam imports from tropical

countries was down by 3.8% last year, in spite of the rise

in volumes, meaning that the average price of the imported

tropical window scantlings was lower than the year before.

Importers frequently mentioned a trend towards standardquality

meranti scantlings rather than the higher-quality

full log material last year, which may be an explanation

for the lower import value.

The rise in volumes was exclusively due to higher

deliveries from Indonesia (+10%) and Malaysia (+24%).

In 2014, these two countries delivered 23,500 m3 and

23,300 m3 respectively to the EU and together accounted

for roughly 79% of all EU imports of this commodity from

the tropics.

EU imports from all other significant tropical supply

countries declined last year, including Vietnam (-4%),

Singapore (-45%), Ivory Coast (-23%) and Ghana (-43%)

(Chart 7).

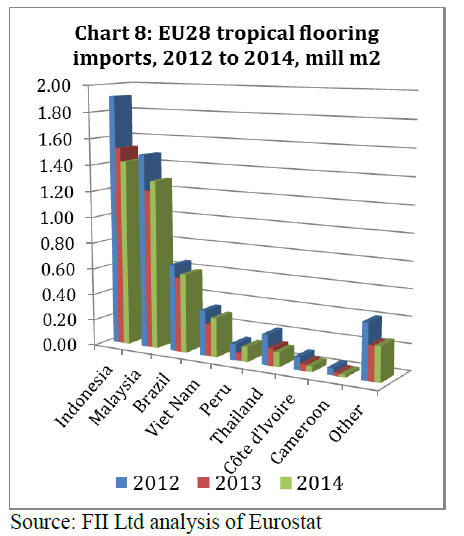

Flooring imports remain at a low level

EU imports of tropical wood flooring only showed a minor

increase by 2% to 4.17 million m2 last year, against the

very weak level reached in 2013. Compared to 2012,

import volume in 2014 was still down by 21.7%.

Moreover, the 2014 import value of €83 million was 5.8%

lower than in 2013 and 25.9% lower than in 2012.

Most European markets have seen a very strong trend

towards oak flooring in the last few years, which resulted

in lower demand for tropical timber. What is more, wood

in general has continued to lose market share to substitute

products such as Luxury Vinyl Tiles.

A closer look at the important supplier countries reveals

that the shift in flooring import volumes from Indonesia

towards Malaysia continued into 2014. Malaysian

deliveries recovered with a 7% increase last year, while

imports from Indonesia dropped by another 7%. In 2013

deliveries from both countries had declined, but Indonesia

experienced a much sharper fall (Chart 8).

Indonesia and Malaysia together account for the bulk of

the European tropical flooring imports. Of the other larger

supplier countries, Brazil (+6%), Vietnam (+20%) and

Peru (+88%) showed signs of improvement, while

deliveries from Thailand (-17%), Ivory Coast (-14%), and

Cameroon (-11%) continued to decline.

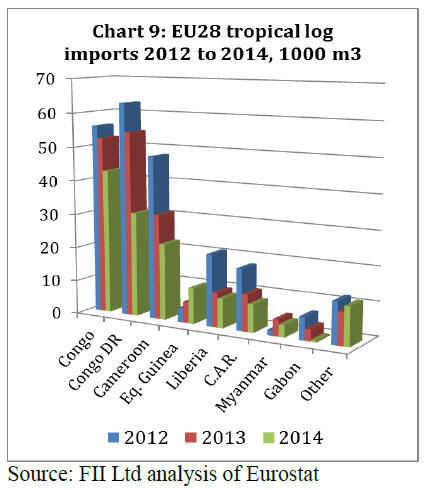

Tropical log exports plummeted again

Last year, as in previous years, EU imports of tropical

hardwood logs experienced the sharpest fall among all

tropical timber products. EU imports of 139,000 m3 in

2014were down 24% compared to 2013. Log imports have

declined steadily over the last ten years.

In terms of value, the EU‟s 2014 tropical log imports were

only worth 15% of those in 2004. Deliveries from all the

main supplier countries, with the exception of Equatorial

Guinea were down by double-figure percentages last year

(Chart 9).

Besides logistical restrictions and log export bans

instituted by various tropical countries including Gabon

and Myanmar in the last few years, this renewed decline is

probably also due to uncertainty over the reliability and

acceptance by EUTR competent authorities of

documentation for log exports from some regions.

This seems particularly true for the Democratic Republic

of the Congo, which saw its deliveries to Europe plunge

by 43% in 2014.

Environmental groups have shown a particular interest in

the Congo region since introduction of the EUTR,

resulting in the first major case in Germany when 57

wenge logs were seized by the country‟s competent

authority at the end of 2013. The case is not yet closed but

currently looks likely to end with the auctioning of the

wood by the German state.

European importers are cautiously optimistic for 2015

European demand for various tropical timber products and

species in the first quarter of 2015 is described as

satisfactory to good by several importers. The UK market

remains good, even if demand in some instances is

reported to be slightly less buoyant than the same time last

year.

Some importers report signs of recovery in France and

Scandinavia. Some Eastern European markets, especially

Poland, are described as relatively active at the moment.

The German market is described as stable.

As regards the different products and regions of origin,

African timber, especially sapele, wawa, framire, and in

some European markets also sipo are in relatively strong

demand.

However, importers also report continuing difficulties in

sourcing enough timber in Africa. Framire is reported to

be very hard to get hold of at the moment and importers

suggest they could sell more if there were any extra

supply.

Sourcing of other African wood species is made difficult

by on-going logistical problems. European importers

suggest that truck shortages are causing delays in overland

transport in some parts of Africa. In addition to the abovementioned

delays in the port of Douala in Cameroon,

some importers also mention delays in shipping from

Pointe Noire in the Congo.

Competition for supply from Asian and American buyers

is mentioned as another challenge by European importers.

Some importers said the EUTR and related documentation

was still making it hard to compete with their Asian

counterparts, as African sawmills would frequently prefer

selling to Asia, where less documentation was required

and where customers are less picky when it comes to

specifications.

American buyers are also finding it relatively easy to

outbid their competitors from the Eurozone at the moment

due to the strong US dollar and the weakening euro value.

Demand for bangkirai and meranti from Indonesia and

Malaysia was also relatively good in February and March

of this year, as traders stocked up in anticipation of

exchange-rate related price hikes. Importers with large

inventories, who were able to offer material at mixed

prices, profited from this in particular.

A similar trend was observed for tropical timber from

South America. However, the costs of South American

tropical wood products had not only increased due to

unfavourable exchange rate trends but also due to price

hikes instituted by various producers at the end of last

year. As a result, importers report that they have been very

cautious in placing new orders for shipping this spring.

The strong US dollar represents a factor of uncertainty for

sales of tropical wood products traded in this currency in

the Eurozone. Whether sales will continue at their current,

satisfactory level will largely depend on future currency

trends as well as on suppliers‟ willingness to adjust prices.

The minor price concessions made by Indonesian and

Malaysian suppliers at the beginning of this year were

insufficient to offset the loss in value of the euro over the

last twelve months and in particular since December 2014.

Moreover, some importers expect those reductions to be

temporary in nature and that producers will go back to

their old prices in the next few weeks. On the other hand,

some sources believe that Brazilian producers may lower

their prices in the next few weeks, as the real has also

weakened against the US dollar.

|